In our Luckbox (private) – Meet the CEO report, Luckbox CEO Quentin Martin provided insights into esports and esports betting that included:

- Esports audiences have surpassed those of NFL and MLB;

- The 2020 pandemic created a rapid shift from betting on traditional sports to esports, and;

- In 2020, esports betting could be a market worth between US$12 billion to US$15 billion.

We had the opportunity to continue our discussion with Quentin, focusing on how Luckbox, which is about to go public on the TSX Venture exchange under the symbol LUCK is positioned to capture a large share of the multi-billion dollar esports betting market.

Q: Quentin, congratulations on Luckbox’s pending public markets debut.

A: Thank you. It was a lot of work, but we had great partners to guide us through the process.

Q: And we know you’ve been spending a lot of time with investors lately, so thank you for making time to tell us about Luckbox and your plans to grow the company by competing in the lucrative and growing esports betting market.

A: You’re welcome. It’s my pleasure to be here. I’m excited to talk about Luckbox and more.

Q: In our last conversation, you told us that the betting industry underwent a massive shift from traditional sports to esports due to the coronavirus pandemic. Did Luckbox benefit from this industry transition?

A: Let’s take a bit of a step back to the esports business before we talk about COVID impacts on esports betting. Even prior to the pandemic, the number and size of esports tournaments was rising meaningfully over the past few years. This secular change was already capturing the attention of major advertisers. For example, major international brands such as Coca-Cola, DHL, and Mercedes-Benz were seeking exposure at esports events, which a few years ago was minimal. As a result, the consumer experience in esports events had started to mimic traditional sports events, leading to increased interest in esports betting. In this context, at the onset of the pandemic, traditional sports leagues halted games whereas esports competitions suffered minimal disruptions. Without traditional sporting events and competitions, the betting industry faced a massive contraction of business. However, nimble firms quickly added esports to rebuild their businesses, and bettors followed suit because there was nothing else to wager upon at the time. So, we, at Luckbox, absolutely benefited from this transition since we are an esports betting platform.

Q: Can you quantify how much Luckbox benefitted from the transition from betting on traditional sports to esports.

A: At the start of the pandemic, Luckbox saw our registrations increase with the suspensions of traditional sports leagues. For example, when the English Premier League suspended the season, Luckbox saw a 54% increase in new registrants. Our turnover rose almost 13 times from what we measured in November 2019, and our customer deposits increased 10 times. As well as an increase in registrations, the average bet sizes placed on Luckbox almost doubled from February to present.

Q: Who is Luckbox’s typical customer?

A: Right now, Luckbox’s customers are predominantly aged 18 to 40 years, 70 to 75% male, have above average earnings, and are highly tech literate. When we compare the general esports industry demographic to sports bettors, esports bettors tend to be 5 to 10 years younger and are more likely to be male. This divergence is more pronounced for more engaged esports fans, as they tend to skew younger. Casual esports bettors are less divergent from the traditional sports bettor, and this segment is growing at a faster rate.

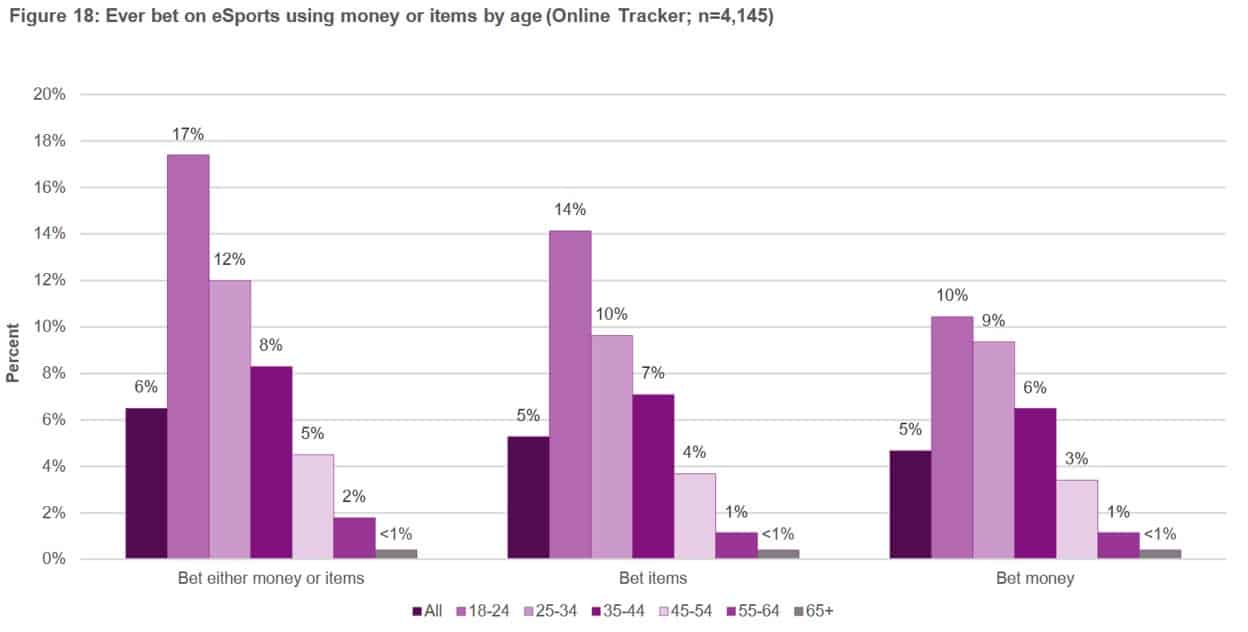

2019 U.K. esports bettors by age

Source: U.K. Gambling Commission

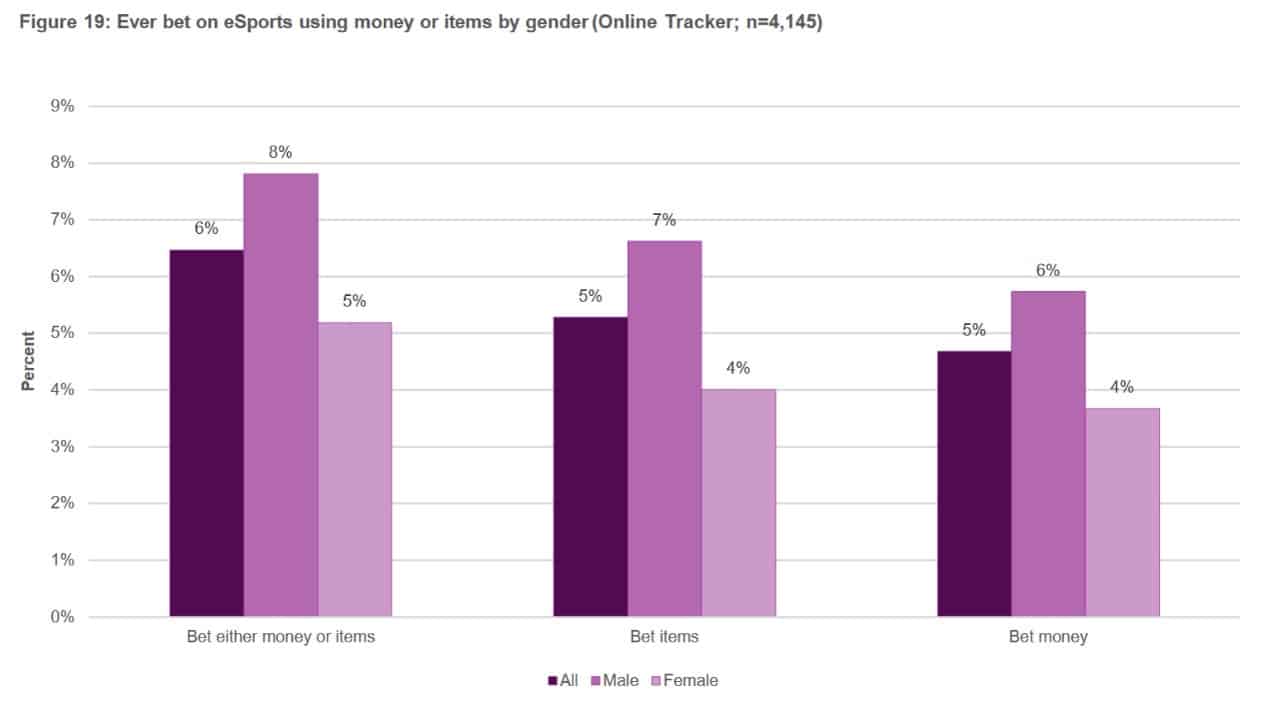

2019 U.K. esports bettors by gender

Source: U.K. Gambling Commission

Q: ‘Right now’? Are you anticipating a demographic shift in your customer base?

A: I’m glad that you ask that because this is a key point that will help Luckbox to scale. Today’s engaged esports viewers are tomorrow’s bettors. This demographic tailwind sets up both Luckbox and the esports betting industry very well for the future. For example, the average age of a Luckbox bettor is 32 years. A bettor in the traditional gaming industry is 18- to 80-years old, 80% male, and the average bettor age ranges from 55 to 60 years. Traditional bettors, who largely focus on traditional sports are aging, and their numbers will decline over time. Every year, more Gen-Z (those born in the late 1990s and through the first decade of the 2000s) reach adulthood. This is the generation that has grown up constantly connected to broadband Internet and are therefore more at ease with native online experiences. This naturally lends to gaming and esports, more than any other group. So, we expect the number of Luckbox bettors will continue to grow. We’ll likely see the average age of a bettor on our platform increase over time, and we’ll likely see their bets grow larger as salaries typically increase with age.

Q: Who are Luckbox’s main competitors?

A: I’ll start by saying that there are 4 types of competitors. The first type are black-market competitors. These are unlicensed, illegal operators that offer no consumer protection or monitor cash movements to see if money laundering is occurring on their platform. No one in the betting industry – whether its esports or traditional sports – approves of black-market operators.

Q: Who is the second type of competitor?

A: The second type of competitor have a traditional sports betting background, also known as “non-endemic” providers. These were the firms that added esports when the leagues halted competitions, and some were perhaps expanding into esports from adjacent markets. We’re not too concerned with these firms because they typically cater to the older bettors, which overlaps with their existing user base, who may perhaps not be as interested in esports betting. Nor may they be as tech savvy as Gen-Z esports bettors. As a consequence, these operators’ esports marketing strategies and customer acquisition channels face a bit of an uphill climb. This is because typical esports players and the community is somewhat skeptical of traditional marketing and branding. As a result, these providers may be hampered by having neither the understanding nor the skill to penetrate the esports community.

Q: Don’t the large, non-endemic betting firms have the resources and marketing dollars to figure it out?

A: Theoretically, ‘yes’. But it’s not as easy as sponsoring an esports competition to display your logo. Esports attracts a younger crowd, and as I suggested, this audience is suspicious of brands and prioritize trust as the foundation in their corporate relationships. Showing up at an esports event isn’t enough for a brand – you have to build that trust or else you won’t succeed at any aspect of esports – sponsoring, competing, betting. Trust and community are paramount, and betting platforms need these to not only attract customers but also access the data feeds from esports competition organizers. Without that data, providers cannot build an esports betting business. From what we’ve seen so far and from what we’ve heard from industry peers, the resources of the large non-endemic leaders are better suited to trying to grow the markets they know best, which is not esports.

Q: With everything you’ve said about the potential growth of esports betting market, I can’t envision the big non-endemic betting firms will bypass the opportunity?

A: You’re right. They are trying to compete now, but many are struggling. It’s tough and time consuming for even the biggest, well-capitalized firms to build trust and community. This is especially true for new entrants trying to penetrate esports betting. Brands, including ours, have built that trust and as long as we continue to do the right thing and provide the right services, our target audience will remain sticky, at least from a general betting industry perspective. I think the best way for the large, non-endemic firms to penetrate esports betting is to buy a brand that already has the esports community’s approval and trust or perhaps enter some sort of strategic partnership with existing esports providers, in order to eliminate any risk.

Q: So, the larger historical betting firms could perhaps acquire esports betting companies like Luckbox. What is the third type of competitor that Luckbox encounters?

A: The third type of competitors are the firms doing what Luckbox does. Pure esports betting firms are known in the industry as “endemic”. I would further distinguish endemic firms as those with strong betting licenses from those with weak betting licenses.

Q: I assume Luckbox has a ‘strong’ license? What’s the difference between a ‘strong’ and ‘weak’ license?

A: We are licensed by the Isle of Man Gambling Supervision Commission, which is one of the most respected gaming commission in the world. Isle of Man is highly stringent when it comes to anti-money laundering, consumer protection, and supporting licensed companies. With an Isle of Man license, Luckbox subjects itself to mandatory annual audits as well as police background checks. The funds we receive and pay out are held in segregated accounts to protect our customers in case we became illiquid. It requires the implementation of steps to keep underage people off betting platforms. The Isle of Man authorities insist upon these requirements largely to protect consumers, investors, and communities from illegal activities. Weaker licenses, although legitimate, do not provide protection as rigorous as Isle of Man or Malta, another highly respected jurisdiction. Weaker licenses may also limit operators from entering specific regions.

Q: I want to circle back to Luckbox’s competitors, but before I do, does Luckbox’s Isle of Man gambling license restrict the Company from operating in certain countries?

A: We can accept, but not necessarily market to, customers in territories such as Latin America, half of Europe, Asia, and Africa. We can probably reach into about one third of the world and are live in about 80 territories today.

Q: Thank you, Quentin. I now want to rephrase my prior question about your competitors – who are Luckbox’s endemic competitors that possess strong licenses?

A: That is the correct competitive question to ask! There are two competitors whom we think are doing a great job – Rivalry and Unikrn. Both have Isle of Man licenses; both are private at the moment; both are endemic; and all three of us are in similar point in our lifecycle.

Q: What differentiates Luckbox from Rivalry and Unikrn?

A: Rivalry has a strong esports pedigree and has built a good betting experience for their customers. However, in addition to having a strong esports background Luckbox management also has a strong gambling pedigree, and we leveraged our real money gaming expertise and relationships to quickly build a platform and formulate a detailed growth strategy. Unikrn is well funded, and their team has deep technology expertise. Our gaming expertise has allowed us to catch up to Unikrn, even though we started much later and with less capital. Other key Luckbox differentiators would be the breadth of our front end, markets for placing bets, and wide coverage of esports events for our customers to bet on.

Q: Turning to your team, tell us about Ran Kaspi, Luckbox’s new CFO.

A: Ran has over 15 years of experience in corporate finance, business analytics, and financial planning in international listed companies. Prior to joining Luckbox, Ran was the CFO of ASX-listed ParaZero LTD., a drone solutions developer. He brings substantial online gaming experience, having spent more than five years at London Stock Exchange-listed 888.com, where he led the economics and performance team. Ran holds an MBA degree in Finance from the Tel-Aviv University in Israel and a BA in Economics and Management. He is licensed by the Israeli Securities Authority.

Q: And you yourself are no stranger to the online gambling space.

A: I am not, having spent 8 years at PokerStars in various roles, most recently as the General Manager of Social Casino at PokerStars. Luckbox co-founders Lars Lien and Mike Stevens are also PokerStars alumni.

Q:We’ll end it here for now. Please tell us how can investors get more info about Luckbox?

A: Investors can contact Sophic Capital for more information. You can also subscribe to Luckbox’s email newsletter: https://upscri.be/l4q7zg

Q: Thank you, Quentin.

A: Thank you, as well. I look forward to continuing our conversation.

Coming up…

In our final interview with Luckbox CEO Quentin Martin, we focus on the Company’s differentiators, relevant metrics, revenue model and potential catalysts investors should keep an eye for.