Dirty, dirty oil. We are so past that. Renewables are all the rage – clean energy, renewable natural gas, wind and solar. Whether you are committed to or skeptical about renewable energies, you cannot deny that ESG companies are getting a lot of media headlines and bylines. For those new to ESG, it stands for “Environmental, Social and Governance”, and includes not only renewable energy companies but also firms changing their practices to affect positive environmental, social, and government changes.

Not convinced that ESG is a real trend? Major investment firms and corporations are embracing ESG: Microsoft (MSFT:NASDAQ) has said it will be carbon negative by 2030 – yes, that isn’t a typo – and BlackRock (BLK:NYSE), the world’s largest asset manager, announced it is all in on ESG and sustainability and is already holding companies like Siemens (SIE:DE) accountable.

If you think you have missed the trade, think again. We believe we’re still early in the ESG trade, so it’s time to put on your research cap and start increasing your exposure. We started our due diligence by looking internally at our clients and, surprisingly, found two that fall into the ESG investment bucket.

At first glance, qualifying one of our clients as an ESG investment candidate would likely get a lot of pushback since this firm helps the much-reviled pipeline industry transport those dirty fossil fuels. But before you hit the delete button for this supposedly ludicrous idea, please hear us out. And please be patient because we’d first like to introduce our fossil fuel thesis before telling you about this ESG company that could be the saving grace for the pipeline industry by potentially returning its social license to build more pipelines.

Dirty, Dirty Oil – Are We Really So Past That?

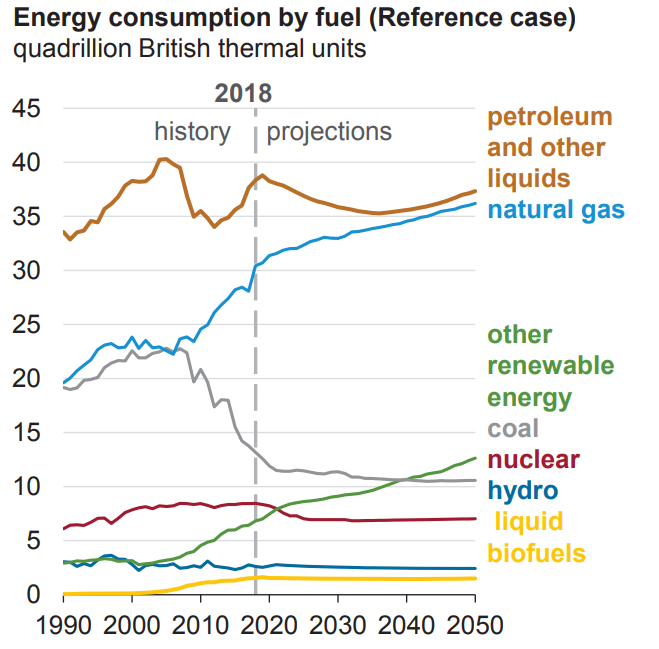

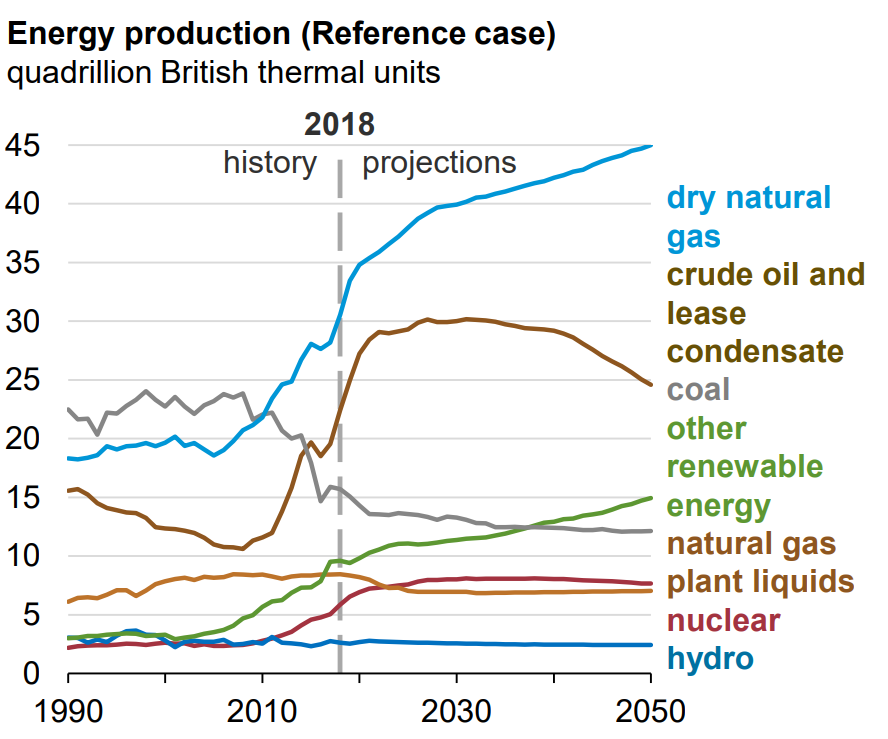

U.S. Energy Information Administration (“EIA”) data shows that fossil fuel demand (Exhibit 1) will continue to dominate American energy consumption for the next 30 years. Exhibit 1 also shows that demand for renewable energy should consume most renewable energy production (Exhibit 2) over the same period. What this means is that despite the laudable efforts of activists, governments, and the petroleum industry itself to wean the U.S. away from fossil fuels, the country is decades away from fully transitioning to renewable energy.

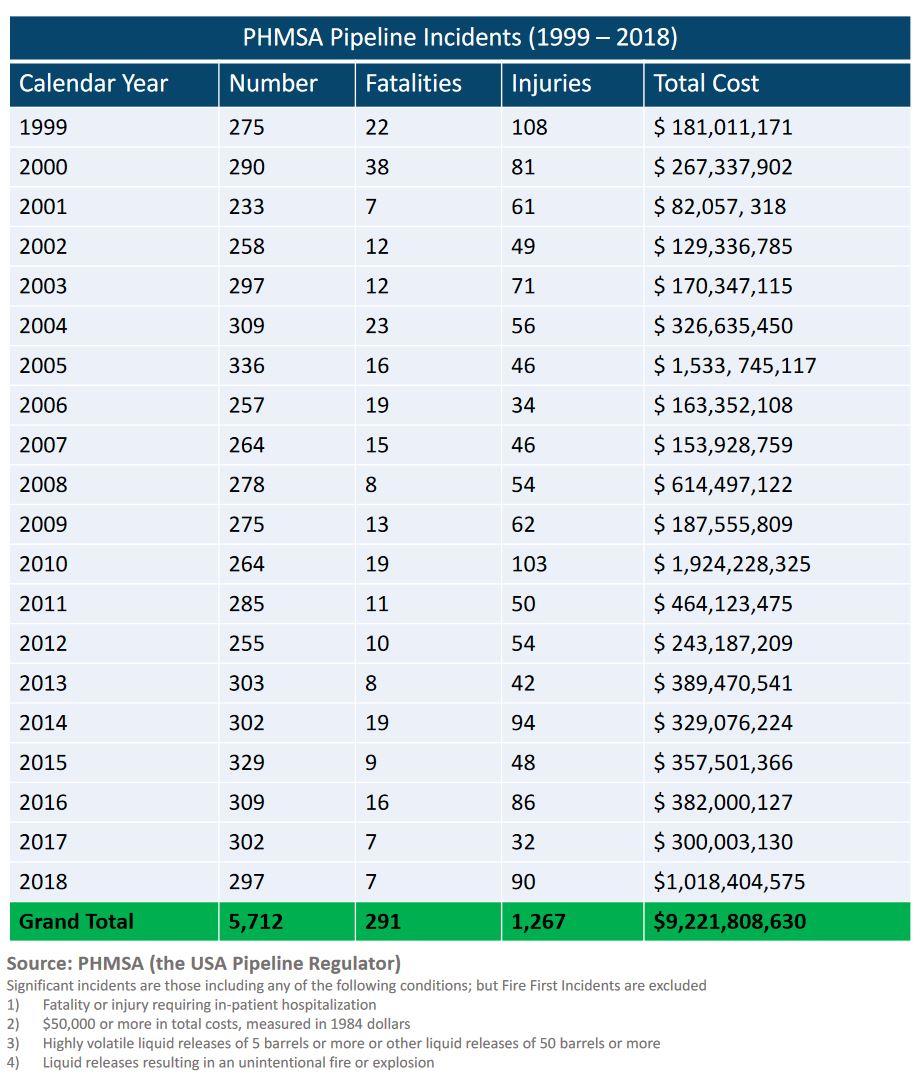

If we accept that the United States is decades away from transitioning to renewable energy, then reliance on American fossil fuel pipelines will continue. Transporting fossil fuels by train is an option; but the runaway train carrying oil that derailed and exploded in Lac-Mégantic, Quebec unfortunately demonstrates the lethal consequences that can happen with trains. And if this is the case, it’s incumbent upon the regulators, industry and consumers to ensure that that pipeline infrastructure is safe and sound. Unfortunately, this has not been the case. Exhibit 3 illustrates the number of pipeline incidents, injuries, and fatalities over the past 20 years.

Over the past 20 years, a pipeline “significant incident” has occurred every about 1.25 days in the U.S. The Pipeline and Hazardous Materials Safety Administration (“PHMSA”), America’s pipeline regulator, defines a “significant incident” 1 as:

- Fatality or injury requiring in-patient hospitalization;

- $50,000 or more in total costs, measured in 1984 dollars;

- Highly volatile liquid releases of 5 barrels or more or other liquid releases of 50 barrels or more, or;

- Liquid releases resulting in an unintentional fire or explosion.

Over the past 20 years, there have been about on average 63 injuries and 14 fatalities annually across America’s pipelines (Exhibit 3). The average repair costs over the 20-year history is $1.6 million, and the average cost in 2018 was $3.4 million. Consequently, pipeline operators have limited social license to build new infrastructure. And given that incumbent pipeline analysis technology (mostly Microsoft Excel macros) has not retarded significant incidents across America’s aging pipeline infrastructure (Exhibit 4), social license will likely continue to deteriorate, especially since the volume of data in these spreadsheets lends to the ability to only analyzing about 5% of it. Compounding this pressure is that PHMSA has strengthened regulatory compliance, with additional new regulations scheduled to take effect on July 1, 2020.

New PHMSA Regulations Add Pressure to Pipeline Operators

To address energy pipeline safety in the United States, PHMSA issued three pipeline safety rules on October 1, 2019. Key points that we uncovered in the rules include PHMSA:

- Can now issue emergency orders to address unsafe conditions or practices without a court order;

- Has limited the circumstances where a pipeline can be constructed without being able to accommodate a smart PIG;

- Is adding wall thickness and seam type to manufacturing information for operator records requirements;

- Extended record keeping to offshore gathering and Type A gathering pipelines;

- Extended operator reporting requirements to liquid gravity and rural gathering lines;

- Will require onshore hazardous liquid pipeline segments outside of high-consequence areas to be capable of accommodating in-line inspection tools;

- Operators will have to inspect affected pipelines following an extreme weather event or natural disaster, and;

- Has mandated (subject to limited exceptions) that all pipelines in or affecting high-consequence areas be capable of accommodating in-line inspection tools within 20 years.

Surprising to many, American pipeline industry associations (American Petroleum Institute, Interstate Natural Gas Association of America, American Gas Association) welcomed the new regulations. We’ve attended the Pipeline Pigging & Integrity Management Conference (“PPIM”) for the last several years, which is the industry’s largest trade show, and we’ll be there again on February 17-20, 2020. From our past PPIM attendance, America’s pipeline industry understands the gravity of pipeline and environmental safety. No one wants to see a colleague killed or injured. No one wants to see environmental damage caused by a pipeline leak. And no one enjoys being the whipping post for activists, consumers, and regulators. Regardless of what industry narrative you subscribe to, the industry does care about health and safety and the environment.

Coming Up: ESG Investment for the Petroleum and Gas Pipeline Industry

Our next report will unveil our ESG investment within the fossil fuel pipeline industry. Fossil fuel consumption will continue to be America’s main energy source at least through 2050. We’ll detail how a Sophic Capital client can minimize and even perhaps eliminate pipeline incidents, keeping the environment and industry workers safe.