CEO Interview

Sophic’s newest client is U.S.-based Body and Mind inc. [OTC:BMMJ, CSE:BAMM], a multi-state cannabis operator with retail, distribution, cultivation and/or processing operations in Nevada, California, Arkansas and Ohio. CEO Michael Mills has had an extensive business career spanning over 25 years, and we caught up with him to learn about the U.S. cannabis market and how Body and Mind (“BAMM”) is positioning itself to win U.S. market share.

Q: Michael, our readers are familiar with the Canadian cannabis market. BAMM operates in the U.S. market. How big is the U.S. industry?

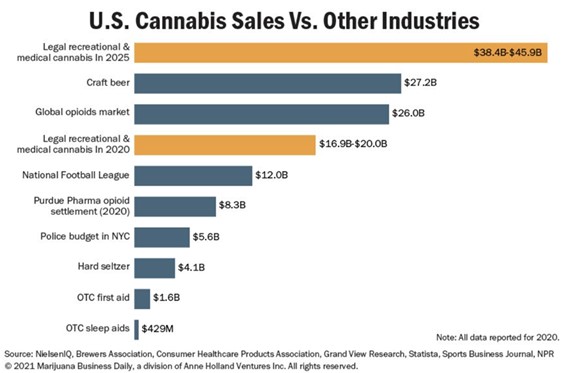

A: In 2019, Americans spent about US$80 billion on legal and illegal cannabis. According to analytics firm New Frontier Data, US$66 billion came from illegal sources, meaning the legal market generated about US$14 billion. Leafly estimated the 2020 market was US$18.3 billion and created 321,000 full time jobs. With the SAFE banking act formally scheduled to receive a vote on the House floor on Monday, April 19th, the U.S. market could see a continued shifting of revenues away from the illegal market in the coming years. New Frontier Data forecasts that the U.S. legal cannabis market could be worth US$41.5 billion by 2025 with an annual compound growth rate of 23% for adult use legal cannabis. The Marijuana Business Factbook estimated that the national impact could range from US$106 billion to US$130 billion by 2024. In comparison, Canadians spent about $2.6 billion on legal cannabis in 2020, and expectations are that the market could reach $11 billion by 2025.

Q: From a regulatory perspective, what are the major differences between the U.S. and Canadian cannabis markets?

A: The biggest difference is that cannabis possession and the business of cannabis is legal in Canada at the federal level. In the United States cannabis remains illegal at the federal level but is legal in some states. The federal illegality of cannabis prevents U.S. cannabis companies from transporting products across state lines, stops U.S. banks from handling cash and credit card processing, and severely curtails access to capital from institutional investors. All U.S. cannabis operations need to be state specific, and product can not cross state lines. There are many U.S. banks and brokerages that will not allow trading of U.S. cannabis shares, and companies with U.S. operation are currently not allowed to list on the NASDAQ or NYSE and generally trade on the CSE. By comparison, all Canadian cannabis companies are considered “legal” for investing purposes and can be traded by U.S. funds and institutions, list on the TSX, NASDAQ and NYSE. Another significant difference is cannabis taxation, as U.S. taxes are currently much higher for cannabis companies than almost every other industry due to a tax called 280E. Canada took a broad approach to legalization which allowed investors, banks and businesses access to capital and allowed consumers to understand regulations across the country.

Q: We wanted to spend some time diving into “limited-license” states and jurisdictions; what does that mean, and why is it important to BAMM?

A: “Limited-license” means that a state or city or county only allows a fixed number of retail/ dispensaries, production, or cultivation licenses to operate. Some cities within legal states do not allow cannabis operations and are currently opening up for new applications. Licenses are granted at the state and city level, and the licensee generally wins the license on a merit-based system. “Limited-license” is important to BAMM because a) it limits competition, b) creates a strong group of operators and c) helps drive greater brand awareness. We prefer to focus on limited-license states, and our current footprint has been meticulously selected due to the inherent moats that we can create in each individual market. As an example, Ohio has a population of over 11 million people and there are less than 60 dispensaries licensed for the entire state. San Diego has roughly 1.5 million people and there are 16 dispensary licenses for the entire city.

Q: When you think about the broader U.S. market, is BAMM planning to export its products to states where it doesn’t have operations?

A: That’s certainly a long-term consideration. However, cannabis is currently illegal at the U.S. federal level. Transporting cannabis across state lines – even between legal states – is prohibited. In addition, each state where cannabis is legal has its own regulations and standards, so how we operate in our current states may violate laws in other states. However, we are starting to see a shift in sentiment with Senate majority leader Chuck Schumer commenting recently that “at some point we’re going to move forward, period”. Changes at the federal level could provide a significant boost to the industry and is something we are watching very closely. We also keep a very close eye on the states that are opening for medical and adult use cannabis for licensing and acquisition opportunities.

Q: What recent regulatory developments could help transform the U.S. cannabis market?

A: I think one important piece of news was this past March when New York became the 16th state to legalize recreational cannabis. Under New York’s Marijuana Regulation and Taxation Act, possessing up to three ounces of marijuana will be legal. The catalyst for this move has been interesting as well; in November 2020, voters across 5 other states chose to legalize medical and/or recreational marijuana. One of those states was New Jersey, which has a population of 9 million compared to New York’s 19 million. This prompted a lot of speculation that New Jersey would vacuum a lot of taxes out of New York’s coffers, which is already facing revenue shortfalls in key industries like real estate, dining, and tourism due to the COVID pandemic. We are quickly approaching a critical mass of U.S. states that have some form of legal cannabis, and one of the most recent surveys by the Hill outlined that a total of 75% of U.S. voters support either federally legalizing marijuana or letting states decide on the issue. 25% of respondents said they want to keep cannabis illegal. We’ve seen a huge change in attitudes and normalization around cannabis over the past years.

Q: Does Body and Mind have operations in New York state?

A: No, since legalization just happened in New York, and it will likely take another year or so before cannabis sales start. It is obviously a very large market with a lot of potential. We currently operate in California, Nevada, Ohio, and Arkansas, but are constantly assessing potential new markets. We have been successful in winning licenses in the past and will closely monitor the license process in New York when the state opens for applications.

Q: So why would you consider New York state’s legalization of recreational cannabis significant?

A: The key is that only 16 states have passed legislation to legalize recreational cannabis. New York saw that recreational cannabis availability in New Jersey represented a lost opportunity to tax. I think we’re going to see the same dynamic eventually pan out across all the lower 48 states. People have shown a preference for safe legal cannabis and the selection offered by legal operations, and they will often visit a neighboring legal state to purchase. Cannabis generates tourism, and non-legal states are going to recognize significant missed tax opportunities. Given the potential size of the New York market as well as many other states and public opinion, it could play a crucial role in helping to shift the overall sentiment at a federal level.

Q: The states where you currently operate – what stops them from simply issuing more licenses?

A: Compliance is the biggest factor. Cannabis remains a heavily regulated market in the U.S. with each state having its own policies, regulations, testing requirements and licensing criteria. We understand these regulations and have been working in the industry for years. Generally, most states desire to keep the growing and distribution of cannabis tightly controlled. Licensing is a complicated process, requiring not only the basic business requirements like a tax ID, sales tax permits, et cetera, but also several unique requirements for the industry. Employees often must be licensed; municipalities have to approve the business; and sometimes residency is required in the jurisdiction where the business operates. Limited-license states typically want some control over cannabis, in part, to prevent cannabis from entering municipalities where voters don’t want it available in their communities. And don’t forget – the major economic focus here from a state level is tax revenues. If they start allowing cannabis stores on every block, the impact to pricing and profitability can be negative, driving down the potential pool of tax revenues longer term.

Q: California has almost 1,500 dispensary licenses granted – is there any concern it’s becoming too prolific?

A: California is the world’s largest cannabis market and has a population approaching 40 million people. As of January 2021, California had issued about 10,000 commercial cannabis licenses which includes all parts of the value chain from cultivation to manufacturing to transportation to retail. So having about 1,500 dispensaries for the 40 million people living in the world’s 5th largest economy isn’t close to saturating the market (for example, there are over 7,000 off-premises liquor outlets in L.A. County alone). The BAMM stores in the state were strategically chosen due to the strength of the local demographics and positioning of the real estate. As our brand builds awareness, we think this will help provide a moat for our dispensaries.

Q: How many dispensaries does BAMM operate in California?

A: We have two stores under the ShowGrow™ banner. One is in Long Beach and performs exceptionally well; and the other is in San Diego, where only 16 dispensary licenses have been issued for a total population of 1.5 million.

Q: Let us touch on some of the other states you operate in, starting with Nevada – tell us how BAMM started in the state.

A: We started in Nevada when the state first opened for medical cannabis, and we won our applications for cultivation and processing licenses. The medical market in Nevada at the time was extremely small, and we became very good cultivators and developed top shelf extracted and edible products and grew our brand and following across the state. We went on to win a number of awards including High Times, Emerald Cup awards and are recognized for our Body and Mind branded products. It put us in a strong position as Nevada transitioned from medical to adult use, and the market has continued to grow considerably year over year. Our strong local following helped maintain our sales through COVID, and we’re looking forward to the return of full tourism to Nevada.

Q: And in Arkansas you have retail operations – why not focus on cultivation if that is what you’re doing in Nevada?

A: We entered Arkansas with our partners Comprehensive Care Group. The idea was to build the dispensary and cultivation together and immediately open the dispensary for cashflow, optimize the operations and then add the cultivation operations. We’ve had the Body and Mind branded dispensary open for about a year, recently added online ordering and delivery, and on April 6, began cultivation (growing) operations in West Memphis, Arkansas. Capturing the entire vertical should lift our total margins across the operation.

Q: What do the operations look like for BAMM in Ohio?

A: Ohio is the 7th largest state by population in the Union, with about 11.7 million people. Only medical cannabis is available in the state, and Kentucky and Indiana are two neighboring states where cannabis is illegal. We have a Body and Mind branded dispensary west of Cleveland (population 1.5 million) and have almost completed construction of a production facility that should be operational soon. We’re looking forward to bringing our Body and Mind products into the Ohio market – we really like the potential in Ohio longer term and believe it can be a key state for the business.

Q: Besides entering states with limited licenses, what else do you look for when considering a new market?

A: We look for strong underlying demographics, established high foot traffic real estate and a pathway to longer term scalability within the market. We look to enter new markets at the lowest cost, whether that is through applying for licenses ourselves or making opportunistic acquisitions. We have a history of efficiently growing the company and responsibly allocating shareholder capital.

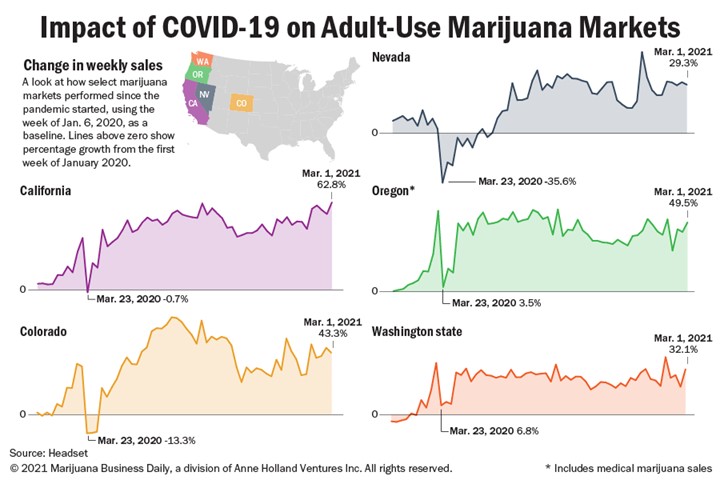

Q: How has the pandemic affected the industry?

A: When the pandemic hit and lockdowns began, the industry (like many others) were in a state of disorder because we did not fully understand what we were dealing with. Every business scrambled to ensure the safety of its staff and customers. In hindsight, demand was still there and continues to grow today. Once we had re-opening guidelines, retailers adjusted to social distancing mandates by implementing ecommerce and offering home delivery, and some states opened regulations to allow for curbside pick-up. It took us a little longer to integrate online/curbside pickup in our dispensaries than we would have liked, but since going live we have seen a nice uptick in volumes through this channel.

Q: And I suppose Nevada is largely dependent on tourism?

A: Tourism definitely plays a big role, as the drop in revenues from the pandemic was more pronounced and impacted by a full closure of in-person sales at dispensaries for a time. We’re optimistic about Nevada post the pandemic because like most, we expect to see a big boost from consumers’ pent-up travel demand. The Centers for Disease Control and Prevention updated its travel guidance on April 2 to say that people fully vaccinated against COVID-19 can travel, provided that they continue to wear masks and social distance. Trip Hoffman, our Chief Operating Officer, lives in Las Vegas and has noted recently that the tourists crowding the streets and casinos appears to be close to what they were pre-pandemic.

Q: What else do you think would be a catalyst for the U.S. cannabis industry?

A: There are several major policy changes that could be coming in the next 12 to 24 months that could provide a nice lift for the entire sector. We are following the SAFE Banking Act closely, which was reintroduced to the U.S. House and Senate this past March. It will create a “safe harbor” for federal depository institutions and credit unions, protecting them from federal prosecution if they work with marijuana-related businesses. The Act will allow these financial institutions to issue loans and credit to cannabis-related industries, which until now have had to rely mostly upon cash, imposing tremendous operational friction and costs. Banking the sector has been a major hurdle for many in the industry. An extension of SAFE banking may create the opportunity for U.S. federally regulated funds and banks to invest in cannabis companies and possibly even the potential for U.S. listings. This is one of the largest handicaps to U.S. companies at this time.

Q: What else do you feel could signal significant change for the U.S. cannabis industry?

A: Another potential upside should cannabis be de-scheduled would be the elimination of a tax on cannabis companies called 280E. The tax code section 280E denies a cannabis business owner the right to deduct normal business expenses when selling a Schedule 1 control substance. Currently, cannabis businesses pay taxes on their gross profit, rather than net income, which can cause tax rates to be 70% or higher. This change could help drive meaningfully higher cash generation for the industry as a whole and increase the sector’s attractiveness to all investors.

Q: What would you like to see happen within the U.S. cannabis industry?

A: We have seen so much change over the past decade, and it’s really accelerated over the last 6 months. Perceptions around cannabis legalization from the broad population have normalized, and we’re seeing this as more and more states pass legislation to legalize cannabis. Many states are enacting decriminalisation along with legalization and are wiping out tens of thousands of past non-violent cannabis records. For the broader industry, our goal is to continue to legitimize legal, safe cannabis and provide customers and patients with a wide range of offerings. We would like to minimize the illicit market – and I say “minimize” because it will be challenging to eliminate it. In 2019, the illicit cannabis market was estimated at US$66 billion – we want to do our part to reduce that market as close to zero by providing safe and reliable products. Having all state and federal governments legalize recreational and medical cannabis will help reduce the U.S. illicit market and expand the opportunity for safe tested cannabis products. We would also like to see fair treatment of cannabis businesses to allow access to banking, U.S. capital markets and a taxation system that is equitable with other businesses.

Q: Lastly, give us your perspective on the U.S. cannabis consumer – who are they today and how do you expect this to evolve in the coming years?

A: Great question. As many know, since cannabis was labelled a dangerous and illicit drug for so long, there remains a lot of negative stigma around cannabis. About 15% of the U.S. population uses cannabis today, with the ratio of male to female users about 2-to-1 and skewing younger overall. We are already starting to see this change, but much like the experience in Canada and Colorado, it takes years for people’s behaviours and opinions to evolve. This adds to our confidence the opportunity that lies ahead – we think limited-license states are unlikely to start opening stores on every corner and we have first mover advantage in many of our locations. We understand the complex regulations around cannabis and have had success with license applications. Most of all, there is an embedded underlying tailwind from a consumer perspective. We know there is a huge illicit market, but we are seeing consumers move towards the legal market due to a much wider range of products. There are a lot of parallels between legalization and the end of alcohol prohibition, and we continue to see significant opportunity for growth in U.S. cannabis sales and macro events around legislative changes at local, state, and federal levels.

Body and Mind Inc. will be presenting at the planet MicroCap Showcase on Wednesday, April 21, 2021 at 4 pm ET.