(Solar) Power to the People

Community solar is a structure whereby a solar energy project provides power to a set of subscribers (aka the “community”), typically a mix of households, organizations, and businesses. These systems are located in a central location and provide electricity to the participating community members through credits on their utility bills. Subscribers do not need to be close to the solar project so long as they are in the same electric utility territory as the project. Since a physical connection between the project and its subscribers is not necessary, community solar allows individuals and businesses who may not have the physical space or financial means to install their own solar panels to participate in the benefits of solar energy. Doing so increases the addressable market opportunity and overall adoption of solar energy, leading to positive environmental and economic impacts.

In the United States, community solar projects provide electricity to the local utility for redistribution, generating credits which are sold to subscribers at a discount (usually about 10%) to the utility rates. Subscribers still consume energy the way they always have (via their local utility), but their utility bills reflect credits purchased from the community solar project. In other words, they can ‘go green’ while saving money and at no cost.

Incentives for U.S. Community Solar Adoption

Community solar is a robust and growing market, with the Department of Energy targeting 8X growth through 2025, enough to power 1 million homes across the country. To encourage community solar project development, the U.S. federal government has instated a number of incentives, including:

1. Investment Tax Credit (ITC): Created during President Bush’s administration, businesses and individuals can claim this federal tax credit if they invest in solar energy. The ITC is currently set at 30% of the “basis” of the solar energy project and can hypothetically be as high as 70% for projects that use domestic content, are located in low income or Native American lands, provide benefit to lower and moderate-income communities, and/or are located in so called “energy communities”. For a project that utilizes third-party tax equity, the basis is generally understood to be the appraised value of the project, which can be significantly higher than a project’s cost basis.

2. Production Tax Credit (PTC): This credit was introduced under the American Taxpayer Relief Act of 2012 during President Obama’s administration. The PTC provides a financial incentive for the production of electricity from renewable sources such as solar, wind, and geothermal. The PTC is currently set at 1.5 cents per kilowatt-hour of electricity produced from a solar energy system but has similar “adders” based on certain criteria that can enhance this value significantly. A solar project can choose only one of the ITC and PTC, and for community solar projects, the ITC is usually more lucrative.

3. On June 28, 2023, the Environmental Protection Agency (EPA) unveiled the US$7 billion Solar for All Notice of Funding Opportunity. Under this program, Solar for All intends to grant a maximum of 60 awards to various entities, including states, territories, tribal governments, municipalities, and nonprofit organizations. The primary objective of these grants is to facilitate the expansion of low-income and disadvantaged communities’ readiness for residential solar investments. This initiative aims to empower millions of low-income households, providing them with the means to access cost-effective, resilient, and environmentally clean solar energy solutions.

4. There are several programs that fall within federal government departments. For example, the Department of Energy issues grants for research and development and manages the Loan Programs Office, which issues loans to various renewable energy, energy efficiency, and clean transportation initiatives. The Department of Agriculture also offers both grants and loan guarantees for solar projects that meet certain criteria.

In addition, state policy helps drive solar adoption, including community solar. Nearly half of all U.S. states have enacted community solar policies that may also include Renewable Energy Credits, tax holidays, and upfront incentives, such as grants provided by New York’s NYSERDA.

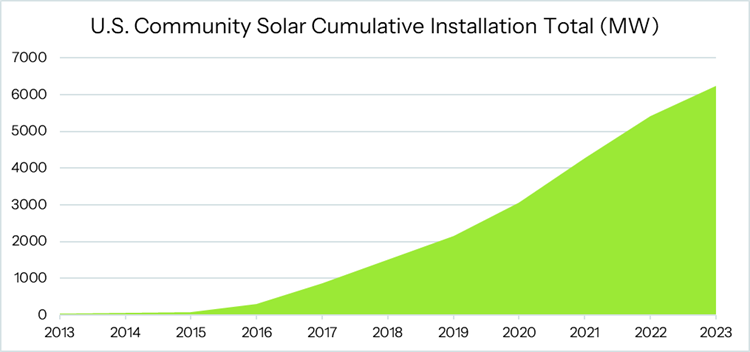

Even within states that lack specific community solar guidance, such projects can be found. When Sophic Capital published our Solar is Hot – Community Solar is Hotter report, community solar projects could be found across 39 states plus Washington D.C. as of December, 2021. As of December 2022, one year later, community solar projects are located in 43 states, plus Washington, D.C., with almost three quarters of the total market concentrated in just four states: Florida (1,636 MW, no change), New York (1,166 MW, up 59.5% from 731 MW), Minnesota (875 MW, up 4.9% from 834 MW), and Massachusetts (858 MW, up 27.3% 674 MW). Cumulatively through the first half of 2023 there was approximately 5.8 GW installed nationwide.

Roadblocks to U.S. Community Solar Adoption

Some factors that may inhibit the adoption of community solar energy in the United States include:

1. Interconnection challenges: Connecting projects to the local electric utility’s infrastructure is crucial, requiring developers to collaborate closely with utilities. Although strategies like reducing project scope and cultivating strong relationships with utilities can be effective on a project-by-project basis, more comprehensive policy changes are essential to shortening interconnection timelines. With the introduction of various energy programs and incentives, there has been a substantial influx of new projects. This surge in demand has placed a strain on existing interconnection processes, resulting in slower-than-expected timelines.

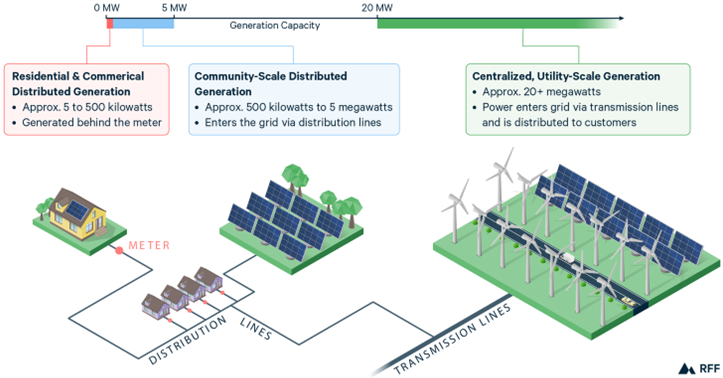

The situation may appear challenging, but it is important to distinguish between various types of power projects. Unlike utility-scale solar projects, which can have a more substantial impact on a utility’s overall performance and require transmission-level studies, community solar projects are typically connected at the feeder and distribution level (Exhibit #1). This characteristic tends to result in shorter delays as more time consuming and expensive transmission-level studies can be side-stepped.

To address and mitigate the risk of project delays, the primary strategy is to target utility interconnection points that have available capacity, aiming to minimize interconnection-related timelines. Another factor is to be highly selective in choosing the locations of projects. Stringent project selection process allows for greater control and oversight, further reducing potential delays. In fact, some utilities have accelerated approval timelines for projects beneath a certain size, which again favors community solar over utility scale projects.

Exhibit 1: Renewable Energy Generation and Integration into the Grid

Source: Resources for the Future: Integrating Renewable Energy Resources into the Grid

2. Complexity: Subscribing to a community solar project can sometimes be complex, with different rules and regulations in place depending on the state or region. For example, subscribers often need to navigate two bills: one from their utility and one from the solar project. This can be confusing for some individuals and businesses and may discourage participation. That said, this is evolving rapidly as the sector grows, with integrated billing becoming the norm in most mature markets.

3. Limited awareness: Many individuals and businesses are not yet aware of community solar as an option for their energy needs, which can limit adoption.

4. Limited access: Many households currently have limited access to community solar projects due to the availability of projects to subscribe to or other barriers.

The Bright Side of U.S. Low-Income Community Solar

Community solar projects can provide opportunities for individuals and businesses in low-income communities to access solar energy along with the financial and environmental benefits it can provide. The cost of energy serves as a disproportionately high percentage of low-income households’ budgets. By subscribing to community solar energy, this demographic can both save money and reduce their environmental footprint.

To further enhance the social impact of community solar, some state programs have implemented income-based subscription models that allow low-income households to participate at a reduced cost. In addition, some states have implemented programs that specifically target the deployment of community solar projects in low-income communities. Lastly, the Inflation Reduction Act provides the ‘adders’, discussed above, which incentivize developers by enhancing the value of the investment tax credit if a certain percentage of energy from a project is purchased by low- and moderate-income subscribers.

Energizing Commercial Real Estate

In addition to providing economic and environmental benefits to subscribers, there are several reasons why commercial, industrial, and agricultural property owners in the U.S. are interested in hosting community solar projects:

1. Passive income: a community solar project host receives a long-term lease for their land or rooftop at competitive rates.

2. Building upgrades: a common project structure includes the developer providing the building owner with funds to renew its roofing membrane (or other capital expenditures to enhance the building), in return for a lower than market lease payment. This financial assistance can be a major driver to why a building owner, facing such capital expenditures, will be incentivized to host a system.

3. Tenant diversification: Community solar projects can provide a way for commercial property owners to expand and diversify their tenant base, while providing long-term certainty through the long-term lease.

4. Shareholder engagement: many REITs and other businesses have environment goals which align with their shareholder interests that may include adoption of renewable energy, and hosting community solar can be “found money” with no out of pocket cost.

5. Lower energy costs: a project host will often get first rights to subscribe to a portion of the energy generated by the project, thereby both receiving a lease payment as well as cheaper energy.

Market Size – It’s Not Just a Ray of Sunshine

The growth rate of community solar in the United States has been steadily increasing in recent years. According to the Solar Foundation, the number of community solar projects in the United States grew from just a handful in 2010 to over 1,000 in 2020. This represents a compound annual growth rate of approximately 70% over the past decade. As of the close of 2023, the total installed capacity in this sector was estimated to be 6.2GW, with nearly half of that capacity (2.2GW) installed in 2021 and 2022 alone, demonstrating ever-increasing momentum.

Wood Mackenzie forecasts a robust 118% growth in the U.S. community solar market over the next five years. This growth is expected to be driven by the addition of a minimum of 6 gigawatts (GW) of community solar capacity within existing markets between 2023 and 2027. This would represent over a doubling of the total market in just four years.

Wood Mackenzie went on to say that the outlook for existing community solar markets in the United States is promising, with an anticipated annual average growth rate of 8%. This trajectory is expected to lead to the accumulation of nearly 14 GW of capacity by the year 2028. However, this forecast does not incorporate the potential impact of new programs, which could potentially yield a substantial increase in capacity and further boost the sector’s growth prospects.

In January 2023, The Coalition for Community Solar Access announced a new target of 30 GW of community solar by 2030, stating that achievement of this goal will require an acceleration of installed capacity in existing markets and the continued establishment of new state markets.

The growth of community solar in the United States has been supported by a number of factors, including:

1. Falling costs: The cost of solar energy has declined significantly in recent years, making it possible to offer subscribers both economic and environmental benefits through community solar.

2. Regulatory: The number of states with specific community solar legislation has expanded rapidly, providing a framework to develop such projects.

3. Government incentives: The U.S. federal government and many state governments have implemented a range of incentives to encourage the development of community solar projects, including investment tax credits, production tax credits, and renewable portfolio standards.

Leaders in Community Solar Generation

There are many companies that are involved in the development and operation of community solar projects in the United States. Some of the leading companies in this space include:

1. Altus Power (NYSE:AMPS) is a full-service solar company offering commercial, industrial, and community solar customer-focused solutions across the United States. Its services range from on-site solar generation for commercial, industrial, and public customers, to community solar, energy storage, and electric vehicle charging.

2. Solstice (private, subsidiary of Mitsui) is a solar energy company that specializes in developing community solar projects. The company works with utilities, businesses, and communities to design and build community solar projects that meet their specific needs.

3. Summit Ridge Energy (private) is an independent community solar power producer focused on project financing, project acquisition, and project development.

4. Nexamp (private) is a renewable energy company that specializes in the development, construction, and operation of solar energy projects, including community solar. The company works with utilities, businesses, and communities to bring clean, affordable energy to a wide range of customers.

5. Sophic Capital client UGE International [TSXV:UGE; OTCQB:UGEIF] develops, finances, builds, owns, and operates solar projects for the 80% of U.S. households and 90% of businesses that cannot install solar projects themselves. UGE is focused on providing access to renewable energy through subscriptions to the community solar projects it develops. UGE has over 14 years of history in this mid-scale solar market and reported 343 MW of project backlog on September 30, 2023. UGE recently reported that its operational portfolio had expanded 2.8X in 2023 alone. UGE has contracted community solar off-take agreements with T-Mobile and Bloomberg for the solar energy it generates. Management and insiders own over 33% of the Company’s shares.

Coming up…

In our next report, we’ll delve more into state-level programs that could benefit UGE and look at how UGE finances projects and an example project’s associated cash flows.