Increasing Need to Care for Existing Infrastructure

Back in our February 2020 Fossil Fuels Aren’t Going Away – Not Your Typical ESG Investment report, Sophic Capital made the case (based on EIA energy production/consumption data) that the United States is decades away from transitioning to renewable energy and that reliance on American fossil fuel pipelines will continue. Recent developments in the pipeline industry support our thesis, and why investors should consider investing in OneSoft Solutions (TSXV:OSS, OTC:OSSIF), a Sophic Capital client.

Hydrocarbon Protestors Focused on Blocking New Pipeline Infrastructure

To reduce hydrocarbon dependency, many green energy activists are targeting oil and liquified natural gas (“LNG”) pipelines. This focus shift away from energy producers aims to prevent the expansion of and upgrades to America’s 2.7 million miles of pipeline infrastructure. One reason is that unlike oil and gas deposits, pipelines typically cross state, county, and city boundaries. This translates into more permitting requirements and legal reviews which, in some cases, can lead to a decade or more of project delays.

Perhaps the most famous pipeline delay is the TC Energy (NYSE:TRP, TSX:TRP), Keystone XL expansion, running 1,210 miles from Hardisty, Alberta, to Steele City, Nebraska with a planned capacity of 830,000 barrels of oil per day. Pipeline constuction was delayed for over a decade by opposition from landowners, environmental groups, and indigenous tribes. President Obama twice rejected the pipeline, but President Trump approved its construction. Three states and the Province of Alberta have begun construction. However, on July 6, 2020, the U.S. Supreme Court upheld a lower court ruling that blocked a key permit, which likely delays Keystone XL at least until 2021. The attorney representing one of the environmental groups involved in the case acknowledged that the plaintiffs had hoped to hamper oil and gas projects nationwide. The environmental groups could gain an ally in November; Democratic President candidate Joe Biden said he would rescind Keystone XL permitting.

Hydrocarbon Protestors Focused on Blocking Current Pipeline Infrastructure

Similarly, Enbridge’s (NYSE:ENB, TSX:ENB) Line 3 and 5 pipelines remain mired in legal battles and regulatory pushback. Line 3 currently is a 1,097-mile crude oil pipeline extending from Edmonton, Alberta to Superior, Wisconsin. Enbridge plans to replace Line 3 with 1,031 miles of 36-inch diameter pipeline from Hardisty, Alberta to Superior, Wisconsin. However, Minnesota regulators are delaying the project, pending an extension of a permitting review.

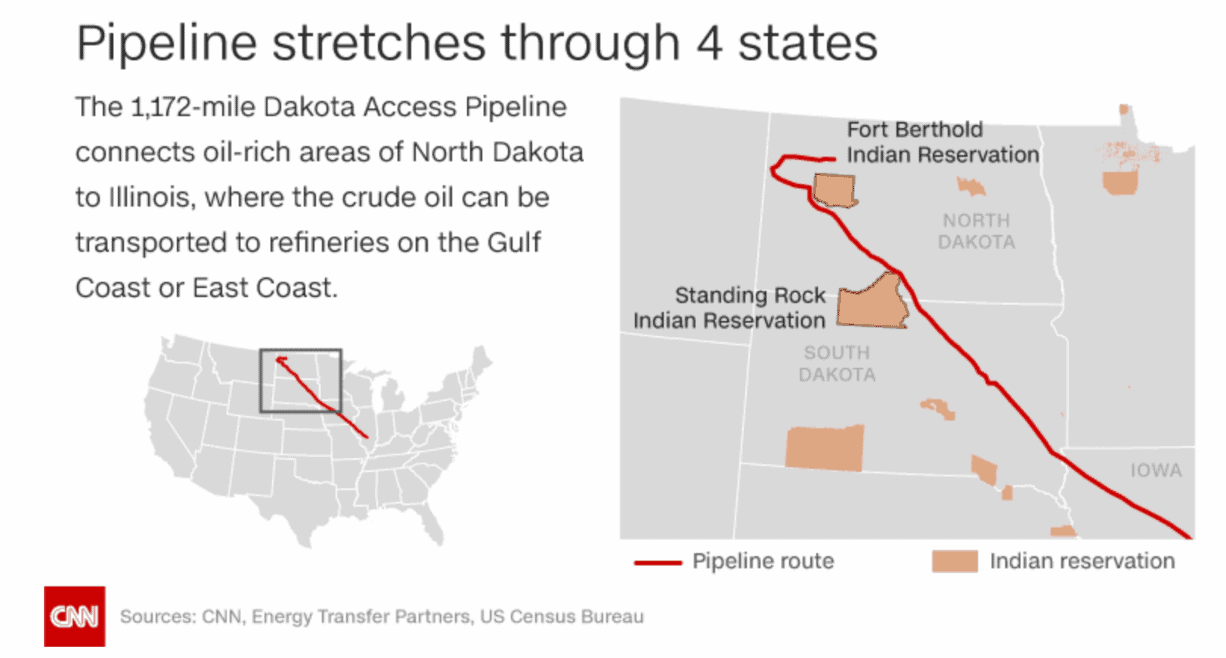

On July 5, 2020, the United States District Court for the District of Columbia ordered that the Dakota Access Pipeline must shut down and be emptied by August 5 in order to complete an environmental impact report. The $3.8 billion, 1,172-mile crude oil transport system was denied permitting by the Obama administration in December 2016, a decision that President Trump reversed during his first week in Office. Construction was completed in June 2017.

Operators Throw in the Towel

On July 5, 2020, Dominion Energy (NYSE:D) and Duke Energy (NYSE:DUK) threw in the towel and canceled their Atlantic Coast Pipeline project. Although the U.S. Supreme Court ruled by a 7-2 margin that the natural gas pipeline could proceed, the companies cited ongoing delays, litigation and an expected increase in costs threatened the economic viability of the project. According to The New York Times, these lawsuits inflated the original project cost of $4.5 to $5 billion in 2014 to almost $8 billion.

The World’s Most Famous Value Investors Go Long on Natural Gas Pipelines

Without a doubt, building or upgrading pipeline infrastructure is difficult because the social license for operators has evaporated. We think this is why Warren Buffett and Charlie Munger invested approximately $9.7 billion of Berkshire Hathaway’s (NYSE:BRK-A) money to acquire Dominion Energy’s gas transmission and storage business. Energy pipelines operate regardless of commodity costs and combined with the environmental backlash against new construction and upgrades, activists have created a competitive moat for America’s current pipeline network.

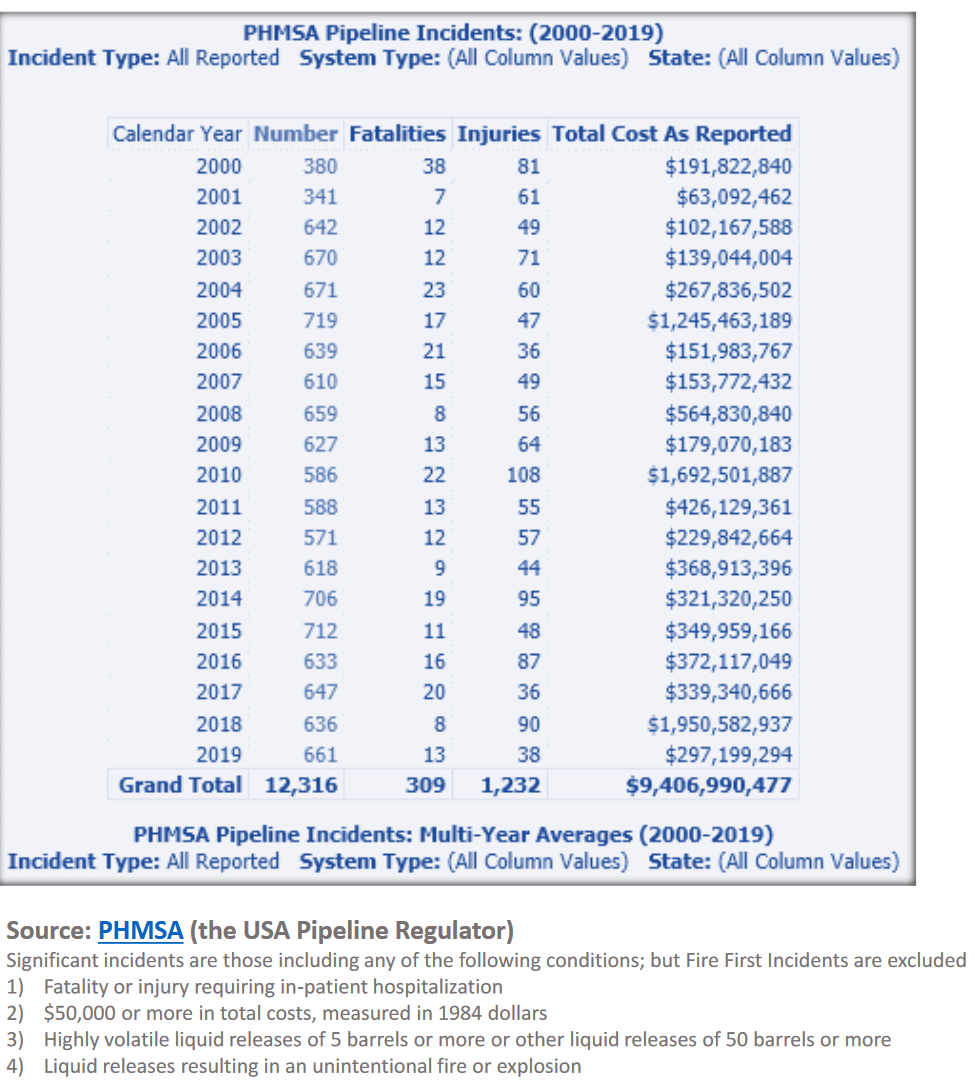

To maintain this competitive moat, pipeline operators will have to ensure that their infrastructure lasts and safeguards the environment. The Pipeline and Hazardous Materials Safety Administration (“PHMSA”), America’s pipeline regulator, mandates that operators must inspect their pipelines every 5 to 7 years (depending upon what the pipeline transports). Current analysis tools (manual inspection of Excel spreadsheet data) are woefully inadequate, as evidenced by the number of annual pipeline incidents really have not improved over the past twenty years (see chart on right). Neither have the numbers of worker injuries and deaths caused by pipeline incidents gotten better; according to PHMSA, 1.8 pipeline incidents occur every day on average in the U.S., and with the industry’s stated goal of “zero pipeline incidents”, better analysis methods are needed.

OneSoft Solutions (TSXV:OSS, OTC:OSSIF), a Sophic Capital client, has a machine learning/predictive analytics SaaS platform that identifies threats to potential pipeline failures before they occur. With Phillips 66 (NYSE:PSX), an energy Super Major, and several other Fortune 500 clients, OneSoft’s machine learning solution is currently keeping about 51,000 miles of America’s pipeline corridors safe. OneSoft’s sales pipeline continues growing, insiders own 34% of issued and outstanding shares, and OneSoft is fully financed and has no debt.

ESG investors may want to consider OneSoft Solutions (click HERE for a software demo). OneSoft has vastly improved its clients’ ability to detect potential pipeline leaks and explosions (the “environmental” in “ESG”), keeping communities safe (the “social” in “ESG”) as well as exceeding regulatory compliance requirements (the “governance” in “ESG”). And if pipelines are here to stay for the next few decades, it’s imperative that all stakeholders – activists, governments, regulators, operators, and investors – adopt OneSoft’s mission: “We predict pipeline failures, save lives and protect the environment … with the assistance of data science and machine learning” in order to maximize safety and protect lives and the environment.