In our Killi (MYID) – Voting for Consumer Data Privacy report, we detailed how governments have implemented or are about to enact legislation protecting personal data. In this report, we discuss how your data is collected, amalgamated, and monetized and how the businesses facilitating this trade are at risk.

Mining and Selling Your Personal Data

Most people understand that brands pay to place advertisements on websites. Many folks also know that somehow brands can generate targeted ads that follow these people across the Internet and applications. Consumers seem to sense that something is collecting their personal data; yet they have no transparency on who is collecting it, what is actually being collected, and what their data is worth to those using it.

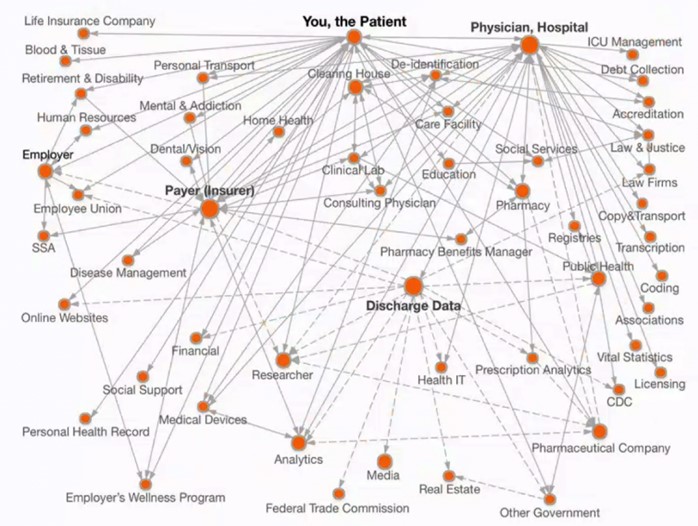

Few people likely know the extent of personal data collection – even drugstores, grocery store chains, banks, and charities are using, sharing, and/or selling personal data. Even the personal medical information of Americans could be at risk, in spite of the U.S. HIPPA Privacy Act, which established standards to protect patient records (one way is to anonymize the data). What some people may not know is that many brands sell the data they collect to data aggregators known as “data brokers”.

Multiple patient data sources, which could be sold to data brokers to package and resell. A law professor stated that grocery lists (not included in chart) probably yield more about an individual’s health than a patient record.

Source: The Century Foundation

Data Brokers Vacuum Your Digital Footprint

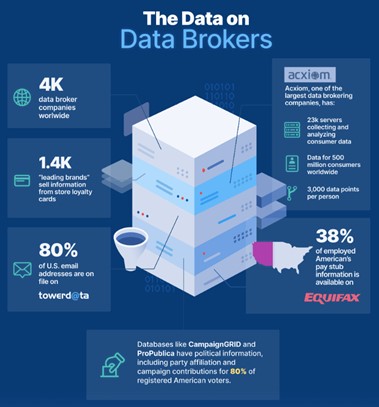

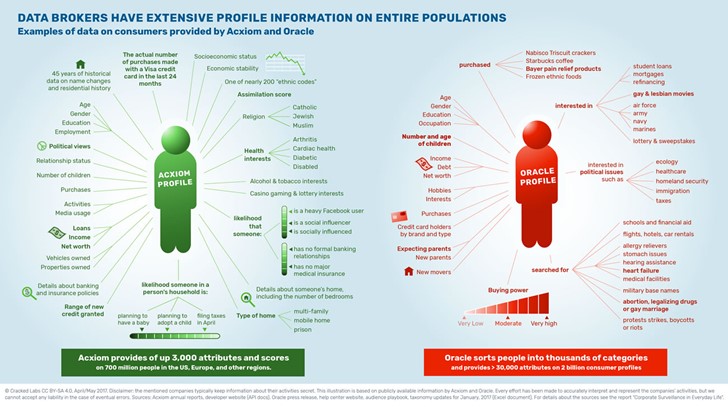

Data brokers buy, track, and collect personal information from multiple sources to resell. They collect your data from your online habits, app usage, location, surveys, loyalty programs, and even your public records. They then use this data to create profiles and sell lists of profiles that match the targeted markets of brands, so that brands know to whom and when to send advertisements. All of this is legal. And it’s big business, worth $76 billion in 2019 and growing to an estimated $200 billion by 2022.

The total number of data brokers is unknown. However, a Vermont law requiring data brokers to annually register with the State netted 348 companies (California has a similar law). Acxiom, a division of Interpublic Group, is one of the largest data brokers that vets and collects data from over 200 third-party sources that supply personal information.

Source: WebFX

Source: Cracked Labs

Your Data is Worth Serious Money to Digital Advertisers

Our lives constantly change. Today, we’ll buy a new gadget online; tomorrow, we’ll search for a local plumber because a pipe bursts at our home. This changes our value to data aggregators because our changing lives introduce new data that appeals to new brands. More brand appeal means more money for both the data aggregators and the websites getting paid by brands to advertise to us.

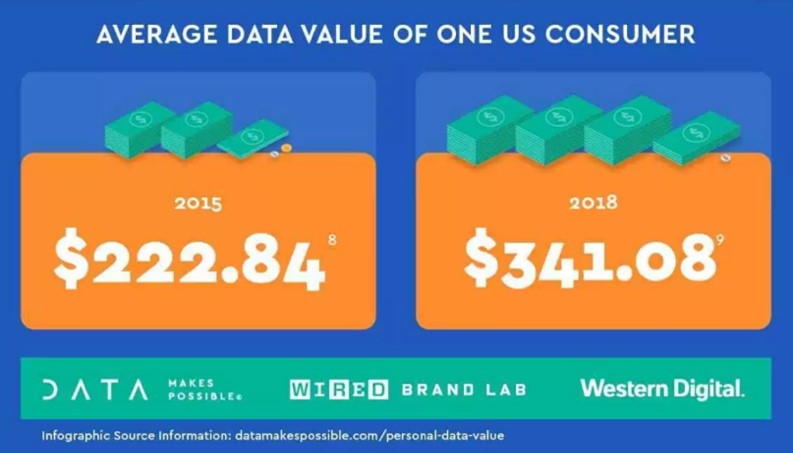

Privacy Hub estimates that data associated with an email address could be worth US$89; accessing your social media accounts would be worth US$8 month. ARPU from Facebook’s most recent quarter was about US$48 per American and Canadian. In 2018, Data Makes Possible, by Western Digital, estimated the worth of personal data to brands by dividing the total U.S. digital advertising spend by the number of Americans accessing the Internet.

Have you granted any enterprise your consent to monetize your data? How much are you earning from your personal data? We’d bet nothing.

Source: Western Digital

Trouble Ahead for Data Brokers

Your data is the raw marketing material for all companies and suppliers to thrive. Consumer privacy protection laws like the California Consumer Privacy Act allow consumers to opt out of the collection and monetization of their personal data. We believe that the firms collecting and selling data will bear the onus to manage consumer opt-outs. And if they do not, tech firms will.

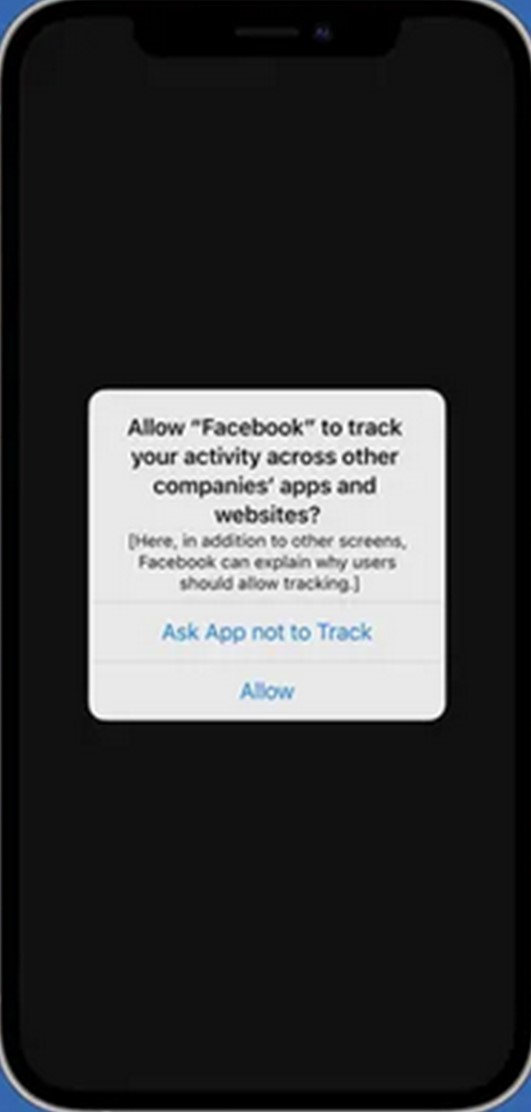

At its June 2020 Worldwide Developers Conference, Apple announced that its upcoming iOS 14 would allow users to opt-out of ad tracking by installed applications. Facebook was quick to detail the potential impact, emphasizing its use of data to target advertisements on publisher websites. But American Apple consumers clearly like the feature (deployed in iOS 14.5 in April 2021), with 96% opting out tracking. Globally, only 15% of Apple users had opted into tracking, as of May 16, 2021. However, the apps are responsible for generating the tracking prompt – not Apple. Many apps are not up to date and are at risk of being banned from Apple’s App Store if they fail to offer tracking opt-outs. Clearly, Apple has made data privacy legitimate and a differentiator that distances them from other tech giants; a differentiator that could see more Fortune 500 companies implement data privacy into their consumer interactions.

Then in June 2021, Google followed Apple’s lead, allowing Android users to opt out of advertisement tracking under Android 12. This also followed Google’s announcement that it would ban third-party cookies on its Chrome browser (scheduled for the end of 2023). The news also followed Firefox’s third-party cookie blocking by default and Safari browser’s default cookie blocking. Cookies are clearly on their way out, and that’s going to cause a lot of data businesses to disappear. Those that remain will see further pressure from U.S. data laws (in our Killi (MYID) – Voting for Consumer Data Privacy report, we detailed that California, Virginia, and Colorado have passed data privacy laws and another 30 are going through the process) and will likely see litigation increases. This is a ticking time bomb for the data industry.

But this doesn’t mean Google still won’t use your data – its Federated Learning of Cohorts will track Chrome users’ browsing and place them in audiences for advertisers to target. It seems that Google’s cookie policy may be a way for it to get bigger market share (Google’s revenues are largely generated from advertising). Google will still track user activities, effectively forcing brands to come to Google since Chrome commands about 70% of browser market share. However, in our next report, we’ll share how Sophic Capital client Killi [TSXV:MYID, OTCQB:MYIDF] offers an ecosystem of solutions (including a Chrome browser extension) where users consent to personal data collection.

No tracking means no data. No cookies mean no data. Regardless of Big Tech’s motivations to reduce data tracking, these announcements will impact the Internet advertising industry – especially the data brokers whose business models revolve around personal data collection.

Remember that the data broker business was worth $76 billion in 2019 and growing to an estimated $200 billion by 2022. If Big Tech and data privacy laws will reduce their access to data, who benefits?

Sophic Capital believes Killi benefits.

Coming Up…

What we find interesting is that data privacy laws have helped consumers to understand that brands and data brokers are collecting personal data without consent. Consumers are also realizing that they aren’t getting paid for their unconsented personal information. Consumers may start to ask how they can gain transparency into what third parties are collecting, how they can control what they choose to share, and possibly how they can monetize their personal info. In our next report, we’ll share how Killi Ltd. [TSXV:MYID, OTCQB:MYIDF], a Sophic Capital client, provides an ecosystem of solutions where consumers consent to personal data collection. Why would consumers provide this consent? Because Killi’s ecosystem then allows consumers to control and monetize their personal data; users passively earn income (or not, should they decline) rather than big tech and data brokers. We know of no other public vehicle for investors to participate in the consumer privacy rights disruption.