Prior Report Recaps

In Sophic Capital’s Shining A Light On The U.S. Solar Industry report, we highlighted:

- Substantial cost reductions for solar energy panels and the all-in cost of solar energy have driven global adoption of solar power over the past decade;

- The USA market has experienced an average annual growth rate of 49% per year over the past decade, and;

- UGE International (“UGE” or the “Company”) [TSXV:UGE; OTC:UGEIF], a Sophic Capital client and small cap Canadian equity developing and operating community solar projects, is a way to invest in the growing solar energy theme.

In Sophic Capital’s subsequent solar report UGE International Ltd. – Time To Ride The Solar Coaster report, we introduced:

- UGE’s unique business model of leasing commercial building rooftops to develop and operate community solar projects;

- UGE’s US$83 million (since updated to over US$100 million) backlog could be hiding more value than investors may expect, and;

- UGE’s management 50%+ ownership and tight share structure (under 30 million shares) is aligned with investor interests.

In this report, we provide data points about why investors should invest in solar energy companies. Exhibit 1 outlines, the Invesco Solar ETF [NYSEARCA:TAN]. The ETF seeks to track investment results of the MAC Global Solar Energy Index, which is designed to provide exposure to companies listed on exchanges in developed markets that derive a significant amount of their revenues from solar power equipment producers including ancillary or enabling products. This ETF has handily outperformed the NASDAQ-100 index year-to-date, suggesting investors expect continued out performance in the sector. Importantly, this outperformance has been delivered despite a less friendly US federal administration.

Exhibit 1: Investors Expect Continued Solar Outperformance As Evidenced By Solar ETF Performance

Source:Google Finance

Continued Growth Expected in Solar Energy Generation

Perhaps the most powerful statement that shook up the solar energy industry came from the International Energy Agency (“IEA”), a global energy advocacy founded to address the 1970s oil crisis. In its World Energy Outlook 2020 report, the IEA stated: “…solar PV is consistently cheaper than new coal- or gas-fired power plants in most countries, and solar projects now offer some of the lowest cost electricity ever seen.” In most nations, solar photovoltaics (“PV”) are now cheaper than coal and natural gas plants.

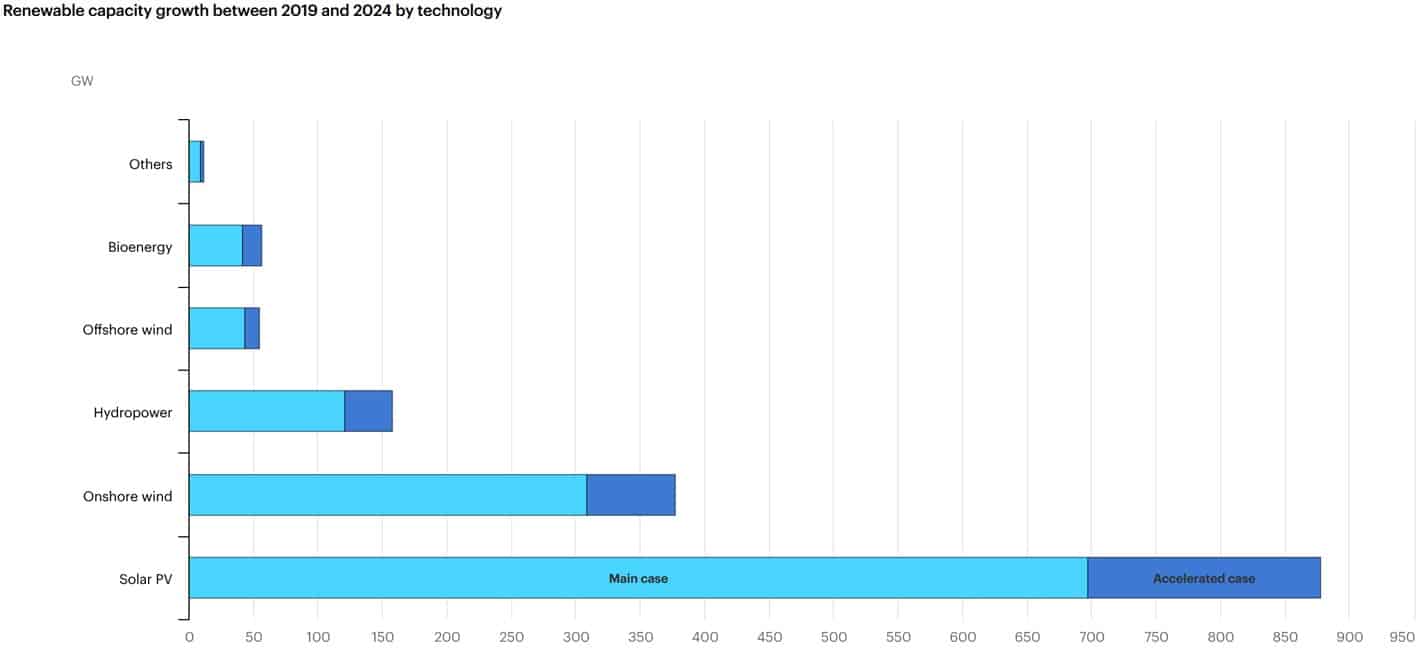

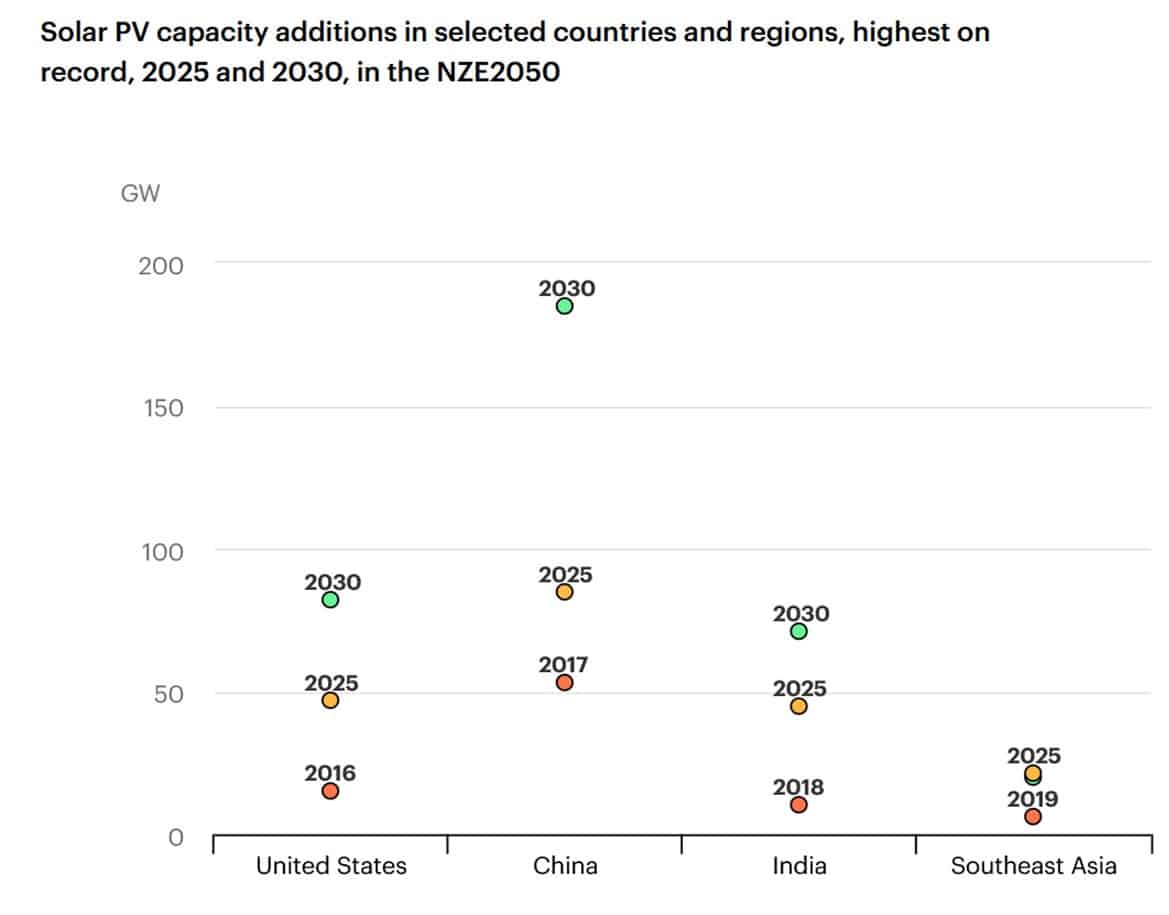

We’d like to highlight two important points: The first is that globally, solar PV is the dominant renewable energy source and will likely continue to lead through 2024 (Exhibit 2). Second, according to IEA, China is about to embark on the most aggressive solar PV expansion through 2030 (Exhibit 3). China will account for almost half of global distributed solar photovoltaic growth, potentially surpassing European Union installed capacity next year.

IEA also forcasts the U.S. to significantly increase solar PV energy production by 2030. For this report, we will focus on the U.S. since it is UGE International’s primary targeted market.

I see solar becoming the new king of the world’s electricity markets. Based on today’s policy settings, it is on track to set new records for deployment every year after 2022.

Dr. Fatih Birol

IEA Executive Director

Exhibit 2: Solar PV Leads Other Renewables for Current and Forecasted Capacity Through 2024

Source: IEA.org

Exhibit 3: China is Poised to Have the Most Aggressive Solar PV Capacity Expansion Through 2030

Source: IEA.org

No Shortage of U.S. Federal, State and Utility Incentives, Despite Political Rhetoric

A combination of declining PV panel costs and government incentives have contributed to increasing PV adoption in the United States. Federal and local governments and utilities offer varying incentives that can be summarized into five categories:

- Federal tax investment credit (“ITC”): At a basic level, a tax credit reduces the taxes that an enterprise pays. U.S. commercial solar projects tax credits are expected to decline over time — projects started in 2019 benefit from a 30% ITC. For 2020, the ITC is 26%; 22% for 2021, and 10% for 2022 and beyond. ITCs can be carried back 1 year and forward 20 years. Solar PV projects claiming the ITC can also accelerate depreciation of assets. Under an potential Biden presidency and a Republican led Senate, we see an extension of the ITC at 30% being highly likely; in fact, Mitch McConnell has previously passed at least one bill that included this measure, only to see it struck by President Trump. As further potential upside, there exists the possibility of a ‘cash grant’ option under new stimulus measures, which would give solar developers the option to receive the incentive as a cash payment, instead of a tax credit.

- Solar renewable energy credits (“SREC”): A solar incentive allowing project owners to sell certificates to their utility. Each MWh of energy earns one SREC. Like a stock, SREC values vary and can be worth over US$300 in some states.

- Property assessed clean energy (“PACE”): This is a long-term financing model, allowing a property owner to finance the up-front cost of energy or other eligible improvements on a property and then pay the costs back over time through a voluntary assessment. This assessment is attached to the property rather than a property’s original owner. Commercial building PACE (“C-PACE”) is available in over 35 U.S. states plus the District of Columbia. To date, about $800 million of projects have received C-PACE financing.

- State incentives: There are numerous state incentives, and you can find details HERE.

- Utility incentives: These vary by utility, but many utilities (and states) offer special rates called feed-in tariffs (“FIT”) for purchasing electricity from certain renewable energy systems. Many utilities also offer net metering (“NM”) where qualifying renewable energy systems connect to an electric utility’s distribution grid. NM programs vary but generally a customer generating excess renewable energy can ‘bank’ the excess and later have her electric bill reduced by the excess renewable energy banked.

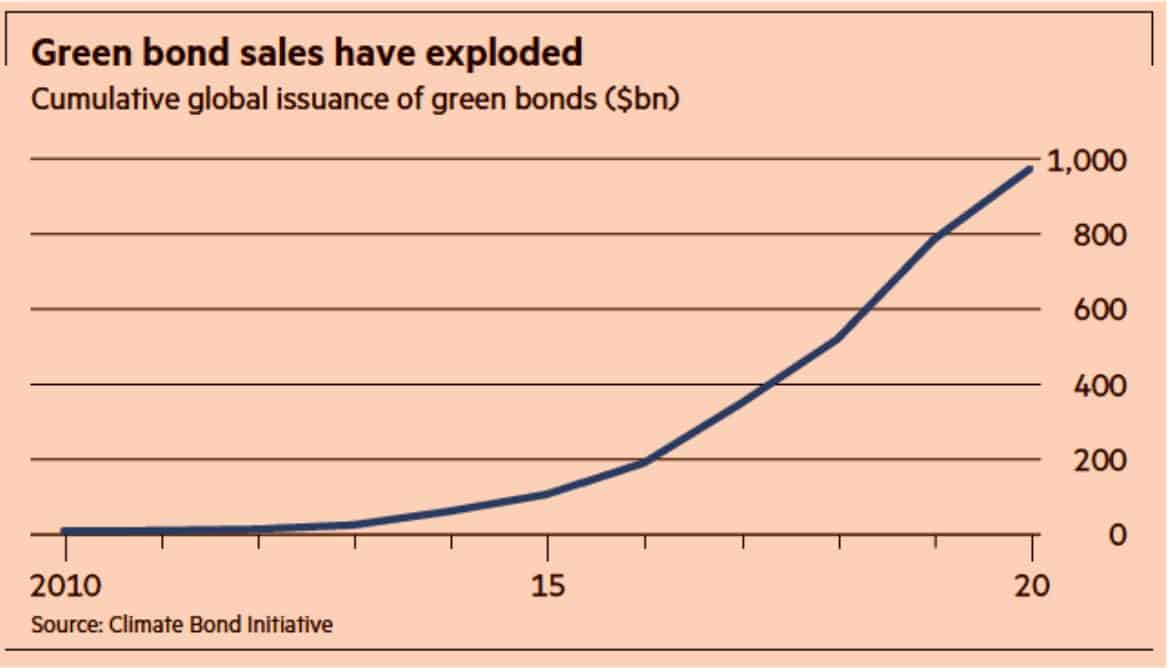

Beyond Incentives – No Shortage of Renewable Project Financing

Governments and utilities are not the only agencies providing incentives for the development of renewable energy. As the chart below demonstrates, green bond issuances have cumulatively grown from almost nothing in 2010 to US$1 trillion in 2020, implying investors’ increased appetite for financing climate and environmental projects. This appetite appears to have materially accelerated since 2015.

Source: FT.com

U.S. Solar Forecasts

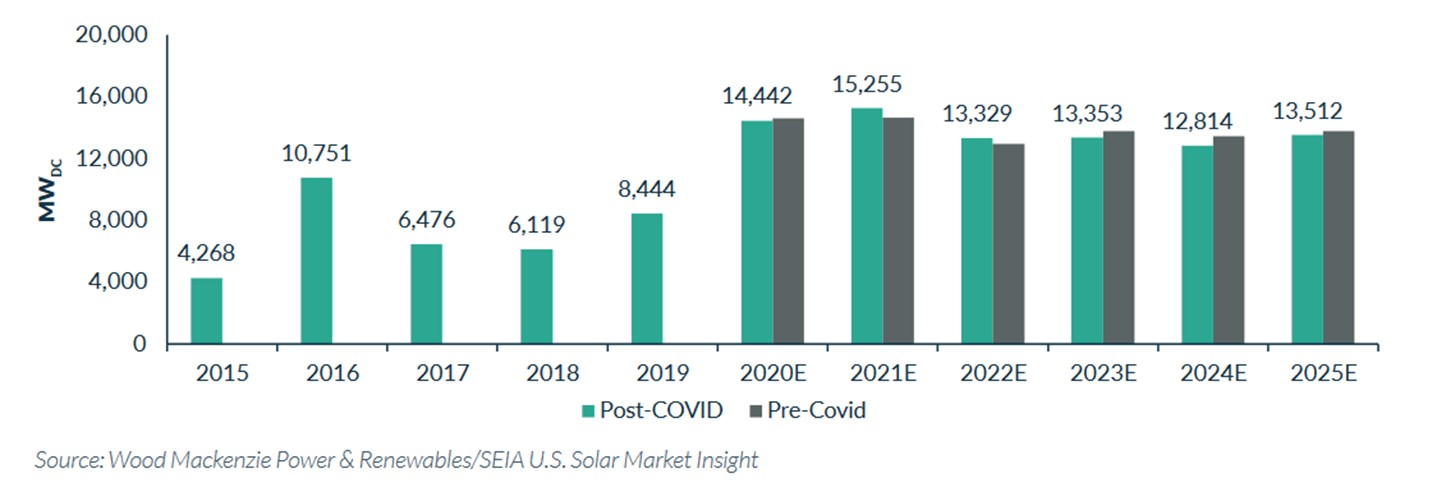

According to Deloitte, in April 2019, renewable energy provided 23% of U.S. power generation versus coal’s 20%. In the first half of 2019, wind and solar together accounted for approximately 50% of total U.S. renewable electricity generation, displacing hydroelectric power’s lead. Even the COVID-19 pandemic could not halt U.S. solar adoption – in the second quarter of 2020, the U.S. had installed 3.5 GW of solar PV capacity, reaching a total installed capacity of 85GW, enough to power 16.1 million homes. And as Exhibit 4 illustrates, 2021 should be a banner year for utility-scale PV as projects delayed in 2020 catch up next year.

Community solar expanded its geographic diversification. According to the SEIA, New York became the third market to exceed 300 MW of community solar capacity. The first quarter of 2020 was the Empire State’s second-largest quarter on record. However, the COVID-19 pandemic caused a 12% quarterly decline in non-residential PV segment (which includes commercial, government, non-profit and community solar) – its lowest quarterly total in four years. Restrictions during the initial stages of the pandemic delayed many projects, which will restart and carry over into 2021.

New York’s long-awaited community solar renaissance has begun in earnest, with another 100 MW of community solar projects brought online in Q1 2020 following more than 160 MW being installed in Q4 2019.

SEIA.org

Solar Market Insight Report 2020 Q2

Exhibit 4: Annual U.S. Utility-Scale PV Installed Capacity and Post COVID-19 Forecast (MW)

Source: UK Solar Fund

Coming Up: Helping Investors to Value UGE’S Solar Projects (and Stock)

In our next report, we look at some solar transactions over the past 12 months to see what multiples were paid. We will also look at UGE’s project backlog, which stands at over US$100 million, and the multiple the market currently applies to UGE. With these data points, investors should be able to determine if risk reward potential in small cap stock UGE warrants investing in the Company’s shares.

Disclosures

UGE International has contracted Sophic Capital for capital markets advisory and investor relations services.

Disclaimer

The information and recommendations made available through our emails, newsletters, website and press releases (collectively referred to as the “Material”) by Sophic Capital Inc. (“Sophic” or “Company”) is for informational purposes only and shall not be used or construed as an offer to sell or be used as a solicitation of an offer to buy any services or securities. In accessing or consuming the Materials, you hereby acknowledge that any reliance upon any Materials shall be at your sole risk. In particular, none of the information provided in our monthly newsletter and emails or any other Material should be viewed as an invite, and/or induce or encourage any person to make any kind of investment decision. The recommendations and information provided in our Material are not tailored to the needs of particular persons and may not be appropriate for you depending on your financial position or investment goals or needs. You should apply your own judgment in making any use of the information provided in the Company’s Material, especially as the basis for any investment decisions. Securities or other investments referred to in the Materials may not be suitable for you and you should not make any kind of investment decision in relation to them without first obtaining independent investment advice from a qualified and registered investment advisor. You further agree that neither Sophic, its, directors, officers, shareholders, employees, affiliates consultants, and/or clients will be liable for any losses or liabilities that may be occasioned as a result of the information provided in any of the Material. By accessing Sophic’s website and signing up to receive the Company’s monthly newsletter or any other Material, you accept and agree to be bound by and comply with the terms and conditions set out herein. If you do not accept and agree to the terms, you should not use the Company’s website or accept the terms and conditions associated to the newsletter signup. Sophic is not registered as an adviser or dealer under the securities legislation of any jurisdiction of Canada or elsewhere and provides Material on behalf of its clients pursuant to an exemption from the registration requirements that is available in respect of generic advice. In no event will Sophic be responsible or liable to you or any other party for any damages of any kind arising out of or relating to the use of, misuse of and/or inability to use the Company’s website or Material. The information is directed only at persons resident in Canada. The Company’s Material or the information provided in the Material shall not in any form constitute as an offer or solicitation to anyone in the United States of America or any jurisdiction where such offer or solicitation is not authorized or to any person to whom it is unlawful to make such a solicitation. If you choose to access Sophic’s website and/or have signed up to receive the Company’s monthly newsletter or any other Material, you acknowledge that the information in the Material is intended for use by persons resident in Canada only. Sophic is not an investment advisor nor does it maintain any registrations as such, and Material provided by Sophic shall not be used to make investment decisions. Information provided in the Company’s Material is often opinionated and should be considered for information purposes only. No stock exchange or securities regulatory authority anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. Sophic and/or its principals and employees may have positions in the stocks mentioned in the Company’s Material and may trade in the stocks mentioned in the Material. Do not consider buying or selling any stock without conducting your own due diligence and/or without obtaining independent investment advice from a qualified and registered investment advisor. The Company has not independently verified any of the data from third party sources referred to in the Material, including information provided by Sophic clients that are the subject of the report, or ascertained the underlying assumptions relied upon by such sources. The Company does not assume any responsibility for the accuracy or completeness of this information or for any failure by any such other persons to disclose events which may have occurred or may affect the significance or accuracy of any such information. The Material may contain forward looking information. Forward-looking statements are frequently, but not always, identified by words such as “expects,” “anticipates,” “believes,” “intends,” “estimates,” “potential,” “possible,” “projects,” “plans,” and similar expressions, or statements that events, conditions or results “will,” “may,” “could,” or “should” occur or be achieved or their negatives or other comparable words and include, without limitation, statements regarding, projected revenue, income or earnings or other results of operations, strategy, plans, objectives, goals and targets, plans to increase market share or with respect to anticipated performance compared to competitors, product development and adoption by potential customers. These statements relate to future events and future performance. Forward-looking statements are based on opinions and assumptions as of the date made, and are subject to a variety of risks and other factors that could cause actual events/results to differ materially from these forward looking statements. There can be no assurance that such expectations will prove to be correct; these statements are no guarantee of future performance and involve known and unknown risks, uncertainties and other factors. Sophic provides no assurance as to future results, performance, or achievements and no representations are made that actual results achieved will be as indicated in the forward looking information. Nothing herein can be assumed or predicted, and you are strongly encouraged to learn more and seek independent advice before relying on any information presented.