A NASA wrench 3D printed in space. Source: NASA

Opportunities abound in the health and retailing sectors. A health care practitioner can manufacture patient-specific prosthetics right within her office. Surgeons can build models to practice upon before the patient enters the operating theater. Retailers can print samples of new products and use them to gauge market reaction prior to investing in a full-scale, traditional manufacturing run.

Model to practice brain tumour removal. Source: 3DPrinter.net

We believe 3D printing is about to gain mass adoption in the education sector. This virtually untapped market is gaining traction amongst early adopters in our schools. The goals are not only to create on-demand teaching aids but also to teach students computer skills in an interactive and engaging manner. However many teachers don’t understand 3D printing; nor do they want to create curricula. But as we detail later in this report, Tinkerine Studios, a Sophic Capital client, is focusing on the education sector with a strategy to mitigate teacher resistance to 3D printing.

3D Printing – A Layered History

On March 11, 1986, the United States Patent and Trademark Office (USPTO) granted Charles Hull, the founder of 3D Systems, patent 4,575,330 for an “apparatus for production of three-dimensional objects by stereolithography.” Stereolithography, or SLA, involves using a laser to project an object’s cross-sections across pool of resin. The laser cures the resin then repeats the process with the next cross-sectional layer. The process is quick and produces smooth surfaces but requires a final cleaning and curing. Plus, objects with heavy overhanging parts may need supports to prevent the plastic from collapsing upon itself.

Part of patent 4,573,330 application. Source: Google

On June 9, 1992, the USPTO published patent 5,121,329 for an “apparatus and method for creating three-dimensional objects.” The USPTO granted the patent to Stratasys founder Scott Crump for a technology called fused deposition modeling (FDM). FDM deposits layers of heated plastic filament to build an object – no resin required. The patent expired in 2009 and became open source (anyone could use it without paying royalties). New companies such as MakerBot and Ultimaker cropped up and began selling 3D FDM printers.

Although FDM is open source technology, it has limitations. FDM cannot print some large, intricate designs; overhanging parts perpendicular to the build axis may need supports or may not be viable to manufacture; since FDM printers lay beads of hot plastic the way a glue gun lays hot glue, the finished product’s surface is not as smooth as the SLA process; FDM and SLA are slow. The benefit against these potential FDM pitfalls is an inexpensive printed object.

Selective laser sintering (SLS) to the rescue. Like SLA, SLS uses a laser. But rather than create an object’s cross-sections in a pool of resin, SLS spreads powder and fuses it with laser light. Once the powder has cured, a new layer of powder is added and then cured by the laser. The advantages of SLS are that it can use any powder that melts (including glass and metal), objects are flexible, and SLS is faster. However, SLS surfaces are porous and rough. In addition, the complexity of the process can generate more errors compared to SLA.

U.S. patent 5,597,589 covers the sintering process but expired January 28, 2014. This led to speculation that the 3D printing industry should see numerous competitors enter the market similar to when the FDM patent became open source. However, this is not the case. The commercial SLS printer market has grown but the consumer market hasn’t developed. Even 3D Systems, the owner of the patent, doesn’t have a consumer SLS printer.

So what’s holding back the development of consumer SLS printers? There are numerous reasons. First, there are many related patents surrounding SLS. Creating SLS printers that skirt the patents’ claims may not be feasible and could be costly should the patent holders claim infringement and take the SLS designers to court. Second, SLS involves powders, and therefore proper ventilation and post-production handling are important. Third, SLS lasers are more powerful than those used in SLA printers. SLS lasers are capable of melting metal powders, and we’re not sure hobbyists and their insurance companies want blobs of 1,668ºC titanium burning down garages. However, this doesn’t mean that companies aren’t trying (to develop a consumer SLS printer and not burn down garages, that is). U.K. company Norge had a Kickstarter campaign to bring SLS printing to the masses by creating a £4,166 model for the market (unfortunately, they did not meet their target). That raises another issue: price. We believe that prices need to fall below $3,000 to $5,000 to spur consumer adoption of SLS printers. However, we believe that SLS may not be able to reach this range of price points in the near- or midterm.

Market Forecast

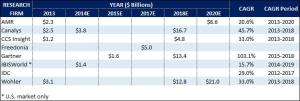

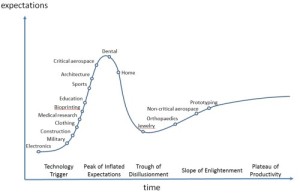

Although independent research firms have diverging market forecasts (Exhibit 1), one cannot doubt that 3D printing is a growth market in its infancy (Exhibit 2). There are a range of theories fueling this growth: The drive from hobbyist to manufacturing; the availability of metal and alloy printers, bioprinting (the recreation of tissues and organs), growth in Asia Pacific, increased content, and hardware price declines. We can’t dispute any of these reasons for growth. We would add that there was a catalyst that spurred the adoption of FDM and SLA 3D printing and could drive growth: the expiration of key patents. As more patents expire (Exhibit 3), we believe more 3D printing products will appear.

Exhibit 1: 3D Printing Market Forecasts

Source: Company press releases, Sophic Capital

Exhibit 2: 3D Printing Hype Curve

Source: IDTechEx

Exhibit 3: Key Industry Patents

Source: 3D Printing Industry, Google Patents, Sophic Capital

Education Technology is Where the Money will be Made

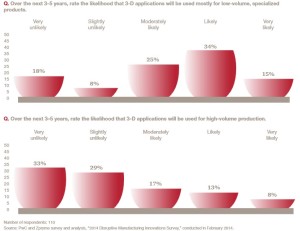

We believe one 3D printing market is poised for rapid growth. As we mentioned before, 3D printing has gained footholds in the manufacturing, dental, and medical industries. In fact, the sweet spot for manufacturers appears to be prototyping and producing low-volume, highly specialized, one-off products (Exhibit 4); products that would require expensive tooling and moulds for plastic injection systems, for example. However, medical and dental sectors are not our markets of interest.

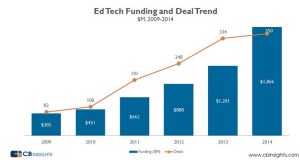

Education is attracting more capital market inflows. Research firm CB Insights[ii] estimates that in 2014 Ed Tech collected about $1.87 billion across 350 deals. Looking at Exhibit 5, 2014 deal sizes were larger than those in 2013. And 2015 funding is off to a nice start with the $186 million that Ed Tech company Lynda.com raised in January

Exhibit 4: Manufacturers more likely to use 3D printing for low-volume, specialized products

Source: PwC

Exhibit 5: Total Annual Value of Ed Tech Deals Continues to Ramp

Source: CB Insights

Education – 3D Printing Engages Students

Teachers are constantly concerned about how to engage students. In the days of pencil and paper, students who didn’t engage lessons doodled, read books, or dipped pigtails in their inkwells. Some teachers would command the students to pay attention, stand a bored kid in the corner, or, as the author recalls from personal experience, get a hard whack on the back of the head (trust me; this worked). Technologies such as desktop computers, video, and tablets brought some of these withdrawn students back into the lessons, but the reality is that not all students will participate. This doesn’t stop many dedicated teachers and school boards from investigating new ideas to get the students to invest themselves in their education.

Project-based learning is an educational trend. Its appeal to students is interactivity. Its appeal to teachers is that real-world experiences teach students to confront, challenge, and solve problems. An added benefit is that group projects, teach students the value of team-work, a real marketable skill that they’ll need in their careers.

A decade-long “trend”: STEM education. Although STEM (science, technology, engineering, math) learning teaches students problem solving and creativity skills, many people don’t realize the impact that these fields have on the greater workforce. Almost 75%[iii] of those in the United States who have earned bachelor STEM degrees work in other fields. So similar to how reading and writing were necessary for landing a good job 50 years ago, STEM skills are imperative today.

3D printed, STEM-based projects engage students. With 3D printing STEM assignments, students learn to solve problems, computer-aided design, and how to test theories via the objects they create. Rather than read about automotive aerodynamics, students can design model cars, print them, and test them. Rather than look at a picture of a fractal image, students can design formulas that replicate the image, print it out, and study the fractal in their palms. Rather than dissect a real frog, squeamish students can print a plastic frog, take it apart, and piece it together. Theoretically, 3D printing STEM-based projects are only limited by the teachers’ and students’ imaginations. In reality, they are limited by available content, and many teachers are unwilling or unable to develop their own.

Not So Fast – Not All Teachers are Eager for Change

As shown in Exhibit 2, 3D printing in the education sector is climbing the hype curve toward the peak of inflated expectations. We agree with this for several reasons. First, like the rest of the population, the majority of all teachers aren’t early adopters of technology. Most understand neither 3D printing nor how to use it. Second, even for those early adopter teachers, little content exists to develop curricula. That means teachers have to create content themselves, which is difficult when the majority of teachers don’t understand the technology. Third, there are teachers who flat out refuse to learn a new technology. According to Martin Stevens[iv] CEO of It Is 3D, a 3D technology company for education in the U.K., “…you have 20% at the other end of the curve, who say ‘I’m going to be retiring in the next fifteen years, I don’t have time to learn this’.”

Governments Want to Help Teachers and Students

In late 2013, the U.K. government allocated £500,000 to help 60 teaching schools purchase 3D printers. The funds were not only for purchasing hardware but also training teachers to use the technology. Education Secretary Michael Gove[v] stated, “3D printers are revolutionising manufacturing, and it is vital that we start teaching the theory and practice in our schools. Teaching schools will be able to develop and spread effective methods to do this. Combined with our introduction of a computer science curriculum and teacher training, this will help our schools give pupils valuable skills.”

The government of Australia’s Victoria state has a similar initiative to that in the U.K. The Victorian government formed Quantum Victoria[vi], a science and math innovation center that trains teachers how to build 3D printers and how to incorporate the machines into curricula.

Japan won’t leave its students behind. The government subsidizes two thirds of the cost of 3D printers in universities and technical schools in order to help to foster R&D[vii]. Currently the budget for this initiative is about $2 million.

In April 2014, the South Korean government revealed plans to invest about $2.3 million with the goal of creating 3D printing centers to train small and medium sized business employees. Then, in June 2014, the South Korean government created the 3D Printing Industry Development Council which has set a goal to train 10 million people by 2020. To facilitate this latter initiative, the government will provide 3D printers to 5,885 schools and 227 libraries by 2017[viii].

Although the United States leads the 3D printing market, government funding is lacking to place the technology in schools. The private sector, however, is filling the void. MakerBot has an initiative to help the public donate to 3D projects. The company’s broader goal is to have a 3D printer installed in every school and unveiled Starter Lab to help get 3D printing up and running within schools and organizations. And to further support educators, Airwolf 3D taught a group of Orange County, California teachers how to build a 3D printer.

3D Printer Companies Want to Help Teachers and Students

3D printer companies understand the challenges faced by teachers wary of new technologies. We highlight some of the companies that are helping to place 3D printers in schools and develop curricula for teachers. These companies are focused on a niche market (education) that we believe is about to explode.

MakerBot, a division of Stratasys (NASDAQ:SSYS), has an ambitious goal of placing a 3D printer in every American school. MakerBot was the first mover company that exploited the FDM open source patents. It did such a good job that Stratasys bought MakerBot in June 2013 for 4.76 million shares (~$403 million) plus an earn out of 2.38 million shares (~$201 million). To facilitate its 3D printer in every school goal, MakerBot created MakerBot Academy. MakerBot Academy has partnered with DonorsChoose.org to help teachers crowd-fund projects requiring 3D printers. It also has created projects via Thingiverse. More important, for teachers and students, is that in December 2014 Stratasys released a free, 14-week, modular, 3D printing curriculum.

3D Systems (NYSE:DDD) is about 3D printing for everyone. A 3D printing pioneer, 3D Systems holds over 1,200 patents and also invented SLA and SLS. The company has an initiative called Make.Digital which aims to build an ecosystem of 3D printers, scanners, software, curriculum, partners, and support for the educational institutions. Its 3D printers are priced from $1,000 up to almost $1 million[ix] for the high-end manufacturing and healthcare markets.

it is 3D (yes, “it” is lower case) supplies affordable yet high-quality 3D digital technologies to the education and industrial sectors. Formerly known as A1 Technologies, this U.K. company offers a range of 3D design printing, scanning, and machining products and even has a 3D media player to engage students during classroom lectures.

Afinia is a subsidiary of media duplication company Microboards Technology. Founded in 2009, Afinia has a $1,299 printer targeting educators, engineers, and hobbyists. Although Afinia does not have 3D printing projects or curricula for teachers, it offers a booklet about educator success stories.

LeapFrog (NYSE:LF) not only provides 3D printers but also pre-packaged projects for both the primary and high school markets. Dutch-based LeapFrog was founded in 2012 by AV Flexlogic due to a need to create prototypes and inexpensive replacement parts. LeapFrog also focuses on the engineering, architecture, medical, retail, and art sectors.

Ultimaker is another Dutch-based company and has shipped 3D printers since May 2011. During September 2014, Ultimaker expanded its operations into the United States to decrease manufacturing and shipping costs and improve customer service in this market. The company appears to be targeting the consumer desktop market but not specifically the education sector. When PC magazine[x] tested the Ultimaker 2, it noted that “it’s a breeze to set up and is the only 3D printer we’ve tested that operated without a single hitch.”

Solidoodle’s Press is a no-frills 3D printer that sells for $499. If that caught your attention, consider that Solidoodle’s 3 model has a sticker price of $399. In fact, the most expensive of the company’s five models is $1,199. Solidoodle has started an educational initiative called Solidoodle U which provides tutorials and projects for teachers.

Tinkerine – Focused on the Underserved Education Market

Tinkerine Studios, a Sophic Capital client, is the only public North American pure-play in consumer desktop 3D printing. The company is focusing not only on the consumer desktop space but also on the massively underserved education market – specifically, online learning and training, a market expected to hit $107 billion this year according to market research firm Global Industry Analysts[xi]. In an effort to provide educators, students, consumers, and technicians with the necessary 3D printing tools (printers & STEAM content) and the support that they need in the classroom or workplace, the Company launched Tinkerine U on March 12, 2015 following a successful global pilot with educators (Tinkerine U was preceded by an Apple iPad app). In a world where “content is king” (think television, blogs, streaming music), we believe Tinkerine U has a competitive advantage with its peer-to-peer Apple iTunes store-like architecture. And as an incentive, most Tinkerine U content is free.

As Tinkerine executes on its pipeline of opportunities, one of the largest education content providers has noticed them. Pearson, a world leader in educational content and technology, selected Tinkerine to present 3D printing on Teachability.com, Pearson’s online community of education professionals. We believe that this validates that Tinkerine is a contender in the burgeoning Ed Tech markets. You can access the interview here.

What differentiates Tinkerine 3D printers? Reliability. Tinkerine’s hardware is solid – its Ditto™Pro, the third generation printer, received high praise from MAKE: magazine[xii], the leading 3D printing publication. Tinkerine is developing educational content to reduce teacher reluctance toward implementing 3D printers within the classroom.

Don’t take our word for it though; this is what NASA’s Jet Propulsion Laboratory (JPL) had to say about piloting Tinkerine’s Ditto™Pro:

“A successful prototype. Valued the entire experience.”

Gabriel Rangel, NASA JPL

NASA’s Jet Propulsion Laboratory (JPL) is also a customer. NASA has been involved in AM since the 1990s and has experimented with metals and plastics. NASA has a plan to push desktop 3D printing since the technology facilitates problem solving and innovation at lower costs. Tinkerine has sold small quantities into JPL, and NASA JPL has taken the Ditto™Pro to events, as shown below (the Ditto™Pro is in the bottom left picture).

The Largest Companies are Consolidating the Industry

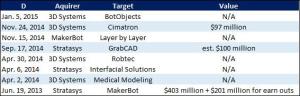

Exhibit 6 shows that the largest 3D printing companies are snapping up smaller competitors. We expect consolidation to continue as more 3D printing companies enter the industry (3D printers are popular crowdfunding projects). More competition will drive down hardware prices which we believe will make assets of some companies attractive. But as we stated before, we believe the biggest differentiator in the education space will be content, since teachers don’t want to develop content.

Consolidation could accelerate in the educational content sector. Lynda.com, an online learning tool provider, raised $186 million in January 2015 that, according to research firm CB Insights[xiii], represented the largest education-technology financing in at least the past five years. Lynda.com’s CEO, Eric Robinson stated, “It’s an opportunity for us to continue to strengthen our balance sheet and continue to do acquisitions in this segment.” [xiv]

Exhibit 6: The Large 3D Printing Companies are in Acquisition Mode

Source: Company press releases, Sophic Capital

Consumables – Another Differentiator

We believe that another differentiator, both now and in the future, is consumables. The industry typically uses two types of plastics: PLA and ABS. The primary differences between the two is that PLA is more brittle than ABS whereas ABS shrinks more while cooling thus necessitating a temperature-controlled environment. PLA is also a corn sugar-based plastic whereas ABS is a petroleum-based plastic. This means that PLA does not emit off gas fumes that smell like plastic – an important consideration for non-industrial environments such as schools, homes, and offices.

One major technical challenge faced by 3D printers is regulating the printer’s nozzle temperature. Regardless of what plastic the 3D printer consumes, the material must have a consistent composition, and the nozzle must maintain a constant temperature to melt the plastic. Scrap plastics compose some third-party “discounted” consumables. This raises the issue of different melting temperatures for the different scrap pieces in the consumable’s composition. This inconsistency can cause nozzles to clog and 3D prints to fail. Therefore, 3D printing companies that provide quality consumables can differentiate themselves within the industry.

Conclusions

We believe the education industry is about to embrace 3D printing, an industry that could grow across all sectors from $1.4 billion in 2013 to $21 billion by 2020. Hobbyists and the medical and retailing sectors have recognized 3D printing’s potential, but lack of teacher training and curricula content has hindered adoption in the education sector. However, 3D printing companies are mitigating teacher concerns. Combined, this focus on educational content and the support from several national governments could drive widespread adoption of 3D printing in schools, universities, and libraries.

Investors seeking opportunities in the 3D printing educational market should consider Tinkerine Studios, a Sophic Capital client.

A once-shuttered warehouse is now a state-of-the art lab where new workers are mastering the 3-D printing that has the potential to revolutionize the way we make almost everything… And I ask this Congress to help create a network of 15 of these hubs and guarantee that the next revolution in manufacturing is made in America.”

President Barack Obama, 2013 State of Union Address

Acronyms Used in this Report

3D three dimensional

AM additive manufacturing

FDM fused deposition modeling

JPL Jet Propulsion Laboratory

MOU memorandum of understanding

SLA stereolithography

SLS selective laser sintering

STEAM science, technology, engineering, arts, math

STEM science, technology, engineering, math

USPTO United States Patent and Trademark Office

References

[i] 3D Printing and Additive Manufacturing Industry Expected to Quadruple in Size in Four Years, Wohlers Associates, Inc., August 19, 2014

[ii] Ed Tech Funding Hits $1.87 Billion in 2014, CB Insights, January 20, 2015

[iii] Wesley Robinson, Most with college STEM degrees go to work in other fields, survey finds, The Washington Post, July 10, 2014

[iv] Meritxell Garcia Sein-Echaluce, 3D Printers Coming to Every School In the UK – Education Insights with Martin Stevens, CEO ‘It Is 3D’, 3DPrint.com, August 30, 2014

[v] www.3Ders.org, UK grants £500K funds to bring 3D printers to 60 schools, October 19, 2013

[vi] Ian Burrows, 3D printing aims to revolutionise Australian schools, manufacturing, November 7, 2013

[vii] Jelmer Luimstra, Japanese Government to Invest in 3D Printing Education, 3D Printing.com, February 5, 2014

[viii] www.3Ders.org, South Korea drawing up a 10-year plan for 3D printing, July 16, 2014

[ix] 3D Systems, Manufacturing the Future, May 20, 2014, pg. 5

[x] Tony Hoffmann, Ultimaker 2, PCMag.com, June 24, 2014

[xi] Global E-Learning Market to Reach US$107 Billion by 2015, According to New Report by Global Industry Analysts, Inc., PRWeb, February 15, 2015

[xii] PR Newswire, Tinkerine’s DittoPro 3D Printer Awarded For Overall Performance By MAKE Magazine, November 12, 2014

[xiii] Eric Newcomer, Lynda.com Raises $186 Million in Funding Led by TPG Capital, Bloomberg, January 14, 2015

[xiv] Ibid.

Disclaimers

The particulars contained herein were obtained from sources that we believe to be reliable, but are not guaranteed by us and may be incomplete or inaccurate. The opinions expressed are based upon our analysis and interpretation of these particulars and are not to be construed as a solicitation of offer to buy or sell the securities mentioned herein. Sophic Capital Inc. (“Sophic Capital”) may act as financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein, and may receive remuneration for its services. Sophic Capital and/or its principals, officers, directors, representatives, and associates may have a position in the securities mentioned herein and may make purchases and/or sales of these securities from time to time in the open market or otherwise. This report may not be reproduced in whole or in part, or further distributed or published or referred to in any manner whatsoever nor may the information, opinions or conclusions contained herein be referred to without in each case the prior written consent of Sophic Capital.