Trafficking counterfeit goods kills people, enriches criminal organizations, destroys jobs, and shrinks economies. Alarmist? Consider this data:

- 72,000 to 169,000 children may be dying each year from pneumonia due to substandard and falsified antibiotics

- 116,000 additional deaths from malaria could be caused every year by substandard and falsified antimalarials

- 1 in 10 medical products circulating in low- and middle-income countries is either substandard or falsified

- 90,900 direct and indirect jobs are lost annually in Europe due to counterfeit goods

- Trade in fake goods is now 3.3% of world trade and rising and could become a $1.82 TRILLION market in global brands by 2020

- Europol concludes that low risks and high profits will continue to drive organised crime groups towards the trade in counterfeit and pirated goods

The U.S President Has Taken Action

On January 31, 2020, U.S. President Donald Trump issued an Executive Order to stop the importation of counterfeit goods. This followed an April 2019 Memorandum that specifically targeted third-party, online retailers selling counterfeited and pirated goods. The most recent Order tasks the U.S. Department of Homeland Security Customs and Border Protection (“CBD”) with strengthening criteria for companies importing goods from overseas. Importers found violating the new rules could face more rigorous inspections, see their operations suspended, barred from selling to government agencies, or participating in federal programs. Guilty individuals could face bans working with any import company.

President Trump’s Executive Order had special provisions for the United States Postal Service (“USPS”). The reason is because most counterfeit goods aren’t peddled in street markets and back alleys anymore. Online commerce websites are the preferred sales channel. Why? Ease of payment and ease of shipping.

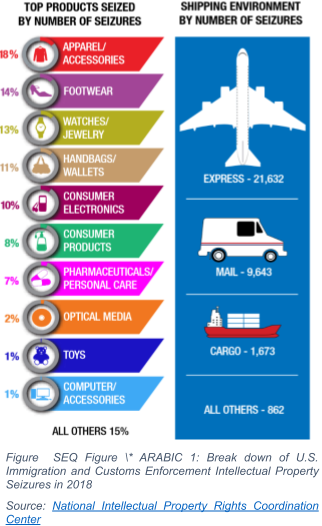

For example, in 2018, U.S. Immigration and Customs Enforcement (“ICE”)1 conducted 33,810 intellectual property seizures worth an estimated $1.4 billion (as measured by manufacturers suggested retail price). About 28% (Figure 1) of these seizures were shipped by mail. But when we consider that USPS handled about 146 billion pieces of mail in 2018, its unlikely that the U.S. will intercept a mailed counterfeit good.

1 USPS receives international mail from more than 190 countries. Many foreign postal operators provide advance electronic data to USPS, which is then passed on to CBP.

eCommerce Websites Are Scrambling to Halt Sales of Counterfeit Goods

Page 14 of Amazon’s (NASDAQ:AMZN) most recent 10-K form discloses third-party selling of counterfeit goods as a business risk and potential shareholder liability. An Amazon executive claimed that the Company spent $400 million in 2017 to fight the problem, employing over 5,000 workers in the process. The U.S. Trade Representative placed Taobao.com, China’s largest e-commerce platform, which is owned and operated by Alibaba Group (NYSE:BABA), on its “2018 List of notorious online markets” due to its “high volumes of infringing products”. Alibaba claims that in 2018 and 2019, its real-time scanning technology proactively removed 96% of questionable listings before a single sale occurred. These efforts are laudable, but they may not be enough to satisfy America’s greater ambition of eliminating counterfeit good sales through ecommerce websites.

Anti-counterfeiting Before the Sale

A January 24, 2020 U.S. Department of Homeland Security report to the President could force third-party ecommerce websites to police their entire supply chains. The report states that “counterfeits are being trafficked through vast e-commerce supply chains in concert with marketing, sales, and distribution networks” and that stakeholders require “redoubling efforts to police their own businesses and supply chains”. Perhaps most concerning to ecommerce is that ICE and the Department of Justice will “develop a strategy to investigate and prosecute intellectual property violations at all levels of the supply chain”. To us, “all levels of the supply chain” indicates that third-party ecommerce website anti-counterfeiting policies, processes, auditing, and technology could become far more complex and will likely have to leverage new technologies to find solutions.

Supply Chain Technology Impossible to Counterfeit

Nanotech Security Corp. (TSXV:NTS, OTC:NTSFF) (“Nanotech”), a Sophic Capital client, has anticounterfeiting technology that not only validates brand authenticity but also could be used as a supply chain verification tool. The Company has a portfolio of products that integrate into any packaging or manufacturing line and that can be applied to any surface or substrate. The products are made from nanometer sized holes that are embedded in a surface. The holes can be designed to reflect any colour of light, an array of colours and even video motion. Nanotech can even embed nano-sized codes for scanning purposes. And unless a counterfeiter has access to complicated mathematic algorithms for programming the holes, millions of dollars of equipment, and a clean room for creating shims for pressing the holes, Nanotech’s products are extremely difficult to replicate.

We believe that Nanotech’s products could address concerns that the U.S. government has with counterfeit products in third-party ecommerce retailers. As mentioned, Nanotech’s products can be embedded on any surface or material. The products cannot be removed, duplicated, or forgotten, given their luminescence. The products are unmistakeable, making them easily identifiable in any supply chain. Plus, identification codes can be embedded at the nanometer level and scanned for further supply chain validation.

Nanotech has a suite of anti-counterfeiting products for the brand protection market, deploying its LiveOptikTM technology to deliver both security and design flexibility. The Company was selected to provide the security feature for UEFA’s 2016 soccer competition and has some contracts with commercial brands.

Top Ten Banknote Issuer Validation

A top ten banknote issuer has validated Nanotech’s core technology, and the Company is working through a $30 million development contract to develop a security feature that could be incorporated into the issuer’s banknotes. If the issuer accepts the feature and banknote production begins, Nanotech should see recurring revenue from this contract, with the typical initial lifespan of a banknote security feature estimated at 17 years.

Nanotech is fully funded to execute its business plan. With $9.5 million in cash and short-term investments as of December 31, 2019 and no debt, plus a revamped sales strategy and sales team to execute, management has the potential to address supply chain counterfeiting not only for third-party ecommerce providers but also brands.

The Stock is Trading at 0.53x Price/Book Value

Currently, Nanotech is trading at ~$0.20, implying a market cap of ~$13.8 million. The Company has $9.5 million of cash, no debt and a book value of $26.1 million, which doesn’t include the patent portfolio. With the stock at these levels, long term value investors who believe that the Company can execute on its existing large government banknote contracts and continue to penetrate the consumer market, could see very strong returns and look back to the current market meltdown as a perfect buying opportunity.

In times like we are experiencing today, if you have cash and are looking to deploy some into microcap stocks, look for solid businesses (profitable or low burn rates in sectors that will only be mildly impacted) with very strong balance sheets trading at distressed valuations. It may be the perfect storm to tuck away some Nanotech Security (TSXV:NTS, OTC:NTSFF) and not look at it for 12 months.