With the US elections looming in the coming days, capital markets newsflow in the USA this past week focused on M&A vs. new issues. Internationally, the imminent Ant Group IPO, seems very eagerly anticpated by investors. In Canada, as we expected a few weeks ago, we saw activity in the healthcare tech space with Vitalhub and CB2 Insights, both announcing financings.

Canadian Technology Capital Markets & Company News

Pivotree Inc. completes Initial Public Offering. Pivotree Inc, a global commerce and master data management (“MDM”) services provider, announced the successful closing of its previously announced initial public offering of 7,059,000 common shares at a price of $8.50 per share for total gross proceeds of $60,001,500. The common shares of the Company will commence trading today on the TSX Venture Exchange under the symbol “PVT”. https://bit.ly/31YbhaU

Galaxy Digital (GLXY-TSX) announces $50 million in primary capital financing to drive further growth across institutional services businesses. Galaxy, which operates—through Galaxy Digital Holdings LP—businesses across Trading, Asset Management, Investment Banking and Principal Investments dedicated to the digital asset, cryptocurrency, and blockchain technology industry, announced a private investment in public equity financing (“PIPE”) of $50 million of aggregate gross proceeds. The PIPE is expected to close in November 2020, subject to customary closing conditions. https://bit.ly/3jQ5l9Y

Bragg Gaming Group Inc. (BRAGG-TSXV) announces upsize of previously announced bought deal public offering to $18 million. The company amended its agreement with a syndicate of underwriters led by Cormark Securities Inc. and Canaccord Genuity Corp. and have agreed to increase the size of its previously announced $12.5 million “bought deal” public offering. Pursuant to the upsized deal terms, the Underwriters have agreed to purchase, on a “bought deal basis”, 25,715,000 units in the capital of the Company, at a price of $0.70 per Unit for aggregate gross proceeds of $18,000,500. https://bit.ly/3jHaEIV & https://bit.ly/2HHjlps

Vitalhub Corp. (VHI-TSXV) announces $15 million bought deal public offering. Vitalhub Corp. entered into an agreement with a syndicate of investment dealers led by Cormark Securities Inc. pursuant to which the Underwriters have agreed to purchase 5,172,500 Common Shares (the “Common Shares”) from the treasury of the Company, at a price of $2.90 per Common Share for total gross proceeds of approximately $15 million. https://bit.ly/3mIEAWV

CB2 (CBII-CSE) announces upsize to bought deal. CB2 Insights announced that it has amended the terms of its previously announced offering of Common Shares. Under the amended terms of the Offering a syndicate of underwriters co-led by Echelon Capital Markets and Beacon Securities Limited, and including Canaccord Genuity Corp., Mackie Research Capital Corp., Leede Jones Gable Inc. and PI Financial Corp., and pursuant to which the Underwriters have agreed to purchase, on a bought deal basis, 10,640,000 common shares (the “Common Shares“, each a “Common Share”) in the capital of the Company at a price of C$0.47 per Cer Common Share for aggregate gross proceeds to the Company of C$5,000,800. https://bit.ly/3erDWud

Faire raises US$170 million Series E, looks to grow Kitchener-Waterloo office. Faire, a wholesale marketplace startup based in Kitchener-Waterloo and San Francisco, has raised a US$170 million Series E round of financing. According to a report from Forbes, the deal more than doubled Faire’s valuation to $2.5 billion. Faire’s Kitchener-Waterloo location, which employs 150, will likely grow to over 200 by the end of 2021. The round was led by Sequoia Capital. According to Forbes, existing investors included Y Combinator, Lightspeed Venture Partners, Forerunner Ventures, Khosla Ventures and Founders Fund participated. New participants in this round included DST Global, D1 Capital Partners, Norwest Venture Partners and Dragoneer. https://bit.ly/35Rncbw

AddÉnergie raises $53 million Series C for EV charging technology. AddÉnergie, a Québec City-based startup that creates charging solutions for electric vehicles (EV), has closed $53 million in Series C funding. The round, which consisted of both equity and debt financing, brings the startup’s total raised to date to $83 million. Mackinnon, Bennett & Company led the round, while Business Development Bank of Canada, Fonds de solidarité FTQ and Export Development Canada participated. Existing investors Caisse de dépôt et placement du Québec and Investissement Québec also participated, and as part of the round, AddÉnergie entered into a new credit facility with National Bank of Canada. The investment will be used to bring AddÉnergie’s EV charging technology to new markets in North America. The round follows the company deploying over 11,000 charging stations in the past year in cities such as Los Angeles, Cincinnati, and Toronto. https://bit.ly/3mC08nW

Canvass Analytics raises $8.5 million as it gears up for “aggressive” global expansion. Toronto-based Canvass Analytics, which offers artificial intelligence-enabled industrial software, has raised an $8.5 million ($6.5 million USD) Series A round of financing. This latest round brings the company’s total funding to date to approximately $17 million. https://bit.ly/3oGQ3Ip

TikTok moves into social ecommerce with Shopify (SHOP-TSX, SHOP-NYSE) deal. TikTok users will be able to shop as they scroll through its short-form videos via a new deal with ecommerce platform Shopify, bringing the Chinese-owned app in line with social media rivals such as Facebook. Canada-based Shopify is adding TikTok to a portfolio of partners that includes other social sites including Facebook, Instagram and Pinterest, as well as the likes of Amazon, Google and Walmart’s marketplace. Social commerce is finally starting to scale up in the US after huge growth in China in recent years, driven by apps such as WeChat, Kuaishou and Pinduoduo. Research group eMarketer predicts that social commerce sales in China will grow to Rmb1.7tn (US$253 billion) this year, compared with under US$20 billion in the US last year. Shopify merchants already using TikTok include The Knot Pillow, Brooklyn Tea and Adwoa Beauty. https://on.ft.com/2Ji7xdP

Global Markets: IPOs, Venture Capital, M&A

Jack Ma’s Ant IPO lures US$3 trillion of bids in retail frenzy. Jack Ma’s Ant Group Co. attracted at least US$3 trillion of orders from individual investors for its dual listing in Hong Kong and Shanghai, enough money to buy JPMorgan Chase & Co. 10 times over. Bidding was so intense in Hong Kong that one brokerage’s platform briefly shut down after becoming overwhelmed by orders. Demand for the retail portion in Shanghai exceeded initial supply by more than 870 times. The stampede is fueling predictions of a first-day pop when Ant is due to start trading on Nov. 5, even as skeptics warn of risks including the U.S. election, tightening regulations in China and rising Covid-19 infections worldwide. Whether Ant surges or not, the Chinese fintech behemoth’s US$35 billion-plus IPO represents a major vote of confidence in a company that could end up shaping the future of global finance. It also underscores China Inc.’s ability to marshal huge amounts of capital without tapping American markets, a win for Beijing as it tries to reduce its vulnerability to the threat of U.S. financial sanctions. https://bloom.bg/3jLBeAy

Ant Group prices Hong Kong leg of stock offering at HK$80 a share in the world’s largest initial public offering. Chinese billionaire Jack Ma’s Ant Group set the price for the Hong Kong leg of its initial public offering at HK$80 a share (US$10.32), putting it on track to raise roughly US$17 billion in the offshore tranche of its share sale, according to people familiar with the matter. The world’s most valuable unicorn is likely to make its hotly anticipated debut on Shanghai’s Nasdaq-styled Star Market and Hong Kong’s stock exchange on November 5, after the US election on November 3. Its stock code will be 6688. The number of monthly active users of Ant’s mobile payment app Alipay hit 731 million on September 30, dwarfing Palo Alto-based PayPal, the world’s largest payments platform outside China. Ant’s IPO values it at US$313 billion, rising to US$318.50 billion when an over allotment option is included. The core group of analysts at banks orchestrating the share sale have pegged Ant’s near-term valuation in a range from US$350 billion to US$450 billion, according to people familiar with the matter. https://bit.ly/2HIQn8g

Airbnb’s common stock price rises 10%. The fair value of Airbnb’s common stock rose 10% last quarter to US$69.76 a share, Airbnb’s chief financial officer told shareholders Friday. That roughly equates a US$20 billion valuation. Airbnb’s common stock value is now about 20% higher than its nadir in the spring, but it still at about half its peak last year, when it was valued at about US$38 billion. Employee turnover at the company has accelerated as a result. The 409a value was determined by a third-party firm and approved by the board of directors on Sept. 30. It is typically a conservative estimate of the valuation, tied to public company comparables and previous fundraising prices. Airbnb’s board also approved a two-for-one stock split for existing shareholders, halving the value of their shares but doubling the number of their shares, a common practice for pre-IPO companies to make their per-share price more attractive to potential new investors. After the stock split, the per-share value is US$34.88. Bloomberg first reported the stock split. https://bit.ly/2Tx7wV7

Airbnb to launch ‘Host Endowment’. Airbnb said Friday it would set aside 9.2 million shares for an endowment that would eventually fund improvements to the site recommended by the home rental site’s hosts. The company said a new advisory board of hosts would help direct the funds once the endowment reaches US$1 billion in value. The announcement likely represents the company’s effort to ensure hosts feel included by the potential windfall of the IPO, which will mint millionaires among early employees and investors. Uber and Lyft sold or set aside shares directly to some of its earliest or most productive drivers. A similar program was likely more difficult for Airbnb, whose host base is predominately international. Airbnb is trying to repair relations with its millions of hosts as it prepares to go public. When the pandemic hit, the company offered refunds to all travelers, which took money out of hosts’ accounts. More recently, the company has had to pledge to improve its customer service wait times, which skyrocketed after it laid off staff. Many hosts are also still finding few bookings as the pandemic continues. https://bit.ly/2HU42cK

Lordstown Motors spikes 19% after SPAC merger kicks off public trading. The company is the latest vehicle startup to enter the public market through a reverse merger with a special-purpose acquisition company, or SPAC. Lordstown combined with blank-check firm DiamondPeak Holdings Corp. last week. The merged entity joins Nikola and Hyliion Holdings in the expanding electric-vehicle-maker-turned-SPAC-target space, with Canoo and Fisker set to join in the near future. Lordstown is expected to raise US$675 million through the SPAC takeover and use the funds for bringing its Endurance pickup truck to market. Production is slated to begin in the second half of 2021, with deliveries beginning in the summer. The company has said it has 40,000 preorders for the truck, which could bring in $2 billion in revenue. Lordstown enjoyed time in the national spotlight last month when President Donald Trump highlighted the pickup model outside the White House. The president praised Lordstown for its purchasing of General Motors’ old production facility and bringing jobs to northeast Ohio. More than US$59 billion has been raised across 160 SPAC deals in 2020 so far, according to SPACInsider.com. That handily exceeds the US$13.6 billion raised across 59 mergers in all of 2019. https://bit.ly/3oEhhzx

SAP shares collapse after lockdowns force cuts to revenue. SAP SE shares dropped as much as 21%, the biggest intraday fall since 1999, after the software company cut its revenue forecast for the full year and said it expects a fresh wave of lockdowns to hurt demand through the first half of 2021. In a test for Christian Klein, who became sole chief executive officer in April, the pandemic will delay SAP’s goals for cloud revenue, overall sales and operating profit by one or two years, especially in hard-hit industries such as business travel, the Walldorf, Germany-based company said in a statement on Sunday. The drop in shares on Monday wiped 28 billion euros (US$33.1 billion) off SAP’s market value. The drop-off in SAP’s cloud revenue is a sign that companies are putting off making major decisions about updating their software, as the pandemic continues to limit any global economic recovery. SAP said it expects limited growth and margin improvement over the next two years, and moved expectations to meet its 2023 strategy plan out to 2025. Klein said on a call Monday he expects a conservative recovery into the first half of next year. The pessimistic short-term outlook from SAP risked a knock-on effect on the European software industry, warned analysts at Citi. Europe’s Stoxx Technology index fell as much as 6.3%, its biggest one-day loss since March. https://bloom.bg/34rujYR

Juul cuts valuation to US$10 billion. E-cigarette manufacturer Juul Labs has cut its valuation to US$10 billion, signaling the company anticipates obstacles ahead, the Wall Street Journal reported. That’s down from its US$38 billion valuation in late 2018, US$20 billion valuation in January and US$13 billion valuation in May. The Altria-backed firm has encountered regulatory hurdles and lawsuits from state attorneys general, school districts and parents as its core product has drawn younger audiences. Altria, which owns the producer of Marlboro cigarettes in the U.S. market, reports earnings Friday morning and could share more information on Juul’s valuation. https://bit.ly/2TGGk6o

AMD to acquire Xilinx in all-stock deal valued at US$35 billion. Advanced Micro Devices Inc. said Tuesday it has reached an agreement to acquire Xilinx Inc. in an all-stock deal valued at US$35 billion. Xilinx shareholders Will receive 1.7234 share of AMD for each share owned, equal to US$143 in cash. AMD shareholders will own about 74% of the net entity, while Xilinx shareholders own the remaining 26%. The deal is expected to close before end 2021. “The combination will create the industry’s leading high performance computing company, significantly expanding the breadth of AMD’s product portfolio and customer set across diverse growth markets where Xilinx is an established leader,” the companies said in a statement. “The transaction is expected to be immediately accretive to AMD margins, EPS and free cash flow generation and deliver industry-leading growth.” Xilinx shares jumped 11% premarket on the news, while AMD fell 3.7%. https://on.mktw.net/2TuzLE8

Marvell nears deal to buy Inphi. Marvell Technology Group Ltd. is nearing a deal to buy Inphi Corp. for as much as $10 billion, according to people familiar with the matter, in what would be the second big semiconductor tie-up this week as the industry rapidly consolidates. The companies could announce a deal as soon as Thursday, assuming the talks don’t fall apart, the people said. https://on.wsj.com/31U9bbZ

Apple buys self-learning AI video company to improve apps. Apple Inc. acquired a startup specializing in advanced artificial intelligence and computer vision technology that may help the iPhone maker improve its own AI across a number of apps and services. The Cupertino, California-based technology giant acquired Barcelona-based Vilynx Inc. earlier this year, according to people familiar with the deal. Vilynx developed technology that uses AI to analyze a video’s visual, audio and text content to understand what the video shows. It used that technology to create tags for the video, making it searchable. https://bloom.bg/3jHL7zq

Under Armour sells MyFitnessPal to investment firm. Under Armour is selling its diet and fitness app MyFitnessPal to tech investment firm Francisco Partners for US$345 million, the companies announced, confirming our scoop from July that Under Armour was looking to sell the app. The sale is a retreat for Under Armour, which paid US$475 million to buy MyFitnessPal in 2015 as part of a bigger push into digital fitness apps. But Under Armour’s retail business is under pressure from the pandemic. While the connected fitness part of its business was growing, it’s a tiny part of its overall operation. https://bit.ly/384xcRB

Credit Karma looks to sell tax preparation business to Square. Credit Karma is in talks to sell its tax preparation business to Square, the Wall Street Journal reported Friday. The sale would ameliorate antitrust concerns surrounding Credit Karma’s pending US$7.1 billion sale to Intuit, the maker of tax preparation software TurboTax, bookkeeping software QuickBooks and personal budgeting software Mint. The Justice Department would have to approve the sale of the business, which would consolidate Intuit’s TurboTax with Credit Karma’s growing tax preparation business, potentially leaving taxpayers with fewer and costlier electronic filing options. This isn’t the only financial technology deal on the Justice Department’s antitrust radar: Visa’s pending $5.3 billion acquisition of banking software maker Plaid may face litigation. Square’s stock is up 143% from the beginning of the year, but fell over 8% Friday following the Wall Street Journal’s report. https://bit.ly/35RI9TT

Sony nears acquisition of US anime streaming service Crunchyroll. Sony has entered into final negotiations to acquire U.S. anime-streaming service Crunchyroll, Nikkei learned on Friday, a deal that could catapult the Japanese icon into a global battle with the likes of Netflix. Sony could end up spending more than 100 billion yen (US$957 million) on the U.S. streamer, gaining its 70 million members around the world. Crunchyroll was founded in 2006 and has its headquarters in San Francisco. In 2018, AT&T, the U.S. telecommunications giant, became its parent company. Sony recently obtained the exclusive right to negotiate for Crunchyroll. After acquiring Funimation, an anime distributor, in 2017, Sony gained 1 million paying subscribers, mainly in the U.S., but came up against obstacles expanding this customer base. Crunchyroll has 70 million free members and 3 million paying subscribers in more than 200 countries and regions, including the U.S. and Europe. Crunchyroll would also give Sony more than 1,000 titles that it can use to vary its offerings. According to The Association of Japanese Animations, the global anime market in 2018 was worth about US$21 billion, 1.5 times that of five years earlier. https://s.nikkei.com/3ehQO5H

Top banks, including JPMorgan Chase and Goldman Sachs, are battening down their technology hatches for next week’s presidential election. Around next Tuesday, the final day of voting, JPMorgan and Goldman will both halt software updates to the retail and investment banking systems their customers use to manage accounts, The Information has learned. It’s a precaution intended to minimize the risk of outages of their services during a period of potential market volatility surrounding the election. Banks have good reason to institute these software code “freezes.” Faulty software updates are one of the main culprits behind online service outages. While suspending software updates is common for banks during times of heightened market volatility, this year’s election could be especially turbulent, with wide fears over civil unrest and contested election results. Outages triggered by software updates can also present inviting moments for attacks by cybercriminals, said Andrew Plato, CEO of Anitian, a cybersecurity business that works with large companies, describing this year’s especially raucous campaign and election as a “dumpster fire.” https://bit.ly/2HL4hqE

Samsung reclaims the top spot as smartphone market performs better than expected with 353.6 million device shipments in 3Q20, according to IDC. The worldwide smartphone market showed signs of improvement in the third quarter of 2020 (3Q20) with shipments declining just 1.3% year over year, according to preliminary data from the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker. In total, 353.6 million smartphones were shipped during 3Q20 and while the market declined, the results were stronger than IDC’s previous forecast of a 9% year-over-year decline. This is largely attributed to the re-opening of economies around the globe as COVID-19 restrictions were gradually relaxed. Apple shipped 41.6 million iPhones in 3Q20, down 10.6% year over year, which placed the company in fourth for the first time with 11.8% share. This drop was expected and is mainly due to the delay in the launch of the new iPhone 12 series, which is usually in the third quarter. Regardless, the iPhone 11 series did exceptionally well, contributing the majority of Apple’s volume, followed by the SE device. https://bit.ly/2GntEP6

Emerging Technologies

Daimler Trucks partners with Waymo to build self-driving semi trucks. Two automotive giants are teaming up to bring self-driving semi-trucks to market. Under this deal, Waymo and Daimler Trucks are partnering to build an autonomous version of the Freightliner Cascadia truck. This is Waymo’s first deal in the freight business. The truck would be equipped with Level 4 autonomous technology, meaning it could drive itself without a human but only in pre-defined areas. It is expected to be available in the U.S. “in the coming years.” https://tcrn.ch/2TtwB3z

Harley-Davidson’s ebike is here, just don’t call it a Harley. Harley-Davidson, an aging brand that has faced shrinking sales over the past year, is starting an ebike company that it hopes could help it connect with a younger audience and grow its business. Serial 1, the new Harley-Davidson venture, revealed the first glimpse Tuesday of its electric bicycle, which it says will be for sale in the first half of 2021. Harley-Davidson (HOG) originally showed off photos of a concept electric bicycle in January 2019, but the company will be a minority shareholder in Serial 1, and venture capitalists will own the majority of the new brand, though Serial 1 declined to reveal the investors. https://cnn.it/3oA5ORc

Honeywell announces its H1 quantum computer with 10 qubits. Honeywell, which was a bit of a surprise entrant into the quantum computing space when it announced its efforts to build the world’s most powerful quantum computer earlier this year, announced its newest system: the Model H1. The H1 uses trapped-ion technology and features 10 fully connected qubits that allow it to reach a quantum volume of 128 (where quantum volume [QV] is a metric of the overall compute power of a quantum computer, no matter the underlying technology). That’s higher than comparable efforts by IBM, but also well behind the QV 4,000,000 machine IonQ says it was able to achieve with 32 qubits. In addition to the next generation of its quantum computer, the company also announced its overall quantum roadmap for the next 10 years. The plan here is to go from 10 to 40 qubits with all-to-all connectivity as it moves toward a next generation of devices that are fault tolerant and can be deployed at a larger scale. https://tcrn.ch/34M1l6b

Media, Streaming, Gaming & Sports Betting

Apple and Netflix discussed acquiring ‘Bond’ movie for streaming. Metro-Goldwyn-Mayer Inc. held discussions with Apple Inc. and Netflix Inc. about taking its new James Bond film directly to streaming, according to people familiar with the situation, but the studio says it’s committed to a theatrical release. The film, “No Time to Die,” could fetch hundreds of millions of dollars in a potential streaming sale, said the people, who asked not to be identified because the discussions were private. MGM declined to comment on any talks, but said the film “is not for sale.” The MGM feature was originally scheduled to hit theaters in April 2020, but it was delayed until November after the Covid-19 pandemic forced theaters around the world to shut down. Even though cinemas have begun to reopen, consumers have been slow to return, and studios have been reluctant to release their biggest pictures. Earlier this month, “No Time to Die” was pushed back again until April 2021. Nabbing the rights to “No Time to Die,” would have been a major coup for a streaming service and could have helped entice subscribers looking to watch the latest Bond movie. The Daniel Craig film, which cost about US$250 million to produce, would be the most notable movie to switch to streaming due to the pandemic, though other films have taken a similar route. https://bloom.bg/2J7FUnH

Spotify subscribers pull further ahead of Apple Music, but on loss-making deals. Spotify has pulled further ahead of Apple Music in terms of paid subscribers, announcing that it now has 144 million against the last-declared number from Apple at 60 million. Apple last shared its subscribers way back in June of last year, but the lack of update since then suggests that growth since then has been relatively slow. Digging into the details, however, reveals a mix of good and bad news for Spotify. Spotify reported that it’s now seeing the best of both worlds when it comes to recovering from the impact of the coronavirus crisis. From a content consumption standpoint, global consumption hours surpassed pre-COVID levels during the quarter, and all regions have fully recovered. Consumption trends by platform have returned to normal usage, including in-car listening hours which is now above the pre-COVID peak. Usage on connected devices inside the home, which saw a spike during lockdown, also remains above pre-COVID levels. https://bit.ly/3oJUYbk

Facebook’s new video game streaming service is part of a big push for the tech giant to sell more ads. Facebook has a new video game service that enables games to be played from the cloud, streamed directly to your device, without a download. The new service is a rare push into gaming from Facebook that makes more sense when paired with another Facebook announcement tied to the new service: “Cloud Playable Ads,” which Facebook said will “provide an authentic preview of a full game.” The new ads may be a driving reason for Facebook, which along with Google controls the majority of digital advertising, to get into video game streaming. The ads use cloud streaming to enable viewers to play a brief demo of a game, and are intended to “support interactive demos from a game’s native code, blurring the line between games and ads.” https://bit.ly/35Ap88w

Peacock hits nearly 22 million users, but it’s not clear how many are paying. NBCUniversal’s Peacock streaming service has hit almost 22 million users just over three months after its launch, Comcast announced today as part of its Q3 2020 earnings release. The company didn’t say how many of those signups were for its free, ad-supported plan versus its more premium paid tiers, however. NBCUniversal is looking to help offset some of that theatrical loss in the future, thanks to a new deal with AMC that could see its films hit streaming services just 17 days after they’ve been released in theaters, although it has yet to actually take advantage of that new deal, due to the lack of any major theatrical releases right now. https://bit.ly/2HMYAbL

How Discord (somewhat accidentally) invented the future of the internet. Discord’s founders just wanted to create a way to talk to their gamer friends. They created something much bigger. Most longtime Discord users have a similar origin story. They liked playing video games, and liked playing with their friends, so they used TeamSpeak or Skype to talk to their friends in-game. They mostly hated TeamSpeak and Skype, but they were really the only options. Eventually, a lot of those gamers realized something. They wanted to talk to their gaming friends even when they weren’t in a game, and they wanted to talk about things other than games. Their gaming friends were their real friends. As luck would have it, in early 2015, a new tool called Discord showed up on the market. Its tagline was not subtle: “It’s time to ditch Skype and TeamSpeak.” It had text chat, which was cool, but mostly it did voice chat better than anybody else. Fast-forward a few years, and Discord is at the center of the gaming universe. It has more than 100 million monthly active users, in millions of communities for every game and player imaginable. Its largest servers have millions of members. Discord’s slowly building a business around all that popularity, too, and is now undergoing a big pivot: It’s pushing to turn the platform into a communication tool not just for gamers, but for everyone from study groups to sneakerheads to gardening enthusiasts. Five years in, Discord’s just now realizing it may have stumbled into something like the future of the internet. Meanwhile, the other thing Discord has had to figure out is how to make money. This is a significantly less urgent problem: The company has raised nearly US$400 million, including US$100 million this past summer that valued the company at US$3.5 billion. Forbes estimated its revenue at over US$120 million this year. Point is, Discord has plenty of runway. But there’s not often a clean exit path for a huge communications platform with a spotty reputation for moderation (just ask Twitter and Reddit). Eventually, the company’s going to have to make real money. https://bit.ly/2TIWKLW

Adtech, Privacy & Regulatory

Trump campaign website is defaced by hackers. President Trump’s campaign website was briefly taken over by hackers who defaced the site on Tuesday. The defacement lasted less than 30 minutes, but the incident came as Mr. Trump’s campaign and that of his opponent, Joseph R. Biden Jr., as well as law enforcement and intelligence agencies, have been on high alert for digital interference ahead of next week’s election. The hackers appeared to be looking to generate cryptocurrency. They invited visitors to donate cryptocurrency to one of two funds — one labeled “Yes, share the data,” the other labeled “No, Do not share the data.” They solicited payments in Monero, a hard-to-trace cryptocurrency. https://nyti.ms/2HErElR

Surprisingly, Europe’s digital chief warns against breaking up big tech. The European Union normally takes a tough stance on antitrust matters, but the EU’s digital head has warned against breaking up big tech companies. A report in The Information says EU digital head and former competition commissioner Margrethe Vestager has argued against this – at least for now. Vestager, who has aggressively pursued antitrust investigations against the likes of Google, Amazon and Apple in recent years, said it would be “doable” to force the breakup of the tech giants under current EU law. But she warned of unintended consequences and potentially lengthy court battles between European regulators and the tech giants. “I don’t think it is something that should be introduced in this legislation and I think one should be very careful with that type of remedy because one should be very sure how it would actually work,” Vestager said. “It would tie you up in court for a very very long time. I think it’s important we try these routes first with the platforms.” Instead, she favors stricter rules on tech giants, designed to ensure that they cannot abuse their dominant positions. https://bit.ly/34IJfC5

The DOJ is investigating Visa’s US$5.3 billion bid for Plaid on antitrust grounds. It’s not just big tech that’s getting the antitrust treatment from the Department of Justice. Late Monday afternoon, the Department of Justice tipped its hand that it was investigating Visa’s proposed US$5.3 billion acquisition of the venture-backed Plaid, which allows applications to connect with a users’ bank account. It’s a tool that powers a good chunk of new fintech offerings, and the Justice Department has apparently spent the past year looking into how the deal would affect the broader market for new financial services coming from startups. The revelation that the DOJ was taking a closer look at the Plaid acquisition came from a petition filed in the U.S. Court for the District of Massachusetts to compel Bain, the consulting firm that worked on Visa’s bid for Plaid, to comply with the agency’s civil investigative demand (CID). The DOJ is alleging that Bain has withheld documents demanded by asserting that it had some privilege over the documents — effectively stalling the DOJ’s investigation. Visa’s bid for Plaid isn’t the only big fintech acquisition that is in the DOJ’s sights, according to a report in The Wall Street Journal. Federal regulators are also looking at MasterCard’s US$1 billion bid for the fintech startup Finicity, and Intuit’s US$7 billion pitch to acquire the credit advisory and lending marketplace, Credit Karma. https://tcrn.ch/3jJH8C6

Apple hits French snag over trackers. Apple has received an antitrust complaint in France over its plans to restrict trackers used for mobile advertising, one of the first legal actions alleging that Big Tech is using privacy arguments to abuse market power. A coalition of trade groups in online advertising, spanning publishers, app makers, adtech groups and social media platforms, has asked France’s competition authority to stop Apple applying privacy controls early next year that would cripple targeted advertising on iPhones. Under the plans, many apps would need to ask users explicitly whether they agreed to their behaviour being tracked across other apps and websites, a step likely to severely reduce access to the identifiers, known as IDFAs, that are the backbone of mobile advertising. https://on.ft.com/3kDtbXW

Apple is quietly building a search rival to Google ahead of the DOJ’s landmark antitrust case, according to a report. Apple is quietly building a rival to Google’s ubiquitous search engine, the Financial Times reported Wednesday, just as the US Department of Justice’s (DOJ) landmark antitrust suit aims to break Google’s grip on worldwide search queries. Users who downloaded iOS 14, the latest iPhone operating system, noticed that Apple now shows its own results when users search on their home screen. Clicking on links takes users directly to the website in question, rather than through another search engine. Google has been the iPhone’s default search engine for more than 10 years. The DOJ claims Google has paid Apple up to US$12 billion a year for the arrangement — the deal is central to its antitrust case. https://bit.ly/2HOYkJF

eCommerce

Influencers’ next frontier: their own live shopping channels. Carla Stevenné’s first live stream terrified her. As part of Amazon Live’s influencer beta group, she needed to find stuff to sell, and she needed to figure out how to fill her allotted hour. She had never tried to hawk products live before, let alone fill 60 minutes talking to herself and a camera. She looked around her house. A few things stood out: a waterproof Bluetooth speaker, Crest 3D Whitestrips, and a Bluetooth karaoke machine. “I’m looking at the time, I was 15 minutes in, [and] I’m like, ‘O. M. G., 45 more minutes to get to an hour — I do not know how I’m going to do this.’” she says. Almost no one tuned into Stevenné’s first stream, but now, more than 200 streams later, she says an hour is nowhere near as daunting, and hundreds of people can tune in at a time. https://bit.ly/35HlFoq

Fintech, Blockchain & Cryptocurrency

Coinbase to launch debit card in the US with rewards program. Cryptocurrency exchange Coinbase is launching a debit card in the U.S. this winter. Customers can join the waitlist and get the Coinbase Card whenever it is available. Coinbase already launched the Coinbase Card in the U.K. and Europe. The Coinbase Card is a Visa debit card that works with any Visa-compatible payment terminal, online checkout interface and ATM. It works with a mobile app that lets you control how you want to spend your cryptocurrencies. In the U.S., customers get a virtual card immediately after signing up, and a plastic card within two weeks. https://tcrn.ch/3kIMeQA

JPMorgan launches blockchain division called Onyx after a big tech client adopts its cryptocurrency for commercial use. JPMorgan has launched a new business division dedicated to blockchain technology, called Onyx, after the bank’s own digital currency was adopted for commercial use this week, CNBC reported on Tuesday. A JPMorgan spokesperson confirmed the report to Business Insider. JPM Coin, which was created last year, has been picked up for round-the-clock global payments by a “large technology client” this week, Takis Georgakopoulos, the bank’s global head of wholesale payments, told CNBC in a phone interview. He did not name the client, but said others are being onboarded too. That headway and other under-the-radar progress induced the launch of Onyx, which is aimed at capturing the major shift towards digital currencies in the financial services industry. “We are launching Onyx, because we believe we are shifting to a period of commercialization of those technologies, moving from research and development to something that can become a real business,” Georgakopoulos told CNBC. https://bit.ly/3oJIhxe

Leaked ‘Tai Chi’ document reveals Binance’s elaborate scheme to evade Bitcoin regulators. Binance Holdings Limited, the world’s largest cryptocurrency exchange conceived of an elaborate corporate structure designed to intentionally deceive regulators and surreptitiously profit from crypto investors in the United States, according to a document thought to be created by its senior executives and obtained by Forbes. Cayman Islands-based Binance is currently responsible for about US$10 billion in total crypto trades per day and its founder and CEO Changpeng “CZ” Zhao is one of the few known cryptocurrency billionaires. The 2018 document details plans for a yet-unnamed U.S. company dubbed the “Tai Chi entity,” in an allusion to the Chinese martial art whose approach is built around the principle of “yield and overcome,” or using an opponent’s own weight against him. While Binance appears to have gone out of its way to submit to U.S. regulations by establishing a compliant subsidiary, Binance.US, an ulterior motive is now apparent. Unlike its creator Binance, Binance.US, which is open to American investors, does not allow highly leveraged crypto-derivatives trading, which is regulated in the U.S. https://bit.ly/37XA6HS

ESG

Japan, world’s third largest economy, vows to become carbon-neutral by 2050. Japan’s new prime minister, Yoshihide Suga, committed his country on Monday to reaching a target of zero emissions of greenhouse gases and achieving a carbon-neutral society by 2050, with a “fundamental shift” in policy on coal use. Suga outlined the major move in his country’s attitude toward climate change in his first policy speech to Japan’s parliament since taking office last month. Suga said innovation was key to achieving the goal, including next-generation solar cells and carbon recycling, and he promised investment in research and development, as well as deregulation and “green investment.” It had previously made a commitment only to reduce emissions 80 percent by 2050 and achieve carbon neutrality in the second half of the century. Now, however, it is following in the footsteps of the European Union, which vowed last year to become carbon neutral by 2050, and China, where President Xi Jinping set a similar target for 2060 only last month. “It’s pretty powerful,” said Takashi Hongo, senior fellow at Mitsui Global Strategic Studies Institute. “He was emphasizing a fundamental shift, and that indicates how strongly he feels about the change that needs to be made.” In 2017, Japan sourced more than 41 percent of its electrical power supplies from coal and oil, with natural gas accounting for almost 40 percent. Renewable energy made up about 16 percent, while nuclear power, still recovering from the aftermath of the 2011 Fukushima accident, made up just 3 percent. Under its current Basic Energy Plan, it aims to increase the share of renewables to 22 to 24 percent by 2030, and nuclear power to between 20 and 22 percent, although it is expected to unveil new targets next year. https://wapo.st/3jxdDn7

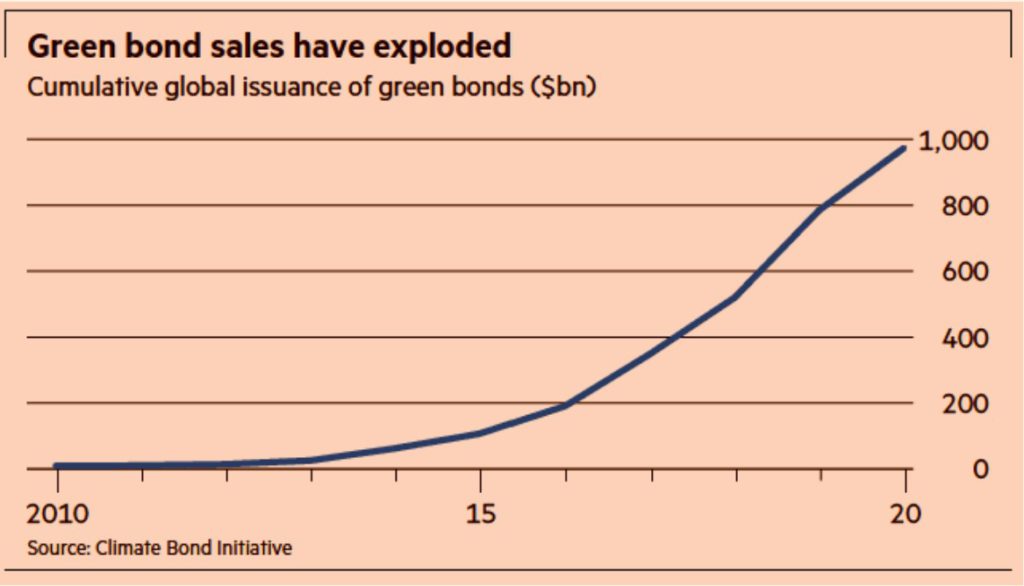

Investors probe ESG credentials of bond sellers on ‘greenwashing’ fears. The rapid growth of the green bond industry is fanning suspicions that some debt is environmentally friendly in name only, encouraging investors to ignore the label and focus on the credentials of the issuer instead. The green bond market has grown from almost nothing a decade ago to roughly €660bn in outstanding debt today, and is forecast to hit €2tn by the end of 2023, according to research by NN Investment Partners this month. But the Dutch asset manager also found that 15 per cent of such bonds are issued by companies “involved in controversial practices that contravene environmental standards”. https://on.ft.com/37Os0RS

Sophic Capital Client Insights

AnalytixInsight (ALY:TSXV, ATIXF:OTC) – Extracting Value from Artificial Intelligence & Machine Learning. With adoption of ERP and CRM systems in the 1990s and cloud-based computing and IoT devices in the 2000s, enterprises are using artificial intelligence and machine learning (“AI/ML”) to unlock valuable insights from these big data sets. AnalytixInsight is a pure play AI/ML firm, against a backdrop where investors do not have many publicly traded small cap stocks to benefit from this secular theme. https://bit.ly/380Nn2s

AnalytixInsight (ALY:TSXV, ATIXF:OTC) – Workforce Optimization. When it comes to optimizing enterprise operations, many people think about machinery, supply and manufacturing chain logistics, and leveraging cloud computing. However, optimizing employee performance is often overlooked. AnalytixInsight has AI/ML-based workforce optimization solutions that could surface near-term value via a partnership with IFS. These efforts are expected to lead to the addition of several new clients, as per the Company’s Q2/20 MD&A filing. As a result, management is highly confident in the company’s efforts that are coming to fruition, which will result in transitioning away from being from a ClickSoftware systems integrator to a product licensing platform via its partner, IFS. https://bit.ly/3egUwww

Disclaimer

The information and recommendations made available through our emails, newsletters, website and press releases (collectively referred to as the “Material”) by Sophic Capital Inc. (“Sophic” or “Company”) is for informational purposes only and shall not be used or construed as an offer to sell or be used as a solicitation of an offer to buy any services or securities. In accessing or consuming the Materials, you hereby acknowledge that any reliance upon any Materials shall be at your sole risk. In particular, none of the information provided in our monthly newsletter and emails or any other Material should be viewed as an invite, and/or induce or encourage any person to make any kind of investment decision. The recommendations and information provided in our Material are not tailored to the needs of particular persons and may not be appropriate for you depending on your financial position or investment goals or needs. You should apply your own judgment in making any use of the information provided in the Company’s Material, especially as the basis for any investment decisions. Securities or other investments referred to in the Materials may not be suitable for you and you should not make any kind of investment decision in relation to them without first obtaining independent investment advice from a qualified and registered investment advisor. You further agree that neither Sophic, its, directors, officers, shareholders, employees, affiliates consultants, and/or clients will be liable for any losses or liabilities that may be occasioned as a result of the information provided in any of the Material. By accessing Sophic’s website and signing up to receive the Company’s monthly newsletter or any other Material, you accept and agree to be bound by and comply with the terms and conditions set out herein. If you do not accept and agree to the terms, you should not use the Company’s website or accept the terms and conditions associated to the newsletter signup. Sophic is not registered as an adviser or dealer under the securities legislation of any jurisdiction of Canada or elsewhere and provides Material on behalf of its clients pursuant to an exemption from the registration requirements that is available in respect of generic advice. In no event will Sophic be responsible or liable to you or any other party for any damages of any kind arising out of or relating to the use of, misuse of and/or inability to use the Company’s website or Material. The information is directed only at persons resident in Canada. The Company’s Material or the information provided in the Material shall not in any form constitute as an offer or solicitation to anyone in the United States of America or any jurisdiction where such offer or solicitation is not authorized or to any person to whom it is unlawful to make such a solicitation. If you choose to access Sophic’s website and/or have signed up to receive the Company’s monthly newsletter or any other Material, you acknowledge that the information in the Material is intended for use by persons resident in Canada only. Sophic is not an investment advisor nor does it maintain any registrations as such, and Material provided by Sophic shall not be used to make investment decisions. Information provided in the Company’s Material is often opinionated and should be considered for information purposes only. No stock exchange or securities regulatory authority anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. Sophic and/or its principals and employees may have positions in the stocks mentioned in the Company’s Material and may trade in the stocks mentioned in the Material. Do not consider buying or selling any stock without conducting your own due diligence and/or without obtaining independent investment advice from a qualified and registered investment advisor. The Company has not independently verified any of the data from third party sources referred to in the Material, including information provided by Sophic clients that are the subject of the report, or ascertained the underlying assumptions relied upon by such sources. The Company does not assume any responsibility for the accuracy or completeness of this information or for any failure by any such other persons to disclose events which may have occurred or may affect the significance or accuracy of any such information. The Material may contain forward looking information. Forward-looking statements are frequently, but not always, identified by words such as “expects,” “anticipates,” “believes,” “intends,” “estimates,” “potential,” “possible,” “projects,” “plans,” and similar expressions, or statements that events, conditions or results “will,” “may,” “could,” or “should” occur or be achieved or their negatives or other comparable words and include, without limitation, statements regarding, projected revenue, income or earnings or other results of operations, strategy, plans, objectives, goals and targets, plans to increase market share or with respect to anticipated performance compared to competitors, product development and adoption by potential customers. These statements relate to future events and future performance. Forward-looking statements are based on opinions and assumptions as of the date made, and are subject to a variety of risks and other factors that could cause actual events/results to differ materially from these forward looking statements. There can be no assurance that such expectations will prove to be correct; these statements are no guarantee of future performance and involve known and unknown risks, uncertainties and other factors. Sophic provides no assurance as to future results, performance, or achievements and no representations are made that actual results achieved will be as indicated in the forward looking information. Nothing herein can be assumed or predicted, and you are strongly encouraged to learn more and seek independent advice before relying on any information presented.