Cybersecurity Solutions for Government and Enterprise

Tailored Cybersecurity Solutions for a Geopolitically Charged World

Cybersecurity encompasses the strategies and tools used to safeguard internet-connected devices, networks, and data against unauthorized access and illicit use. Cybersecurity is meant to provide confidentiality, integrity, and accessibility of data throughout its entire lifespan. This protective framework encompasses both software and hardware elements, as well as information shared across the internet, protecting a wide array of assets ranging from personal information to complex organizational systems.

Today’s cybersecurity landscape faces a relentless barrage of sophisticated threats. Malicious actors, from profit-driven criminals to nation-states, possess the tools to cripple critical infrastructure, steal sensitive data, and disrupt our daily lives. Schools, hospitals, businesses, and government agencies alike are all vulnerable.

Pure-play cybersecurity Company and Sophic Capital client Plurilock Security [TSXV:PLUR, OTC:PLCKF] is a leader in the fight against cyber threats. Plurilock stands out as a prominent North American cybersecurity Company in the microcap space. Plurilock is a trusted provider of IT and cybersecurity solutions for governments and commercial clients across North America and NATO countries. The Company develops and integrates innovative solutions for specific security challenges, addressing gaps in the market. Their portfolio boasts established brands renowned for their commitment to client safety and regulatory compliance. Their focus on high-value critical services, combined with patented AI, data, and identity solutions positions them as a key player in the evolving cybersecurity market.

Plurilock operates three business units with offices on the east and west coasts of both the United States and Canada: 1) The Solutions Division serves as the foundation, reselling technology and cybersecurity solutions through its deep partner network and customer base, facilitating both critical service delivery and SaaS sales, 2) The Critical Services Division (formerly Professional Services) delivers customized services to address and resolve critical security gaps that disrupt organizations, and 3) Plurilock AI, a proprietary SaaS platform. While all aspects of the business are growing, the Critical Services division is a key growth driver given its much higher gross margin profile and stickiness with customers. The strategy involves leveraging existing relationships with value added reseller (VAR) clients to cross-sell / up-sell higher-margin critical services and software and once deployed becoming the go-to trusted partner for all things cyber.

Strategic Partnerships and Trusted Solutions

With data as the new battleground, cyberwarfare is poised to become the primary front in future conflicts. Just as the aerospace and defense industry safeguards physical borders, Plurilock stands as a guardian in the digital realm. Plurilock recognizes the intricate link between global events and cybersecurity threats. Stringent regulations, geopolitical tensions, and the ever-evolving threat landscape create unique security challenges for multinational corporations. Plurilock specifically tailors its services to address these real-world complexities, ensuring clients are protected in today’s volatile environment.

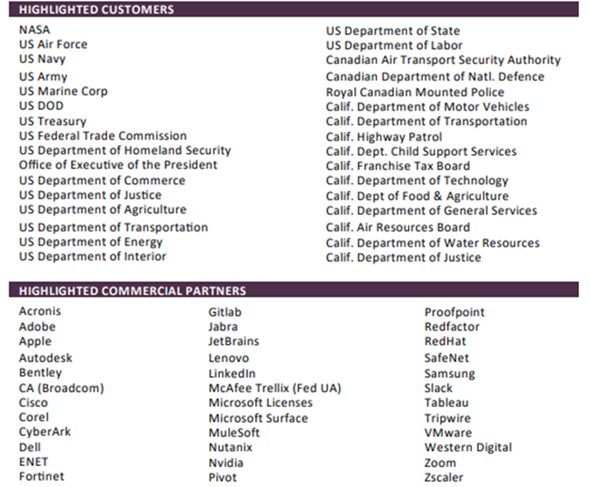

Plurilock’s Solutions Division resells cybersecurity industry products and technologies to meet the needs of commercial and government customers in North America (Exhibit 1). The Solutions Division also sells services directly to end users.

Exhibit 1: Some of Plurilock’s Customers

Source: Plurilock Company Investor Presentation

Plurilock prioritizes a consultative approach, combining best-in-class partner solutions with in-house security expertise. This allows the Company to address complex cybersecurity challenges for clients and support their business-critical applications. By identifying complementary high-margin offerings, Plurilock utilizes the VAR network to introduce existing clients to new solutions that address additional security needs. This not only expands client value but also boosts profitability.

Plurilock wins deals against established competitors by leveraging their competitive advantage. Plurilock utilizes existing master service agreements from the Solutions Division to build trust and secure new business in combination with an advisory council of renowned experts to open doors and facilitate deal flow. Additionally, they recommend AI-powered solutions (drawing on their expertise in building AI products) over traditional, resource-intensive consulting approaches.

Cross-selling Critical Services to existing VAR clients is proving successful. The Critical Services segment, fueled by strong demand from existing clients, has become the fastest-growing segment (~3x growth in 2023, 134% CAGR since 2020). Plurilock can organically grow this high-margin segment without the need to acquire new clients, as demonstrated by the composition shift in revenue, with Critical Services growing from ~1% in 2022 to ~4% in 2023 increasing overall gross profit margins from 7.7% to 8.3%. More recently, Plurilock reported Q2 2024 gross profit of $2 million, which is 44% growth year-over-year. This can be attributed to prioritizing high-end consulting and services above software sales, leading to a faster sales cycle with improving margins. Q2 had a gross margin of roughly 15.6% up from 11.2% in Q1 2023, reflecting the consulting business growing into a larger portion of total revenues. The continued expansion of the Critical Services segment should be a key driver of future profitability and value creation.

Plurilock’s Advisory Council – World Class People Creating New Opportunities

Plurilock has assembled an impressive advisory council featuring some of the most influential names in cybersecurity, government, military, aerospace, and banking (Exhibit 2). Beyond their impressive credentials, these advisors offer Plurilock invaluable networks and expertise. When the time is right, their connections in mergers and acquisitions can help facilitate strategic partnerships and exits, while their government and military ties can open doors to new contracts and opportunities. Additionally, their deep understanding of cybersecurity can bolster Plurilock’s Critical Services division and position them for strategic growth.

In essence, this advisory council represents a wealth of opportunities for Plurilock. With such a powerful advisory council in place, Plurilock is well-positioned to expand its reach, increase deal flow, and drive revenue growth. As the Company’s footprint expands, it can leverage its scale to improve margins and solidify its position as a leading player in the cybersecurity market. This strategic advantage positions Plurilock for significant growth and success, with clear evidence these relationships are already in bloom. Plurilock is becoming the trusted partner for more and more clients, which should increase its share of wallet and stickiness with its existing and new potential client base.

Exhibit 2: Partial List of Plurilock’s Subject Matter Experts

Source: Plurilock Corporate Website

High-Value Solutions for High-Profile Clients

Plurilock Critical Services division provides high-end security consulting services, solving critical issues for multibillion dollar companies, and governments. When organizations face urgent cybersecurity issues, Plurilock Critical Services steps in. Leveraging Plurilock’s pool of highly skilled consultants and engineers to deliver immediate solutions, ensures a perfect product-to-market fit for each unique challenge.

Largest Deal in Company History

On October 3, 2024, Plurilock signed a US$19.3 million contract with a S&P 500 semiconductor company to modernize the security stack of a major global enterprise. Plurilock to re-platform the customer’s security operations stack using leading AI-native cybersecurity platform and provide dedicated Critical Services team members for a 12-month period. This deal followed US$1.9 million in new cybersecurity contracts with a prominent S&P 500-listed semiconductor company to modernize several of the Customer’s foundational cybersecurity and information security platforms and resources.

TD SYNNEX

On September 12, 2024, Plurilock entered into a partnership with TD SYNNEX (NYSE: SNX) to provide AI-focused Critical Services and cybersecurity solutions across their North American operation. This represents the initial phase of a potential wider partnership, with the possibility of future expansion into the Company’s global footprint.

Plurilock has been a leader in AI-powered cybersecurity since their inception over eight years ago. Being chosen to deliver Critical Services in this area highlights the Company’s expertise and validates their mission to protect world leading organizations from evolving threats. With Plurilock as a service provider, TD SYNNEX can enhance the range of AI services they offer in this crucial sector, driving both current business outcomes and future growth for their partners. This announcement followed recent Advisory Council addition, Brian Aebig.

New Advisory Council Member

These announcements followed recent Advisory Council addition Joe Sexton. Plurilock does not offer a point solution, rather a combination of products and services, with the ability to service companies of any sizes and solve a wide range of problems. Part of the reason Mr. Sexton joined Plurilock was the belief in the Company’s ability to execute. Plurilock has the tools and the resources to succeed right now, they just need the reach. Part of the Advisory Council’s objective is to leverage their connections to create new opportunities, which is made easier by the fact Plurilock already has the trust of both the U.S. Government and other larger enterprises. Mr. Sexton’s emphasis on business outcomes and strategic growth aligns with Plurilock’s goals, bringing a focused approach to capturing market share in the competitive cybersecurity sector.

Cashed Up and Ready for Growth

Following a successful $5.5 million equity financing in May 2024 and the recent injection of an additional $2 million from warrant exercises, Plurilock is well-capitalized and positioned for growth. While the Company is not yet profitable, its increasing revenues, expanding high-margin Critical Services, and a robust pipeline of new opportunities signal a clear path toward profitability. The strengthened balance sheet provides ample runway to reach this milestone, while also allowing Plurilock to continue evaluating strategic, accretive acquisitions that would expand its platform and further capitalize on its growing customer base.

For More Research

Access more Plurilock Security research HERE

Sign up for Sophic Capital’s reports HERE

Disclosures

Plurilock Security Inc. [TSXV:PLUR, OTC:PLCKF] has contracted Sophic Capital for capital markets advisory and investor relations services.

Disclaimers

The information and recommendations made available through our emails, newsletters, website and press releases (collectively referred to as the “Material”) by Sophic Capital Inc. (“Sophic” or “Company”) is for informational purposes only and shall not be used or construed as an offer to sell or be used as a solicitation of an offer to buy any services or securities. In accessing or consuming the Materials, you hereby acknowledge that any reliance upon any Materials shall be at your sole risk. None of the information provided in our monthly newsletter and emails or any other Material should be viewed as an invite, and/or induce or encourage any person to make any kind of investment decision. The recommendations and information provided in our Material are not tailored to the needs of particular persons and may not be appropriate for you depending on your financial position or investment goals or needs. You should apply your own judgment in making any use of the information provided in the Company’s Material, especially as the basis for any investment decisions. Securities or other investments referred to in the Materials may not be suitable for you and you should not make any kind of investment decision in relation to them without first obtaining independent investment advice from a qualified and registered investment advisor. You further agree that neither Sophic, its, directors, officers, shareholders, employees, affiliates consultants, and/or clients will be liable for any losses or liabilities that may be occasioned as a result of the information provided in any of the Material. By accessing Sophic’s website and signing up to receive the Company’s monthly newsletter or any other Material, you accept and agree to be bound by and comply with the terms and conditions set out herein. If you do not accept and agree to the terms, you should not use the Company’s website or accept the terms and conditions associated to the newsletter signup. Sophic is not registered as an adviser or dealer under the securities legislation of any jurisdiction of Canada or elsewhere and provides Material on behalf of its clients pursuant to an exemption from the registration requirements that is available in respect of generic advice. In no event will Sophic be responsible or liable to you or any other party for any damages of any kind arising out of or relating to the use of, misuse of and/or inability to use the Company’s website or Material. The information is directed only at persons resident in Canada. The Company’s Material or the information provided in the Material shall not in any form constitute as an offer or solicitation to anyone in the United States of America or any jurisdiction where such offer or solicitation is not authorized or to any person to whom it is unlawful to make such a solicitation. If you choose to access Sophic’s website and/or have signed up to receive the Company’s monthly newsletter or any other Material, you acknowledge that the information in the Material is intended for use by persons resident in Canada only. Sophic is not an investment advisor, nor does it maintain any registrations as such, and Material provided by Sophic shall not be used to make investment decisions. Information provided in the Company’s Material is often opinionated and should be considered for information purposes only. No stock exchange or securities regulatory authority anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. Sophic and/or its principals and employees may have positions in the stocks mentioned in the Company’s Material and may trade in the stocks mentioned in the Material. Do not consider buying or selling any stock without conducting your own due diligence and/or without obtaining independent investment advice from a qualified and registered investment advisor. The Company has not independently verified any of the data from third party sources referred to in the Material, including information provided by Sophic clients that are the subject of the report, or ascertained the underlying assumptions relied upon by such sources. The Company does not assume any responsibility for the accuracy or completeness of this information or for any failure by any such other persons to disclose events which may have occurred or may affect the significance or accuracy of any such information.

The Material may contain forward looking information. Forward-looking statements are frequently, but not always, identified by words such as “expects,” “anticipates,” “believes,” “intends,” “estimates,” “potential,” “possible,” “projects,” “plans,” and similar expressions, or statements that events, conditions or results “will,” “may,” “could,” or “should” occur or be achieved or their negatives or other comparable words and include, without limitation, statements regarding, projected revenue, income or earnings or other results of operations, strategy, plans, objectives, goals and targets, plans to increase market share or with respect to anticipated performance compared to competitors, product development and adoption by potential customers. These statements relate to future events and future performance. Forward-looking statements are based on opinions and assumptions as of the date made and are subject to a variety of risks and other factors that could cause actual events/results to differ materially from these forward-looking statements. There can be no assurance that such expectations will prove to be correct; these statements are no guarantee of future performance and involve known and unknown risks, uncertainties and other factors. Sophic provides no assurance as to future results, performance, or achievements and no representations are made that actual results achieved will be as indicated in the forward-looking information. Nothing herein can be assumed or predicted, and you are strongly encouraged to learn more and seek independent advice before relying on any information presented.