Sizing Clear Blue Technologies’ Market Opportunities

In Sophic Capital’s Clear Blue’s Clear Business Model report, we learned about:

- The business backgrounds of Clear Blue’s management team;

- Clear Blue’s revenue model, and;

- Some of the world’s largest brands who are Clear Blue customers.

In this report, we’ll look deeper at the markets targeted by Sophic Capital client Clear Blue Technologies [TSXV:CBLU, OTC:CBUTF]. Today, Clear Blue has clients in the Middle East and Africa (contributing about 88% of revenues over the past four quarters), the United States, and Canada. In these markets, Clear Blue is targeting off-grid telecom power systems, smart solar lighting, and IoT verticals.

Large and Growing Addressable Markets

Telecom Power Systems

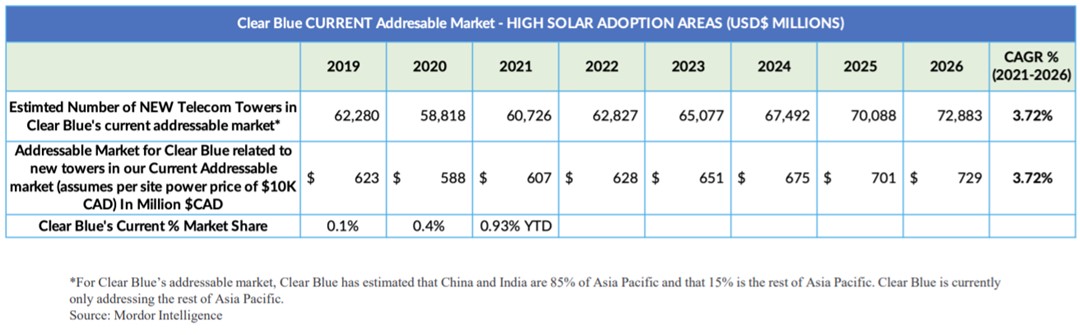

The global market for telecom tower power systems was US$4.34 billion in 2020 and could grow at a 3.25% CAGR to US$5.25 billion in 2026, according to Mordor Intelligence Market Research. Exhibit 1 shows that in the Middle East and Africa, which represent the largest potential telecom power system market growth through 2026, Clear Blue’s market share is less than 1%, suggesting the company has a large growth opportunity. These are regions where Clear Blue has demonstrated success at winning major regional telecom operators and suppliers, including IHS Towers, NuRAN, and Parallel Wireless.

Exhibit 1: Regional Telecom Power System Market Sizes and Forecasts

Source: Clear Blue Technologies

According to Mordor Research, there were 250,000 new telecom towers installed globally in 2020. Extrapolating Clear Blue’s current addressable market, there were approximately 58,818 new telecom towers installed in 2020 in Clear Blue’s current addressable market. Starting with a 0.1% market share in 2019 while in pilot mode, and by 2020 (Clear Blue’s first deployment year) the Company had captured 0.4% market share. Thus far in the first three quarters of 2021 (traditionally the Company’s seasonal smallest quarters), Clear Blue has grown to 0.9% market share (Exhibit 1).

Street Lighting

The off-grid solar sector currently provides lighting and other energy services to 420 million people. To achieve universal access to electricity by 2030, the off-grid solar sector would need to serve as many as 132 million households. And estimates suggest that off-grid solar is well on its way to achieving this goal: the global off-grid solar lighting market had an estimated value of US$1.6 billion in 2020 and could grow to US$4.9 billion by 2027. The U.S. represented US$473.1 million of the global 2020 US$1.6 billion market.

Building more resilient and Smart City infrastructure, including lighting, is a key focus for governments around the world. Damaged grid infrastructure that is cost-prohibitive to repair and lacks redundancy is a prevalent problem. Clear Blue combines green energy with advanced technology to deliver the most reliable solar- and wind-powered streetlights in the industry. The Company’s Smart Off-Grid software enables the lights to be managed, monitored, and controlled over the Internet, delivering unmatched reliability while lowering installation and maintenance costs by up to 80%.

IoT

The global Internet-of-Things (IoT) market was valued at US$761.4 billion in 2020 and could reach over US$1,386 billion by 2026. IoT functions as a global infrastructure for the information society, enabling advanced services to interconnect things based on existing and evolving communications. With the development of wireless networking technologies, the emergence of advanced data analytics, a reduction in the cost of connected devices, and an increase in cloud platform adoption, the market is expanding and diversifying. As the world continues to urbanize, IoT can help the energy sector transition from a centralized to a distributed, smart, and integrated energy system.

Between 2014 and 2019, mobile operators invested about US$320 billion to expand and upgrade their networks. That brought mobile broadband coverage to another billion people and enabled access to the Internet via mobile phones. The addition of IoT devices further stresses existing telecommunications network infrastructure as these devices connect to the Internet both passively and remotely controlled. Wireless power based upon solar facilitates IoT device installation anywhere, removing dependencies from utility grids or fossil fuel power generators. With Clear Blue’s built-in wireless networking and Smart Off-Grid technology, every pole with an installed IoT device becomes a smart pole (Exhibit 2). The Company’s Smart Off-Grid solutions provides highly secure communications and networking between poles and to the Cloud, an open architecture, interoperable with leading applications, and Cloud redundancy and reliability.

Exhibit 2: Examples of Clear Blue’s IoT Applications

Source: Clear Blue Technologies

Africa Powers Ahead

Off-grid solar is crucial to Sub-Saharan Africa, given that 46% of the region had the lowest access to energy in 2019. In terms of telecom power system demand, Africa has the largest long-term growth opportunity in the world, and Clear Blue has a strong foothold in sub-Saharan Africa. The region is home to 67% of the world’s population that are not currently covered by mobile broadband, and the population could double by 2050. This young and growing population will likely be high demand users of cellular, satellite and Internet connectivity.

About 871 million Africans lacked Internet access in 2020. Less than a third of the population has access to broadband connectivity, and according to The World Bank, achieving universal, affordable, and reliable internet access by 2030 will require US$100 billion of investment.

Lack of access to reliable and affordable electricity poses a challenge to accelerating Africa’s digital transformation. The telecom tower marketplace is moving towards renewables for power because of lower costs, a desire to move away from fossil fuels and generators, and the lack of available reliable grid power. With Clear Blue having established and proven itself as a leading provider of mission-critical off-grid power, there is significant potential for opportunities in this market over the coming years.

Customers and Connections

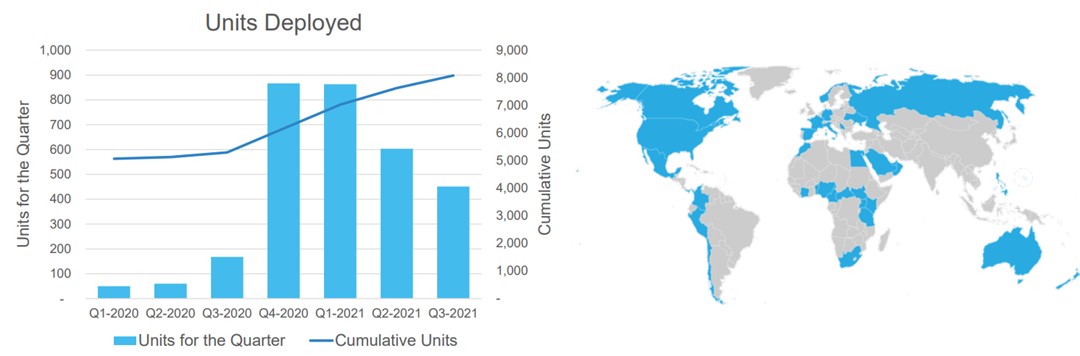

Clear Blue Technologies has established itself as a global leader in wireless power (Exhibit 3) and across several industries. In the telecom sector today, Clear Blue mostly focuses on wireless broadband connectivity. That includes cell phones (2G/3G/4G) and the backhaul that connects it, which could be either satellite or microwave. The bulk of the wireless broadband marketplace is focused on Africa.

The two largest telco operators in Africa are MTN and Orange. Through Clear Blue’s partner network in that market, including IHS Towers, Parallel Wireless, NuRAN, and others, Clear Blue is powering and controlling infrastructure in numerous countries for MTN and Orange. The Company also has a number of projects in Latin America, including those with Mayu, Telefonica and Facebook.

Satellite marketplace could see unprecedented growth in the coming years with a push for global Internet access. Clear Blue believes its satellite market growth will accelerate and has partnered with Avanti to deploy rural connectivity. The Company is also working with several other satellite companies, positioning itself for future growth.

Exhibit 3: Clear Blue Technologies has Extensive Global Traction

Source: Clear Blue Technologies

Clear Blue’s primary focus of the streetlight vertical (Illumient Applications) is North America. Providing solar off-grid streetlights has proven to be critical for progressing infrastructure as an ongoing Energy-as-a-Service (EaaS) to cities, towns, and municipalities. Clear Blue currently provide services to both the New York and North Dakota Departments of Transportation, as well as numerous provinces, states, and cities; Boston, Philadelphia, Mississauga, and Hamilton to name a few. Customers also include NASA, Boston Scientific, and Allentown, PA.

Current and Future Opportunities

Clear Blue is investing in sales, scaling, and R&D to capitalize on large growth opportunities. Clear Blue’s sales funnel has grown significantly in the last 18 to 24 months, increasing from approximately $200 million to now exceeding $450 million. Some of Clear’s Blue’s more recent announcements include:

- a strategic contract with Parallel Wireless with the first order of that project which shipped in Q3 2021;

- a partnership with Avanti communications, a leading satellite service operator across Africa, and Clear Blue to deploy several systems and projects with them along with other partners and customers;

- an agreement with NuRAN Wireless to provide more than 1,333 Smart Off-Grid power systems for its Orange DRC service. The contract has an estimated value of C$8 million to C$10 million over the next three years, with a minimum of C$750,000 of products and services delivered in 2021, and;

- a joint project with Facebook Research and Mayu Telecommunications. This independent study aims to validate and quantify the benefits of smart power. The project is already underway, and the Company expects that they will be able to announce the results sometime in early 2022 to help their telecom customers understand the value of Clear Blue’s technology and the value that predictive analytics and smart power management deliver to the marketplace.

Early Evidence Supports Management’s Bullish 2022 Outlook

On November 16, 2021, the Company reported its Q3 2021 financial results, when the Clear Blue reported record railing Twelve Months (TTM) Revenue of $9 million (up nearly 140% year-over-year). More importantly, we would like to draw investors’ attention to management’s comments on the Company’s 2022 outlook. Driven by customer planning for Telecom system rollouts and Illumient construction planning for 2022, the Company indicated a high level of confidence with regards to strong indications to a very strong start to 2022, and a bullish view on internal volume forecasting for H1 2022. From an investor perspective, the Company is anticipating a large order, which could potentially double bookings from Q3 levels of ~$2.9 million which is not fully reflected in Forward Twelve Month (FTM) guidance. FTM revenue for the period Q4 2021 to Q3 2022 is expected to be greater than $9 million. While the Company’s Q3 Gross Margin was relatively strong at 39%, for the next few quarters, Management expects the Gross Margin to be in the 30% to 35% range, owing to ongoing and well documented global supply chain constraints, leading to higher raw materials and shipping costs, even as the Company has been proactively managing its supply chain. In the medium to long-term, Management expects Gross Margin to be higher in the 33% to 38% range. Overall, with its short-term Gross Margin profile, and all else equal, Management anticipates the Company could be Adjusted EBITDA break-even at an annual revenue in the $15 million to $20 million range – a meaningful inflection point, that larger institutional investors watch – as it implies a Company’s base business is self-sustaining and significantly reduces investor risk of equity dilution.

Framing The Upside For Investors – Peer Valuation Metrics

Clear Blue Technologies has clearly established itself as a lead in wireless, remote power systems. As we have highlighted, third party estimates suggest that Clear Blue has targeted growing, billion-dollar industries that need the Company’s solutions and services.

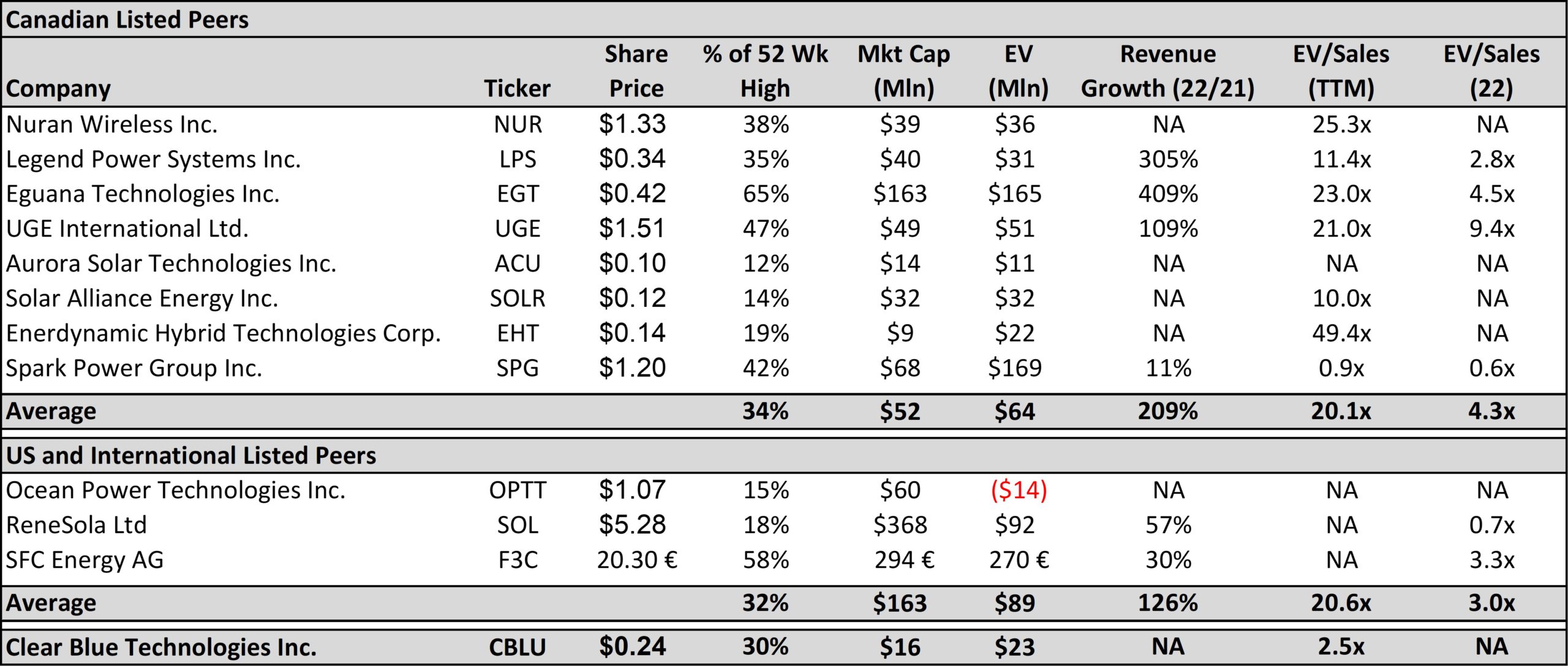

Investors do not yet appear to be giving the stock credit for the Company’s prospects. Clear Blue has been bullish about its prospects, as evidenced by recent management commentary and outlook, which we previously discussed. With that context, how does Clear Blue Technologies’ current valuation compare to peer companies? In Exhibit 4, below we see that on a Trailing Twelve Month (TTM) basis, Clear Blue trades at ~2.5x revenue vs. similar companies trading at over 20x on a similar metric. Higher TTM valuations typically occur when investors expect companies to grow rapidly in the near term. Indeed, this appears to be the case with peer companies – as their 2022 revenue growth from 2021 appears to be over 125% on average. On a 2022 basis, these peer companies are trading at 4.3x revenue in Canada and 3.0x internationally.

Exhibit 4: Clear Blue Technologies’ Growth Prospects Not Yet Fully Appreciated Relative To Peers

Source: Company reports, Sophic Capital

What an upside scenario could look like, based on the Company’s guidance and current market valuations. Looking at the data that management has provided, before factoring in any major early 2022 contract wins management has telegraphed in November, — if we apply the average Canadian 2022 revenue multiple to the low end of Clear Blue’s Forward Twelve Month (FTM) guidance of >$9 million for the period ending September 2022, we arrive at an Enterprise Value of $39 million, which when adjusted for the Companies November convertible debenture deal and existing share structure implies a per share value of ~$0.50, or over 80% higher than current levels. The Company has also suggested that it could attain Adjusted EBITDA break-even at an annual revenue in the $15 million to $20 million range. The low end of that range i.e., $15 million at 4.3x, would imply a value of ~$0.80 or ~230% higher than current levels taking into account, warrants and options, which would be in the money at that point. We note this illustrative exercise is based on the revenue guidance the Company provided on November 16, 2021, based on how the market is valuing similar companies, in a punishing market environment, and without taking into account any additional contract wins/guidance revisions. Therefore, investors who believe that off-grid telecom tower, street light, and IoT deployments will accelerate globally may want to consider adding Clear Blue Technologies [TSXV:CBLU, OTC:CBUTF] to their portfolios.

Sign up for all Sophic Capital’s reports at https://sophiccapital.com/subscribe/