Enterprise Tools for Extracting Actionable Insights from Data

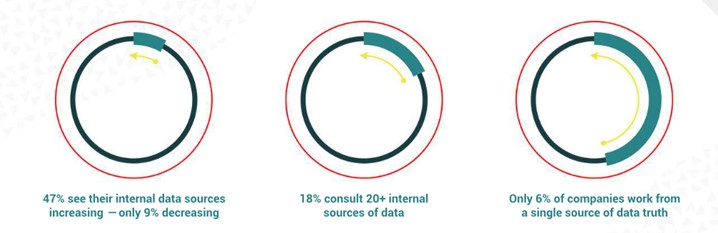

Enterprises are drowning in data, and it’s crucial that they make their data actionable. Greater reliance on technology and regulations have created large volumes of data, which also include bad and missing data due to legacy systems, outdated processes, and lack of internal controls. Extracting accurate insights from big data is crucial for setting strategy, uncovering new revenue opportunities, and cost savings. What’s needed is proper data governance and tools to accelerate data to actionable business insights.

Enterprises have flaunted technologies like data analytics, artificial intelligence (AI) and automation as the panacea to combat misinformation arising from bad and missing data. Although these and other technologies have powerful roles, several issues abound. For example, enterprises deploy technologies piecemeal – that is, they will typically license one or two tools to implement systems in isolation rather than as a part of the solution to achieve their larger overall goals. Even when fully deployed, technologies are not fully utilized to drive growth and success.

Also key to navigating vast datasets is logical data warehouses. Unreachable, siloed data reduces the ability of enterprises to uncover the value and/or risks of hidden data assets. Logical data warehouses, where the path and rights to data are stored in one location and accessible to those who need it, provides governance over what data is added, modified, and deleted as well as who has access. This drives consistency and confidence since end-users have access to authorized sources of corporate data. There are many types of native and centralized data: 1) authoritative operational data from sources; 2) stream data from 3rd party sources; 3) data lakes, where data is unprocessed, and 4) data warehouses, where processed data is stored. Data lakes are among the fastest growing segments , which were a US$3.74 billion market forecasted to reach US$17.6 billion by 2026, according to market researcher, Research and Markets.

So, while business leaders need accurate, decision-ready data that is easily accessible, IT departments need to deliver increasingly complex solutions. IT departments need to find multiple data sets (often siloed somewhere in the enterprise) often from legacy systems that don’t connect well with modern technology tools. Plus, IT departments need to validate data, and present it simply and in a manner that allows extraction of insights, manipulation of data, in real-time.

C-level executives aren’t the only ones demanding accurate answers quickly. Regulators demand proof of compliance (data privacy laws like Europe’s GDPR and California’ CCPA, for example, or PHMSA for the regulation of U.S. energy pipelines). The consequences of non-compliance can be financial penalties or even suspension of business activities.

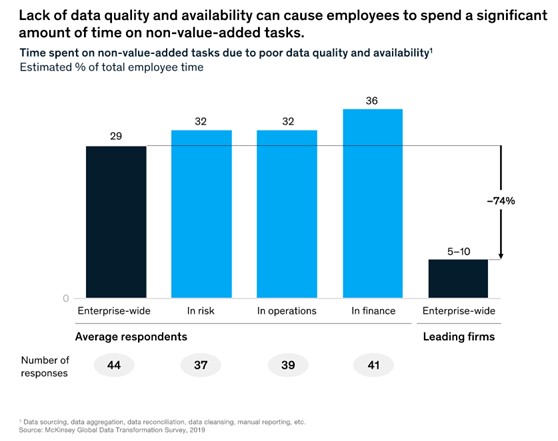

Of course, data isn’t the sole culprit for bad decisions. Often, decisions are siloed from the rest of an organization, left with people who have never experienced front-line worker issuers, or are reactive rather than proactive. However, these decisions can be expensive. In fact, bad data can waste up to 30% of employees’ time (Exhibit 1). This doesn’t even factor in the possibility that decisions based upon bad data could drive strategies and actions that create little or even negative value for enterprises.

Bad data can even affect brand strength. Product data encompasses multiple data sets, including inventory, descriptions, pricing, and shipping. Each of these aspects (and there are many more) to customer experience represents a potential point of failure should a customer involuntarily use bad data to transact (or not). And many customers aren’t forgiving – 59% of respondents to a Robert Half customer survey said it just takes 1 or 2 bad customer service experiences to decide not to work with a company in the future.

Current Enterprise Systems Solutions

There are five main software segments attempting to unify enterprise systems and improve operations:

- Integration-Platform-as-a-Service (iPaaS) is a suite of cloud services for building and deploying integrations within the cloud and between the cloud and enterprise. iPaaS functions as a conduit for communication between multiple systems, allowing for integration and data sharing.

- Enterprise Data Management (EDM) solutions help customers manage the data produced by multiple systems to report, operate and plan operations. Segments include Database management systems, data preparation, data warehouse architectures and data integration needed for analysis and decision making.

- Analytics and Business Intelligence (ABI) solutions perform the reporting and the analysis of information to improve and optimize decisions and performance and most often provide recent and longer historical perspectives.

- Intelligent Automation (IA) solutions execute decisions based on business rule and workflows. Known by several segments. Known by several segments robotic process automation, business process automation, hyper-automation, and release automation they all feature the ability to accelerate execution and reduce demand on labor.

- Digital Experience Platforms (DXP) help companies deliver an exceptional digital experience to their customers via the digitizing of business operations, customer experiences, and collecting customer insights. DXPs provide enterprises with tools to gather cross-channel data to understand their customers. Companies can then apply the learnings from this data towards the creation, management, and delivery of content.

Source: Edge Total Intelligence

Market Sizes

From data management to experience there is positive growth from enterprises to extract insights and make better decisions from their data and connect customers, employees, and partners to what is happening.

In 2020, the estimated DXP market size was US$9.2 billion and growing to US$22.9 billion by 2028, according to market researcher, Grand View Research. North America represented 30% of the 2020 DXP market, and Asia Pacific likely to drive future industry growth. Various forecasters believe Increasing preference of organizations to deliver integrated, personalized, and optimized user experience and engagement across numerous marketing channels is what will drive DXP market growth.

In 2020, the global enterprise data management market size was US$72.79 billion and is expected to grow at a compound annual growth rate (CAGR) of 13.8% from 2021 to 2028 to reach US$208.87 billion, according to market researcher, Grand View Research. Significant growth over the forecast period is owing to increasing need for real-time information, a structured process and automation for data delivery to consumers, and effective management to ensure regulatory compliances across industry verticals.

Coming up…

In Sophic Capital’s follow-on report, we’ll introduce our client Edge Total Intelligence (TSXV:CTRL), a provider of cloud-based intelligence software for centralizing business data/information into a single control platform.

Sign up for Sophic Capital’s reports at https://sophiccapital.com/subscribe/