Sale Suggests UGE’s Stock Could Have

More Upside Potential

\

Solar Project Valuation Report Recap

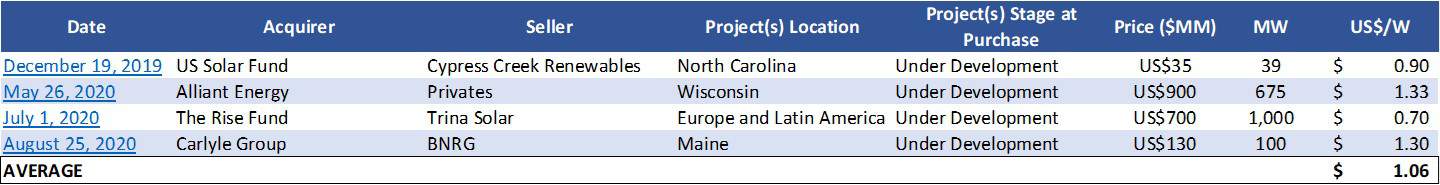

Our Sizzling Solar Project Valuations Bode Well For UGE report showed that solar projects under development sold between US$0.70/W and US$1.33/W (Exhibit 1). Based on discussions Sophic Capital has had with industry participants, we believe buyers would incur costs in the range of an additional US$1.00/W in order to bring these projects to operational status. This suggests that transaction values for operational assets could range between US$1.70/W and $2.33/W (including costs to make the project operational).

Exhibit 1: Solar Projects Under Development Have Been Traded Between US$0.70 and US$1.33/W

Source: Sophic Capital

Sophic Capital client UGE International (“UGE” or the “Company”) [TSXV:UGE; OTC:UGEIF], a developer and operator of U.S. community solar projects, today announced the sale of an operational solar project for what equates to about US$2.30/W. This news was part of a broader announcement that saw UGE also secure three new deals. Net of the debt associated with this project, the price equates to roughly US$1.10/W. Not only does UGE’s transaction support our discussions with industry contacts, which suggested meaningful value in UGE’s backlog, but it could also set the stage for investors to realize more value in UGE’s stock as projects become operational.

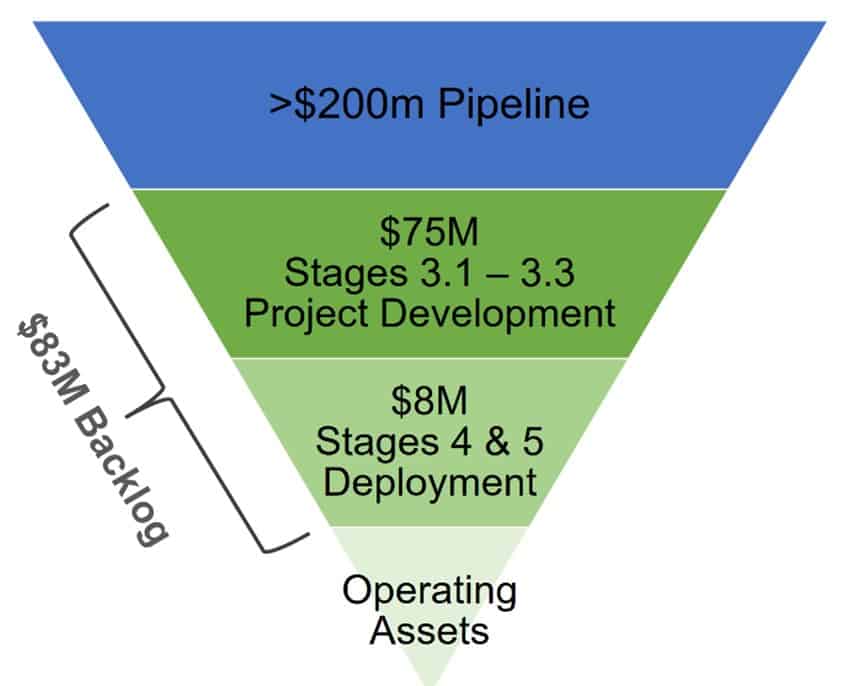

Figure 1 shows UGE’s US$83 million of backlog as of June 30, 2020 quarter-end. In addition, Figure 1 does not include US$21.5 million of new community solar projects in Maine announced September 16, 2020 or the US$3.1 million from 3 new projects also reported today. Based upon these additional projects, we estimate UGE’s backlog as closer to US$108 million and about 67MW of solar power generation potential post-sale of 300kW facility sold.

We remind investors that UGE’s “backlog” actually represents the net present value (“NPV”) of discounted cash flows across the Company’s portfolio of projects. UGE’s backlog refers to the unlevered (excluding debt) NPV of committed projects, less value already realized, or the present value of all of UGE’s projects, ignoring the debt required to finance the projects today. UGE expects to operate these projects within 24 months, and until facilities are operational, the backlog is not included in the Company’s reported financial results.

Figure 1 : UGE International’s Project Development Funnel (June 30, 2020)

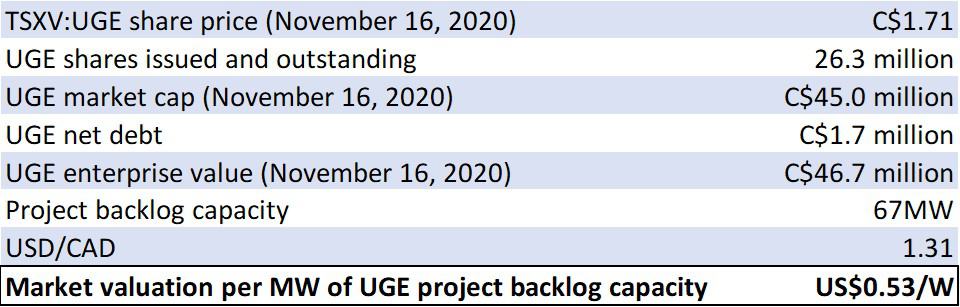

Market is Undervaluing UGE Versus Recent Project Sale and Peer Transactions

Exhibit 1 showed that solar projects under development have sold for between US$0.70/W and US$1.33/W, and UGE just sold an operational project for a net value of US$1.10/W. However, based upon UGE’s November 16, 2020 stock price, the market is valuing UGE at about US$0.53/W (Exhibit 2), around a 24% discount to the minimum US$0.70/W peer transactions have commanded, and a much more significant discount to the higher end. Further compounding this discount is that UGE expects to have 67MW of backlog projects operational within two years. Applying US$1.10/W to UGE’s 67MW of backlog suggest UGE’s stock has room for significant appreciation. For perspective, a net valuation of US$1.10/W implies a stock price of about $3.50 to $4.00/share for UGE, all else equal and before factoring in any additional project wins.

Exhibit 2: Current Market Valuation of UGE (per Watt Basis)

Source: Company reports, Sophic Capital

UGE’s Project Sale Demonstrates Access to Non-Dilutive Cash

UGE International’s [TSXV:UGE; OTC:UGEIF] business strategy is to own and operate community solar projects it designs and finances. UGE’s sale of a 300kW operational solar project for about US$2.30/W (US$1.10/W including debt associated with the project) demonstrates that the Company has access to cheap capital, if required. The August 2020 purchase by Carlyle for an under-development project in Maine for US$1.30/W suggests buyers are willing to purchase pre deployment projects as well. That said, we are not suggesting that UGE will continue to sell projects; nor are we saying the balance sheet is stretched, but simply a willingness for buyers to purchase solar projects, which are either in development or operational at valuations significantly higher than implied by UGE’s stock price.

Management has been an excellent steward of the Company’s capital table (less than 27 million shares issued and outstanding and about 30 million fully diluted). This is not surprising given that management and insiders own about 51% of shares. Insider interests are fully aligned with shareholder interests, and should the market re-rate small cap stock UGE on a per watt basis that is inline with peer transactions, all shareholders should benefit.

Disclosures

UGE International has contracted Sophic Capital for capital markets advisory and investor relations services.

Disclaimer

The information and recommendations made available through our emails, newsletters, website and press releases (collectively referred to as the “Material”) by Sophic Capital Inc. (“Sophic” or “Company”) is for informational purposes only and shall not be used or construed as an offer to sell or be used as a solicitation of an offer to buy any services or securities. In accessing or consuming the Materials, you hereby acknowledge that any reliance upon any Materials shall be at your sole risk. In particular, none of the information provided in our monthly newsletter and emails or any other Material should be viewed as an invite, and/or induce or encourage any person to make any kind of investment decision. The recommendations and information provided in our Material are not tailored to the needs of particular persons and may not be appropriate for you depending on your financial position or investment goals or needs. You should apply your own judgment in making any use of the information provided in the Company’s Material, especially as the basis for any investment decisions. Securities or other investments referred to in the Materials may not be suitable for you and you should not make any kind of investment decision in relation to them without first obtaining independent investment advice from a qualified and registered investment advisor. You further agree that neither Sophic, its, directors, officers, shareholders, employees, affiliates consultants, and/or clients will be liable for any losses or liabilities that may be occasioned as a result of the information provided in any of the Material. By accessing Sophic’s website and signing up to receive the Company’s monthly newsletter or any other Material, you accept and agree to be bound by and comply with the terms and conditions set out herein. If you do not accept and agree to the terms, you should not use the Company’s website or accept the terms and conditions associated to the newsletter signup. Sophic is not registered as an adviser or dealer under the securities legislation of any jurisdiction of Canada or elsewhere and provides Material on behalf of its clients pursuant to an exemption from the registration requirements that is available in respect of generic advice. In no event will Sophic be responsible or liable to you or any other party for any damages of any kind arising out of or relating to the use of, misuse of and/or inability to use the Company’s website or Material. The information is directed only at persons resident in Canada. The Company’s Material or the information provided in the Material shall not in any form constitute as an offer or solicitation to anyone in the United States of America or any jurisdiction where such offer or solicitation is not authorized or to any person to whom it is unlawful to make such a solicitation. If you choose to access Sophic’s website and/or have signed up to receive the Company’s monthly newsletter or any other Material, you acknowledge that the information in the Material is intended for use by persons resident in Canada only. Sophic is not an investment advisor nor does it maintain any registrations as such, and Material provided by Sophic shall not be used to make investment decisions. Information provided in the Company’s Material is often opinionated and should be considered for information purposes only. No stock exchange or securities regulatory authority anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. Sophic and/or its principals and employees may have positions in the stocks mentioned in the Company’s Material and may trade in the stocks mentioned in the Material. Do not consider buying or selling any stock without conducting your own due diligence and/or without obtaining independent investment advice from a qualified and registered investment advisor. The Company has not independently verified any of the data from third party sources referred to in the Material, including information provided by Sophic clients that are the subject of the report, or ascertained the underlying assumptions relied upon by such sources. The Company does not assume any responsibility for the accuracy or completeness of this information or for any failure by any such other persons to disclose events which may have occurred or may affect the significance or accuracy of any such information. The Material may contain forward looking information. Forward-looking statements are frequently, but not always, identified by words such as “expects,” “anticipates,” “believes,” “intends,” “estimates,” “potential,” “possible,” “projects,” “plans,” and similar expressions, or statements that events, conditions or results “will,” “may,” “could,” or “should” occur or be achieved or their negatives or other comparable words and include, without limitation, statements regarding, projected revenue, income or earnings or other results of operations, strategy, plans, objectives, goals and targets, plans to increase market share or with respect to anticipated performance compared to competitors, product development and adoption by potential customers. These statements relate to future events and future performance. Forward-looking statements are based on opinions and assumptions as of the date made, and are subject to a variety of risks and other factors that could cause actual events/results to differ materially from these forward looking statements. There can be no assurance that such expectations will prove to be correct; these statements are no guarantee of future performance and involve known and unknown risks, uncertainties and other factors. Sophic provides no assurance as to future results, performance, or achievements and no representations are made that actual results achieved will be as indicated in the forward looking information. Nothing herein can be assumed or predicted, and you are strongly encouraged to learn more and seek independent advice before relying on any information presented.