In Sophic Capital’s Aires to Success report, we highlighted how the CEO of Sophic Capital client American Aires Inc. (CSE:WiFi, OTCQB:AAIRF) has developed, and is successfully executing against, a business model that leverages high-impact partnerships. In this report, we detail American Aires’ revenue model.

Revenue Model

American Aires generates revenues three ways: direct-to-consumer (DTC), international distributors, and OEM/licensing. DTC involves direct media advertising on channels such as Facebook, YouTube, TikTok, Rumble and Instagram. DTC also leverages content creation via podcasts and appearances on consumer programs like Dr. Drew and Ben Greenfield. International distributors facilitate ease of navigating the complexities to best serve international consumers. OEM/licensing applies to third party manufacturers or companies that choose to license American Aires’ electromagnetic field (EMF) protection products.

Management estimates that DTC and international distributors could drive about $600 million of global revenue over time. This is based on 80% of the adult population in targeted markets (primarily USA, Canada and Australia) then extrapolated globally, a 13% addressable market, 10% Aries market share across its targeted geographies and $400 Consumer Lifetime Value.

OEM/licensing has a $2 billion revenue potential. This opportunity is driven by opportunities to incorporate the Aires technology into consumer tech products, and is based on similar assumptions as DTC, but with lower wholesale pricing.

Together, these three revenue models suggest American Aires is just beginning to execute on large growth opportunities.

Finally, a key part of American Aires’ revenue model stems from its business strategy of generating loyal customers that translate into repeat business. In Sophic Capital’s Clearing the Aires report, we showcased American Aires’ suite of EMF protection products. The products scale in price as the effective diameters of coverage increase. American Aires’ loyal customers are repeat customers, often buying the same initial product for family or friends or purchasing higher-priced products with larger coverage ranges. Based on sales data, Management estimates that ~20-25% purchases are driven by repeat purchasers, who, once satisfied with their purchase, return to purchase products for their friends and family etc.

The Revenue Model is Working

In Sophic Capital’s Aires to Success report, we detailed how CEO Josh Bruni has implemented his tested business strategy of leveraging high-impact partnerships to generate co-branded content for far-reaching advertising campaigns. This strategy typically returns $3 of order volume for every $1 of variable advertising spend (Return on Ad Spend, or ROAS). This dynamic also implies that every additional dollar of advertising spend produces about $1.80 of Gross Profit (assuming a 60% Gross Margin, inline to slightly below Aires current levels). We examine the relevance of this relationship a little further in this report. Typically, new partnerships and marketing initiatives have a fixed cost component, which goes into the Company’s marketing expenses. Once these initiatives have been launched and ramped, the key tactic is to direct variable advertising spending towards them while employing rigorous analytics and metrics, which is CEO Josh Bruni’s area of expertise.

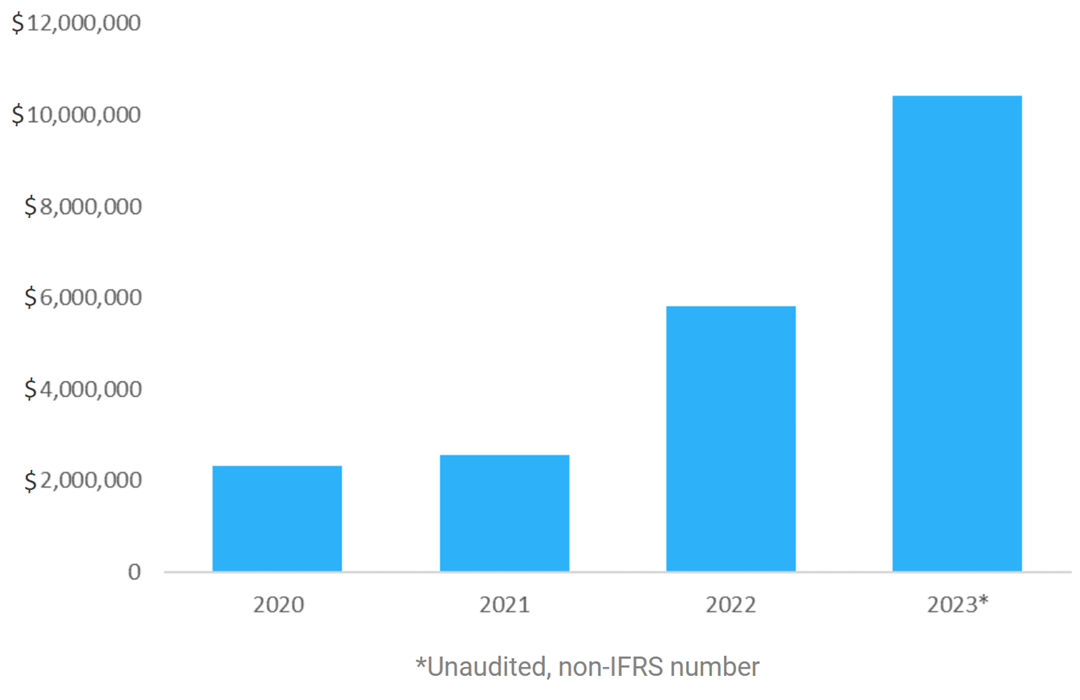

Since joining American Aires in late 2021, Mr. Bruni’s strategy has boosted sales fourfold through the end of 2023, 128% year-over-year in 2022 and 79% in 2023 to over $10.4 million (Exhibit 1). Note that on August 28, 2023, the Company entered a partnership with HUCK Project LLC (HUCK) whereby HUCK became a non-exclusive global, retail-only distribution partner. From January 1, 2023 to August 28, 2023 (the pre-HUCK period during the year), American Aires continued to build on the strength in demand and recorded sales of $5.5 million. For the remainder of the year, the Company sold through HUCK, generating $4.9 million of sales. From an accounting perspective, HUCK received the sales but American Aires got the profits. Combining American Aires and HUCK sales resulted in non-IFRS combined sales of $10.4 million, representing a 79% year-over-year growth.

Exhibit 1: Historical Annual Sales (CAD$)

Source: Company reports

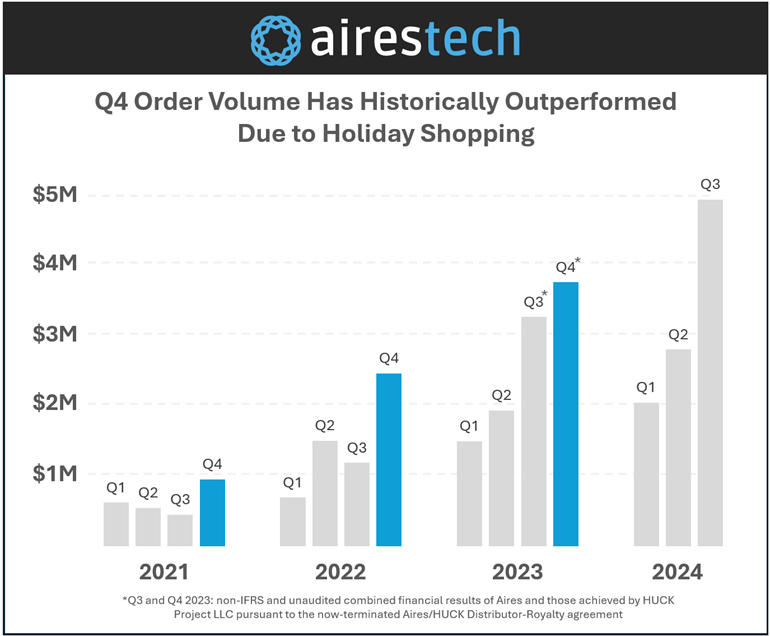

Q3 2024 Demonstrated Continuing Robust Growth Going Into The Seasonally Strong Q4

During American Aires’ third quarter of 2024 for the 3 months ending September 30 (Q3 2024), the Company reported record quarterly order volume of $4.92 million, a 61% increase over the third quarter of 2023 (Q3 2023). After taking into account relevant accounting adjustments that include shipping revenue, returns, return provision and deferred revenue, American Aires’ reported sales increased 57% year-over-year to a record of $4.59 million versus non-IFRS sales of $2.92 million during Q3 2023. Note, Q3 2023 revenue is non-IFRS due to the former partnership the Company had with HUCK, where HUCK recorded the sales and American Aires received the profits.

Achieving its highest ever order volume and sales in Q3 2024 was an important milestone for American Aires, validating the business strategy and confirming actions undertaken in the first and second quarters of the year. These efforts in the first half of 2024 drove Q3 results and will likely spill into Q4 as well, mirroring the prior 3 years (Exhibit 2). And thus far, it appears as this is the case; in the Company’s Q3 2024 financial results press release, CEO Josh Bruni noted that from October 1 through 25, order volume grew 147% year-over-year to $2,004,516 versus $813,059 in the same 2023 period. Gross margins during both periods were 62% and 63% respectively.

Exhibit 2: Historical Order Volume Historically Weighted in Holiday Season (Q4)

Source: Company materials

The Q3 2024 quarter’s increase in order volume and reported sales was driven largely by the efficient deployment of scaled-up advertising and marketing budgets, which included strategic partnerships the Company entered into during Q2 and Q3 2024, including with the UFC, NHL star John Tavares, Canada Basketball, NBA star RJ Barrett, and the WWE. The quarterly performance extends the Company’s multi-year trend of strong revenue growth through widening its user base, opening new market segments, and expanding its overall reach and brand name recognition.

Compounding the order volume effects from efficient advertising and marketing spend was the content generated from the partnerships forged in Q2 and Q3 of 2024. Creating and leveraging co-branded content for the Company drives the marketing and advertising campaigns which, in turn, drives order volume and sales. The result of this strategy was the 61% year-over-year order volume increase in the quarter to a record $4.92 million. The Company’s Q3/2024 results are consistent with management expectations. Several of these partnerships are multi-year, which should provide ample co-branded content for American Aires to leverage as part of its continued growth.

Gross margin remained in the 60% range, coming in at 63% during Q3 2024 versus 62% in Q3 2023. Advertising and promotion and marketing expenses did scale to $3.45 million during the quarter versus $1.74 million in the previous year’s Q3. This resulted in an Adjusted EBITDA loss of $1.17 million in Q3 2024 compared to a loss of $0.38 million in Q3 2023. We note that increased losses were expected as the Company ramps its sales, spending to capture new customers and generate repeat orders, particularly to take advantage of the strategic league and athlete partnerships mentioned above. With continued growth in the 60-80% range, and once fixed costs level, variable ad spending should see more operating leverage, driving the Company to Adjusted EBITDA breakeven; perhaps once the Company generates annual revenue in the $35 million+ range, initial EBITDA break-even is likely on an annual (versus quarterly) basis since the business is highly seasonal, with Q3 and Q4 tending to be the strongest revenue generating periods for the Company. And with Q4 generally being the most robust seasonal quarter (accounting for an average 38% of annual revenues since 2021), order volume should continue to be strong while Adjusted EBITDA is expected to improve, strengthening the balance sheet. In fact, Q4 2023 saw a 79% increase in year-over-year order volume as well as recording Adjusted EBITDA profitability.

Coming Up…

In our next report, we’ll examine the capital structure of Sophic Capital client American Aires Inc. (CSE:WiFi, OTCQB:AAIRF) and also compare the Company’s valuation (as a multiple of sales) to some companies with similar business models and/or companies who operate in the health tech/consumer space.

For More Research

Access more American Aires Inc. research HERE

Sign up for Sophic Capital’s reports HERE

Sign up for American Aires updates HERE

Disclosures

American Aires Inc. [CSE:WiFi, OTCQB:AAIRF] has contracted Sophic Capital for capital markets advisory and investor relations services.

Disclaimers

The information and recommendations made available through our emails, newsletters, website and press releases (collectively referred to as the “Material”) by Sophic Capital Inc. (“Sophic” or “Company”) is for informational purposes only and shall not be used or construed as an offer to sell or be used as a solicitation of an offer to buy any services or securities. In accessing or consuming the Materials, you hereby acknowledge that any reliance upon any Materials shall be at your sole risk. None of the information provided in our monthly newsletter and emails or any other Material should be viewed as an invite, and/or induce or encourage any person to make any kind of investment decision. The recommendations and information provided in our Material are not tailored to the needs of particular persons and may not be appropriate for you depending on your financial position or investment goals or needs. You should apply your own judgment in making any use of the information provided in the Company’s Material, especially as the basis for any investment decisions. Securities or other investments referred to in the Materials may not be suitable for you and you should not make any kind of investment decision in relation to them without first obtaining independent investment advice from a qualified and registered investment advisor. You further agree that neither Sophic, its, directors, officers, shareholders, employees, affiliates consultants, and/or clients will be liable for any losses or liabilities that may be occasioned as a result of the information provided in any of the Material. By accessing Sophic’s website and signing up to receive the Company’s monthly newsletter or any other Material, you accept and agree to be bound by and comply with the terms and conditions set out herein. If you do not accept and agree to the terms, you should not use the Company’s website or accept the terms and conditions associated to the newsletter signup. Sophic is not registered as an adviser or dealer under the securities legislation of any jurisdiction of Canada or elsewhere and provides Material on behalf of its clients pursuant to an exemption from the registration requirements that is available in respect of generic advice. In no event will Sophic be responsible or liable to you or any other party for any damages of any kind arising out of or relating to the use of, misuse of and/or inability to use the Company’s website or Material. The information is directed only at persons resident in Canada. The Company’s Material or the information provided in the Material shall not in any form constitute as an offer or solicitation to anyone in the United States of America or any jurisdiction where such offer or solicitation is not authorized or to any person to whom it is unlawful to make such a solicitation. If you choose to access Sophic’s website and/or have signed up to receive the Company’s monthly newsletter or any other Material, you acknowledge that the information in the Material is intended for use by persons resident in Canada only. Sophic is not an investment advisor, nor does it maintain any registrations as such, and Material provided by Sophic shall not be used to make investment decisions. Information provided in the Company’s Material is often opinionated and should be considered for information purposes only. No stock exchange or securities regulatory authority anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. Sophic and/or its principals and employees may have positions in the stocks mentioned in the Company’s Material and may trade in the stocks mentioned in the Material. Do not consider buying or selling any stock without conducting your own due diligence and/or without obtaining independent investment advice from a qualified and registered investment advisor. The Company has not independently verified any of the data from third party sources referred to in the Material, including information provided by Sophic clients that are the subject of the report, or ascertained the underlying assumptions relied upon by such sources. The Company does not assume any responsibility for the accuracy or completeness of this information or for any failure by any such other persons to disclose events which may have occurred or may affect the significance or accuracy of any such information.

The Material may contain forward looking information. Forward-looking statements are frequently, but not always, identified by words such as “expects,” “anticipates,” “believes,” “intends,” “estimates,” “potential,” “possible,” “projects,” “plans,” and similar expressions, or statements that events, conditions or results “will,” “may,” “could,” or “should” occur or be achieved or their negatives or other comparable words and include, without limitation, statements regarding, projected revenue, income or earnings or other results of operations, strategy, plans, objectives, goals and targets, plans to increase market share or with respect to anticipated performance compared to competitors, product development and adoption by potential customers. These statements relate to future events and future performance. Forward-looking statements are based on opinions and assumptions as of the date made and are subject to a variety of risks and other factors that could cause actual events/results to differ materially from these forward-looking statements. There can be no assurance that such expectations will prove to be correct; these statements are no guarantee of future performance and involve known and unknown risks, uncertainties and other factors. Sophic provides no assurance as to future results, performance, or achievements and no representations are made that actual results achieved will be as indicated in the forward-looking information. Nothing herein can be assumed or predicted, and you are strongly encouraged to learn more and seek independent advice before relying on any information presented.