The Wave May Be Just Getting Started

Surging Stock Still Looks Undervalued

Even though the stock of Sophic Capital client Kraken Robotics (PNG:TSXV, KRKNF:OTCQB) has surged over 150% in the past six months, it still appears undervalued when compared to its peers. In this report, we outline that even though Kraken Robotics is out-executing the competition both operationally and financially, the stock still trades below the peer average on an enterprise value to forward Adjusted EBITDA basis. We also compare the Company’s revenue growth and EBITDA margins to those peers, illustrating that Kraken should potentially trade at a premium to the group. We look at where the stock is currently trading and then provide some sensitivity to the valuation if the stock were to trade closer to or above peer valuations. Spoiler alert if Kraken were to trade inline with the defense technology peer group at 18.5x the mid-point of the Company’s 2024 EBITDA guidance of $21 million, the stock would be worth $1.85 per share or 68% upside from the closing price on March 12, 2024, of $1.10.

Geopolitical and environmental tailwinds are driving significant growth in the defense and offshore energy sectors. And the iShares U.S. Aerospace & Defense ETF (ITA:US) reflects this, which can be attributed to current events surrounding Ukraine/Russia, Israel/Palestine, and China/Taiwan. Over the last 6-months, the ETF has risen from US$102 to almost US$130, about a 30% gain (Exhibit 1).

Exhibit 1: iShares U.S. Aerospace & Defense ETF

Source: Sophic Capital, Quotestream

Kraken Robotics is also benefitting from these trends as evidenced by the Company’s recently announced $900 million pipeline. Management’s strong execution on signing significant NATO Navy contracts over the last several years is now leading to an acceleration of opportunities and pipeline that has underpinned the stock’s performance. Macro tailwinds include geopolitical uncertainty and an accelerated shift towards green energy initiatives. This operational and financial execution has led to a shift from a largely retail held stock to one that has attracted several large institutional shareholders over the last six months. And as the market continues to broaden out, we are witnessing increased capital inflows into small-cap and micro-cap stocks; a potential favorable environment for Kraken’s continued re-rating. Exhibit 2 charts the course Kraken Robotics has taken.

Exhibit 2: Kraken Robotics 6-Month Stock Chart from C$0.40 to C$1.10

Source: Sophic Capital, Quotestream

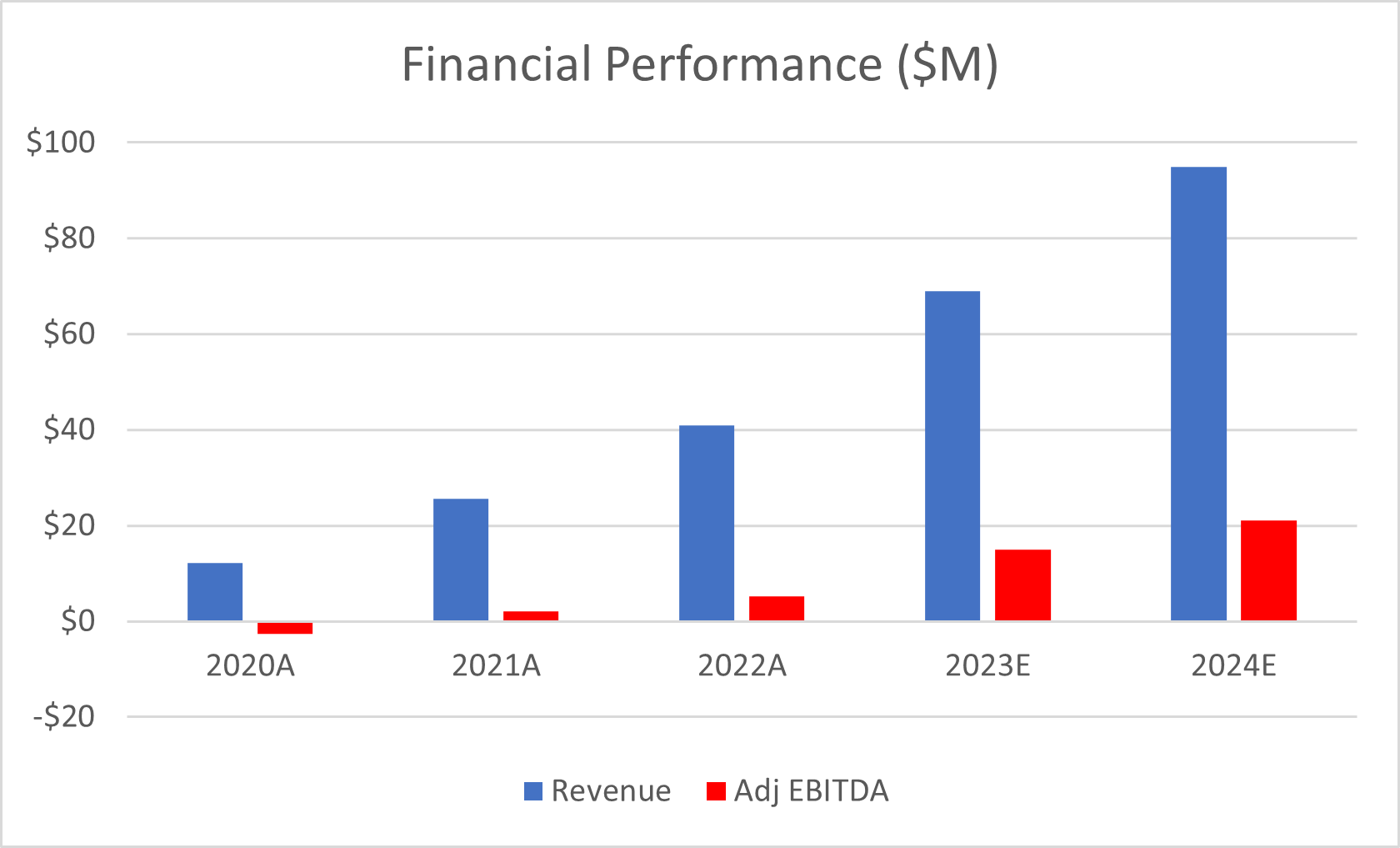

Over the last 4 years, Kraken Robotics has grown its revenue at a 77% CAGR (Exhibit 3). During recent investor meetings and conference presentations, management has conveyed their expectations for sustaining robust growth, targeting approximately 40% annual growth for the foreseeable future.

Presently, Kraken’s revenue composition is an 80/20 split between defense and commercial segments, respectively, which is further bucketed into a 75/25 ratio between products and services, respectively. Within defense programs, the Company typically engages in equipment acquisition programs spanning 2 to 4 years, subsequently followed by maintenance and support contracts encompassing logistical support, repair, and spare activities that can run for up to 7 years with potential renewals.

Exhibit 3: Kraken Robotics Revenue and Adjusted EBITDA Growth Including 2024 Guidance (mid-point)

Note: 2024E is midpoint of management’s recently released financial guidance

Source: Sophic Capital, Company Reports

On February 15, 2024, Kraken Robotics reiterated its guidance for F2023 (ending December 31, 2023). The Company expects to report $69 million in revenue for F2023, demonstrating robust demand across its sonar, batteries, and services segments. Kraken expects to report Adjusted EBITDA for F2023 at the higher end of its guidance range between $12 million to $15 million, with expected Adjusted EBITDA margins improving to 20% or higher. This translates to year-over-year revenue and Adjusted EBITDA growth of more than 60%.

In the same press release, Kraken provided guidance for F2024 (ending December 31, 2024) and are projecting revenue to be in the range of $90 million to $100 million (midpoint $95 million) and Adjusted EBITDA between $18 million to $24 million (midpoint $21 million). Street consensus estimates for 2024 align with the Company’s guidance, with revenue projected at $93 million and Adjusted EBITDA at $22 million. Kraken’s long-term financial targets aim for revenue growth of 40% year-over-year, with Adjusted EBITDA margins consistently in the 20% to 25% range, underscoring its commitment to sustained growth and profitability.

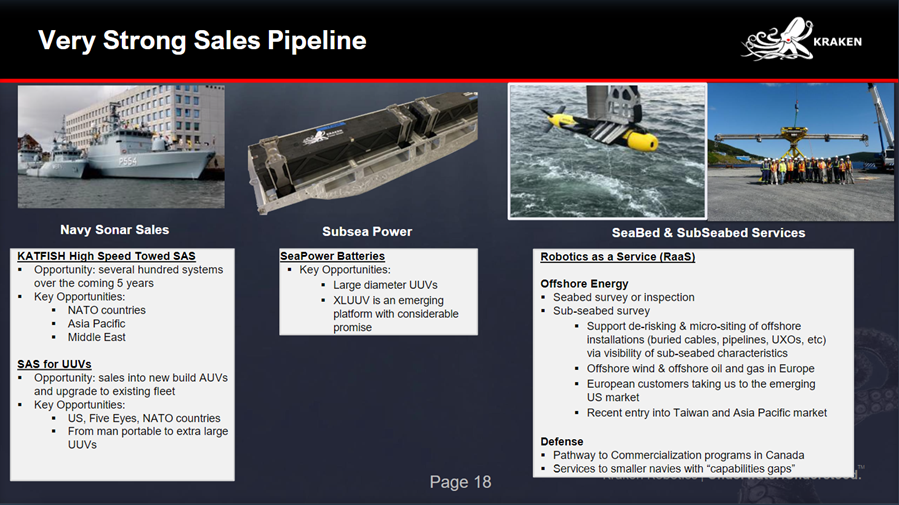

After many years of consistent revenue growth, investors are bound to ask if Kraken’s growth can continue? Management seems to believe so and indicated the current pipeline is now $900 million. The slide below from the Company’s investor deck illustrates the breadth of the pipeline across all business units.

Cresting the Wave

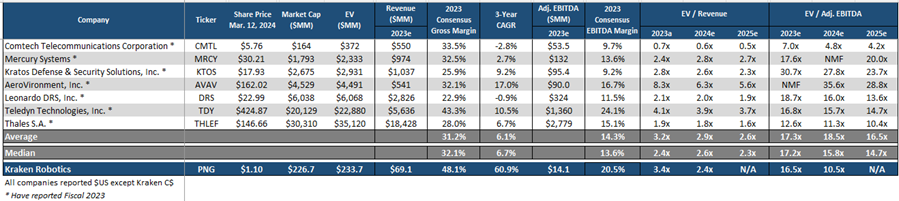

So given Kraken’s growth rate, gross margin of 48% (consensus estimate) and Adjusted EBITDA margins ranging from 20% to 25%, where should the Company’s stock (PNG:TSXV) trade? Kraken Robotics currently trades at 11.1x 2024 EV/Adjusted EBITDA, assuming the mid-point of guidance of $21 million. Exhibit 4 is a comp table that illustrates Defense Technology stocks, which are trading at an average 18.5x 2024 EV/Adjusted EBITDA and 16.5x for 2025. Note that the 2024 consensus EBITDA estimate for Kraken is $22.2 million, implying that it currently trades at a 10.5x multiple (Exhibit 4). If Kraken were to trade inline at 18.5x 2024 EV/Adjusted EBITDA (using $21 million guidance midpoint) this would imply a stock price of ~$1.85 per share or 68% upside from the $1.10 per share the stock closed at on March 12, 2024.

Exhibit 4: Comp Table for Peer Defense Technology Stocks

Source: Sophic Capital, Koyfin

Should Kraken trade in-line or at a premium? If you look at the growth rates, gross margin, and EBITDA margin of the competition in 2023 versus Kraken, Kraken is outperforming the group on all metrics. The average 3-year revenue growth rate for the peers in 2023 was 6.1% (Kraken is expected to be 61%, 10x the average), the average gross margin for the peers was 31% (Kraken is expected to be 48%) and the average EBITDA margin for the peer group is 14% (Kraken is guiding to ~21%). Generally, stocks that have better growth and financial metrics trade at higher multiples – should the Company trade at a premium? We will leave that for you to decide, but right now, Kraken’s stock trades at a discount.

Potential Strategic Value Could Fetch Premium Valuations

An argument could be made that Kraken Robotics deserves a premium valuation given its extensive success at winning defense contracts. Kraken Robotics’ position as a frontrunner in synthetic aperture sonar (SAS) technology and pressure-tolerant batteries, coupled with its success in securing multiple NATO Navy bids in recent years with its towed KATFISH product, illustrates its industry leadership and potential competitive advantage. Kraken’s innovative solutions and track record of winning crucial contracts position it as a prime player in the defense and maritime sectors.

In response to escalating tensions in the Indo-Pacific region, particularly within maritime domains, NATO countries have intensified their focus on investing in significant quantities of attritable Autonomous Underwater Vehicles (AUVs). By leveraging autonomous technologies, NATO nations seek to adapt to evolving security challenges and fortify their military posture. This strategic initiative aims to bolster deterrence capabilities, enhance power projection, and achieve cost-effective scalability.

Typically, Kraken operates as a sub-contractor on large NATO deals, which represent substantial contracts for major defense companies. While these contracts are significant in scale, they often involve collaboration with multiple subcontractors, including Kraken, to fulfill various aspects of the project. Despite being a sub-contractor, Kraken’s involvement in these deals can still be substantial, particularly in providing specialized technologies such as sonar and battery systems.

The surge in demand for Unmanned Underwater Vehicles (UUVs) is evident, with Kraken Robotics experiencing heightened interest in its offerings, including both sonar and batteries for AUVs, along with minehunting solutions using the KATFISH towed SAS. The emergence of Extra Large UUVs (XLUUVs) has also sparked the need for higher energy density and significantly more batteries within the UUV sector, benefiting Kraken’s pressure tolerant subsea battery business.

Moreover, numerous countries and navies worldwide are in the process of modernizing their subsea surveillance capabilities, opting for advanced solutions such as towed sonar or AUVs deployed from crewed or Unmanned Surface Vessels (USVs). Kraken’s extensive technology portfolio and comprehensive product and service offerings position the Company favorably to capitalize on this burgeoning demand, ensuring its readiness to ride the wave of increasing market interest in underwater solutions.

Kraken’s Valuation Versus Multiple-Platform Defense Contractors

Kraken Robotics supplies sensors and batteries to several large defense contractors. Kraken’s sensors are plug and play, ranging from $300 thousand to $600 thousand per UUV. Kraken’s pressure tolerant, deep sea batteries provide best-in-class energy density and range from ~$1 million – $1.5 million in a normal UUV and from $5 million to $10 million in XLUUVs. In some cases, Kraken provides products to competing contractors, making the Company’s business priority on a first-come-first serve basis. This approach not only strengthens Kraken’s relationships with key industry players but also enhances its overall market positioning. This could create a strategic asset for large defense companies, with the potential to have in-house sonar and battery technology, securing supply, while shutting out competition and helping to gain market share.

In such a scenario, where Kraken becomes a preferred supplier to major defense companies, the Company’s value proposition is significantly elevated. The exclusivity and strategic importance of Kraken’s technology solutions could warrant a premium valuation, reflecting the Company’s pivotal role in supporting the growth and competitiveness of its partners in the defense sector.

Exhibit 5 illustrates larger diversified Defense Contractor stocks, which are trading at an average 14.1x 2024 EV/EBITDA, below the average 18.5x 2024 EV/EBITDA of the defense technology company peers listed above. Much like the defense technology companies, Kraken has higher margins and 3-year growth rate compared to these large defense contractors, yet it trades at a discounted 10.5x 2024 EV/Adjusted EBITDA (based on the consensus estimate).

Exhibit 5: Comp Table for Multiple-Platform Defense Contractor Stocks

Source: Sophic Capital, Koyfin

An acquisition of Kraken Robotics has the potential to be highly accretive, potentially even at a premium valuation. Such a move could not only bolster the acquiring company’s overall valuation but also yield strategic advantages, especially for larger defense firms that may lack expertise in sensor and battery technology. By integrating Kraken’s cutting-edge solutions into their portfolio, these firms could enhance their competitiveness and expand their capabilities in the rapidly evolving defense and maritime sectors.

Sailing Off into the Sunset

Exhibit 6 is a sensitivity chart illustrating where Kraken’s stock could trade based on its 2024 Adjusted EBITDA guidance using various multiples:

Exhibit 6: Kraken Robotics 2024E Adjusted EBITDA Multiple Illustrating Potential Share Prices

Source: Sophic Capital

Today, Kraken Robotics’ stock (PNG:TSXV) trades at $1.10, representing 10.5x 2024 Adjusted EBITDA (consensus guidance). At the low end of the Adjusted EBITDA guidance range of $18 million, the stock is trading at 13x, and at the high end of the range, $24 million the stock is trading at 9.7x.

As previously mentioned, the Company recently announced a pipeline of $900 million and has stated they expect to continue to grow at a similar rate. Based on current contract wins and visibility into the sales pipeline, Kraken anticipates sustained growth for 2024 and beyond.

Within the defense sector, nations are responding to evolving geopolitical dynamics, particularly in the safeguarding of underwater infrastructure and territories. Kraken’s success in securing new clients, coupled with increased sales to existing customers, positions them well for continued expansion in this market segment.

Similarly, in the commercial sphere, Kraken foresees continued growth driven by service offerings tailored to companies operating in offshore wind and offshore energy sectors. As these industries continue to expand and evolve, Kraken is well-positioned to capitalize on the growing demand for their innovative products and services.

Conclusion

In conclusion, based on the consensus analyst estimates of 2024 Kraken’s stock currently trades at 10.5x EV/Adjusted EBITDA, while peer defense technology companies are trading at 18.5x 2024 EV/Adjusted EBITDA and large defense contractors trade at 14.1x. In both peer groups, Kraken is out-performing on all financial metrics, which generally can lead to higher multiples. We have provided some different scenarios of what the stock could be worth under different multiples to illustrate potential future stock values. If the Company can continue to execute and illustrate similar growth opportunities in 2025 then at some point later this year the market could start looking at 2025 Adjusted EBITDA, which could have the potential to lead to another re-rating of the stock. We will leave it to you to make your own assumptions around multiples you are comfortable using and where you think the stock should be trading and where it could be trading a year from now.

Disclosures

Kraken Robotics [PNG:TSXV, KRKNF:OTCQB] has contracted Sophic Capital for capital markets advisory and investor relations services.

Disclaimers

The information and recommendations made available through our emails, newsletters, website and press releases (collectively referred to as the “Material”) by Sophic Capital Inc. (“Sophic” or “Company”) is for informational purposes only and shall not be used or construed as an offer to sell or be used as a solicitation of an offer to buy any services or securities. In accessing or consuming the Materials, you hereby acknowledge that any reliance upon any Materials shall be at your sole risk. In particular, none of the information provided in our monthly newsletter and emails or any other Material should be viewed as an invite, and/or induce or encourage any person to make any kind of investment decision. The recommendations and information provided in our Material are not tailored to the needs of particular persons and may not be appropriate for you depending on your financial position or investment goals or needs. You should apply your own judgment in making any use of the information provided in the Company’s Material, especially as the basis for any investment decisions. Securities or other investments referred to in the Materials may not be suitable for you and you should not make any kind of investment decision in relation to them without first obtaining independent investment advice from a qualified and registered investment advisor. You further agree that neither Sophic, its, directors, officers, shareholders, employees, affiliates consultants, and/or clients will be liable for any losses or liabilities that may be occasioned as a result of the information provided in any of the Material. By accessing Sophic’s website and signing up to receive the Company’s monthly newsletter or any other Material, you accept and agree to be bound by and comply with the terms and conditions set out herein. If you do not accept and agree to the terms, you should not use the Company’s website or accept the terms and conditions associated to the newsletter signup. Sophic is not registered as an adviser or dealer under the securities legislation of any jurisdiction of Canada or elsewhere and provides Material on behalf of its clients pursuant to an exemption from the registration requirements that is available in respect of generic advice. In no event will Sophic be responsible or liable to you or any other party for any damages of any kind arising out of or relating to the use of, misuse of and/or inability to use the Company’s website or Material. The information is directed only at persons resident in Canada. The Company’s Material or the information provided in the Material shall not in any form constitute as an offer or solicitation to anyone in the United States of America or any jurisdiction where such offer or solicitation is not authorized or to any person to whom it is unlawful to make such a solicitation. If you choose to access Sophic’s website and/or have signed up to receive the Company’s monthly newsletter or any other Material, you acknowledge that the information in the Material is intended for use by persons resident in Canada only. Sophic is not an investment advisor nor does it maintain any registrations as such, and Material provided by Sophic shall not be used to make investment decisions. Information provided in the Company’s Material is often opinionated and should be considered for information purposes only. No stock exchange or securities regulatory authority anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. Sophic and/or its principals and employees may have positions in the stocks mentioned in the Company’s Material and may trade in the stocks mentioned in the Material. Do not consider buying or selling any stock without conducting your own due diligence and/or without obtaining independent investment advice from a qualified and registered investment advisor. The Company has not independently verified any of the data from third party sources referred to in the Material, including information provided by Sophic clients that are the subject of the report, or ascertained the underlying assumptions relied upon by such sources. The Company does not assume any responsibility for the accuracy or completeness of this information or for any failure by any such other persons to disclose events which may have occurred or may affect the significance or accuracy of any such information.

The Material may contain forward looking information. Forward-looking statements are frequently, but not always, identified by words such as “expects,” “anticipates,” “believes,” “intends,” “estimates,” “potential,” “possible,” “projects,” “plans,” and similar expressions, or statements that events, conditions or results “will,” “may,” “could,” or “should” occur or be achieved or their negatives or other comparable words and include, without limitation, statements regarding, projected revenue, income or earnings or other results of operations, strategy, plans, objectives, goals and targets, plans to increase market share or with respect to anticipated performance compared to competitors, product development and adoption by potential customers. These statements relate to future events and future performance. Forward-looking statements are based on opinions and assumptions as of the date made, and are subject to a variety of risks and other factors that could cause actual events/results to differ materially from these forward looking statements. There can be no assurance that such expectations will prove to be correct; these statements are no guarantee of future performance and involve known and unknown risks, uncertainties and other factors. Sophic provides no assurance as to future results, performance, or achievements and no representations are made that actual results achieved will be as indicated in the forward looking information. Nothing herein can be assumed or predicted, and you are strongly encouraged to learn more and seek independent advice before relying on any information presented.