In Sophic Capital’s A Revenue Model that’s a Breath of Fresh Aires report, we detailed the revenue model of Sophic Capital client American Aires Inc. (CSE:WiFi, OTCQB:AAIRF). Essentially, American Aires (the “Company”) generates revenue by selling direct to the consumer, through partnerships, and OEM/licensing. As well, we noted that part of American Aires’ business strategy was to create loyal customers who will purchase additional products. In this report, we compare the valuation of the Company versus its peers, based upon where their stocks trade.

Aires of Distinction: Valuations in a League of its Own

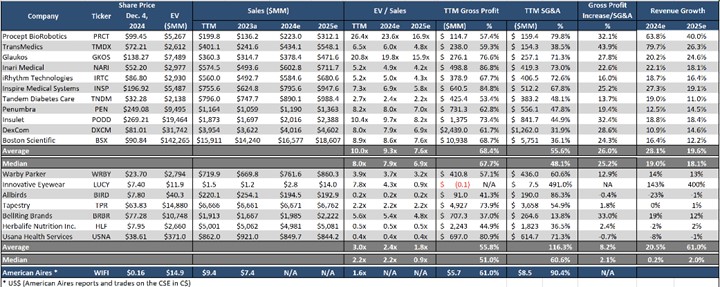

In the following analysis, we compare American Aires’ valuation to MedTech and Direct to Consumer companies. Some investors could argue that American Aires sits somewhere in the middle on this spectrum of classification given the Company’s offerings and technology-based IP. Indeed, we find that on a revenue growth and Gross Margin scale, American Aires does sit in the middle of this spectrum.

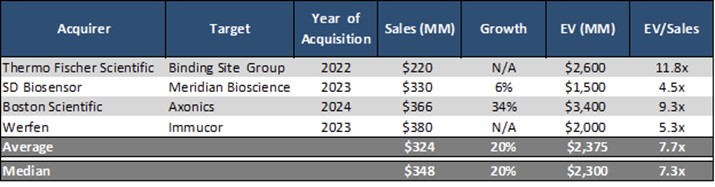

Exhibit 1 shows that MedTech companies (peers) trade on average 7.6 times their forward 2025 sales estimates, while Direct to Consumer (“DTC”) companies trade on average 1.8 times forward 2025 sales estimates. On a trailing twelve month (“TTM“) sales basis, American Aires stock on the Canadian Securities Exchange trades at 1.6 times revenue, versus MedTech companies trading at ~10 times and DTC companies at ~3 times. We admit that comparing forward and TTM sales estimates is an apples-to-oranges comparison, since in addition to measuring different time periods (for a growing company TTM sales multiples will be higher than a forward multiple), different companies have different growth rates as they scale and different margin structures. To put this in context, MedTech companies are generally expected to grow revenue at ~20% year over year in 2025, and have TTM Gross Margin in the high 60% range. Direct to Consumer companies are generally not expected to grow much in 2025, with the notable exception of Innovative Eyewear, which develops and sells smart eyeglasses and sunglasses to sell them via various ecommerce and retail channels. These Direct to Consumer companies trade at an average ~1.8 times forward 2025 revenue and have TTM Gross Margin in the mid 50% range.

American Aires does not provide revenue or margin guidance, but has grown revenue by 128% and 79% annually in 2022 and 2023. That said, American Aires trades at 1.6x trailing twelve month revenue. Assuming the Company can grow its top line by 70% in 2024, which would be towards the low end of annual growth rates since 2022, implies the stock trades at even lower, about 1.2 times 2024 sales – a discount to both MedTech and Direct to Consumer peer valuations. As per Exhibit 2, MedTech have been acquired for an average of nearly 8 times revenue in recent years. Aires is trading at a lower valuation multiple despite growing at a higher rate than both categories and having Gross Margin in the low 60% range (i.e. in between MedTech and Direct to Consumer companies). For additional context, Aires’ revenue growth was 128%, 79% in 2023 and 2022 respectively, and while predicting revenue growth from such rapid growth rates is challenging, the company does have immediate pockets of growth, as evidenced by recent commentary around the 2024 holiday shopping season Order volume from October 1 through 25, 2024, which showed strong growth, totaling C$2,004,516 (versus C$813,059 in 2023), representing a 147% increase for the same date range year-over-year. Gross Margin percentage for the same date range was 62% (versus 63% in 2023).

Exhibit 1: Peer Company Valuations

Source: Corporate Press Releases

Valuation Deep Dive – Putting Sales Multiples In Context of Business Model

Another way to frame the valuation discussion is to examine how efficient American Aires’ business model is relative to peers. In this regard, as Exhibit 1 highlights, MedTech companies on average generate ~25% average incremental Gross Profit for each dollar spent on SG&A, while Direct to Consumer companies produce about 8% average incremental Gross Profit for each dollar spent on SG&A. We calculate this by dividing the increase in 2025 Gross Profit from 2024 Gross Profit (using trailing Gross Margin levels) by the trailing twelve month SG&A expenses. It is important to keep in mind that this exercise does not reflect the effectiveness or return on advertising spending (which we examine a little later in this report), but rather how effective different companies’ business models and operating structures are. Now, as indicated previously, even though American Aires does not provide revenue or margin guidance, if we assume 2024 revenue grows 70% as we previously did (towards the low end of annual growth rates since 2022), and 2025 revenue grows at an even lower 50% while holding Gross Margin at the trailing twelve month 61% mark, this ratio for American Aires works out to around 50%. This calculation suggests that using these conservative assumptions, trailing twelve month SG&A spend of $1 could produce nearly 50c of incremental Gross Profit in 2025 for American Aires vs. 25c for MedTech companies and 8c for Direct to Consumer companies. In other words, based on where these companies are in their lifecycle and their operating structures, Aires is nearly 2x more effective at generating Gross Profit from SG&A spend relative to more established/larger scale MedTech companies, and almost 6x more effective at generating Gross Profit from SG&A spend relative to D2C companies. To further clarify this analysis, the additional Gross Profit produced in 2025 is generated by the SG&A spend already incurred and paid in the last 12 months, which implies that this incremental Gross Profit should either fall to the Company’s operating earnings, or could provide additional cash in 2025 in order to fund revenue growth in 2026, depending on how management chooses to optimally allocate these dollars. Despite this positive operating leverage, and having Gross Margin roughly in the middle of both relevant categories of comparable companies, American Aires trading at a lower relative valuation Naturally, for this value generation thesis to play out, American Aires needs to to keep executing on its organic revenue growth strategy and maintain current Gross Margin levels – this is where CEO, Josh Bruni’s marketing prowess comes into play.

Bet On The Jockey Over The Horse

Underpinning American Aires’ growth is CEO Josh Bruni with his 25 years of proven success building international brands and methodically accelerating revenue. As most small cap investors understand, investing in small cap stocks is analogous to betting on the management team. Mr. Bruni’s proven strategy is to leverage high impact partnerships with athletes, celebrities, and leagues in order to create co-branded content to efficiently amplify engagement. To do this, the Company’s current target benchmark is $3 in sales for every $1 spent on advertising (3-to-1 Return on Ad Spend or $3-to-$1 ROAS), a metric that these partnership-related factors could likely amplify as the Aires brand becomes more recognizable, more trusted, and more “household” like (1000+ customer testimonials here on Junip), driving more organic sales, rather than relying on heavy advertising expenses. At the same time, Aires’ management has pointed out that each individual partnership requires initial ramp up time to devise an effective strategy, create content, build, test, and optimize advertising campaigns, to reach the full potential of the investment in the way of order volume, sales growth, and marketing efficiency.

Current partnerships include the UFC®, WWE®, Canada Basketball, and high-profile athletes, including UFC stars Maycee Barber and Michael Chandler (below). In a November 14, 2024 Instagram post, Mr. Chandler revealed that he uses the Company’s Lifetune One on all of his electronic devices for protection.

Source: American Aires

The One Thing to Takeaway…

American Aires’ order volume is strong, validating CEO Josh Bruni’s proven strategy of leveraging high impact partnerships with athletes such as Michael Chandler. In spite of this success, the stock market is not rewarding American Aires’ stock (CSE:WiFi), with the stock trading at lower revenue multiples relative to where the market currently values MedTech and direct-to-consumer peers. Investors seeking exposure to this sector, and a company growing organically via calibrated marketing campaigns, should consider Sophic Capital client, American Aires.

For More Research

Access more American Aires Inc. research HERE

Sign up for Sophic Capital’s reports HERE

Sign up for American Aires updates HERE

Disclosures

American Aires Inc. [CSE:WiFi, OTCQB:AAIRF] has contracted Sophic Capital for capital markets advisory and investor relations services.

Disclaimers

The information and recommendations made available through our emails, newsletters, website and press releases (collectively referred to as the “Material”) by Sophic Capital Inc. (“Sophic” or “Company”) is for informational purposes only and shall not be used or construed as an offer to sell or be used as a solicitation of an offer to buy any services or securities. In accessing or consuming the Materials, you hereby acknowledge that any reliance upon any Materials shall be at your sole risk. None of the information provided in our monthly newsletter and emails or any other Material should be viewed as an invite, and/or induce or encourage any person to make any kind of investment decision. The recommendations and information provided in our Material are not tailored to the needs of particular persons and may not be appropriate for you depending on your financial position or investment goals or needs. You should apply your own judgment in making any use of the information provided in the Company’s Material, especially as the basis for any investment decisions. Securities or other investments referred to in the Materials may not be suitable for you and you should not make any kind of investment decision in relation to them without first obtaining independent investment advice from a qualified and registered investment advisor. You further agree that neither Sophic, its, directors, officers, shareholders, employees, affiliates consultants, and/or clients will be liable for any losses or liabilities that may be occasioned as a result of the information provided in any of the Material. By accessing Sophic’s website and signing up to receive the Company’s monthly newsletter or any other Material, you accept and agree to be bound by and comply with the terms and conditions set out herein. If you do not accept and agree to the terms, you should not use the Company’s website or accept the terms and conditions associated to the newsletter signup. Sophic is not registered as an adviser or dealer under the securities legislation of any jurisdiction of Canada or elsewhere and provides Material on behalf of its clients pursuant to an exemption from the registration requirements that is available in respect of generic advice. In no event will Sophic be responsible or liable to you or any other party for any damages of any kind arising out of or relating to the use of, misuse of and/or inability to use the Company’s website or Material. The information is directed only at persons resident in Canada. The Company’s Material or the information provided in the Material shall not in any form constitute as an offer or solicitation to anyone in the United States of America or any jurisdiction where such offer or solicitation is not authorized or to any person to whom it is unlawful to make such a solicitation. If you choose to access Sophic’s website and/or have signed up to receive the Company’s monthly newsletter or any other Material, you acknowledge that the information in the Material is intended for use by persons resident in Canada only. Sophic is not an investment advisor, nor does it maintain any registrations as such, and Material provided by Sophic shall not be used to make investment decisions. Information provided in the Company’s Material is often opinionated and should be considered for information purposes only. No stock exchange or securities regulatory authority anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. Sophic and/or its principals and employees may have positions in the stocks mentioned in the Company’s Material and may trade in the stocks mentioned in the Material. Do not consider buying or selling any stock without conducting your own due diligence and/or without obtaining independent investment advice from a qualified and registered investment advisor. The Company has not independently verified any of the data from third party sources referred to in the Material, including information provided by Sophic clients that are the subject of the report, or ascertained the underlying assumptions relied upon by such sources. The Company does not assume any responsibility for the accuracy or completeness of this information or for any failure by any such other persons to disclose events which may have occurred or may affect the significance or accuracy of any such information.

The Material may contain forward looking information. Forward-looking statements are frequently, but not always, identified by words such as “expects,” “anticipates,” “believes,” “intends,” “estimates,” “potential,” “possible,” “projects,” “plans,” and similar expressions, or statements that events, conditions or results “will,” “may,” “could,” or “should” occur or be achieved or their negatives or other comparable words and include, without limitation, statements regarding, projected revenue, income or earnings or other results of operations, strategy, plans, objectives, goals and targets, plans to increase market share or with respect to anticipated performance compared to competitors, product development and adoption by potential customers. These statements relate to future events and future performance. Forward-looking statements are based on opinions and assumptions as of the date made and are subject to a variety of risks and other factors that could cause actual events/results to differ materially from these forward-looking statements. There can be no assurance that such expectations will prove to be correct; these statements are no guarantee of future performance and involve known and unknown risks, uncertainties and other factors. Sophic provides no assurance as to future results, performance, or achievements and no representations are made that actual results achieved will be as indicated in the forward-looking information. Nothing herein can be assumed or predicted, and you are strongly encouraged to learn more and seek independent advice before relying on any information presented.