Industry Valuations Suggest UGE International’s Stock Has Upside Potential

In Sophic Capital’s Market Undervalues UGE Versus Peer Transactions report published just before a pullback in Canadian listed small cap stocks, we detailed that valuing UGE International’s solar project backlog translated to a potential UGE share price ranging from C$3.25 to C$3.50. When we published the report (February 18, 2021), Sophic Capital client UGE International (“UGE” or the “Company”) [TSXV:UGE; OTC:UGEIF], a developer and operator of U.S. community solar projects, had a share price of C$2.49. The stock subsequently sold off along with the broader Canadian microcap market to a low of C$1.15 and has since recovered to C$1.46: 41% lower than when we published the last report, despite continued growth in the Company’s backlog. Markets are forward looking, and summer is a seasonally slow period. As investors look ahead to the Fall and 2022, we believe now is a good time for investors to revisit this story.

Management has continued to build it’s business since our last report in February 2021. Since that report, project backlog increased from 68MW to 83.7MW as of June 30, 2021. The Company has set a 120MW project backlog goal for 2021, which management suggested it remains on target for during its Q2 earnings call on the back of pipeline growth to more than 440MW during the quarter. Recent publicly disclosed solar power industry transactions suggest UGE International should be added to your best microcap stocks list. This is why:

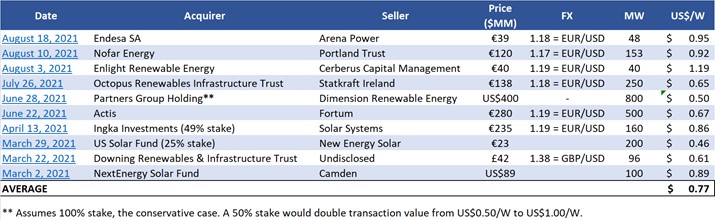

Exhibit 1 shows peer transactions for solar projects under development that have occurred since we published our last report on February 18, 2021. The average solar project under development netted US$0.77/W in the most recent list, below, compared with US$1.14 per watt (“/W”) (as of February 18, 2021). We found far more mid-scale transactions where dollar amounts were NOT disclosed, thus Exhibit 1 may lack higher-valued transactions indicative of the activity suggested by our industry contacts for the type of mid-scale projects that UGE focuses on. Industry contacts we’ve spoken to have stated that the market remains strong.

Transactions in the 40 to 50 MW range in August 2021 sold for US$0.92W to US$1.19/W, suggesting that projects in UGE’s mid-scale size range should still theoretically trade hands at values similar to prior ranges. For example, in November 2020, UGE sold a 300kW project for US$0.7 million or US$1.10/W (net).

Exhibit 1: Solar Projects Under Development Have Traded Between US$0.46/W and US$1.19/W

Source: Sophic Capital

Market is Undervaluing UGE Versus Recent Project Sale and Peer Transactions

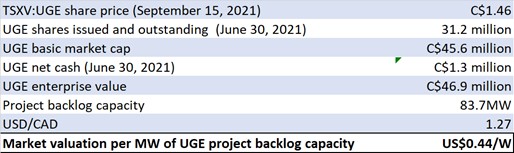

Exhibit 1 showed that mid-scale solar projects under development have sold for between US$0.46/W and US$1.19/W. Based upon UGE’s September 15, 2021 stock price of C$1.46 per share, the market currently values UGE at US$0.44/W (Exhibit 2), which represents about a 43% discount to the average US$0.77/W peer transactions have commanded (Exhibit 1) and approaching the US$0.46/W low end of these transaction values. Note that this is essentially liquidation value – it is prior to giving any value to UGE’s broader pipeline (about 357MW of which was pre-backlog as of June 30th), nor for its ability to continue to close new deals going forward. And it doesn’t include the free option of projects being extended beyond their initial projected lifespan, which has been an ongoing trend in the renewable space.

Exhibit 2: UGE Market Value (per Watt Basis) Shows Significant Potential Value Versus Project Transactions

Source: Company reports, Sophic Capital

Valuing UGE Projects at US$0.77/W

Applying US$0.77/W industry average for solar project acquisitions to UGE’s June 30th pro forma 83.7MW backlog estimate suggests that UGE’s backlog alone could be worth between C$2.60 to C$2.70 per share – a minimum 78% appreciation from UGE’s most recent stock price of C$1.46 per share. UGE has set a 2021 goal of 120MW of project backlog which, using the US$0.77/W industry average for solar project acquisitions, implies a potential backlog value ranging from C$3.65 to C$3.75 per share. Our C$2.60 to C$2.70 range excludes future project wins, giving no value to the Company’s 441MW overall project pipeline (~357MW net of backlog) as of UGE’s Q2 (June 30, 2021) financials. If we conservatively assume that 33% of the ~357MW net pipeline converts over time, back-of-the-envelope math implies another C$3.50 to C$4.00 per share could be added to the C$2.60 to C$2.70 per share estimate over time.

For investors looking at microcap value stocks, especially with ESG and solar themes, we recommend they look closer at UGE International.