Governments Aren’t the Only Ones Cracking Down on Greenhouse Gas Emitters

Whether or not you believe in the theory of anthropological climate change, you cannot deny that Environmental, Social and Governance (“ESG”) investing is a real trend. Greenhouse gas emission regulations are in the crosshairs of institutional investors. Recently, the CEO of Blackrock, (NYSE:BLK), the world’s largest asset manager, announced a shift to investing in companies that require less fossil fuels. Vanguard, one of the world’s largest investment companies, launched funds that include ESG factors as part of their decision process. Fidelity too has a family of ESG funds tied to areas of sustainability. Amazon (NASDAQ:AMZN) also announced its $2 billion Climate Pledge Fund to support the development of sustainable and decarbonizing technologies and services.

For years, enterprises and governments have committed to reducing their greenhouse gas emissions. For example, IBM (NYSE:IBM) has tracked its energy use since 1973 and its greenhouse gas emissions since the late 1990s. In 2015, President Obama implemented measures to reduce the U.S. federal government’s carbon footprint across it’s supply chain. And Microsoft (NASDAQ:MSFT) said it will be carbon negative by 2030. Governments across the globe passed regulations to hold enterprises and citizens accountable. But increasingly, regulatory focus has turned towards commercial building greenhouse gas emissions.

There is more, however, to ESG investing than satisfying activists and safeguarding the environment. According to McKinsey & Company, companies with an ESG focus outperform peers on the top line, have lower costs, productivity enhancements, minimal regulatory interventions, and increased asset optimization on capex investments. This could be why global sustainable investment topped $30 trillion in 2019, a 68% increase since 2014 and tenfold since 2004.

Regulatory Crosshairs Target Commercial Properties

Commercial buildings could account for almost 36% of all U.S. carbon dioxide emissions, and the U.S. Department of Energy estimates that 30% of all energy consumed by commercial buildings is lost. State and municipal governments have reacted by implementing energy efficiency metrics to building codes. New York City, for example, enacted its Climate Mobilization Act, claiming that commercial buildings are responsible for 71% of the entire City’s greenhouse gas emissions. Similarly, Seattle believes that building energy is responsible for 35% of the city’s climate emissions, and Senate Bill 5293 proposes maximizing energy efficiency standards for buildings. In Washington, D.C., the CleanEnergy DC Omnibus Amendment Act of 2018 has also set emissions standards.

One reason that commercial property managers have lacked insight into electrical energy waste and related financial losses across their portfolios is that technology for real time monitoring of these factors did not exist. Commercial property managers have typically been reactive to energy waste rather than proactive. For example, historically, they couldn’t measure the power quality issues that might cause a 4-year old elevator motor to run hot. The issue would usually be uncovered in the motor post-mortem after it burnt out, increasing both maintenance costs and tenant inconvenience. This is just one example of fluctuating power quality that impacts the uptime and lifetime of sensitive systems and equipment in modern buildings. Commercial property managers need a way to measure their energy efficiency to comply with commercial building regulations, in light of government scrutiny and the expectation that fossil fuels will provide the majority of U.S. electricity generation through 2050.

Power Generation is a Major Contributor to a Commercial Building’s Greenhouse Gas Emissions

Buildings on an electrical grid receive inconsistent power from their electrical utilities, and renewable energy sources further exacerbate this variability due to their inconsistent production and availability. Voltage higher or lower than electrical equipment specifications negatively impacts the lifespan or availability of that equipment, creating unnecessary power consumption and the potential for ‘brown-outs’. This results in higher monthly utility bills, premature equipment failure (and higher capital equipment replacement/maintenance costs), a larger than necessary environmental footprint for the affected building, unpredictable power availability and potential tenant/occupant issues.

Legend Power (TSXV:LPS) – Insight into Commercial Building Energy Loss

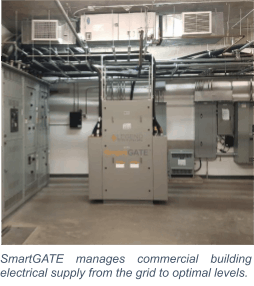

Legend Power® Systems, a Sophic Capital client, has an energy management platform that manages power for better financial performance. The Company’s SmartGATE family of solutions allow firms to assess their buildings for broad-based risk and financial losses resulting from the incoming power supply and to mitigate those risks and losses.

SmartGATE Insights™ Enables Commercial Real Estate Owners to be Proactive NOT Reactive

SmartGATE Insights™ provides commercial real estate owners and operators (“CRE”) with detailed power quality analytics across their properties so that they can identify areas of risk and loss in their portfolio. CREs are dependant upon building systems like lighting, HVAC, elevators, life and safety systems, air filtration, and more to create the experience occupants of their buildings pay for. Too often, CREs are unaware of the full impact of the electricity coming in from the grid on these mission-critical systems. The electricity they depend on can be harming these critical systems and causing malfunctions, increasing repair / operating costs, and ultimately reducing the lifetime of these major systems.

In some cases, system life expectancy can be reduced by 20% to 40% (sometimes more). The SmartGATE Insight analysis finds these financial risks and losses. The SmartGATE platform allows CREs to minimize the root cause within the electricity and reverse the impact. Reducing GHG and environmental impact while increasing the financial performance of the firm is what ESG firms strive to achieve.

Customer Validation – A Fortune 100 Tech Company Can’t be Wrong

Ontario’s education sector has long championed Legend Power’s solutions. Sustainability leader IKEA has also installed SmartGATE units in all 14 stores coast to coast across Canada. Last year, Legend Power Systems entered the Northeastern U.S. market, targeting New York City for its first U.S. sales. A major Fortune 100 technology company purchased a SmartGATE unit for its New York City property and had a follow-on order for three more units (about 75% of SmartGATE customers have made multiple orders).

Customer Validation – 300 Total SmartGATE Installs to Date Can’t be Wrong

Including the aforementioned Fortune 100 technology customer, Legend Power has 304 SmartGATE systems installed. In addition, a North American multi-family REIT with a $2 billion commercial real estate portfolio is installing SmartGATE Insights at a Boston property to evaluate the business impact of electrical issues. Also on Legend Power’s second quarter of fiscal 2020 conference call, management indicated current customer conversations represent over $100 million of potential lifetime customer spend. However, potential partnerships that management is working on could see these numbers scale rapidly.

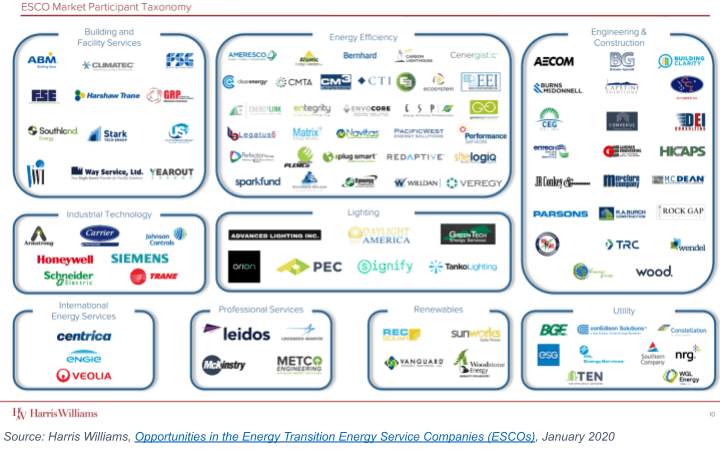

ESCO Partnerships – Potential Company Makers

Energy Service Companies (“ESCO”) are companies that specialize in bundling energy conservation measures for government organizations and schools. They typically audit the energy consumed by a property, design energy efficient solutions, then install and maintain the installed systems. Governments, schools, universities, and healthcare providers are not in the business of designing energy efficient systems and rely upon ESCOs instead. ESCOs are paid by energy savings they generate, so they need solutions that work. Qualifying as an ESCO supplier is a lengthy process, but once approved, suppliers gain a competitive moat and extensive revenue visibility since ESCO contracts are typically 10 to 30 years long.

U.S.-based ESCOs could have over a US$100 billion (C$135 billion) market opportunity ahead. Research from 2017 cited in this February 2020 Lawrence Berkley National Laboratory document assessed the remaining potential of the U.S. ESCO industry from ESCO executive estimates of current market penetration. Based upon a scenario where business and policy conditions don’t change, the authors estimated a USD$92 billion to US$201 billion market opportunity for the U.S. ESCO industry.

Referring again to Legend Power’s second quarter of fiscal 2020 conference call, in the coming months management expects to place a number of systems with some of North America’s largest ESCOs. These ESCOs will act as Legend resellers. Legend Power can add significant additional savings to an average ESCO project, giving the ESCO a competitive advantage. This, in turn, would generate predictable, stable, long-term revenue streams for both Legend Power and the ESCO. Legend’s management stated on the call that late-stage deals are moving forward, despite the pandemic, and contracts should be forthcoming within the next two to three months.

Potential ESCOs Legend could be in discussions with are well established brands. While these ESCOs have not been named, as the Harris Williams chart below shows several companies with well-established brands are seeking to capture some of the US$92 billion ESCO industry.

A US$60 Billion U.S. Market Opportunity without Direct Competitors

Using the U.S. Department of Energy estimate that 30% of all energy consumed by commercial buildings is lost and the ENERGY STAR estimate that U.S. buildings consume US$200 billion of energy annually, we arrive at a US$60 billion U.S. market opportunity to save energy. We’re not suggesting that Legend Power (or any other company) will scoop the entire market opportunity. That said, the U.S. opportunity is large, with plenty of runway for growth in just this one geographical market.

Legend Power has no direct competitors. Indirect competitors would be firms providing solar paneling for buildings, efficient LED lighting, and window upgrades. Penetrating the Northeastern U.S. market has refined Legend’s sales strategy and widened the Company’s competitive moat. As of May 28, 2020, Legend Power had C$3.3 million of cash and cash equivalents (up C$700,000 from March 31), working capital was about C$4.7 million, C$1 million of inventory (should convert into about C$2 million in cash, based on historical margins), giving the Company enough runway to execute the business plan. Assuming inventory has been sold, cash increases to about C$6 million. And assuming no sales, the operating cash burn rate is about C$400,000 per month with approximately C$100,000 of that dedicated to next-generation technologies.

Investors looking to participate on the growing ESG investment trend may want to look at the commercial building sector; specifically, Legend Power Systems (TSXV:LPS) and how it allows property owners, for the first time ever, to quantify in real-time the energy loss and GHG emissions across their portfolios.

Disclosures

Legend Power Systems has contracted Sophic Capital for capital markets advisory and investor relations services.

Disclaimer

The information and recommendations made available through our emails, newsletters, website and press releases (collectively referred to as the “Material”) by Sophic Capital Inc. (“Sophic” or “Company”) is for informational purposes only and shall not be used or construed as an offer to sell or be used as a solicitation of an offer to buy any services or securities. In accessing or consuming the Materials, you hereby acknowledge that any reliance upon any Materials shall be at your sole risk. In particular, none of the information provided in our monthly newsletter and emails or any other Material should be viewed as an invite, and/or induce or encourage any person to make any kind of investment decision. The recommendations and information provided in our Material are not tailored to the needs of particular persons and may not be appropriate for you depending on your financial position or investment goals or needs. You should apply your own judgment in making any use of the information provided in the Company’s Material, especially as the basis for any investment decisions. Securities or other investments referred to in the Materials may not be suitable for you and you should not make any kind of investment decision in relation to them without first obtaining independent investment advice from a qualified and registered investment advisor. You further agree that neither Sophic, its, directors, officers, shareholders, employees, affiliates consultants, and/or clients will be liable for any losses or liabilities that may be occasioned as a result of the information provided in any of the Material. By accessing Sophic’s website and signing up to receive the Company’s monthly newsletter or any other Material, you accept and agree to be bound by and comply with the terms and conditions set out herein. If you do not accept and agree to the terms, you should not use the Company’s website or accept the terms and conditions associated to the newsletter signup. Sophic is not registered as an adviser or dealer under the securities legislation of any jurisdiction of Canada or elsewhere and provides Material on behalf of its clients pursuant to an exemption from the registration requirements that is available in respect of generic advice. In no event will Sophic be responsible or liable to you or any other party for any damages of any kind arising out of or relating to the use of, misuse of and/or inability to use the Company’s website or Material. The information is directed only at persons resident in Canada. The Company’s Material or the information provided in the Material shall not in any form constitute as an offer or solicitation to anyone in the United States of America or any jurisdiction where such offer or solicitation is not authorized or to any person to whom it is unlawful to make such a solicitation. If you choose to access Sophic’s website and/or have signed up to receive the Company’s monthly newsletter or any other Material, you acknowledge that the information in the Material is intended for use by persons resident in Canada only. Sophic is not an investment advisor nor does it maintain any registrations as such, and Material provided by Sophic shall not be used to make investment decisions. Information provided in the Company’s Material is often opinionated and should be considered for information purposes only. No stock exchange or securities regulatory authority anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. Sophic and/or its principals and employees may have positions in the stocks mentioned in the Company’s Material and may trade in the stocks mentioned in the Material. Do not consider buying or selling any stock without conducting your own due diligence and/or without obtaining independent investment advice from a qualified and registered investment advisor. The Company has not independently verified any of the data from third party sources referred to in the Material, including information provided by Sophic clients that are the subject of the report, or ascertained the underlying assumptions relied upon by such sources. The Company does not assume any responsibility for the accuracy or completeness of this information or for any failure by any such other persons to disclose events which may have occurred or may affect the significance or accuracy of any such information. The Material may contain forward looking information. Forward-looking statements are frequently, but not always, identified by words such as “expects,” “anticipates,” “believes,” “intends,” “estimates,” “potential,” “possible,” “projects,” “plans,” and similar expressions, or statements that events, conditions or results “will,” “may,” “could,” or “should” occur or be achieved or their negatives or other comparable words and include, without limitation, statements regarding, projected revenue, income or earnings or other results of operations, strategy, plans, objectives, goals and targets, plans to increase market share or with respect to anticipated performance compared to competitors, product development and adoption by potential customers. These statements relate to future events and future performance. Forward-looking statements are based on opinions and assumptions as of the date made, and are subject to a variety of risks and other factors that could cause actual events/results to differ materially from these forward looking statements. There can be no assurance that such expectations will prove to be correct; these statements are no guarantee of future performance and involve known and unknown risks, uncertainties and other factors. Sophic provides no assurance as to future results, performance, or achievements and no representations are made that actual results achieved will be as indicated in the forward looking information. Nothing herein can be assumed or predicted, and you are strongly encouraged to learn more and seek independent advice before relying on any information presented.