We’ve all seen online advertisements that match our interests. Many of us have pieced together that websites and apps collect our personal info, determine our interests, and somehow advertise to our interests whenever we’re online. What many people don’t know is that there are companies beyond Facebook and Google collecting our personal data and selling our digital profile to the highest bidders. You get paid nothing.

In Part I of Give it Away – The Million You Never Made, we detailed how governments have implemented or are about to enact legislation protecting personal data. In this report, we discuss how your data is collected and monetized and how the businesses facilitating this trade are at risk.

Mining and Selling Your Personal Data

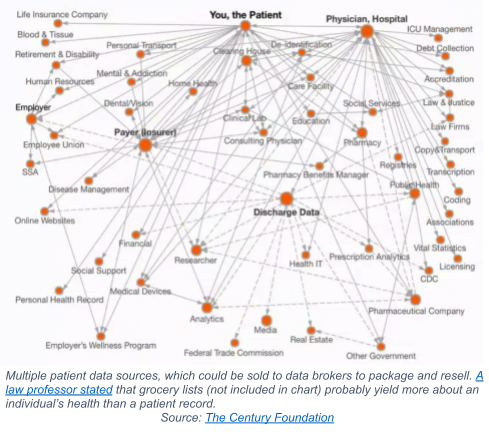

Most people understand that brands pay to place advertisements on websites frequented by their targeted markets. Brands also collect personal data for marketing their products. For example, CVS allows its pharmacy customers to earn up to $50 on prescription refills in exchange for waiving some rights to health care privacy. Grocery store chains, banks and even charities are using and/or selling personal data. What many people may not know is that many brands sell the data they collect to data aggregators known as “data brokers”.

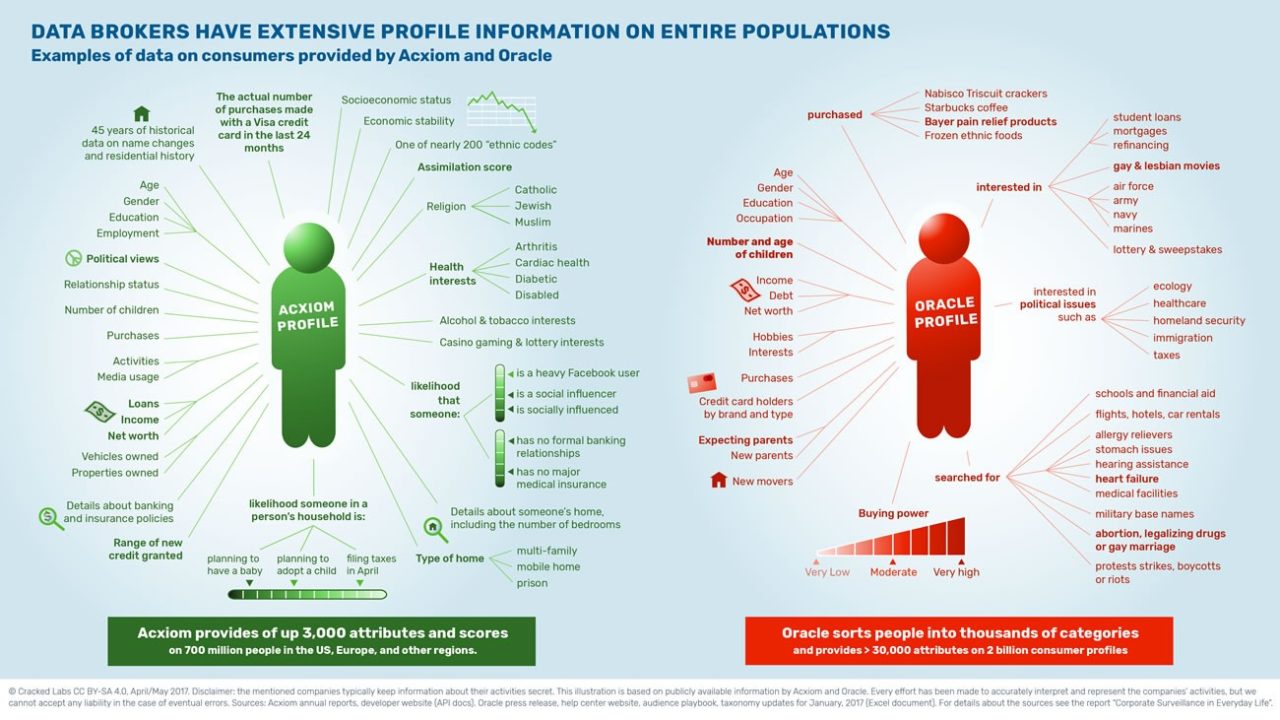

Data brokers track and collect personal information from multiple sources to resell. They collect your data from your online habits, location, surveys, loyalty programs, and even your public records. They then use this data to create profiles and sell lists of profiles that match the targeted markets of brands, so that brands know who to send advertisements. All of this is legal. And it’s a big business, currently worth $76 billion growing to an estimated $200 billion by 2022.

A Vermont law requiring data brokers to register with the State unveiled at least 121 industry players. Privately held Acxiom is one of the largest data brokers, and collects data from over 200 third-party sources that supply personal information.

Your Data’s Worth to Digital Advertisers

Our lives constantly change. Today, we’ll buy a new gadget online; tomorrow, we’ll search for a local plumber because a pipe burst at our rental home. This changes our value to data aggregators because our changing lives introduce new data that appeals to new brands. More brand appeal means more money for both the data aggregators and the websites getting paid by brands to advertise to us.

Data Makes Possible, by Western Digital, estimated the worth of personal data to brands by dividing the total U.S. digital advertising spend by the number of Americans accessing the Internet. The 2018 estimate was $341.08 per American. How much are you getting? We’d bet nothing.

Trouble Ahead for Data Brokers

We believe that a major disruption is about to occur in the advertising industry. Your data is the raw marketing material for all companies and suppliers to thrive. Consumer privacy protection laws like the California Consumer Privacy Act allow consumers to opt out of the collection and monetization of their personal data. We believe that the firms collecting and selling data will bear the onus to manage consumer opt-outs. They are the ones who will likely see revenues affected by data privacy laws.

What we find interesting is that data privacy laws have helped consumers to understand that their personal information has monetary value. They’re also increasingly realizing that they aren’t getting paid for their personal info. Consumers may start to ask how they can control and monetize their personal info. In Part III of Give it Away – The Million You Never Made, we’ll share how Freckle (TSXV-FRKL), a Sophic Capital client, has an app called Killi that allows consumers to control and monetize their personal data. We know of no other public vehicle for investors to participate in the consumer privacy rights disruption.