Estimating the Value of ADM Endeavors

New Fixed Assets

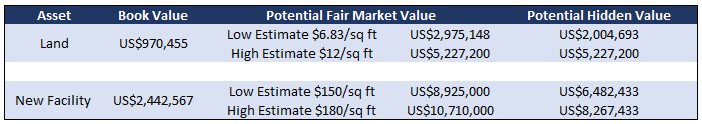

Book Value of Land US$970k versus Potential Fair Market Value of US$3M to US$5M

Book Value of New Facility US$2.4M versus Potential Fair Market Value US$8.9M to US$10.7M

Sophic Capital client ADM Endeavors, Inc. [OTCQB:ADMQ] (“ADM Endeavors”, the “Company”) is a diversified direct marketing and value-added manufacturing company. Its core offering revolves around custom promotional products, uniforms, and wearable items. Strategically targeting contracts with government bodies and educational institutions, ADM Endeavors has commenced construction of a new facility to support its organic revenue growth (by increasing capacity up to five times) and M&A roll-up strategy. Scheduled to open at the end of 2024, we believe the property and future facility are hidden assets not reflected in the stock price, in addition to their potential to drive additional revenue growth. In this report, our focus is on estimating what the fixed assets could be worth.

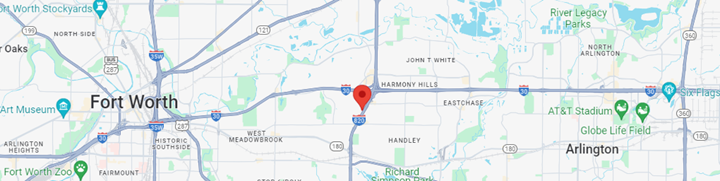

ADM Endeavors is currently building a new two story facility with about 85,000 square foot of floor space on 7.5-acres of land located at 1900 East Loop 820 in Forth Worth, Texas (Exhibit 1). The new facility will serve as a centralized manufacturing hub, fulfillment center, and retail storefront, consolidating operations under one roof, which is also expected to drive margin expansion and better enable ADM Endeavors to grow and serve its customers.

As Exhibit 1 shows, the property is close to the intersection of two major highways – Interstate 30 and highway 820, which is an auxiliary route of Interstate 20. The future facility is situated in a high traffic area, further benefitting to its proximity to AT&T Stadium (home of the Dallas Cowboys), Globe Life Field (Texas Rangers), and a Six Flags amusement park. The current facility does not have this high traffic attribute which should greatly enhance retail sales and increase exposer to new customers at the new facility.

Exhibit 1: Location of ADM Endeavors Facility Under Construction in Fort Worth, Texas

Source: Google Maps

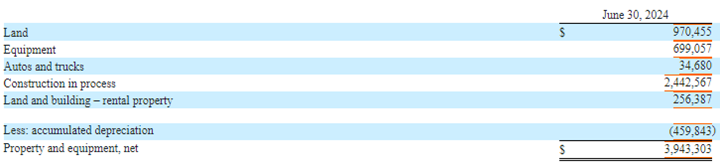

Currently, ADM Endeavors leases an 18,000 square foot facility in Haltom City, Texas. As Exhibit 2 shows, the book value of the land and property on the current facility was US$256,387 as of June 30, 2024. As well, land the Company owns at 1900 East Loop 820 is worth US$970,455 (the Company’s July 2020 8K form states the land was purchased for US$498,000 with 22,232,143 restricted units) and the construction of the new facility was worth US$2,442,567 for a total of US$3,413,022. Our question is what could the land and the new facility potentially be worth?

Exhibit 2: Book Value of ADM Endeavors Property Less Accumulated Depreciation, as of June 30, 2024

Source: EDGAR

Howdy Neighbour!

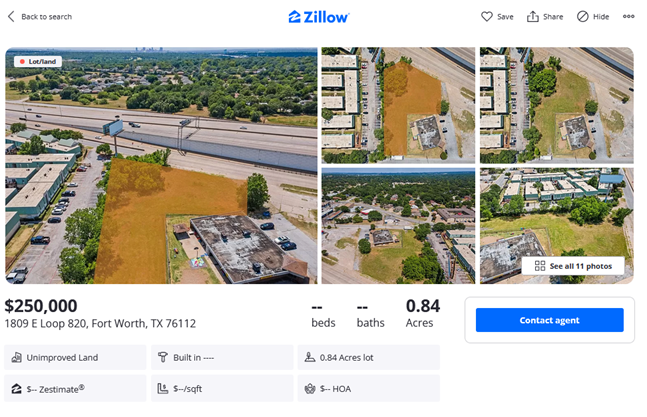

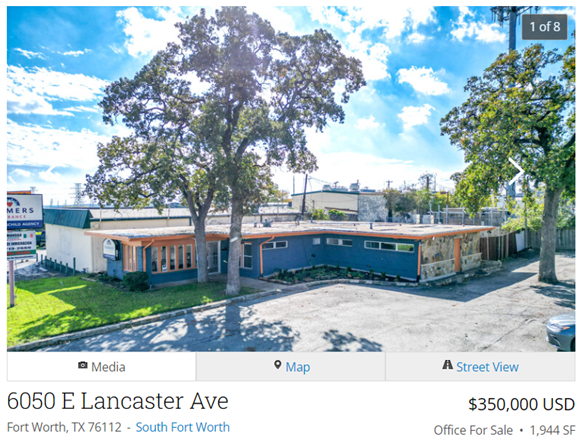

Zillow showed a neighbouring 0.84-acre lot for sale (Exhibit 3) at 1809 East Loop 820 Fort Worth, Texas which is across the highway from ADM Endeavors property at 1900 East Loop 820. This neighbouring lot (36,590 square feet) was priced at US$250,000 or approximately US$6.83 per square foot. However, information from a local real estate agent had another peer property priced at US$12 per square foot.

Applying some “back of the envelope math” using these per square foot values to ADM Endeavors remaining 10-acre (435,600 square feet) lot provides a property valuation of PERHAPS between US$3.0 million to US$5.2 million, about 3 to 5 times what the balance sheet shows and 6 to 10 times the original US$498,000 purchase price. We emphasize “PERHAPS” because we are dealing with few data points to compare to ADM Endeavors land value and real estate market conditions remain in flux.

Exhibit 3: Neighboring Property For Sale Across the Highway at 1809 East Loop 820 Fort Worth, Texas

Source: Zillow

Building Value Through A New Facility

With ADM Endeavors remaining 10-acre property at 1900 East Loop 820 Fort Worth, Texas POSSIBLY worth 3 to 5 times versus what the June 30, 2024, balance sheet indicated, what could the new facility be worth once completed? For our estimation below, we will only be using the 59,500 square foot footprint of the building, excluding the 35,000 square foot second floor, which COULD hold additional value.

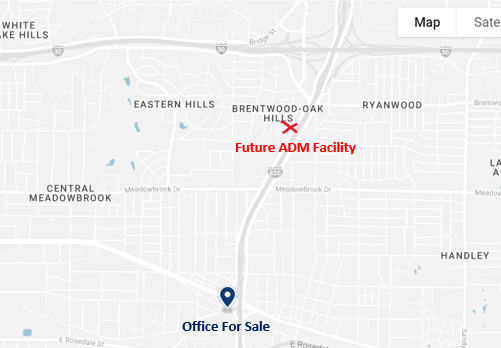

Information we received about peer industrial properties in the area suggest valuations between US$150 to US$160 per square foot. However, as Exhibit 4 illustrates, commercial office space for sale about 2 miles away from the location of ADM Endeavors future facility. On a price per square foot basis, the building is valued at US$180 per square foot. Again, using back of the envelope estimates and applying the lower end of the US$150 per square foot comparable property and the near peer’s US$180 per square foot (Exhibit 4) to ADM Endeavors future 59,500 square foot facility yields a POTENTIAL building value between US$8.9 million to US$10.7 million or about 3 to 5 times more than what Exhibit 2 shows as the value of construction June 30, 2024. As a reminder, the US$8.9 million to US$10.7 million only values the 59,500 square foot footprint of the building and does not include the POTENTIAL additional value that yielded from the 35,000 square foot second floor of the facility. Again, we emphasize “POTENTIAL” and “COULD” because we are dealing with few data points to compare to ADM Endeavors facility value and real estate market conditions remain in flux.

Exhibit 4: Commercial Office Space For Sale Down the Highway

Source: CityFleet.com

Conclusion

ADM Endeavors remaining 10-acre (435,600 square feet) lot has an estimated property value that could range from US$3.0 million to US$5.2 million, which is roughly 3 to 5 times higher than the current balance sheet valuation and 6 to 10 times the original purchase price of US$498,000. The Company’s upcoming 59,500 square foot facility (reminder that this calculation only represents the ground floor footprint, and excludes the 35,000 square foot second floor, which could hold additional value) could have a potential building value between US$8.9 million to US$10.7 million, approximately 3 to 5 times more than the construction value listed on the balance sheet as of June 30, 2024 (Exhibit 5).

Exhibit 5: Summary of Book Value versus Potential Fair Market Value of ADM Endeavors Assets

Source: Sophic Capital Estimates, Local Real Estate Listings

We caution that investors should not rely upon these estimates since they are based off of a few data points of unsold properties. We are saying that we believe that ADM Endeavors [OTCQB:ADMQ] property at 1900 East Loop 820 Fort Worth, Texas and new facility under construction may be undervalued. Beyond this asset perspective, we believe management can extract additional value through future revenue growth at the facility and potential margin expansion. One could make the case that this hidden asset value and business/margin expansion opportunities are not reflected in the Company’s share price.

Disclosures

ADM Endeavors Inc. [OTCQB:ADMQ] has contracted Sophic Capital for capital markets advisory and investor relations services.

Disclaimers

The information and recommendations made available through our emails, newsletters, website and press releases (collectively referred to as the “Material”) by Sophic Capital Inc. (“Sophic” or “Company”) is for informational purposes only and shall not be used or construed as an offer to sell or be used as a solicitation of an offer to buy any services or securities. In accessing or consuming the Materials, you hereby acknowledge that any reliance upon any Materials shall be at your sole risk. None of the information provided in our monthly newsletter and emails or any other Material should be viewed as an invite, and/or induce or encourage any person to make any kind of investment decision. The recommendations and information provided in our Material are not tailored to the needs of particular persons and may not be appropriate for you depending on your financial position or investment goals or needs. You should apply your own judgment in making any use of the information provided in the Company’s Material, especially as the basis for any investment decisions. Securities or other investments referred to in the Materials may not be suitable for you and you should not make any kind of investment decision in relation to them without first obtaining independent investment advice from a qualified and registered investment advisor. You further agree that neither Sophic, its, directors, officers, shareholders, employees, affiliates consultants, and/or clients will be liable for any losses or liabilities that may be occasioned as a result of the information provided in any of the Material. By accessing Sophic’s website and signing up to receive the Company’s monthly newsletter or any other Material, you accept and agree to be bound by and comply with the terms and conditions set out herein. If you do not accept and agree to the terms, you should not use the Company’s website or accept the terms and conditions associated to the newsletter signup. Sophic is not registered as an adviser or dealer under the securities legislation of any jurisdiction of Canada or elsewhere and provides Material on behalf of its clients pursuant to an exemption from the registration requirements that is available in respect of generic advice. In no event will Sophic be responsible or liable to you or any other party for any damages of any kind arising out of or relating to the use of, misuse of and/or inability to use the Company’s website or Material. The information is directed only at persons resident in Canada. The Company’s Material or the information provided in the Material shall not in any form constitute as an offer or solicitation to anyone in the United States of America or any jurisdiction where such offer or solicitation is not authorized or to any person to whom it is unlawful to make such a solicitation. If you choose to access Sophic’s website and/or have signed up to receive the Company’s monthly newsletter or any other Material, you acknowledge that the information in the Material is intended for use by persons resident in Canada only. Sophic is not an investment advisor, nor does it maintain any registrations as such, and Material provided by Sophic shall not be used to make investment decisions. Information provided in the Company’s Material is often opinionated and should be considered for information purposes only. No stock exchange or securities regulatory authority anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. Sophic and/or its principals and employees may have positions in the stocks mentioned in the Company’s Material and may trade in the stocks mentioned in the Material. Do not consider buying or selling any stock without conducting your own due diligence and/or without obtaining independent investment advice from a qualified and registered investment advisor. The Company has not independently verified any of the data from third party sources referred to in the Material, including information provided by Sophic clients that are the subject of the report, or ascertained the underlying assumptions relied upon by such sources. The Company does not assume any responsibility for the accuracy or completeness of this information or for any failure by any such other persons to disclose events which may have occurred or may affect the significance or accuracy of any such information.

The Material may contain forward looking information. Forward-looking statements are frequently, but not always, identified by words such as “expects,” “anticipates,” “believes,” “intends,” “estimates,” “potential,” “possible,” “projects,” “plans,” and similar expressions, or statements that events, conditions or results “will,” “may,” “could,” or “should” occur or be achieved or their negatives or other comparable words and include, without limitation, statements regarding, projected revenue, income or earnings or other results of operations, strategy, plans, objectives, goals and targets, plans to increase market share or with respect to anticipated performance compared to competitors, product development and adoption by potential customers. These statements relate to future events and future performance. Forward-looking statements are based on opinions and assumptions as of the date made and are subject to a variety of risks and other factors that could cause actual events/results to differ materially from these forward-looking statements. There can be no assurance that such expectations will prove to be correct; these statements are no guarantee of future performance and involve known and unknown risks, uncertainties and other factors. Sophic provides no assurance as to future results, performance, or achievements and no representations are made that actual results achieved will be as indicated in the forward-looking information. Nothing herein can be assumed or predicted, and you are strongly encouraged to learn more and seek independent advice before relying on any information presented.