A Clear Update on Clear Blue Technologies from Recent Management Travels

Recently, Clear Blue’s CEO and Co-founder, Miriam Tuerk traveled across Europe and Africa meeting clients, prospective clients as well as investors. With the humanitarian and geopolitical crisis in Ukraine as well as the increasing impact of climate change, we noticed a shift in many of the conversations regarding Clear Blue’s renewable, solar power solutions. Increasingly, numerous stakeholders are asking Clear Blue to assist them in accelerating their transition from diesel generators not just for new but also current installations. Resiliency and moving away from an electrical grid that is increasingly less reliable is another strong theme. We’ve provided some thoughts on these value propositions in this short report, summarizing these developments.

Rise of Energy Prices and Fuel shortages Likely to Impact Africa; Clear Blue’s Key Market

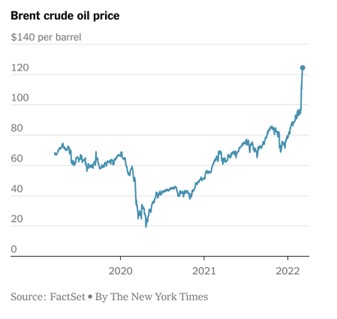

Russia exports about 5 million barrels of oil per day (about 12% of the global trade) and about 2.85 million barrels of oil products per day (approximately 15% of global trade). Although 60% of these exports go to Europe, little goes to Africa, where Clear Blue generates most of its business. But even prior to the Ukrainian war, fuel shortages were having a massive impact on some of Africa’s largest economies. Although Russian energy imports are negligible, African nations, like the rest of the world, are suffering from rising crude oil prices arising from the Ukrainian war. And fuel shortages will also be exacerbated.

Smart, Off grid Energy Independence Gains Relevance

As most Clear Blue investors already know, the Company is not defining a new market but rather targeting money that companies are already spending to keep key, remote infrastructre operating. Clear Blue has numerous greenfield projects and those installations are now almost 100% solar. And now Clear Blue is seeing the conversation shift to complete retrofits of existing diesel and grid powered sites. Clear Blue’s solar solutions with its energy management and intelligent operations needed to operate reliably at scale can replace diesel and gasoline generators, reducing the site’s total lifetime costs. These savings are likely to be even more relevant now as global energy prices march upwards. In this way, the Company plays a part with helping utilize solar energy to reduce fossil fuel usage.

Clear Blue’s renewable solar energy solutions eliminate the need for fossil fuels to generate remote power. Plus, smart, energy management capabilities ensures smooth operations and in a remote ‘lights out’ manner eliminating in person maintainance. Compare these proactive off-grid solutions to current reactive solutions, where companies send workers to a site after the power goes dark or to a site where attempts to troubleshoot are a days long nightmare. In this way, Clear Blue helps save capex and opex for its customers while helping to increase reliability and security. Most importantly, these solutions eliminate customers’ needs to power key off-grid, remote infrastructure with incredibly expensive fossil fuels.

Heightened Market Focus on Solar

Rising energy prices have refocused investors back onto renewable and solar companies. As CNBC recently noted, Renewable energy stocks are outperforming as the rapid surge in oil and gas prices — prompted by Russia’s invasion of Ukraine — makes the case for alternative energy sources more compelling. Even if the price of oil retreats, energy security is top-of-mind for many, which bodes well for solar companies like Clear Blue Technologies.

Source: CNBC

Highlighting this investor focus, in a very turbulent market, the Invesco Solar ETF has outperformed the tech heavy NASDAQ index by almost 30% in the past month, as highlighted in the accompanying chart from Yahoo! Finance.

Source: Yahoo! Finance

Looking Forward

Recently, the Company also announced several new partnerships with African satellite providers. As well Clear Blue has announced new product offerings and has more in the pipeline. Overall, the Company’s sales pipeline continues to scale and expand, and Clear Blue is deepening its relationships with its partners. In addition to these new partners, existing customers such as Parallel Wireless and Nuran Wireless are bringing follow on orders to projects announced in 2021.

Sign up for Sophic Capital’s reports at https://sophiccapital.com/subscribe/