Social Distancing and Keeping Hands Clean Won’t Lessen Banknote Need

Through the 2020 coronavirus pandemic, health officials have inundated us with messaging about washing our hands thoroughly and regularly. This has morphed into a culture of not touching anyone or anything, including paper money. Some businesses fear that paper money carries the coronavirus and can transmit it to whomever handles it. Some businesses have gone as far to disinfect banknotes they accept (a new form of money laundering).

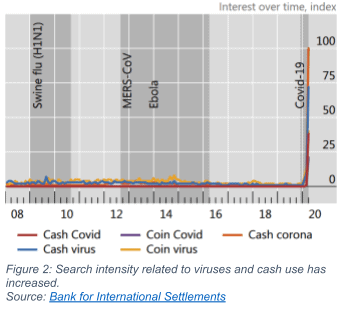

These precautions weren’t part of our behaviour during prior pandemics. Figure 1 shows that Americans continued to withdraw ATM cash and European usage remained flattish during the 2009 Swine Flu, 2012 MERS-Cov, and 2014 Ebola outbreaks. However, Covid-19 has people worried; Figure 2 shows an increase in searches regarding coronavirus transmission via paper and coin money. Should these folks be concerned? Will societies across the globe discard physical money in the future because of the pandemic? Will we one day see a cashless society for any reason? Read on.

The Un- and Under-Banked

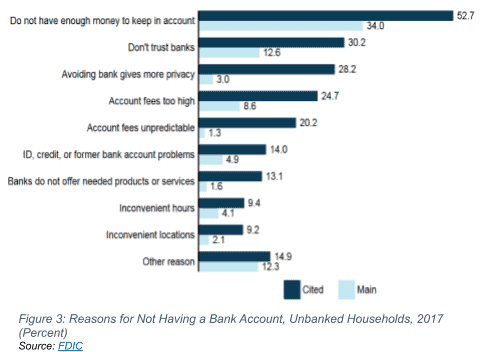

From a cost perspective, cashless transactions are faster, less error prone, transparent, and convenient, making them ideal to lift society’s underprivileged. For these reasons, the idea of a cashless society is a tenet championed by fintech companies. Yet, this premise is false, since physical cash already is a financial tool of inclusion. Not everyone has a bank account, and these folks are dependent upon physical cash to survive; according to a 2017 Federal Deposit Insurance Corporation (“FDIC”) study:

- 6.5% of American households comprising 14.1 million adults and 6.4 million children did not have a chequing or savings account. These are the “unbanked”;

- 18.7% of American households comprising 48.9 million adults and 15.4 million children that had an account at an insured financial institution also obtain financial products and services outside of the U.S. banking system. These are the “underbanked”.

Although these metrics had declined since 2011, we believe that they will worsen due to the coronavirus pandemic. We’re not economists and can’t estimate by how much; however, with 32 million continuing unemployment claims as of June 27, 2020, we’d wager that the number of unbanked and underbanked will grow rather than decrease.

FDIC collected the reasons cited by unbanked households (Figure 3) as to why they did not have a bank account. Some of these like “inconvenient hours” and “inconvenient locations” could sway the unbanked to adopt fintech solutions. Other reasons such as “do not have enough money to keep in an account” and “don’t trust banks” and ”avoiding bank gives more privacy” may be insurmountable.

The Lowest U.S. Wage Earners Use Cash the Most

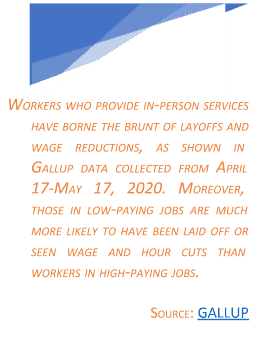

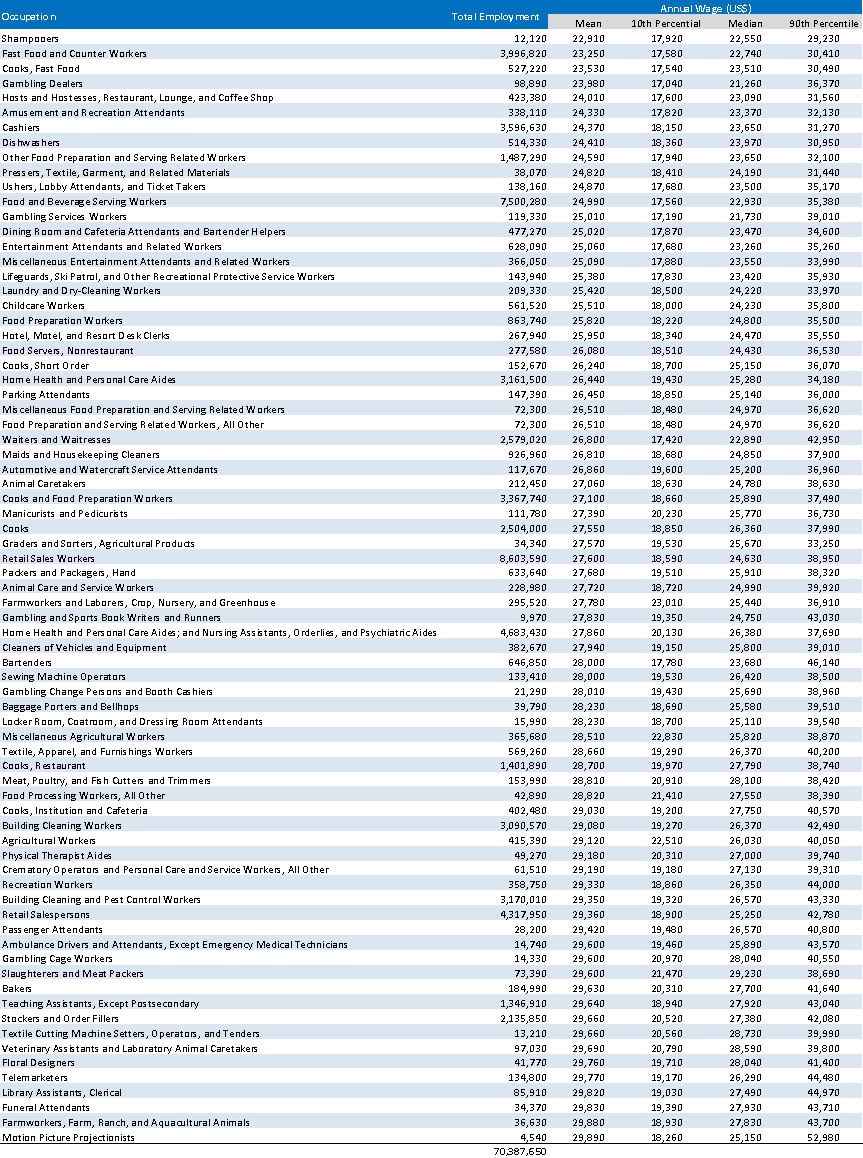

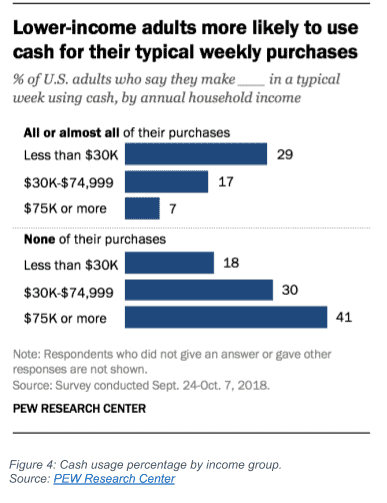

Nearly 46% of Americans that earned an income of less than $75,000 per year still use cash (Figure 4). And 29% of those earning les than $30,000 per year make almost all their purchases with cash (Figure 4). Who are the people making less than $30,000 per year in the U.S., and how has the pandemic affected their employment?

Table 1 shows who in America was earning less than $30,000 annually in May 2019. Scanning the list, many of the occupations are in the services industries, especially those like retail, tourism, and restaurants that were (and are still) hit hard by the pandemic. Will reliance on cash become more prevalent? We’ll have to see.

Other Countries Cash Usage

According to the 2018 G4S World Cash Report, cash represents over 50% of payment transactions, globally. In 2017, the World Bank claimed that 1.7 billion people – 31.5% of all adults – were unbanked (see graphic below). And 24% of these adults were in China and India, the two most populous nations. Recall, too, that in 2016, the Indian government voided 86% of the cash in circulation in an attempt to reduce corruption and black market transactions in order to increase tax receipts. Although Indians turned in about 97% of the banknotes before the deadline (thereby making their wealth more transparent), this didn’t stop black market transactions. Some 72% of transactions in India (in 2019) were still cash-based, partly because many merchants (especially rural merchants) don’t accept or have the network connectivity to accept cashless payments.

Cash is Here to Stay

Pandemic or not, cash transactions will be with us for awhile. Although cash payments are decreasing, we have identified cultural, technological, and economic reasons why we believe we’ll likely never achieve a cashless society and “financial inclusion” for all. Certain people don’t want. Others can’t have it. And given how the pandemic has wrecked the livelihoods across the world, we believe cash usage will increase as a form of payment.

How Investors Can Cash In

Investors who believe that demand for physical money will endure may want to consider Sophic Capital client Nanotech Security (TSXV:NTS), a leader in the development of secure security features used for banknotes, government documents, and brand protection products. These products are made from collections of holes, each less than 1 billionth of a meter in diameter. Nanotech can arrange holes to provide any colour, 3D-depth, movement, and even short videos. Best of all, these features are near impossible to copy, which is why governments and brands have come to Nanotech to develop authentication solutions.

An unnamed top 10 Central banks has signed Nanotech to a $30 million banknote security feature development contract. The customer cannot be named (yet) but having a security feature on a prominent banknote is in circulation, will further validate Nanotech’s leading technologies in the banknote industry.

Nanotech Security has about a $20 million market capitalization, $9.2 million of cash and essentially no debt. The Company has 69.2 million shares outstanding and no immediate needs to raise capital to support growth. It is also important to know that Nanotech has significant assets on their balance sheet beyond cash and today the stock is trading at about 0.8x price to book value. Management and insiders are aligned with shareholders and own ~22% of the Company, and the CEO has added to his position over the last several quarters. Investors who think cash in here to stay may want to look at investing in Nanotech Security.

Disclosures

Nanotech Security has contracted Sophic Capital for capital markets advisory and investor relations services.

Disclaimer

The information and recommendations made available through our emails, newsletters, website and press releases (collectively referred to as the “Material”) by Sophic Capital Inc. (“Sophic” or “Company”) is for informational purposes only and shall not be used or construed as an offer to sell or be used as a solicitation of an offer to buy any services or securities. In accessing or consuming the Materials, you hereby acknowledge that any reliance upon any Materials shall be at your sole risk. In particular, none of the information provided in our monthly newsletter and emails or any other Material should be viewed as an invite, and/or induce or encourage any person to make any kind of investment decision. The recommendations and information provided in our Material are not tailored to the needs of particular persons and may not be appropriate for you depending on your financial position or investment goals or needs. You should apply your own judgment in making any use of the information provided in the Company’s Material, especially as the basis for any investment decisions. Securities or other investments referred to in the Materials may not be suitable for you and you should not make any kind of investment decision in relation to them without first obtaining independent investment advice from a qualified and registered investment advisor. You further agree that neither Sophic, its, directors, officers, shareholders, employees, affiliates consultants, and/or clients will be liable for any losses or liabilities that may be occasioned as a result of the information provided in any of the Material. By accessing Sophic’s website and signing up to receive the Company’s monthly newsletter or any other Material, you accept and agree to be bound by and comply with the terms and conditions set out herein. If you do not accept and agree to the terms, you should not use the Company’s website or accept the terms and conditions associated to the newsletter signup. Sophic is not registered as an adviser or dealer under the securities legislation of any jurisdiction of Canada or elsewhere and provides Material on behalf of its clients pursuant to an exemption from the registration requirements that is available in respect of generic advice. In no event will Sophic be responsible or liable to you or any other party for any damages of any kind arising out of or relating to the use of, misuse of and/or inability to use the Company’s website or Material. The information is directed only at persons resident in Canada. The Company’s Material or the information provided in the Material shall not in any form constitute as an offer or solicitation to anyone in the United States of America or any jurisdiction where such offer or solicitation is not authorized or to any person to whom it is unlawful to make such a solicitation. If you choose to access Sophic’s website and/or have signed up to receive the Company’s monthly newsletter or any other Material, you acknowledge that the information in the Material is intended for use by persons resident in Canada only. Sophic is not an investment advisor nor does it maintain any registrations as such, and Material provided by Sophic shall not be used to make investment decisions. Information provided in the Company’s Material is often opinionated and should be considered for information purposes only. No stock exchange or securities regulatory authority anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. Sophic and/or its principals and employees may have positions in the stocks mentioned in the Company’s Material and may trade in the stocks mentioned in the Material. Do not consider buying or selling any stock without conducting your own due diligence and/or without obtaining independent investment advice from a qualified and registered investment advisor. The Company has not independently verified any of the data from third party sources referred to in the Material, including information provided by Sophic clients that are the subject of the report, or ascertained the underlying assumptions relied upon by such sources. The Company does not assume any responsibility for the accuracy or completeness of this information or for any failure by any such other persons to disclose events which may have occurred or may affect the significance or accuracy of any such information. The Material may contain forward looking information. Forward-looking statements are frequently, but not always, identified by words such as “expects,” “anticipates,” “believes,” “intends,” “estimates,” “potential,” “possible,” “projects,” “plans,” and similar expressions, or statements that events, conditions or results “will,” “may,” “could,” or “should” occur or be achieved or their negatives or other comparable words and include, without limitation, statements regarding, projected revenue, income or earnings or other results of operations, strategy, plans, objectives, goals and targets, plans to increase market share or with respect to anticipated performance compared to competitors, product development and adoption by potential customers. These statements relate to future events and future performance. Forward-looking statements are based on opinions and assumptions as of the date made, and are subject to a variety of risks and other factors that could cause actual events/results to differ materially from these forward looking statements. There can be no assurance that such expectations will prove to be correct; these statements are no guarantee of future performance and involve known and unknown risks, uncertainties and other factors. Sophic provides no assurance as to future results, performance, or achievements and no representations are made that actual results achieved will be as indicated in the forward looking information. Nothing herein can be assumed or predicted, and you are strongly encouraged to learn more and seek independent advice before relying on any information presented.