A High Growth ESG Sector that is Rapidly Consolidating

Two Problems Creating a $100 Billion Annual Opportunity in North America

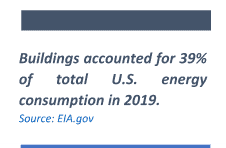

Problem #1: North American buildings waste up to 30% of the energy they consume due to lack of intelligence and technology.

Problem #1: North American buildings waste up to 30% of the energy they consume due to lack of intelligence and technology.

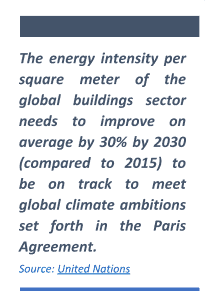

Problem #2: Ask people what the biggest emitter of greenhouse gases (“GHG”) is and they’ll likely say “cars”. Actually, buildings generate about 40% of these gases.

Combined, energy waste and GHG emissions represent an annual addressable market in North America of US $100 billion. Globally these problems scale the addressable market to about US $700 billion.

Most buildings lack real-time intelligence to monitor and control energy consumption and GHGs. And without being able to measure and control what generates waste, building operators cannot solve these problems. While new buildings will more than likely have monitoring and energy efficiency technologies built-in, 2/3 of the today’s buildings (that have little to no real-time intelligence) are forecasted to still exist in 2050, so a large automation opportunity exists to reduce their waste.

Current Solutions Lack Unified Intelligence

New building construction typically incorporates technologies that reduce energy consumption and GHG emissions. However, older buildings usually are not connected to these types of solutions, since the purposes of their designs were to provide shelter, temperature control and safety rather than energy efficiency and low GHG discharges. Older buildings can be automated with new technologies (such as lighting, heating and cooling and co-generation); however, these implementations in the past have been ad hoc and generally lack unification and real-time intelligence. A technology platform which is data-driven and provides a single unified operating platform across an entire portfolio of buildings is the next generation of Smart Buildings technology.

There is more than 81 billion square feet of commercial floor space in the U.S, enough to cover Rhode Island 2.5 times. Reducing commercial building energy use would lower operator costs, improve corporate sustainability, and improve the environment. The way to do this is to make buildings “smarter” (“Smart Buildings”) – that is, give buildings intelligence and systems that can increase energy efficiency, decrease energy demand, and reduce GHGs. Siemens (XETRA:SIE), Johnson Control (NYSE:JCI), Honeywell (NYSE:HON), and Schneider Electric (PARIS:SU) are large caps that dominate the Smart Buildings industry.

Smart Building Technology Market Forecasted to Grow into the Hundreds of Billions of Dollars

Smart Buildings is a trend that leverages several other on-trend technology themes, including Software-as-a-Service (“SaaS”), Internet of Things (“IoT”) and environmental, social, and governance (“ESG”). Smart Buildings is a multi-billion-dollar market opportunity, providing a large enough industry for several entrants to compete. Consider some of the following forecasts:

- Smart Building market to grow from US $43.64 billion in 2018 to US $109.48 billion by 2026, a 12.6% CAGR – Fortune Business Insights

- Global smart building market is expected to grow at a CAGR of ~15.3% from 2019 to 2026 and reach over US $160 billion of market value by 2026 – Acumen Research and Consulting

- Global smart building market was valued at around US $5,800 million in 2016 and is expected to reach about US$ 61,900 million by 2024 – Zion Market Research

It doesn’t matter what forecast to pick; what matters is that the market opportunity for Smart Buildings is extremely large and growing.

A Consolidating Industry

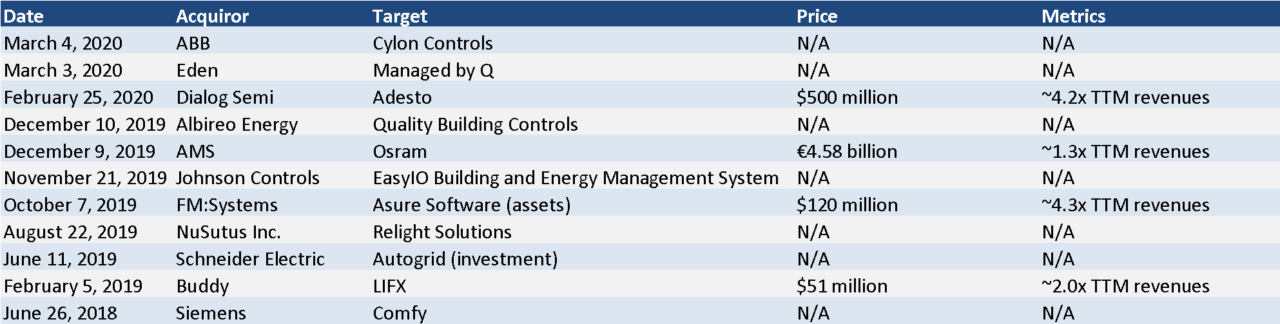

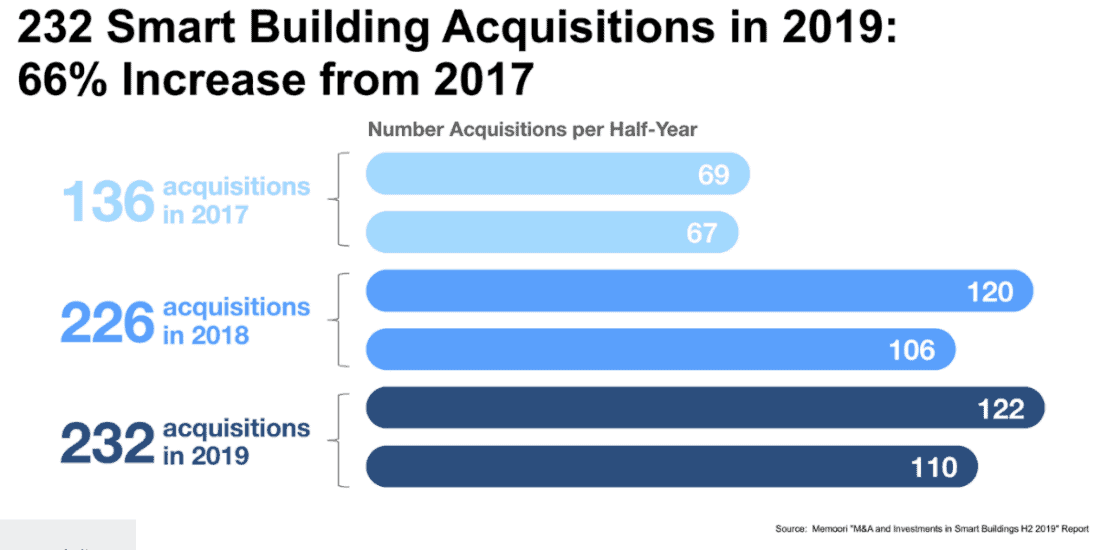

Globally, the smart building industry is consolidating (Figure 1). Last year saw record levels of M&A and about $5.4 billion of investments in the industry.

A Smart Buildings Leader Unknown to Investors

Kontrol Energy (CSE:KNR, OTC:KNRLF) is an undiscovered Smart Buildings technology and solution provider that is also consolidating the industry. The Company has completed 5 accretive acquisitions and is currently working to acquire a firm that generated $3.7 million in revenue (about 40% recurring) in 2019 and $843,000 of net income. While industry large caps have scale advantages, they generally lack a simple, unified platform that can quickly and easily bring a building on-line. As a small cap disruptor, Kontrol Energy has outcompeted many large-caps for important customer wins.

Learn more about Kontrol Energy, its management team, solutions, and customers like Toyota Tsusho and Beyond Meat in Sophic Capital’s next report.