Gen Z, the Ignored Affluent Generation

Many brands and marketers have had little success with Generation Z (“Gen Z”) consumers. If you were born in the mid- to late-1990s, then you were born during the Gen Z years. Unfortunately, many brands and marketers have dismissed this demographic, unfairly focusing on false generation z negative characteristics. These misperceptions could prove detrimental to brands and marketers since 1/3 of global population is Gen Z, and they control about $360 billion of spending power. Gen Z is the next generation of consumers, yet many brands and marketers ignore them or are having trouble connecting with them. And the brands that have recognized that Gen Z can be customers for decades to come have struggled to win their trust.

Gen Z is Unlike Any Other Generation

Marketing to Gen Z is not straightforward because they are not easily understood by conventional marketers. This is a demographic that cherishes video communications for their social, educational, and informational needs. Their cameras are always on, streaming their lives as they multi-task through their days. They like emojis, memes, riding social media trends, getting socially active. They like hanging out in “third places” that converge social media with other activities like gaming (Twitch), communities (Discord), photo sharing (Instagram), and self-expression (Tik Tok). Facebook and Twitter? Yuck.

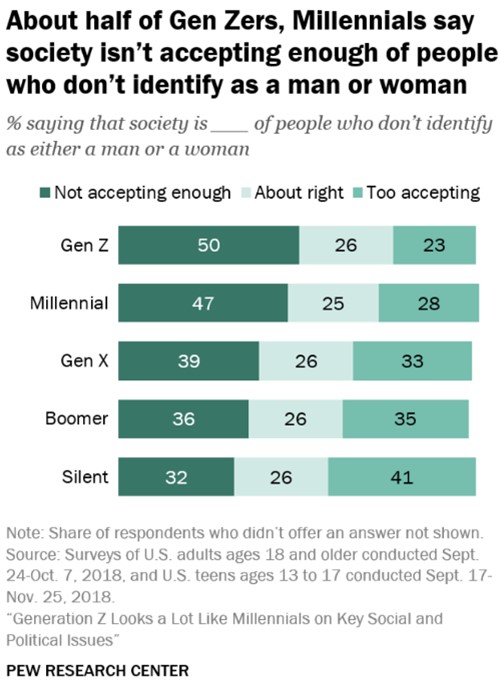

Brands and marketers need to understand these characteristics in their generation z marketing strategies. Social media influencers play a big role in all aspects of Gen Z lives. Gen Z needs convincing, authenticity, and inclusivity before accepting the messenger or the messenger’s messages. They value human rights, protection of the environment, education for everyone, strict corporate governance, and a just political system that does more for citizens. They deplore racism, sexism, harassment, and genderism.

Once Gen Z trusts someone or something, they remain loyal until that trust is broken. Maintain that trust, and Gen Z will go to those influencers for news, info, entertainment, and brand endorsements. Not all brands understand how important trust, authenticity, and inclusivity are – at a minimum, all 3 are required to get Gen Z to crack open their wallets (read commentary about Generation z marketing characteristics and the challenges brands faced when targeting Gen Z at esports events).

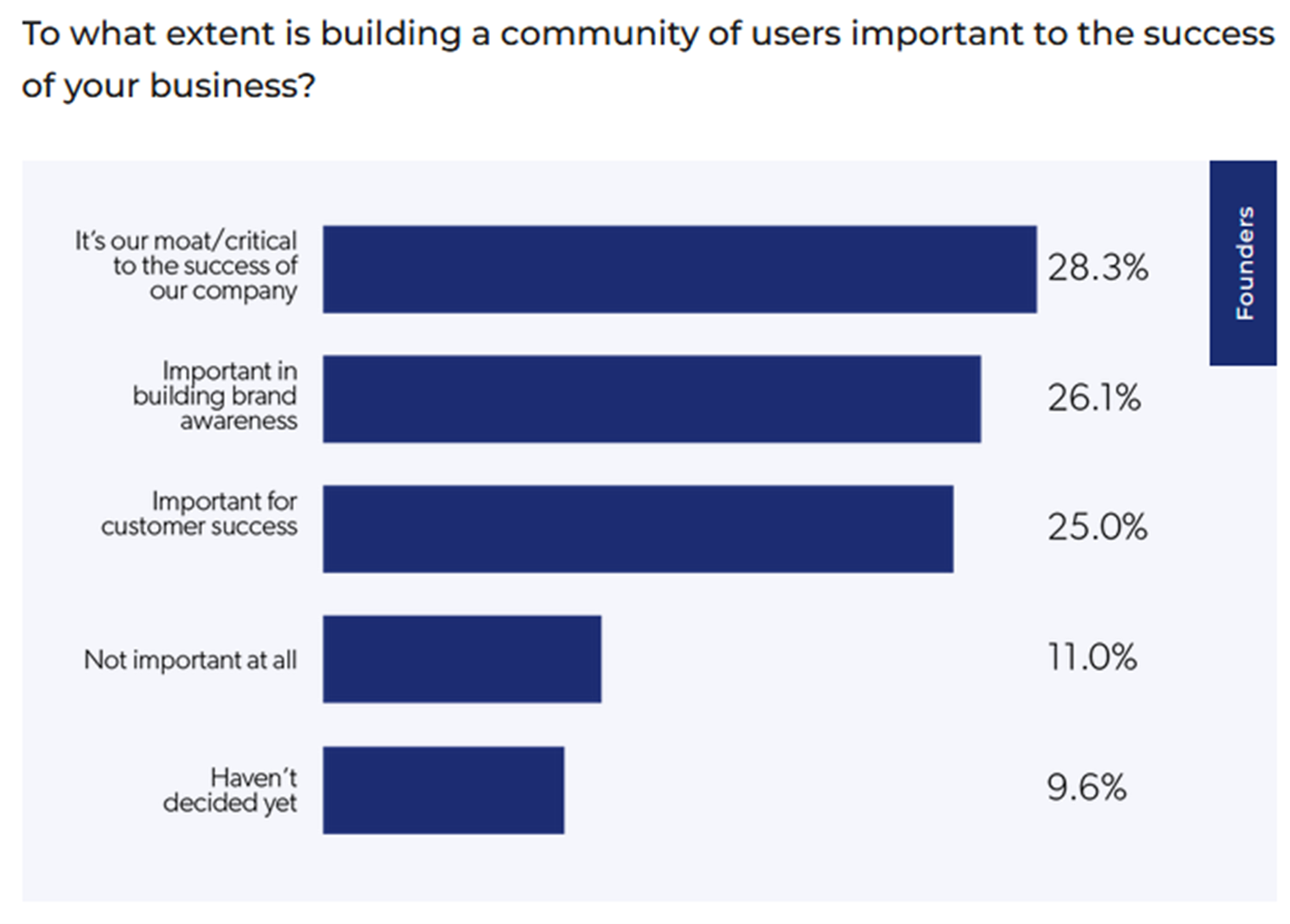

Business founders are awakening to the importance of community when targeting Gen Z. A 2019 First Round Capital survey uncovered that close to 80% of start-up founders considered building community as crucial to their businesses (Exhibit 1). The reasons for this are that an engaged, loyal and passionate community can generate a word-of-mouth viral, virality, and brand/product fit. They understand that communities are built over time and not fake nameplates. They understand that it’s critical to find people who care and invest in these users while determining how to serve them. They understand that community value is not a singular vector – “community value” is multifaceted relationship building with shared purpose that makes people feel as though they are contributing to a community’s growth, which happens to be a part of a company’s offering.

Exhibit 1: Community is the New Moat

Gen Z Has Tight Wallets

Gen Z matured post the Great Financial Crisis, and many saw the negative impacts to their parents’ careers, finances, and homes. As mature adults, Gen Z now has experienced similar negative outcomes from the COVID-19 pandemic. They’re seeing fewer quality job opportunities, university diplomas that are not helping to fulfill their dreams, and societal wealth disparity increasing. These factors have increased Gen Z skepticism towards institutional power and legacy processes.

Financially, Gen Z is astute. A 2017 survey found that 12% were saving for retirement 21% had a savings account before the age of ten. They are also the most digital savvy generation in history, having grown up with smartphones and tablets in hand. They’ve always had instantaneous access to information and entertainment. Yet, today’s financial services weren’t designed for Gen Z.

For example, Gen Z doesn’t understand why they need a passport photo and utility bills to open a bank account. Nor do they get why a SWIFT transfer takes days or why they even must go to a physical bank branch to initiate that transfer. What they want is a digital currency that transacts seamlessly. They want simplified ways to shop (so long malls/ adiós department stores). And they want to do all of this while helping the planet and humanity.

Conscious Consumers and Entrepreneurs

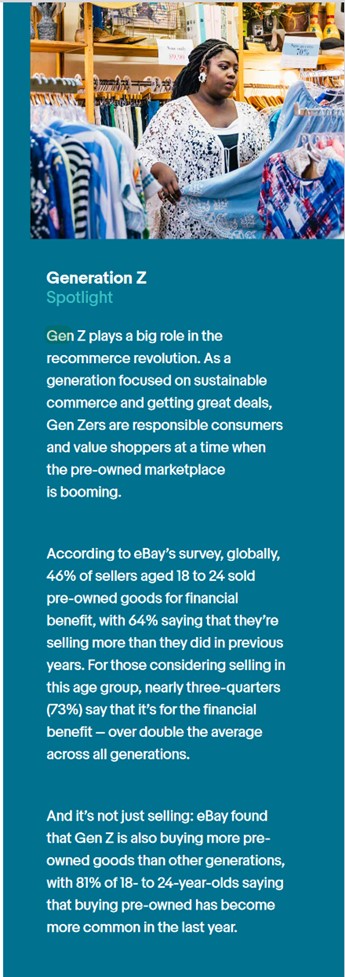

Gen Z is the largest global demographic, comprising 32% of the world’s population. They are also the most consciously aware generation to walk the planet. They demand accountability, transparency, trust, and credibility for all relationships. They’re uncompromising when it comes to fairness, good governance, and safeguarding the environment. For these reasons, many dismiss materialism in lieu of recycling.

Many people don’t realize how big the buy & sell market is. Also know as “recommerce”, “reuse”, “resale”, “thrifting”, and “circular economy”, the buy & sell market is certainly large enough for Facebook, Kijiji, eBay, and Craigslist to create multi-billion-dollar businesses. In fact, the World Resources Institute estimates that consumerism has created $4.5 trillion of waste, an unpleasing fact for Gen Z. But rather than complain, they are taking action and making money while doing it.

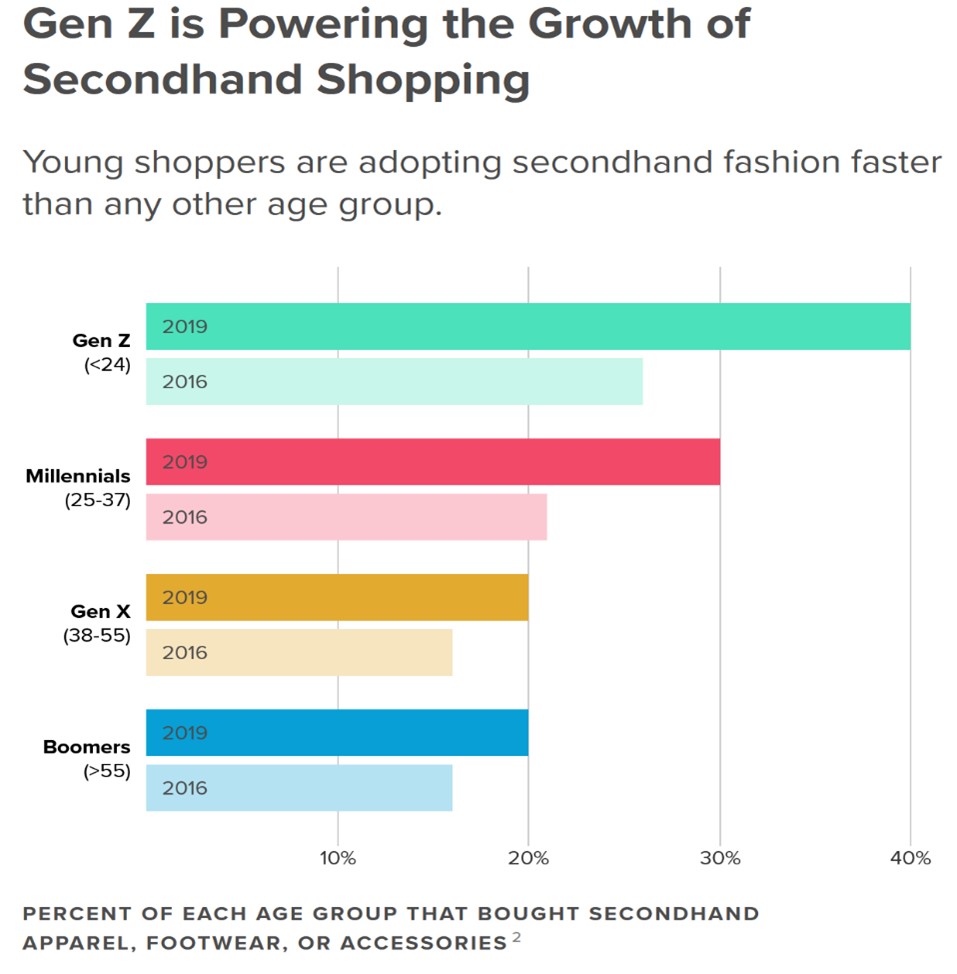

Source: ThreadUp, 2020 Resale Report

Forty percent of Gen Z bought second-hand clothing in 2019, and 80% of this generation attaches no social stigmas to buying recommerced fashion. When money is tight, 90% of Gen Z have or would purchase used clothes. In fact, Gen Z has helped the second-hand clothing market grow into a $28 billion industry – an industry that could grow 18% annually through 2024.

When it comes to cryptocurrency ideal utility, 48% of Gen Z want to conduct financial transactions. This is interesting because a) many cryptos are volatile (some worthless), and b) few enterprises accept cryptos as payment mediums (“a”) is likely a main reason).

Source: ThreadUp, 2020 Resale Report

Like their Predecessors, Gen Z Students Cuts Costs

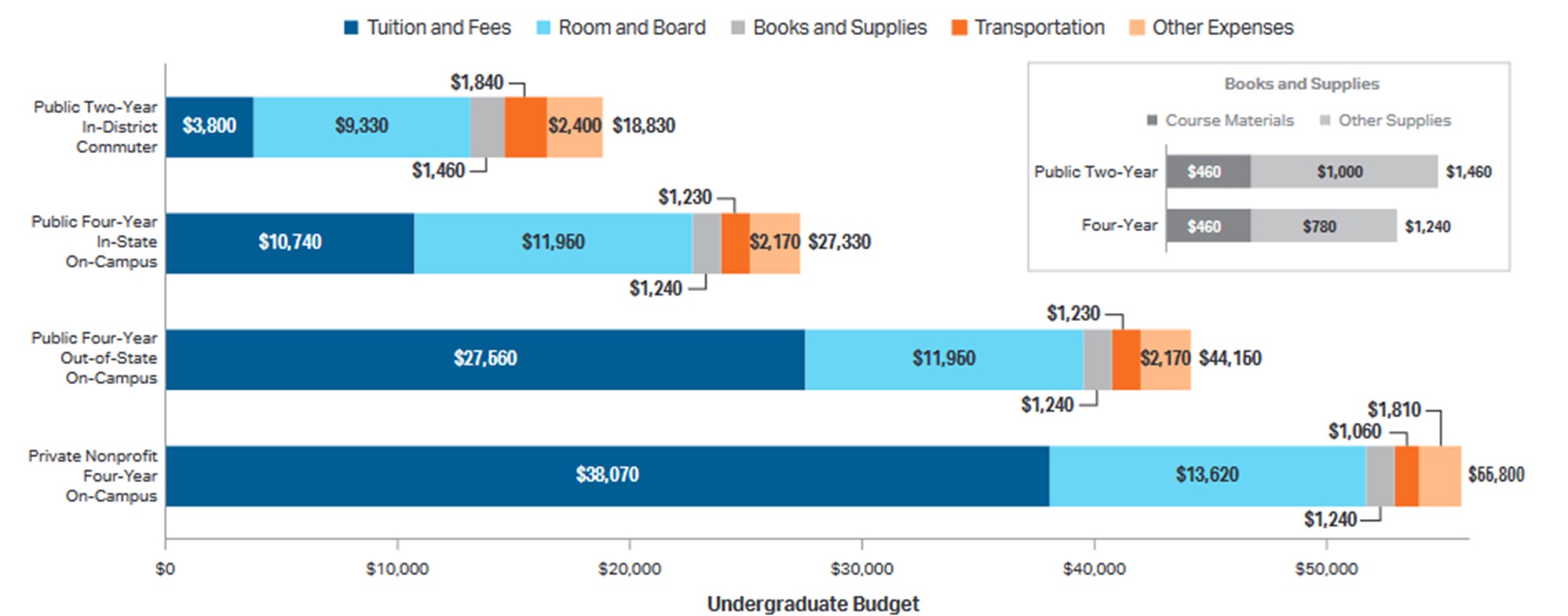

University has always been expensive – not only tuition but also housing, books, and transportation (Exhibit 2). Like the generations that came before them, Gen Z students are not immune to the expenses needed to invest in their futures. And like their predecessors, cutting costs is often required to earn a university degree. However, as we mentioned, Gen Z relishes recommerce and does not attach social stigmas to buying second-hand goods.

Exhibit 2: Average Estimate Fulltime Undergraduate Budgets 2021-2022

Source: CollegeBoard

The “Back-to-School Trade”

Sophic Capital client Mijem (CSE: MJEM) is the convergence of the following Gen Z trends: recommerce and social media. It provides a second-hand buy & sell app targeting university and college students. Plus, it also helps arrange rideshares with other students. Furthermore, Mijem offers Bitcoin SV crypto wallets and rewards to students who transact on the application. Mijem is the first buy & sell community app built specifically for Gen Z.

Canada and the United States has a combined 23 million college students, all waiting to return to campus. Prior to the 2020 COVID-19 pandemic, Mijem had piloted at over 70 North American universities and colleges and had attracted over 39,000 students to the app, each spending 2 to 4 minutes per session. Like many companies did during the pandemic, Mijem minimized marketing efforts, fine tuned its product and is now re-launching post a recent round of financing. Now, with many campuses open, Mijem is revamping its marketing, outreach, and community building efforts to onboard more students.

Mijem’s revenue model parallels that of AirBnB. Per transaction, Mijem takes 12.5% of what the seller earns and nothing from buyers. Mijem then uses about 2% of what’s earned from sellers to fund the purchase of Bitcoin SV for the buyer and seller as a loyalty reward. Future revenue could come from new features and functionality and in-app advertising.

Investors seeking to invest in the largest demographic – Gen Z – and believe that buy & sell is a growing industry that resonates with this generation should consider Sophic Capital’s client Mijem (CSE:MJEM), a company that has fostered online Gen Z university communities through its buy & sell application.

Source: eBay Recommerce Report, March 2021

Sign up for all Sophic Capital’s reports at https://sophiccapital.com/subscribe/