In Sophic Capital’s American Aires – Price is Right report, we demonstrated through peer company analysis how American Aires Inc. (CSE:WiFi, OTCQB:AAIRF) was both very effective at generating gross profit from marketing spend and was undervalued on that basis, at that point in time, relative to peers. In this report, we revisit these metrics, given that American Aires (“Aires” or the “Company”) recently provided fiscal 2025 guidance.

But First –

Record Breaking Sales and 2025 Guidance Announced

On January 27, 2025, management announced record-breaking sales for the fourth quarter of 2024, building on the momentum of the very strong Holiday Shopping Season. Key highlights from this update included:

- $4.2 million in cash as of January 24, 2025, and $2.3 million of inventory (December 31, 2024);

- 110%+ year-over-year increase in order volumes from January 1 through January 24, 2025;

- Q4 revenue was $8.8 million (+135% organic revenue growth year-over-year) – the strongest quarter in Aires’ history, largely due to monetization of partnerships which continue to build strength into 2025, and;

- 2024 sales estimated to be $18.2 million (+75% organic revenue growth year-over-year).

Furthermore, management provided the following guidance for 2025, driven by 2025 being the first full year to amplify and benefit from Aires’ world-class partnerships:

- sales between ~$28 million to $32 million, and;

- EBITDA between -$2 million to +$2 million.

American Aires Remains Undervalued Versus Peers

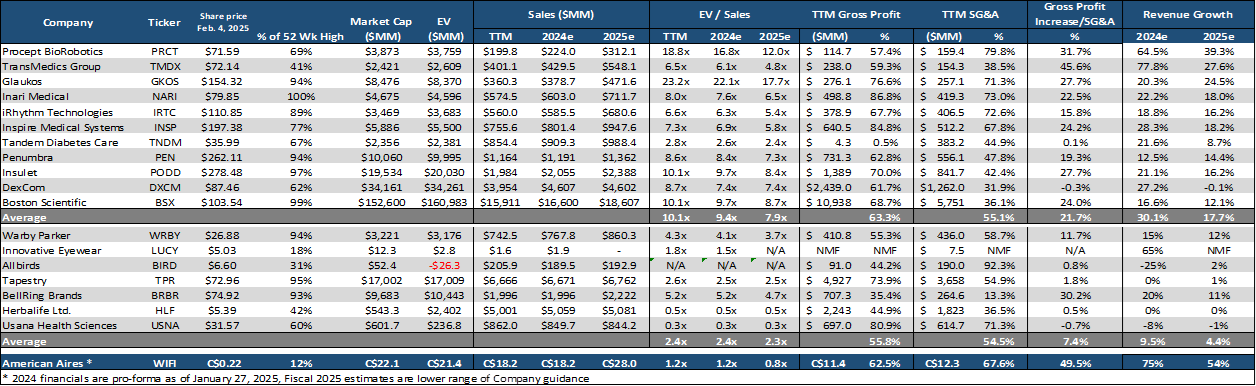

As Sophic Capital did in our American Aires – Price is Right report, we review American Aires’ valuation versus MedTech and Direct to Consumer companies. Recall, in that report, we classified comparable companies into those two categories as investors make the case that American Aires sits somewhere between those categories based on the Company’s offerings and technology-based IP, or its “moat”. Indeed, we find that on a revenue growth and Gross Margin scale, American Aires does sit in the middle of this spectrum.

Exhibit 1 suggests that current prices imply American Aires’ revenue growth and Gross Margins are relatively undervalued, comparing sales multiples with expected 2025 revenue growth and already realized Gross Margins in the Trailing Twelve Months (“TTM”). MedTech companies (“peers”) trade on 7.9 times their average 2025 sales estimates, while Direct to Consumer (“DTC”) companies trade 2.3 times their average forward 2025 sales estimates. Based upon the lower end of Aires’ 2025 revenue guidance range, it trades at 0.8 times.

MedTech companies are generally expected to grow revenue at an average of ~18% year over year in 2025 and have TTM Gross Margin around 63%. Direct to Consumer companies are generally not expected to grow much in 2025 i.e. around 4.4% and have TTM Gross Margin in the 56% range. Preliminary numbers provided by American Aires suggest the Company’s revenues will grow at 54% year-over-year at the lower end of its 2025 guidance, with a TTM Gross Margin of 63%. Therefore, Aires is trading at a lower valuation multiple despite growing at a higher rate than both categories and having Gross Margin in-line with MedTech companies’ 63%.

Exhibit 1: Peer Company Valuations

Source: Koyfin, EDGAR

Sales Multiples in Context of Business Models

Another way to frame the valuation discussion is to examine how efficient American Aires’ business model is relative to peers. In this regard, as Exhibit 1 highlights, MedTech companies on average generate about 22% incremental Gross Profit for each dollar spent on SG&A, while Direct to Consumer companies produce about 7% average incremental Gross Profit for each dollar spent on SG&A. We calculate this by dividing the increase in 2025 Gross Profit from 2024 Gross Profit (using trailing Gross Margin levels) by the trailing twelve month SG&A expenses. It is important to keep in mind that this exercise does not reflect the effectiveness or return on advertising spending, but rather the effectiveness of different company business models and operating structures. This ratio for American Aires works out to around 50%, based on the low-end of the Company’s recently provided 2025 revenue guidance. This calculation suggests that using these conservative assumptions, TTM SG&A spend of $1 could produce nearly 50c of incremental Gross Profit in 2025 for American Aires versus 22c for MedTech companies and 7c for Direct to Consumer companies. In other words, based on where these companies are in their lifecycle and their operating structures, Aires is more than twice as effective at generating Gross Profit from SG&A spend relative to more established/larger scale MedTech companies, and almost seven times more effective at generating Gross Profit from SG&A spend relative to D2C companies.

To further clarify this analysis, the additional Gross Profit produced in 2025 is generated by the SG&A spend already incurred and paid in the last 12 months, which implies that this incremental Gross Profit should either fall to the Company’s operating earnings or could provide additional cash in 2025 in order to fund revenue growth in 2026, depending on how management chooses to optimally allocate these dollars. This optionality is reflected in the Company’s range while providing 2025 revenue and EBITDA guidance.

Despite this positive operating leverage, Gross Margin roughly in the middle of both relevant categories of comparable companies, and having superior self funded organic revenue growth, American Aires is trading at a lower relative valuation. In order for this valuation gap to close, i.e. for American Aires to trade at a higher valuation (and resultant higher stock price) the Company needs to demonstrate continued execution on its revenue growth strategy and maintain current Gross Margin levels; this is where CEO, Josh Bruni’s marketing prowess comes into play and one reason why many investors own the Company’s stock. These investors will need to look for milestones throughout the year that either support or refute this execution path.

For More Research

Access more American Aires Inc. research HERE

Sign up for Sophic Capital’s reports HERE

Sign up for American Aires updates HERE

Disclosures

American Aires Inc. [CSE:WiFi, OTCQB:AAIRF] has contracted Sophic Capital for capital markets advisory and investor relations services.

Disclaimers

The information and recommendations made available through our emails, newsletters, website and press releases (collectively referred to as the “Material”) by Sophic Capital Inc. (“Sophic” or “Company”) is for informational purposes only and shall not be used or construed as an offer to sell or be used as a solicitation of an offer to buy any services or securities. In accessing or consuming the Materials, you hereby acknowledge that any reliance upon any Materials shall be at your sole risk. None of the information provided in our monthly newsletter and emails or any other Material should be viewed as an invite, and/or induce or encourage any person to make any kind of investment decision. The recommendations and information provided in our Material are not tailored to the needs of particular persons and may not be appropriate for you depending on your financial position or investment goals or needs. You should apply your own judgment in making any use of the information provided in the Company’s Material, especially as the basis for any investment decisions. Securities or other investments referred to in the Materials may not be suitable for you and you should not make any kind of investment decision in relation to them without first obtaining independent investment advice from a qualified and registered investment advisor. You further agree that neither Sophic, its, directors, officers, shareholders, employees, affiliates consultants, and/or clients will be liable for any losses or liabilities that may be occasioned as a result of the information provided in any of the Material. By accessing Sophic’s website and signing up to receive the Company’s monthly newsletter or any other Material, you accept and agree to be bound by and comply with the terms and conditions set out herein. If you do not accept and agree to the terms, you should not use the Company’s website or accept the terms and conditions associated to the newsletter signup. Sophic is not registered as an adviser or dealer under the securities legislation of any jurisdiction of Canada or elsewhere and provides Material on behalf of its clients pursuant to an exemption from the registration requirements that is available in respect of generic advice. In no event will Sophic be responsible or liable to you or any other party for any damages of any kind arising out of or relating to the use of, misuse of and/or inability to use the Company’s website or Material. The information is directed only at persons resident in Canada. The Company’s Material or the information provided in the Material shall not in any form constitute as an offer or solicitation to anyone in the United States of America or any jurisdiction where such offer or solicitation is not authorized or to any person to whom it is unlawful to make such a solicitation. If you choose to access Sophic’s website and/or have signed up to receive the Company’s monthly newsletter or any other Material, you acknowledge that the information in the Material is intended for use by persons resident in Canada only. Sophic is not an investment advisor, nor does it maintain any registrations as such, and Material provided by Sophic shall not be used to make investment decisions. Information provided in the Company’s Material is often opinionated and should be considered for information purposes only. No stock exchange or securities regulatory authority anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. Sophic and/or its principals and employees may have positions in the stocks mentioned in the Company’s Material and may trade in the stocks mentioned in the Material. Do not consider buying or selling any stock without conducting your own due diligence and/or without obtaining independent investment advice from a qualified and registered investment advisor. The Company has not independently verified any of the data from third party sources referred to in the Material, including information provided by Sophic clients that are the subject of the report, or ascertained the underlying assumptions relied upon by such sources. The Company does not assume any responsibility for the accuracy or completeness of this information or for any failure by any such other persons to disclose events which may have occurred or may affect the significance or accuracy of any such information.

The Material may contain forward looking information. Forward-looking statements are frequently, but not always, identified by words such as “expects,” “anticipates,” “believes,” “intends,” “estimates,” “potential,” “possible,” “projects,” “plans,” and similar expressions, or statements that events, conditions or results “will,” “may,” “could,” or “should” occur or be achieved or their negatives or other comparable words and include, without limitation, statements regarding, projected revenue, income or earnings or other results of operations, strategy, plans, objectives, goals and targets, plans to increase market share or with respect to anticipated performance compared to competitors, product development and adoption by potential customers. These statements relate to future events and future performance. Forward-looking statements are based on opinions and assumptions as of the date made and are subject to a variety of risks and other factors that could cause actual events/results to differ materially from these forward-looking statements. There can be no assurance that such expectations will prove to be correct; these statements are no guarantee of future performance and involve known and unknown risks, uncertainties and other factors. Sophic provides no assurance as to future results, performance, or achievements and no representations are made that actual results achieved will be as indicated in the forward-looking information. Nothing herein can be assumed or predicted, and you are strongly encouraged to learn more and seek independent advice before relying on any information presented.