Simple, Profitable, and Scalable

Report #1 Recap

In Sophic Capital’s Endeavor Unleashed report, we looked at how Sophic Capital client ADM Endeavors, Inc. [OTCQB:ADMQ] (“ADM” or the “Company”) a diversified, direct marketing and value-added manufacturing company fits into the American markets for promotional products and uniforms. ADM has intentionally pursued contracts with government bodies and schools to secure dependable, reoccurring revenue streams.

Every single consumer for every single product is a potential recipient of branded promotional products. Countless thousands of promotional products have a far greater reaching impact than most people might think, considering the following facts:

- 83% of customers say they enjoy receiving a promotional product with an advertising message;

- After receiving a promotional product, 85% of customers say they do business with the company;

- 58% of customers keep a promotional product for up to four years;

- 89% of customers can recall the advertiser on a promotional product they received in the past two years;

- A promotional product increases the effectiveness of other media by 44%.

In this report, we’ll look at ADM’s revenue model, balance sheet, and catalysts for growth.

ADM’s Revenue Model

ADM Endeavors recognizes revenue for merchandise sales, net of expected returns and sales tax, at the time of in-store purchase or delivery of the product to its customers. When merchandise is shipped to customers, the Company estimates receipts based on historical experience. Revenue is deferred and a liability is established for sales returns based on historical return rates (less than 2 out of every 1000 orders) and sales for the return period. ADM recognizes an asset and corresponding adjustment to cost of sales for its right to recover returned merchandise. At each financial reporting date, the Company assesses its estimates of expected returns, refund liabilities and return assets. For merchandise sold in ADM’s stores and online, tenders are accepted at the point of sale. When ADM receives payment before the customer has taken possession of the merchandise, the amount received is recorded as deferred revenue until the transaction is complete. The Company’s performance obligations for unfulfilled merchandise orders are typically satisfied within one week. Shipping and handling fees charged to customers relate to fulfilment activities and are included in net sales with the corresponding costs recorded in cost of sales.

Balance Sheet

As of the January 2024 corporate update, ADM had a cash balance of US$300 thousand and had access to a US$3.5 million line of credit. The Company has ample resources to pursue its expansion initiatives and capitalize on emerging opportunities in its target markets.

In late 2022, ADM secured a US$4.6 million debt facility, facilitated through a construction loan with a competitive interest rate of 5.5%. The purpose of this financing was to facilitate the construction of an 80,000 square-foot facility, strategically positioned to accommodate anticipated growth opportunities. CEO Marc Johnson has personally guaranteed the $4.6 million loan, underscoring his confidence in the business’s future and its ability to effectively manage the debt obligation. As of September 30, 2023, the last reported quarter, ADM had US$1.5 million of debt on the books.

The current business plan does not anticipate additional capital raises (barring further potential acquisitions).

Financial Performance

For the full year ended December 31, 2023, preliminary results indicate a decrease in revenue from US$5.6 million in FYE2022 to ~US$5.2 million in FYE2023. However, despite the lower sales figures for the fiscal year, the Company remained profitable. Notably, Q4 2023 unaudited revenues amounted to ~US$1.3 million, reflecting a 43% year-over-year increase.

The preceding year marked a pivotal phase of regrouping and restructuring for ADM as it confronted the aftermath of a US$2.5 million revenue loss stemming from YouTube influencer merchandise sales. This adversity underscored the imperative of diversifying the customer base and fortifying resilience against economic downturns. Presently, ADM boasts an extremely diversified revenue mix, with no single client accounting for more than 3% of its total revenue, a contrast to 2022 when individual customers represented as much as 20% of sales. This strategic shift towards a more balanced client portfolio reflects the Company’s commitment to mitigating concentration risks and enhancing stability in its revenue streams.

Recent Company tweets suggest that YouTube influencer merchandise sales are coming back. This resurgence could be upside to the stable base business ADM has built.

The launch of the new facility in 2024 would represent a significant milestone for ADM, catalyzing a potential fivefold increase in production capacity. Currently, the Company operates at an in-house capacity level of US$7 million. Once the facility is up and running, the target operational model aims for gross margins exceeding 50% and EBITDA margins surpassing 12%.

Presently, ADM’s gross margins hover around the 30% mark, with EBITDA margins approximately at 10%. With the enhanced capabilities of the new facility, coupled with optimization strategies, ADM anticipates aligning its operational performance more closely with the target model. The anticipated increase in production capacity is expected to drive economies of scale, potentially bolstering gross margins and EBITDA margins towards the target model. This expansion underscores ADM’s commitment to enhancing profitability and creating long-term value for its stakeholders.

Management

ADM Endeavors’ management team has extensive experience in both promotional products and government industries.

- CEO and Chairman Marc Johnson has over 35 years of experience in the promotional products industry. Mr. Johnson started his first business in high school and formed Just Right Products, Inc. in 2010.

- CFO Alex Archer has public sector experience, largely through a prior role with a Berkshire Hathaway subsidiary. Mr. Archer’s current focus is scaling ADM Endeavors for growth.

- National Sales Manager Bruce Boyce has over 10 years experience in sales and international imports. Mr. Boyce joined Just Right Products in October 2019 and has worked on product development from design, production to fulfillment.

Organic Growth

ADM has established a dominant presence in the government vendor sector within the Dallas/Fort Worth area, setting itself apart from major competitors. Unlike these competitors who depend on external carriers, ADM distinguishes itself by managing all embellishments in-house. This approach not only ensures faster service delivery but also contributes to lower product costs, enhancing the overall efficiency of its operations. ADM has implemented a dedicated delivery route, facilitated by full-time drivers, thereby accelerating the delivery process compared to traditional carriers. This logistical advantage adds another layer of efficiency to ADM’s services, contributing to its competitive edge in the government vendor sector.

The success of this operational model in the Dallas/Fort Worth area opens up opportunities for replication in other regions. ADM could consider strategic acquisitions of existing decorators or brokers in different areas to expand its footprint and replicate its successful approach. This strategic move would not only capitalize on the Company’s proven operational efficiency but also enable it to establish a presence in new markets.

ADM boasts a significant competitive advantage through its control of the manufacturing processes. With all manufacturing operations handled in-house, the Company enjoys the flexibility to quickly adapt to specific requests and stringent requirements. This level of control not only enhances responsiveness but also positions ADM as a reliable provider capable of meeting diverse client needs.

The enhanced production capabilities at the new facility should enable ADM to better cater to the evolving needs of its current clientele, fostering stronger relationships and potentially increasing the scope of services offered. Simultaneously, the increased capacity positions ADM to accommodate new corporate customers, expanding its client base and market reach.

ADM anticipates a natural increase in market share within government-supported business without the need for significant additional marketing expenditure. The Company’s strong position is attributed to the consistent demand for uniforms in schools and among municipal employees. To further expand and enhance its current offerings, ADM plans to introduce a workwear retail segment. This expansion involves leveraging the existing labor force from the school uniform store and utilizing stock workwear products used in current contracts. This approach not only helps prevent inventory stagnation but also has the potential to increase profit margins. By integrating workwear into its offerings, ADM aims to provide an enhanced service to government customers, meeting a broader spectrum of their uniform needs. The efficient utilization of resources and diversification of offerings position ADM for sustained success in this market.

Strategic M&A

There is an opportunity for ADM to further strengthen its market position through the consolidation of regional competitors, which would involve bringing the manufacturing processes of targeted competitors in-house. The Promotional Products Association International (“PPAI”) states that there are 26,000 promotional products businesses in the United States. Many are smaller, regional operations providing ample opportunity for ADM Endeavors to consolidate its market. These could add talent, physical assets, customers, and possibly increased profits, and the Company has been actively exploring potential candidates for accretive M&A.

ADM Endeavors has already successfully acquired and integrated a local competitor. On April 27, 2023, the Company purchased the assets of Innovative Impressions, an online B2B platform offering multi-category promotional products generating about US$1 million of revenue. Management knows how to acquire and consolidate competitors and could continue to grow ADM Endeavors beyond its organic trajectory through future M&A.

The impending completion of the new facility could play a pivotal role in ADM’s M&A strategy. It should serve as a centralized hub, allowing for the consolidation of various operations under one roof. This consolidation is anticipated to unlock synergies, providing ADM with operational efficiencies and strategic advantages.

Catalyst – New facility could add up to 5x production capacity

ADM is expected to launch a new facility in the Fall of this year. Currently, the Company is navigating the permitting stage with the city of Fort Worth, as it prepares to transition its operations to a newly acquired 17.5-acre plot obtained in 2020. Comprehensive site and building plans have been developed, encompassing approximately 80,000 square feet dedicated to both retail and production space. This development aligns with ADM’s strategic expansion plans, fortifying its infrastructure and capacity for both retail and production activities in Fort Worth.

Beyond acting as a new manufacturing facility, the building may also host a retail storefront. This retail space could significantly enhance ADM’s presence in the school uniform market, while facilitating the addition of new segments, such as medical uniforms and workwear, to its product portfolio. The expansion into these segments encompasses both retail and bid contract sales, marking a diversification of ADM’s offerings. The introduction of a new medical uniform segment creates an opportunity for ADM to explore untapped markets, particularly in securing government contracts in this specialized field. The retail storefront could play a crucial role in broadening ADM’s market reach, contributing to increased margins, and providing enhanced services to existing government contract customers. With the existing retail space currently operating at maximum capacity, the new storefront not only addresses this limitation but also positions ADM to actively pursue additional school uniform contracts.

Competitors

According to Promotional Products Association International (“PPAI”), in the past five years the United States promotional products industry expanded greatly, with annual revenues of over US$23 billion and growth of over 3% per year. The industry employs over 250,000 people in over 26,000 businesses. Similar to other advertising industries over the period, the growing economy fostered healthy consumer spending, so businesses respond by increasing expenditures on advertisements to capture the attention of shoppers and downstream clients. In addition, an increase in the total number of U.S. businesses added to the industry’s potential pool of clientele, as new companies often use promotional products to endorse their business, product or service. Over the next five years, ADM Endeavors anticipates continued growth in corporate profit and total advertising expenditure could boost industry demand, compelling companies to spend more on promotional products.

Risks Have Been Mitigated Through Strategic Pivot to Government Sales

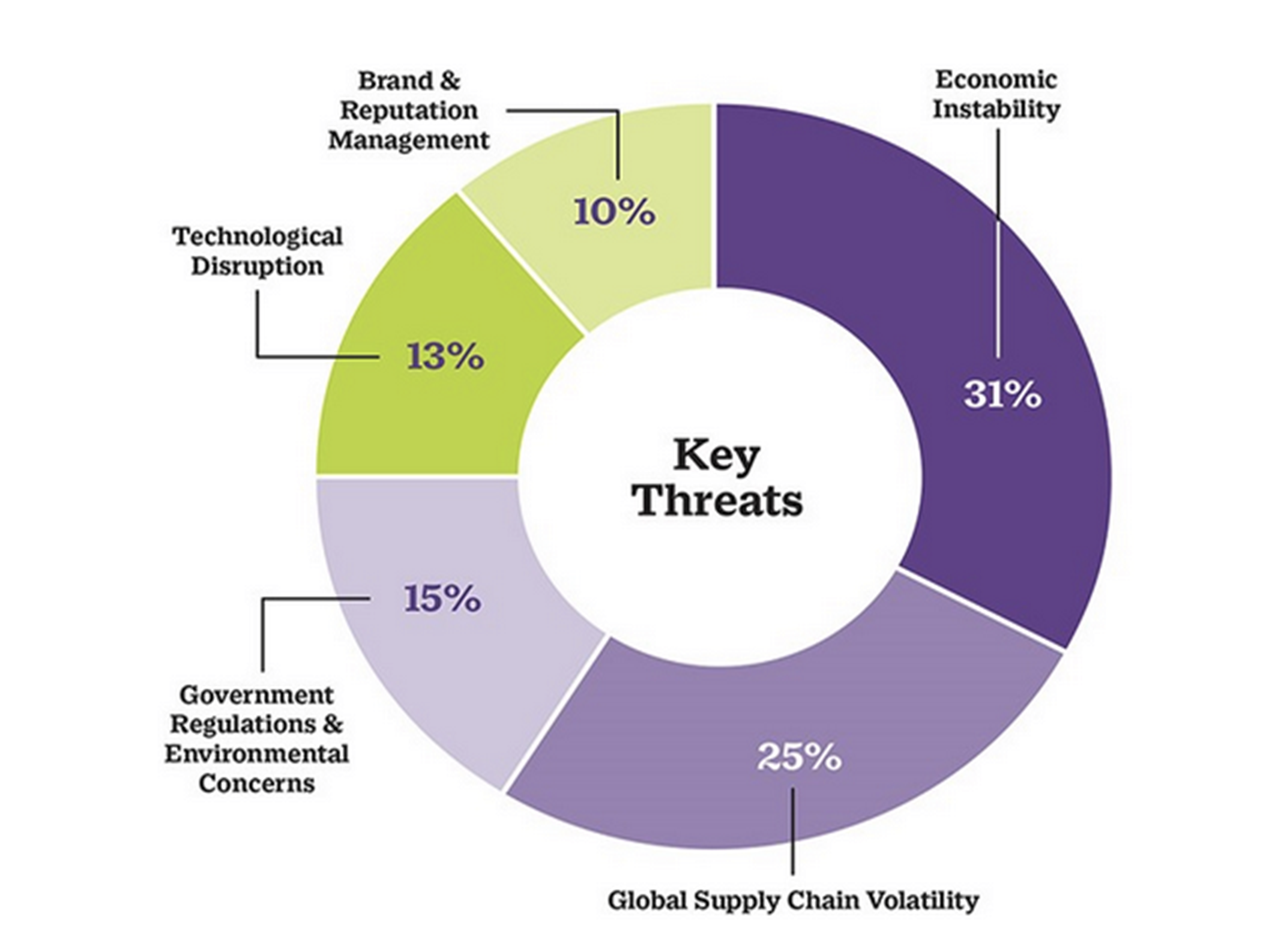

Although ADM Endeavors has a solid and incentivized management team (they own 51% of the Company and have been recent buyers), the Company is subject to the risks of the broader industry (Exhibit 1). However, given the heavy focus on government uniform sales and given management’s solid industry experience and skill at retaining customers, we believe the Company should be well insulated from industry risks detailed in Exhibit 1.

The Company has strategically directed its efforts towards securing contracts with government entities and schools, recognizing the inherent stability and resilience of such business relationships. This focus is driven by the belief that engagements with these entities represent “sticky” business, characterized by a higher likelihood of recurrence. Even in the event of an economic downturn, funding for school systems and government entities tends to remain consistent, providing reliable revenue streams.

This emphasis on sectors less susceptible to economic fluctuations aligns with a broader risk mitigation strategy, acknowledging the relative stability of government-related contracts. By prioritizing these areas, the Company aims to establish a foundation for recurring revenue that can withstand economic challenges. This approach reflects a forward-thinking perspective, emphasizing the importance of securing business in segments with enduring demand, contributing to the Company’s profitability and sustainability in various economic conditions.

Conclusion

American promotional products and uniform are robust, multi-billion-dollar industries with over 26,000 businesses in the former alone. Sophic Capital client ADM Endeavors Inc. [OTCQB:ADMQ] is a leader in the Dallas/Fort Worth area that has ample organic and inorganic growth opportunities. The strategic focus on government entities aims to mitigate economic downturn risks, as funding allocations to these sectors tend to remain resilient irrespective of broader economic fluctuations. Plus, the Company anticipates that a new facility about to start construction could add up to 5 times current capacity. Management has extensive industry experience, owns about 51% of the Company’s shares, and has successfully acquired and integrated a competitor. Investors seeking exposure to the promotional products and/or uniform industries should look at ADM Endeavors Inc.