OneSoft Solutions (OSS-TSXV; OSSIF-OTC) Machine Learning and Data Science to Eliminate Pipeline Failures

In our Fossil Fuels Aren’t Going Away – Not Your Typical ESG Investment report, we detailed that:

- Fossil fuel demand will continue to dominate American energy consumption for at least the next 30 years;

- Legacy techniques for analyzing fossil fuel pipeline infrastructure is inadequate, with an incident occurring every 1.25 days on average;

- PHMSA, America’s pipeline regulator, announced new rules last October for toughening pipeline safety rules;

- Environmental, Social and Governance (“ESG”) activism is a trend in the investment world (i.e. BlackRock [BLK:NYSE] and Microsoft [MSFT:NASDAQ]), and;

- A Sophic Capital client has a proven ESG solution that can minimize the probability of pipeline incidents occurring.

Machine Learning and Data Science to Eliminate Pipeline Failures

We believe that these catalysts bode well for OneSoft Solutions (OSS:TSXV, OSSIF:OTC), a Sophic Capital client. OneSoft Solutions’ (“OneSoft”) mission is to use machine learning and data science to help U.S. pipeline companies achieve their stated objective of reducing pipeline failures to zero. The Company is disrupting the industry with its Software-as-a-Service (“SaaS”) solutions that ingest decades of pipeline data to quickly provide accurate, actionable intelligence about where and when pipelines are predicted to fail. Four Fortune 100/500 firms, one independent and one oil and gas pipeline Supermajor have onboarded OneSoft’s solutions, and several more prospective customers are undergoing these processes now.

A big reason why pipelines fail is because incumbent analysis techniques typically examine only 5 to 10% of pipeline data. Pipeline Inspection Gauges (“PIG”) are data collection tools propelled through pipelines by the product. The PIGs gather “features” data such as areas of wall loss, cracks and dents. PIG data is aggregated in the tool as it’s pushed through the pipeline, then processed by the PIG vendor and sent to the operator in the form of .csv/Microsoft Excel files for analyses and interpretation. The operator’s engineers then use Microsoft Excel to compare files containing the most recent and prior data for the section of pipe pigged and make assessments based on data in the two spreadsheets. This is a highly manual, complicated, time-consuming and expensive process that involves running macros and scrutinizing countless cell entries in search of learnings. A better industry solution is needed, and that solution is what OneSoft has developed – advanced predictive analytics that only machine learning and data science operating on a cloud platform with highly scalable computing power can deliver.

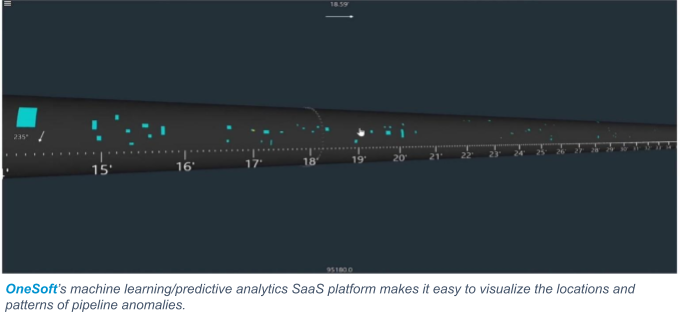

OneSoft’s machine learning/predictive analytics solution processes 100% of PIG data – not just the 5 to 10% that legacy, Excel-based methodologies analyze – in a fraction of the time, with higher accuracy and at lower costs. Because of the large amount of data involved, legacy industry processes typically filter out most data (i.e., greater than “X” or less than “Y”) to focus on what is assumed to be the most crucial information. OneSoft’s solution ingests and analyzes 100% of data that has been collected over time, allowing OneSoft’s proprietary machine learning algorithms to align features over multiple PIG runs with a high degree of probability, ensuring that tool errors are mitigated and the features being considered are the same ones over multiple PIG runs. Once this fidelity of feature data is assured, OneSoft’s algorithms can trace each individual feature back to whenever it first appeared on any historical PIG run data set – something that is virtually impossible to do with legacy techniques. Given the ability to read historic data, growth of each individual feature can be determined over time, and accurate predictions as to when the feature will grow to the point of failure can be made. This “pit-to-pit” alignment of features and analysis provides a much better understanding of the feature threats that will ultimately lead to failures, and when in the future each individual feature/anomaly will grow to the point of failure.

Phillips 66 (PSX:NYSE), Fortune 500 companies, and an unnamed industry Supermajor are all OneSoft clients that have committed to multi-year agreements. Access to these clients’ data is key for OneSoft because more data equates to more accurate machine learning/predictive analytics algorithms. And since OneSoft’s software is a SaaS solution, all customers benefit from new learnings that come from improved, updated algorithms.

Reasons for customers to deploy OneSoft’s solutions include better threat detection, cost efficiencies, visualization of critical data and information in real world context, and adherence to complex regulatory compliance requirements. Sales cycles to initial customers have been complex and lengthy. However, this is now probably advantageous for OneSoft as this makes clients sticky, given their reluctance to repeat the comprehensive and disruptive validation processes to onboard a new solution that manages their most valuable assets (pipelines). We believe that OneSoft has first mover advantage and a considerable head start from future competitors.

Digital transformation is a global trend in the pipeline industry. A few years ago, oil and gas companies were on the sidelines, unaware and/or avoiding both digital transformation and the migration of their computing systems to the cloud. Today, however, multi-national firms are moving in this direction. For example, Suncor recently announced it was working with Microsoft to harness the power of the cloud, artificial intelligence, and machine learning. There was no mention of OneSoft Solutions, and the Company wouldn’t comment; however, we have heard that OneSoft’s solution is typically the first cloud application adopted by U.S. pipeline clients and prospects undergoing digital transformations, so this scenario may occur in Canada.

Regardless of what happens in Canada, Microsoft U.S. continues to work closely with OneSoft. To date, OneSoft’s solutions have been the first and biggest Microsoft Azure workload for OneSoft’s clients. This has motivated these clients to adopt more Azure cloud computing applications like Office 365 and Power BI, representing additional revenue for Microsoft. So, Microsoft’s strong support for OneSoft will likely continue.

OneSoft Can Expand Its Current Total Addressable Market

The petroleum industry is divided into three major segments: (1) upstream, the exploration and production sector; (2) midstream, wherein crude oil, natural gas and natural gas liquids are processed, stored, marketed and transported; and (3) downstream, which includes refineries, petrochemical plants, distribution, retail outlets and natural gas distribution companies. Historically, OneSoft has derived all it’s business from the midstream segment, and the Company estimates a $1.1 billion global addressable market, based on current annual expenditures by the industry for data evaluation.

On November 7, 2019, OneSoft announced its first upstream pilot to an unnamed Fortune 100 client already using the Company’s machine learning solution in its midstream operations. Although we cannot quantify the size of upstream pipeline or the value of this contract, upstream integrity management represents a potential new revenue steam for OneSoft.

The figure to the right shows that OneSoft currently has close to 50% of the 660,000 U.S. piggable miles of midstream pipeline in its sales funnel. The Company has several legs of growth, including:

- Sales funnel clients: Just signing the clients in the active sales funnel could potentially quadruple the Company’s current recurring revenue opportunity, based on its historic metric of $100 per mile per year;

- Expanding the sales funnel: Getting the remaining 50% of U.S. piggable midstream pipeline into the sales funnel could double this opportunity again;

- International markets: OneSoft is focused on the U.S., since the country’s pipeline industry is the world’s largest and most regulated, leaving about 40% of the global addressable market to capture in the future;

- 2.1 million miles of non-piggable midstream pipeline: OneSoft is developing direct assessment, machine learning products (some could be released by late 2020) that predict when non-piggable, midstream pipelines could fail;

- U.S. pipeline operator digital transformation: Large U.S. pipeline operators like Chevron (CVX:NYSE) and Phillips 66 are offloading internally developed systems, a trend that could provide opportunities for OneSoft to expand its SaaS solution. Phillips 66 already provided OneSoft with IP from some of their internally developed software (along with $3 million of funding). OneSoft migrated the IP to the cloud as part of its SaaS solution, and;

- Upstream pipelines potential: Depends upon future success of entering this market, but as noted before, OneSoft has announced an upstream pilot.

More Potential to Grow Revenue

With some modification, OneSoft’s machine learning/data science solutions could likely extract information from other linear assets where measurements of data occur over time. This means that integrity management of water and sewer and railway/rail transit infrastructure could be future markets. To be clear, management is only focused on the U.S. oil and gas pipeline market at this time.

Investors’ Benefit

What’s attractive for investors is that OneSoft’s platform is sticky and generates recurring SaaS revenue with gross margins around 80%. With the aforementioned growth alternatives, we believe that revenues, gross margin, and cash flow could scale nicely. The Company reported in its last MD&A that annual SaaS recurring revenue for 2019 was expected to double over 2018 (results haven’t been released yet) with similar expectations for 2020 over 2019.

OneSoft Solutions is Well Positioned to Capitalize on its First Mover Advantage

As of the September 2019 quarter, OneSoft Solutions (OSS:TSXV, OSSIF:OTC) had $11.3M of cash and no debt; management owns about 33% of the Company. The Company is well capitalized to execute.

OneSoft has a significant competitive moat today. To date, OneSoft has assessed tens of thousands of miles of pipeline data, involving more than 50 million features, which increases the value of the Company’s intellectual property. We believe this is a large competitive factor that will be a difficult to overcome by new competitors. Why? Although pipeline operators guard their data and don’t share it with other operators or regulators, they grant access to OneSoft to conduct the analysis. OneSoft owns the learnings from this data and shares those learnings with all users of OneSoft’s solutions through constant improvements to their algorithms. As OneSoft’s solutions ingest and analyze more and more data, new patterns and learnings discovered through machine learning are shared with all users. U.S. pipeline operators and PHMSA are supportive of sharing learnings without having to disclose confidential data. PIG vendors and large pipeline companies developing internal systems are disadvantaged, because they only have access to their own data rather than the much larger anonymized data sets that OneSoft has collected.

To date, no one else in the industry has had access to these vast data sets from disparate PIG vendors. Why? There are many PIG vendors, all competing for pipeline operator business. All PIG vendors want to be exclusive to their pipeline customers in order to get the most data to make the best tools. But pipeline operators never single source a PIG vendor – even for the same section of pipe because they don’t want any third party to have control over their most valuable asset – pipelines. Giving a PIG vendor a monopoly could also lower service levels and increase pricing, never mind making data potentially less secure if security practices aren’t good.

OneSoft, however, is neutral to pipeline operators because it is not a PIG vendor vying for exclusivity, and Microsoft Azure provides data security. Operators maintain data ownership; OneSoft benefits from PIG data learnings, incorporates those learnings into its cloud solutions, resulting in better predictive analytics for ALL subscribers.

This all combines to provide OneSoft with a significant head start that OneSoft expects it can monetize in the future. OneSoft Solutions has a validated and unique platform to continue to aggregate more data, and no direct competitors today. We believe the company is well positioned to not only execute against its sales funnel but also expand it.

OneSoft is an ESG Investment

As mentioned in our Fossil Fuels Aren’t Going Away – Not Your Typical ESG Investment report, U.S. Energy Information Administration (“EIA”) data shows that fossil fuel demand will continue to dominate American energy consumption for at least the next 30 years. Given this, pipelines will be crucial for transporting fossil fuels across America, and it is incumbent upon the industry, regulatory officials, consumers, and activists to ensure that America’s aging pipelines are safe. Incumbent techniques relying upon Excel methodologies have been and continue to be inadequate to reverse the frequency of incidents and failures. A disruptive new approach that uses advanced data science and machine learning technologies seems to be the logical way forward.

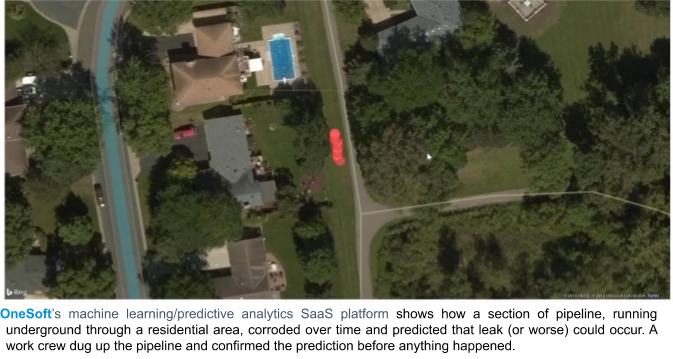

OneSoft’s machine learning/predictive analytics SaaS platform has proven that it can predict threats prior to actual pipeline failures occurring. As such, it has vastly improved its clients’ ability to detect potential pipeline leaks and explosions (the “environmental” in “ESG”), keeping communities safe (the “social” in “ESG”) as well as exceeding regulatory compliance (the “governance” in “ESG”).

ESG is a real trend, and funds are increasingly holding their investments accountable. We believe this trend is only going to get stronger, and it’s not too late for investors to participate. OneSoft’s mantra is “We predict pipeline failures, save lives and protect the environment … with the assistance of data science and machine learning” – fully consistent with ESG. Investors seeking to allocate part of their portfolio to ESG firms should consider OneSoft Solutions (OSS:TSXV, OSSIF:OTC).