At the forefront, Streaming Video Games is a Real and Growing Pastime

Serious Business behind the Fun and Games

In our December 2020 Luckbox (private) – Meet the CEO report, Luckbox (TSXV:LUCK) CEO Quentin Martin shared how the suspension of traditional sports leagues at the onset of the 2020 COVID-19 pandemic drove people to watch esports. Mr. Martin then detailed how betting on traditional sports transitioned to esports, since esports competitions suffered relatively less disruption during the COVID 19 lockdowns. Exiting 2020, playing and streaming video games had firmly established themselves as real and growing pastimes; ones that will likely continue even after the pandemic is under control, as some habits formed during 2020 persist.

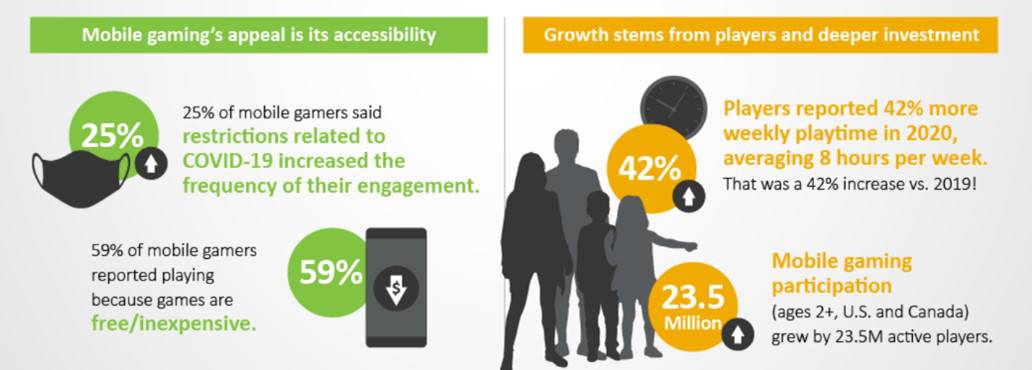

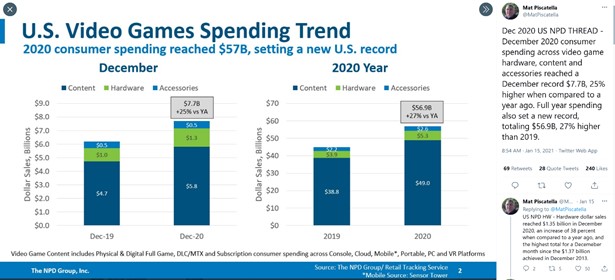

We say that playing video games is “real” and “growing’ due to the consumer spending strength exiting 2020. The NPD Group (a market researcher) estimates that U.S. spending on gaming hardware, software, and related accessories grew 25% year-over-year in December 2020 to US$7.7 billion and 27% year-over-year for 2020 to US$56.9 billion (Exhibit 1). The NPD Group also noted that 65% of U.S. and Canada consumers play mobile video games, and their playtime increased 42% year-over-year to 8 hours per week (Exhibit 2). Nielson’s SuperData predicts: “the long-term habits formed during lockdown are here to stay.”

Exhibit 1: Americans Gravitated to Video Gaming During the 2020 COVID-19 Pandemic

Source: The NPD Group, Twitter

Playing the Games and Watching the Streams

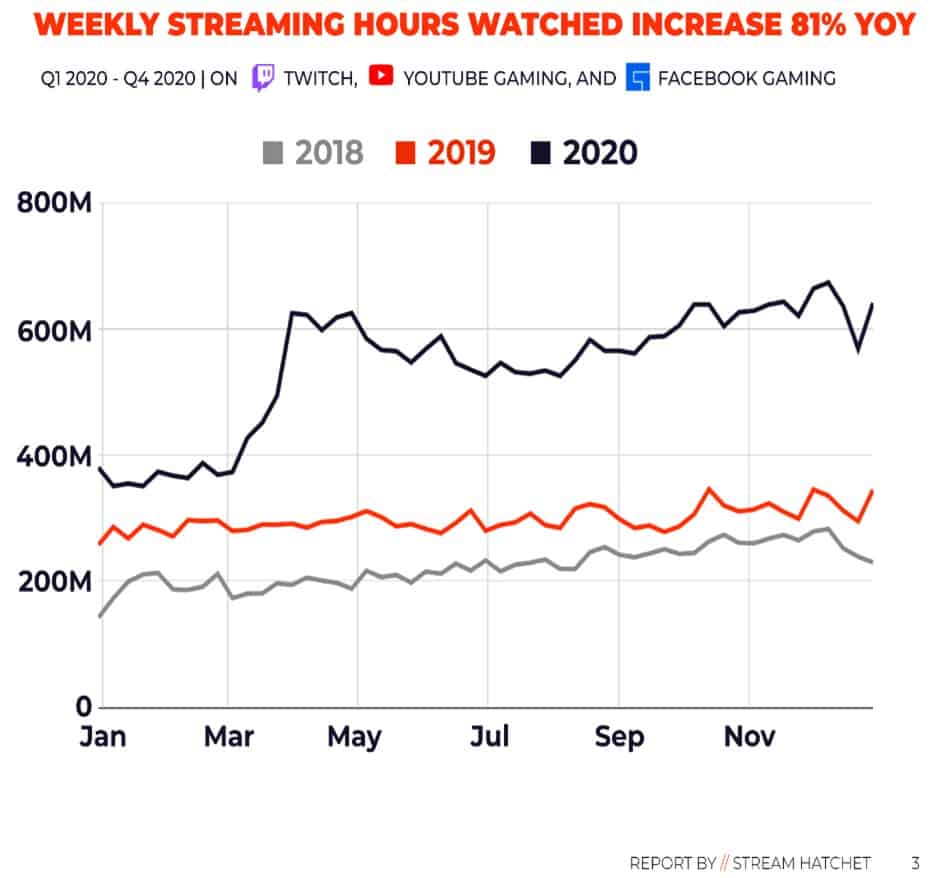

With the passing of the pandemic’s one year anniversary, esports audiences continue to grow. Stream Hatchet (an esports business intelligence provider) estimates that the number of hours of live video game streaming grew 81% year-over-year in 2020. The number of hours being streamed spiked during the Spring as traditional sports leagues suspended matches.

Source: Stream Hatchet

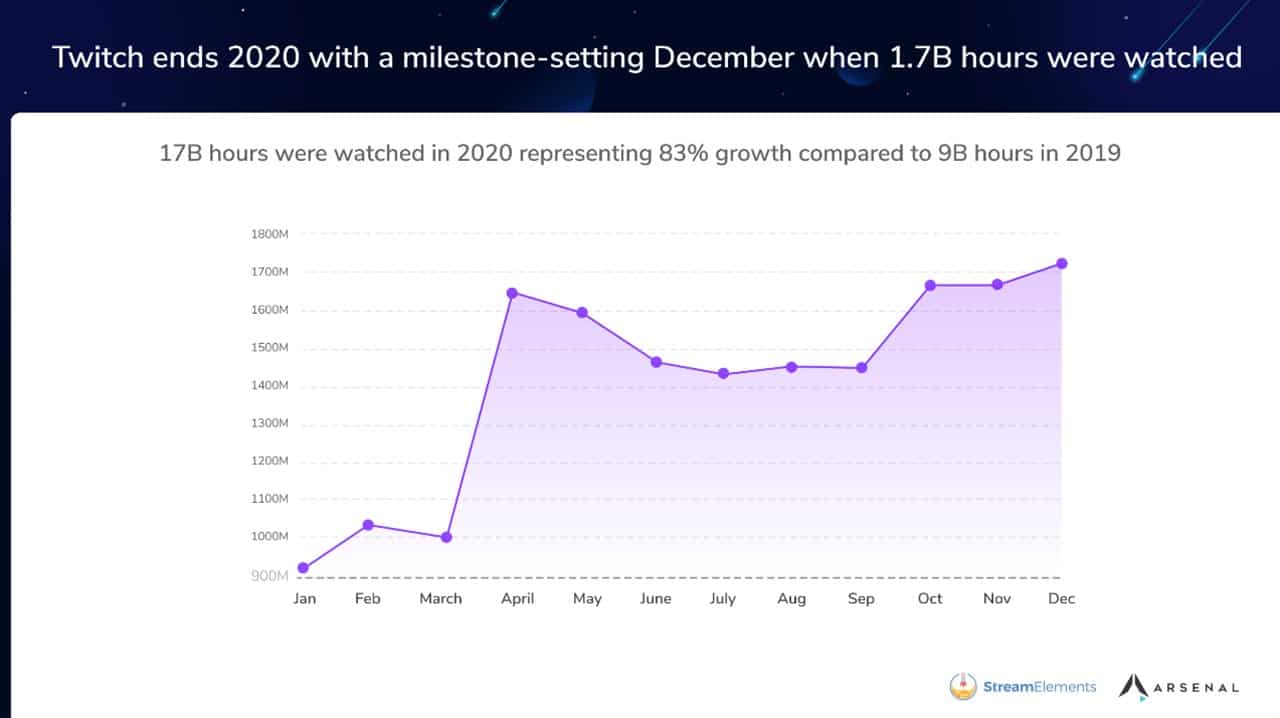

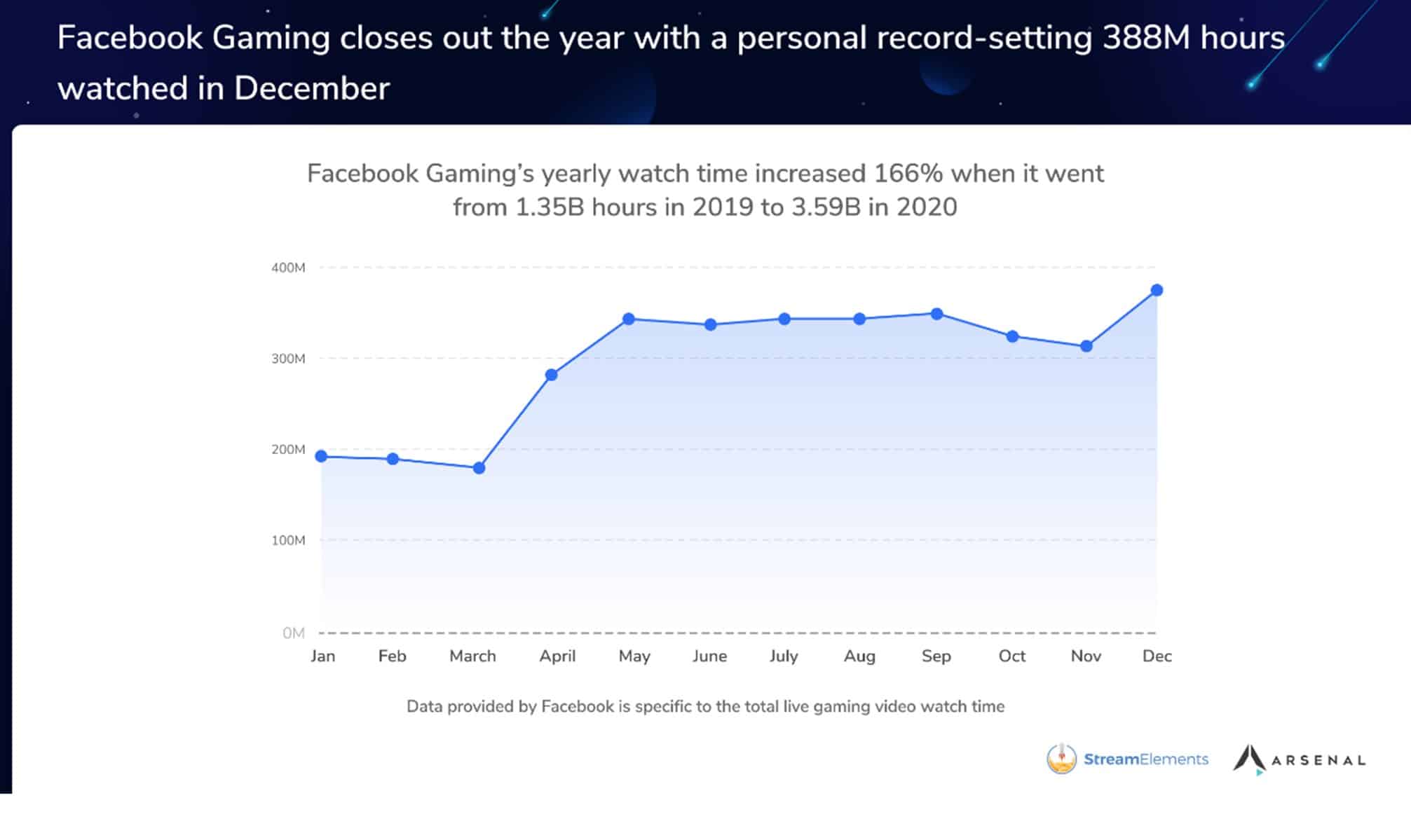

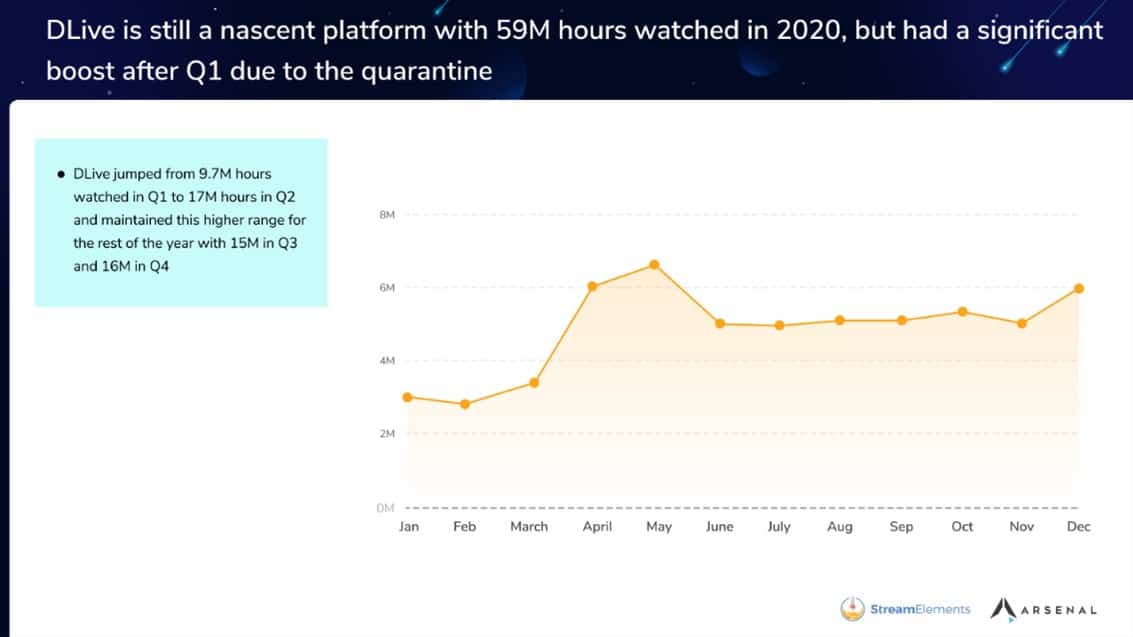

StreamElements (a streaming platform) estimates higher game streaming hours watched in 2020 than Stream Hatchet. Game streaming platforms Twitch, Facebook Gaming, and DLive all saw significant increases in hours watched during the pandemic’s initial onslaught. Overall, 2020 ended with a record number of gaming hours watched on Twitch and Facebook Gaming (1.7 billion and 388 million hours in December, respectively). While DLive ended the year with about 6 million hours watched in December 2020, slightly below the April 2020 peak but well above January 2020 hours watched, which could indicate that viewing behavior changes are likely to persist going forward. Lastly, not to be undersold, YouTube Gaming also had a spectacular 2020, with 100 billion hours of content watched over 40 million active gaming channels. Streaming video games is very clearly emerging as a real and growing pastime in today’s mainstream media eco-system.

Source: StreamElements, Arsenal.gg

Source: StreamElements, Arsenal.gg

Source: StreamElements, Arsenal.gg

esports Prize Pools Compete with Traditional Sports

Since the inception of esports competitions, the cumulative prize pool is now approaching US$1 billion. Epic Games, creator of the popular Fortnite game, has committed US$20 million to 2021 Fortnite Champion Series. Although this is below the US$30 million Epic allocated in 2019, it is US$3 million above the 2020 prize pool. Notably, this prize pool is 60% higher than the US$12.5 million awarded at 2020 U.S. Open (golf) and almost matches NASCAR’s Daytona 500 US$23.6 million prize pool.

Total esports prize money awarded over time.

Source: esportsearnings.com

Dota 2 has awarded the most historical prize money (Exhibit 3). The International is the biggest tournament for the game Dota 2. The 2020 tournament was postponed and will likely be hosted in Stockholm, Sweden in August 2021. The 2019 tournament had over US$34 million in prize money, and the awards for the 2020 tournament are expected to surpass US$40 million – in comparison, Wimbledon’s 2020 tournament had planned US$55 million in total prize money.

With these types of prize pools, it’s hard to dispute that esports are real, popular, and lucrative.

Exhibit 3: Dota 2 Tournaments have awarded the most esports prizes

Source: esportsearnings.com

COVID-19, Lost Tax Revenue and Demand Driving Online Betting

According to Grand View Research, the global online gambling market could grow to US$127.3 billion by 2027, representing a 11.5% CAGR from 2020. The report notes that COVID-19 accelerated demand for online gaming, additionally, smartphones and the presence of numerous online gaming platforms are expected to contribute to strong betting growth going forward.

Gaming law continues to evolve in the USA, and more states seem eager to legalize gaming. One factor driving this shift in non-gaming states’ desire to legalize gaming, is likely the tax revenue being generated in neighboring states. That said, sports betting is highly dependent on the calendar of sporting events. For example, from January through October 2020, New Jersey took in $3.3 billion in sports bets alone. However, New Jersey’s third quarter 2020 net gaming revenues decreased 32% and gross operating profit fell 37%. Although, the variability in the sports betting calaendar can make sports betting driven tax revenue variable as well, states like New Jersey generated some economic activity (including gaming revenue and taxes) while neighboring New York did not, where gambling is illegal…for now.

Source: PlayUSA.com

New York Governor Andrew Cuomo has now embraced mobile sports and announced legislation to authorize mobile sports wagering. The Governor cited a “historic budget deficit due to the COVID-19 pandemic”. With an estimated 20% of New Jersey’s sports wagering revenue coming from New York residents, Governor Cuomo now wants to recoup the millions of lost tax revenue.

In addition to increasing the company’s addressable market, Luckbox’s expansion into sports betting appears to be very well timed. On February 3, 2021, the Company added sports betting to the Luckbox platform. This move will enable Luckbox to expand its reach to over 105 traditional sports. Players will be able to enjoy 85,000 pre-match events, 70,000 live events, and 450 types of bets for these traditional sports. A few days earlier, we learnt that Google Play will allow gambling and betting Android apps that use money to go live in 15 countries (USA included). “Google’s addition of 15 nations (for a total of 19) that can now download gambling apps is a significant boost for the igaming sector. As an operator offering wagering on esports and sports via our Luckbox platform, this is a positive catalyst for the mobile betting sector, as it facilitates further player uptake in a responsible manner and signals the widening global acceptance of gaming,” according to Luckbox CEO, Quentin Martin.

Coming Up Next…

Investors who believe that esports betting is a trend that could yield excellent micro cap stocks to buy should read Sophic Capital’s next report where we detail:

- Increasing capital markets activity in the Canadian and global video gaming space,

- Esports betting’s place in the growing video gaming industry; and,

- How Luckbox (TSXV:LUCK) is positioned to become a dominant esports betting service.

Luckbox stock could potentially fit your microcap investing criteria and is worth keeping on your radar as a microcap stock to watch in 2021.