UGE’s Shining Potential

In Sophic Capital’s A “Sun-sational Take on Community Solar we uncovered incentives for adoption and discussed tailwinds in the U.S. Community Solar industry. This follow on report highlights Sophic Capital client (the “Company”) [TSXV:UGE; OTCQB:UGEIF], a full lifecycle developer and operator of U.S. community solar projects. The Company’s energy subscribers range from individual households to large corporate clients like T-Mobile and Bloomberg. UGE also works with landowners and commercial & industrial building owners, by leasing their land or roof space to host a solar project.

This report looks at how UGE finances its projects.

UGE: Illuminating U.S. Communities One Sunbeam at a Time

Community solar projects allow multiple customers to share the benefits of a single solar installation, regardless of whether they own or have access to a rooftop suitable for a solar panel installation. UGE develops solar projects across the U.S. on commercial building rooftops, ground-mounted solar systems on vacant land, and solar carports above parking lots. UGE benefits by generating and selling energy produced by these projects (currently, the Company owns and operates solar assets totaling 5.3MW, producing roughly 9.7 million kWh per year), and has 17.8MW of additional projects in construction. Commercial property owners and landowners benefit from new revenue streams via lease agreements with UGE; off takers – companies and households that purchase the energy UGE generates – benefit from lower energy costs and cleaner sources of energy, something previously out of reach. UGE is also developing battery energy storage systems which generate returns through various revenue drivers which include local incentives, load shifting, frequency regulation, and demand response, among others.

One of UGE’s operating community solar facilities, of 5.3MW total.

UGE is a leader of community solar development in key U.S. states that have incentives, including:

- New York’s Community Distributed Generation program allows customers to subscribe to a portion of a community solar project’s output, with a goal of expanding access to renewable energy to more residents and businesses.

- New Jersey finalized its Community Solar Energy Program (CSEP) in August 2023. UGE owns and operates two rooftop community solar projects, which were part of New Jersey’s successful pilot community solar program, which has been replaced by the permanent CSEP.

- Maine’s net energy billing and distributed generation programs have structured opportunities for residential and non-residential customers. Net energy billing provides billing offsets from power generated from small renewable power generation.

- California has multiple community solar programs but is also in the process of reworking community solar to better benefit the state’s residents, which is expected to be finalized within 2024.

UGE has several competitive advantages in the community solar industry. The Company has operated for over 14 years and completed over 700 projects, including notable ones for the Eiffel Tower, Whole Foods Market, and the Philadelphia Eagles. Over time, UGE has established expertise in developing and financing distributed energy systems, including both solar and energy storage. Specifically, as a full lifecycle developer the Company is now well versed across all facets of development, including origination, development, engineering, construction, project financing, and asset management. This contrasts with many of its industry competitors, that typically focus on only part(s) of the value chain.

Building Community Solar Projects Without Getting Sunburned

UGE is focused on leveraging the low cost of distributed solar energy to provide energy users with more affordable power.

As a recent example, three UGE projects in Maine are expected to generate $6-7 million of net cash as the portfolio is completed. Two of these Maine projects (2.8MW and 2.7MW) had third-party evaluations of $9.2 million and $9.1 million, respectively. The first of the three projects received permission to operate (PTO) in December 2023, after UGE completed its construction, with the other two projects still in construction.

In addition to its 5.3MW operational portfolio, UGE has also reached Notice to Proceed (NTP) on 17.8MW of projects that are in the process of being constructed. Given average project deployment timelines of nine to 12 months, significant portfolio growth is expected within 2024 as UGE continues to build out its portfolio. We will touch on the significance of these NTP and COD milestones below and explain their impact to the cashflow in a subsequent report.

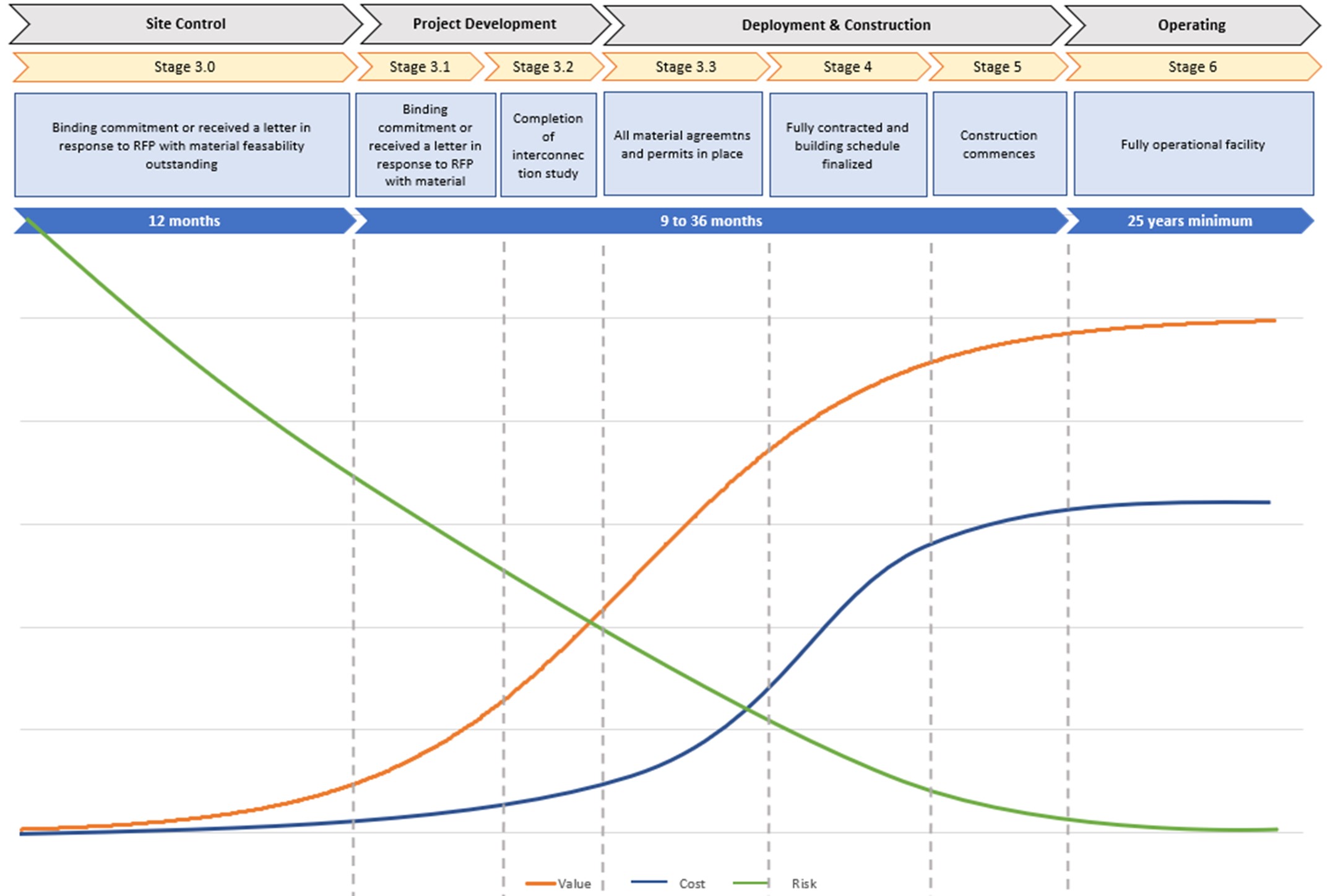

Exhibit 1 illustrates UGE’s process for developing its community solar projects. This process precipitates from the Company’s early-stage pipeline of opportunities (over 2.75GW of projects [as per its most recent disclosure]) and transitions to development after UGE secures site control. “Site control” is typically an Option to Lease or a Lease agreement, granting the Company the right to develop a project in that location. As Exhibit 1 shows, projects in the development pipeline have higher risk in their earlier stages, but the risk decreases as projects proceed through the development process and are almost completely de-risked once they reach Notice to Proceed (Stage 4 when they are cleared for construction). It is important to point out that once a project has achieved Notice to Proceed (“NTP”), that it has been financed and has all approvals to proceed. In essence, the development work has been complete and all that remains is to construct the project. As a result, project developers see the NTP milestone as the pinnacle of value creation.

Exhibit 1: UGE’s Process to Develop Operating Community Solar Projects

Source: Company reports, Sophic Capital

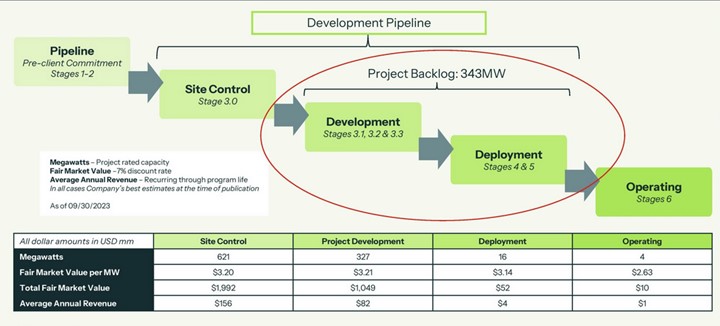

Exhibit 2 expands upon Exhibit 1 by showing UGE ’s sites and projects along with their estimated values beyond Stages 1 and 2. At first glance, Exhibits 1 and 2 appear to contradict each other as projects progress across the stages. However, we highlight that missing from Exhibit 2 is time. As Exhibit 1 shows, for example, is that Stage 3.0 projects graduate to Stage 3.1 in typically 12 months. Moving from Stage 3.1 to Stage 3.2 is predicated on receiving an interconnection agreement from the local utility, which tends to be the most significant bottleneck in most markets, so once projects reach Stage 3.2 they are materially de-risked. Stage 6 projects typically operate for a minimum of 25 years. So later stage projects generate more value over time versus earlier stage projects.

Exhibit 2: Putting Numbers to UGE’s Development Pipeline

Source: Company reports, Sophic Capital

Financing Projects

UGE has proven its ability to finance its growth with successive financings. Over the past 18 months, the Company has closed the following financings for its projects:

- November 17, 2023: completed a Green Bond offering for gross proceeds of CDN$1,538,050 and US$74,100. This was followed by an additional US$518,700 private placement.

- August 24, 2023: closed an overnight marketed offering of Green Bonds having an aggregate principal amount of US$5,882,000, for aggregate gross proceeds of US$5,749,655.

- July 6, 2023: disclosed a US$750,000 grant from Energy Research and Development Authority in New York to help incentivize, among other clean energy priorities, the development of community solar programs and specifically those which serve low-to-moderate income communities.

- May 15, 2023: completed a second tranche closing of its brokered private placement of green bonds previously announced on March 30, 2023 for total gross proceeds of $1,705,087.50.

- March 21, 2023: closed a US$12.5 million debt facility and a US$7 million tax equity facility to fund 3 Maine projects that had reached NTP during Q1 2023.

- November 28, 2022: closed a Green Bond private placement for gross proceeds of CAD$7.38 million (US$5.49 million). The Green Bonds came with a 9% coupon and a four-year maturity, with interest paid semi-annually beginning December 31, 2023.

- October 5, 2022: completed a US$15 million credit line to be used for acquisitions and development expenses.

- July 28, 2022: closed a brokered private placement of debenture for aggregate gross proceeds of CAD$2,225,000. The debentures mature four years from the closing date and bear interest at a rate of 8% per annum, payable semi-annually in arrears calculated on the last calendar day of June and December, commencing December 31, 2022.

Beyond green bonds, UGE also finances its community solar projects facilities via tax equity structures. These structures allocate renewable energy tax incentives – like investment tax credits (ITC) and losses caused by utilizing accelerated depreciation – to tax equity investors (TEI). Through these structures, UGE allocates most of a project’s U.S. taxable income, renewable tax incentives, and a portion of the project’s cash to the TEI in return for project financing. Returns for the TEI are driven by the Year 1 tax credits, but nominal payments to the TEI continue until an agreed-upon after-tax investment return (known as the “flip point”) is reached. Post the flip point, UGE buys out the TEI for a nominal sum and receives all of the project’s taxable income and cash flows. At all times, UGE retains complete control and ownership over the project.

Coming up…

In our next report, we’ll delve more into state-level programs that could benefit UGE and look at how UGE finances projects and an example project’s associated cash flows.