The Next Investment Frontier for Drones

ABSTRACT: The aerial drone market could be cumulatively worth $91 billion over the next decade. As attractive as this market is, Sophic Capital believes that there is a nascent drone market which could prove more lucrative to investors – sea drones, or unmanned underwater vehicles.

Water covers over 70% of the Earth, yet we’ve explored less than 5% of seabeds due to the sea’s hostile environment, an environment better suited for machines than humans. We believe the unmanned underwater vehicle industry, which MarketsandMarkets estimates will be worth $4.8 billion by 2019, will ramp in a similar manner to its aerial drone cousin.

Reasons to Read this Report

- The aerial drones market continues to expand; the unmanned underwater vehicle, or sea drone, market is a nascent industry at an inflection point;

- Water covers 70% of the Earth’s surface, yet we’ve mapped only 5% of the seabed (never mind everything between the surface and the seabed), creating a big opportunity;

- You’ll learn about the different types of unmanned underwater vehicles (UUV);

- An industry insider tells us how he sees UUVs evolving in the oil and gas sector;

- You’ll read about the diverse industries set to adopt UUVs, en masse;

- You’ll understand the types of technology used in UUVs;

- You’ll learn about investable companies, including Kraken Sonar Systems (TSXV:PNG), a Sophic Capital client.

Introduction

On September 8, 2015, Sophic Capital published our aerial drone report, Drones: A Rising Market. In that report, we stated that:

- The aerial drone market could cumulatively generate $91 billion over the next decade[i];

- The military sector has been the biggest adopter of aerial drones;

- Aerial drones are starting to penetrate the consumer and industrial spaces (possibly a $1 billion to $2 billion market by 2023);

- Large industrial companies compete in this space including: Lockheed Martin (NYSE:LMT). Northrop Grumman (NYSE:NOC), and L-3 (NYSE:LLL); and,

- Funding for aerial drone startups is accelerating in 2015.

Although we see healthy growth continuing in the aerial drone market across the military, consumer, and industrial verticals, we believe investors could find even larger returns in the drone market focused on the Earth’s final unexplored frontier – the sea. We are before the inflection point, and this drone report, our second, focuses on the underwater drone market, or the “unmanned underwater vehicle” market as it is known in the industry.

Water: The Next Big Drone Frontier

About 70% of the Earth’s surface is covered by water, with the oceans holding over 96% of that water.[ii] The total volume of the Earth’s water is 1.386 billion km³, which would fill a sphere that has a 1,365 kilometer diameter.[iii]

Less than 5% of the ocean seabeds are mapped.[iv] Oceans are hostile environments; frigid temperatures, crushing pressure, and lack of light make oceans dangerous for human exploration. And although men and women have braved these treacherous conditions for centuries, technology has advanced to minimize human exposure to these dangerous aquatic environments.

Unmanned underwater vehicles are becoming responsible for the most dull, dirty, and dangerous sea jobs. These vehicles undertake mapping, water-sampling, harbour patrolling, and sea mine detection duties, making the seas safer for everyone.

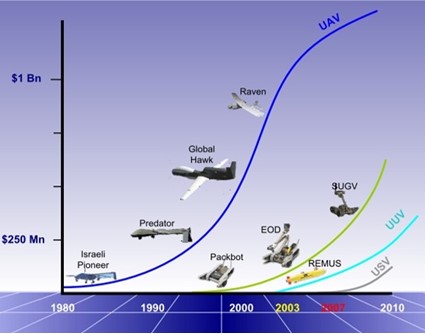

The nascent UUV industry is where the unmanned aerial industry (UAV) was in the 1990s – heavily used by the military. Militaries are increasingly adopting UUVs, a market forecasted to be worth $4.8 billion by 2019.[v] Given this, we believe that the underwater drone market could ramp like the aerial drone market did years ago. Our reasoning is that navies have already adopted UUVs for numerous applications ranging from harbour patrol to naval mine detection. Several non-military verticals, which we detail later in this report, are also utilizing UUVs. And although we believe the commercial seabed survey market is the largest, long-term UUV opportunity, the military industry appears to be the closest market to monetize.

Sizing the Underwater Drone Market Opportunity

We like to think of the UUV market as the underwater drone market. Furthermore, we believe that the UUV market is about to ramp as the aerial drone market did during the 1990s. There are several market drivers to accelerate this ramp. These include seabed mining, oil and gas, and telecommunications.

Research firm MarketsandMarkets forecasts the UUV market will grow from $1.2 billion in 2014 to $4.8 billion in 2019.[vi] MarketsandMarkets also estimates that the global AUV market will expand from $457 million in 2014 at almost 32% CAGR through 2019. [vii] Douglas-Westwood estimates that from 2015 through 2019, global subsea vessel operating expenditures will generate $122 billion.[viii] The firm also anticipates that by 2018, 825 AUVs will be deployed across the globe, led by the military sector.[ix]

Early Stages of the Underwater Drone Market

Underwater exploration was once the domain of divers and limited by how long they could hold their breath. This expanded to snorkeling with hollow reeds. One of the first technical breakthroughs came in 1797 when Karl Klingert invented “The Diving Machine,” a design that left the arms and legs exposed but head and chest protected from the water pressure. This design evolved from a leather bag filled with air that Giovanni Borelli tested in 1680.

In the 1620s, Cornelius Drebbel created the first working submarine.[x] By 1800, France had built a human powered submarine called the Nautilus. During the 1860s, the U.S. Navy contracted a submarine design, the Alligator, which was built but never deployed into battle – the Alligator was cut adrift to prevent the USS Sumpter (its tow ship) from sinking. The Titanic tragedy brought calls to develop systems for detecting underwater objects and threats. Canadian Reginald Fessenden developed an underwater echo system (circa 1912) to detect underwater threats and objects.[xi] By 1918, the French and British Navies developed ASDIC (Anti-Submarine Detection Investigation Committee) to conduct submarine detection research. ASDIC was deployed during World War I and transferred to the United States for further development during World War II. The Americans adopted the SONAR acronym – SOund NAvigation and Ranging – to describe the technology.

Source: Undersea Warfare

Post war sonar applications expanded rapidly. Some non-military sonar uses include: fish detection for the fisheries, echo sounding (determining water depth), net location, crashed aircraft location, wave measurement, bathymetric mapping, and water velocity measurement.

Types of UUV

An unmanned underwater vehicle (UUV) is a vehicle that operates underwater without people onboard. There are two types of UUVs: autonomous underwater vehicles (AUV), which are untethered and operate without the input from a surface-based operator, and remotely operated underwater vehicles (ROV), which are tethered and operate with the input of a surface-based operator. Some UUVs operate on the water’s surface and are known as unmanned surface vehicles (USV). The desire to take operators out of harm’s way has driven the growth of USVs, and these USVs often carry and deploy AUVs to achieve this vision.

Autonomous Underwater Vehicles (AUVs)

AUVs operate independently in the sea without the need for a human controller or tether. These robots carry all power (lithium ion batteries, fuel cells, or diesel fuel) onboard and are self-guiding. Since they are untethered, they eliminate the risk that the tether could become entangled in a tightly navigated area. Plus, they eliminate the tons of cabling required to tether a UUV to a ship.

The military currently uses the most AUVs, and market research firm Douglas-Westwood forecasts that by 2018, commercial applications will represent 9% of the AUV market.[xii]

AUVs used to look like torpedoes, but now their shapes are varied. Some are installed with solar panels to provide the vehicle with rechargeable power. Many have advanced shapes that allow them to stop, hover, dive, and surface, blurring the lines between underwater and surface vehicles.

Technology advancements should help to extend the time AUVs can be deployed. Lower power consuming electronics help prolong battery life. As well, better sensors with wider swaths, higher resolution, and processing capabilities will make missions more productive by increasing the area coverage rate or the overall amount of useful data that is collected. But we believe the biggest factor that will improve the length of missions are batteries.

The UUV market should benefit from lithium ion battery (LiB) development occuring within the automotive industry and lithium polymer batteries. The automotive sector is focused on improving the density of LiBs. Today’s LiBs hold more than twice as much energy and cost ten times less than when they first appeared in 1991[xiii]. They offer higher power-to-weight ratios, high energy efficiency, light weights, and superior temperature and discharge characteristics over lead-acid and nickel-metal hydride batteries. And on September 4, 2014, Tesla Motors announced a $5 billion investment in a LiB plant. Tesla chose Nevada to build the plant, called “The Gigafactory,” which Tesla expects will manufacture 50GWh of annual capacity by 2020 – enough for 500,000 Tesla cars.

While lithium batteries are well suited to meeting today’s AUV requirements, both naval and civilian applications will require endurances of that exceed today’s requirements by a factor of 20 in the near term and 60 beyond that. These requirements dictate the need for new energy technology. Solid oxide and proton exchange membrane fuel cells show the most promise at present and are under development.

Remotely Operated Vehicles (ROVs)

ROVs typically serve two functions: “eyeballs” in the sea, or “workers” in the sea. The “eyeball” type of ROVs are used to observe, explore, inspect, and salvage. “Eyeball” class ROV comprises of small or mini ROVs used in applications like observation, scientific exploration, inspection, and rescue. “Worker” ROVs are typically larger and heavier UUVs that deploy or lift underwater equipment. Some crawl on the seabed and can bury cables or dig trenches.

Smaller ROVs are typically preferred, due to their better manueverability, operating costs (fewer personnel are required for deployment and operation), and maintenance costs. As a result, the industry is reliant upon technological advances to reduce ROV form and power consumption. This has led to smaller scientific instruments, cameras, sensors, and robotic arms. Reducing weight and power consumption in the ROV translates to thinner umbilicals or tethers, reducing the size and cost of the surface handling equipment. However, there are exceptions to the smaller ROV preference; some construction ROVs need larger form factors to haul big payloads.

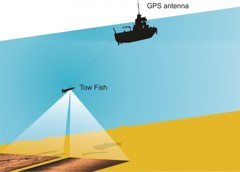

Towed Vehicle

A towed vehicle is an UUV that is towed by another vessel. The main advantage of a towed vehicle is that they provide real-time data to ship crews whereas AUVs need to surface for crews to collect the data. Data turnaround time for an AUV can be on the order of 24 hours or longer. Another benefit of a towed vehicle is that explorers can get the sensors closer to the underwater structure or sea floor for better resolution compared to a sensor mounted on the hull of a ship. As well, towed vehicles can operate at high speeds (8 to 10 knots) and are more stable in rough water when compared to a shipborne sensor.

Towed vehicles also have limitations. As depths increase beyond 500 meters, the drag on the cable becomes prohibitive. This drag results in slower survey speeds (less than 1 meter per second) thereby slowing surveys to the point where they become unproductive in terms of area coverage. This is why AUVs have largely replaced towed vehicles in deep ocean surveys. Towed vehicles also rely upon a ship to steer their course. And due to the distance between the ship and the towed vehicle, determining the towed vehicle’s position lacks precision. This makes towed vehicles challenging to position for some underwater tasks such as pipeline and cable route survey.

Unpropelled UUVs – Gliders

Gliders are quickly becoming widespread, especially for mid-water oceanographic surveys. First used in the mid-1990s, gliders were deployed to replace drifting buoys used for ocean observation. Theoretically, gliders have a range in excess of 25,000 miles. Some have even crossed the Atlantic, and others have traveled from the USA’s west coast to Hawaii. They propel themselves by varying their buoyancy and converting this vertical lift into slow forward motion with their wings. And by varying their buoyancy, they follow an undulating pattern from the ocean’s surface to depths as much as 6,000 meters, collect their data, and then returning to the surface. Once they resurface, they contact their controller over a satellite link and receive updates mission commands, if necessary.

Source: Maritime Security Challenge 2016

Gliders are entering mainstream marine surveys at the expense drifting oceanographic buoys. This is because gliders collect 2D survey data whereas the buoys only gather unidimensional data. Gliders also have a cost advantage over small diameter (<20cm) propelled AUVs – gliders are about 10% of the cost of an AUV. However, glider cost benefits can be diminished by the fact that they are more likely to be lost at sea compared to AUVs. In fact, many surveyors purchase two gliders with the expectation that they will only have one after five years.

An Industry Consultant sees Changes in the Oil & Gas Industry

We spoke with an industry veteran who was previously employed at large UUV manufacturers. He didn’t want his name or past employers quoted, and in exchange for maintaining his confidentiality, he shared his thoughts about how he foresees the UUV industry evolving within the oil and gas sector.

Over the next five to 10 years, AUVs used for inspections will largely replace ROVs used offshore and for pipeline surveys. The reason for this is AUVs are far less expensive to operate than ROVs. ROVs require dynamic positioning[1] ships that can cost upwards of $250,000 per day (and this doesn’t include the ROV). Deploying AUVs is less expensive – around $30,000 per day, and they can survey a pipeline two to three times faster than a ROV. AUVs also don’t cost as much as ROVs. All these factors make the business case to deploy AUVs rather than ROVs.

Hybrid AUVs, AUVs that carry ROVs, will replace the maintenance and repair ROVs, particularly in satellite fields. A few hybrid AUVs have been built, and many offshore oil and gas companies are factoring their development and acquisition into their near term plans. The reason for this transition mirrors that for why AUVs will replace inspection ROVs – cost.

A drawback of a hybrid AUV is that the vehicle has to be “plugged in” to power in order to operate the ROV. In the next five to 10 years with the quantum leap forecast in processing power, the first artificially intelligent AUVs will start replacing the hybrid vehicles. Prototype development leading to this capability is now ongoing.

[1] “Dynamic positioning” refers to computers that use a ship’s propellers and thrusters to maintain the ship’s position and heading.

UUV Use Cases

Military

Militaries are the largest consumer of UUVs, using AUVs and Towed Systems to search for underwater mines. They also use AUVs for intelligence collection, surveillance, and reconnaissance. AUVs also hold the potential to scour the seas for hostile submarines and warships. We spoke with a retired submarine commander who noted that this is probably one of the missions for the U.S. Large Diameter UUV. He believed that such a “scouring” mission could take the form of pre-positioning or locating a number of AUVs at a land-base close to a strategic maritime chokepoint[2]. AUVs would be stationed across the chokepoint listening for and reporting submarines and other shipping as they pass.

The U.S. Navy is investing 22% of its science and technology dollars on the underwater domain.[xiv] And the U.S. Navy recently announced that it would invest up to $1.43 billion to support unmanned mine countermeasure vehicles.[xv] The Navy uses Hydroid’s REMUS 100 AUV for both naval mine countermeasures and hydrography (the science of measuring and charting seabed depth). Similarly, the Japanese Defense Ministry uses four REMUS AUVs for depths of 600 meters and a REMUS 100 for seafloor mapping and mine countermeasures.[xvi] Overall, the REMUS AUVs are popular – our retired submarine commander estimates that 15 Navies are using them for mine hunting and tactical hydrography. He further noted that other countries have developed “in-country” AUVs for these two applications.

After 15 years of small and medium size AUV R&D, the U.S. and other navies (including Canada) are focusing on developing of larger, longer endurance AUVs. The AUVs will probably have the initial capability to conduct 70 day missions. These AUVs will likely be used for anti-submarine warfare, payload delivery, mine laying, rapid environmental analysis, intelligence gathering in hostile waters, and littoral seabed surveys.

[2] A chokepoint is a narrowed geographical feature that places an armed force into a vulnerable position should it pass through.

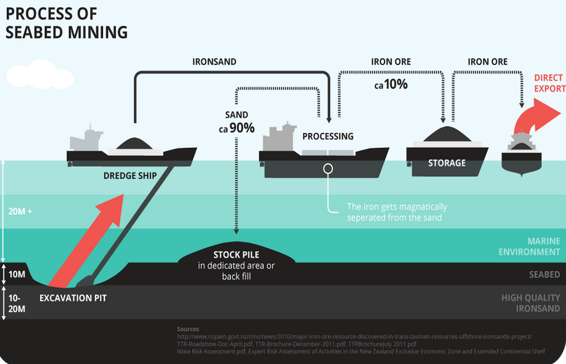

Seabed Mining: Potentially the Largest UUV Market Opportunity

Seabed mining is a nascent industry that could become the largest UUV market. The process typically involves dredging a seabed, stockpiling the dredged contents, processing the material at sea or transporting it to port, and then returning the waste material to the sea. Prior to dredging, AUVs and Towed Systems conduct surveys to determine potentially resource rich mining areas – AUVs equipped with magnetometers can determine iron deposits, for example. Mining companies then map the seabed for obstacles to assist the dredging process.

In 2012, the European Commission estimated that global annual turnover from seabed mining could grow to €10 billion by 2030.[xvii] The European Commission also forecasted that 5% of the world’s minerals, including cobalt, copper and zinc, could come from the ocean floors by 2020 with this share rising to 10% by 2030. Concerns about supply security and technological advances that enable seabed mining should drive this growth.

Source: KASM

In 2013, British Prime Minister Cameron outlined a vision to make the United Kingdom the leader in seabed mining. The prime minister stated that seabed mining could contribute £40 billion to the British economy through 2030 and cited the United Kingdom’s strengths in “technology, skills, scientific and environmental expertise” as reasons why his vision will succeed.[xviii] Other countries have taken the lead – China, Japan, India, the United States, Germany, and France were already supporting the development of their seabed allotments.

There are now 1.2 million square kilometers of ocean floor under 26 mining permits for prospecting. For years, resource companies have exploited shallow water (depths less than 600 meters) to extract diamonds, iron sands, and phosphate. Mining companies are now transitioning to deeper waters, where mineral deposits can be found at depths of 2,500 meters. A MIT paper previously said that exploratory mines could be created before 2020.[xix]

From 1992 through 2005, Dr. Steven Scott of the University of Toronto conducted pioneering seabed mining research which led to his co-discovery of the Solwara 1 seafloor massive sulfide deposit off Papua New Guinea[xx]. The BBC[xxi] suggests that Canadian company Nautilus Minerals will likely create the first seabed mine. Nautilus Minerals’ potential mine is planned in the waters off Papua New Guinea and was arranged in a deal outside of the International Seabed Authority, the organization that issues and governs exploration and mining licenses in international waters.

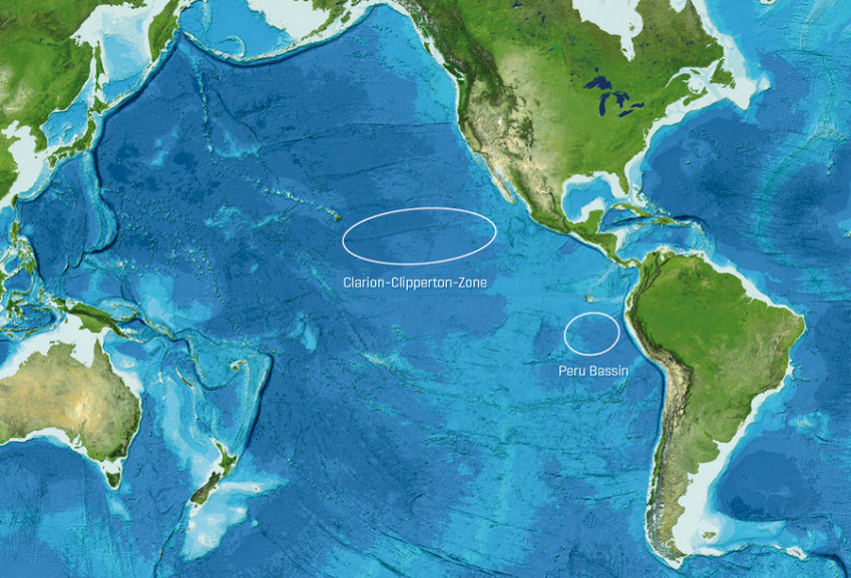

The Solwara 1 deposit in Papua New Guinea is not the only seabed worth mining. All of the world’s ocean seafloors contain high-value mineral deposits. The Clarion-Clipper Zone, which runs from Clipperton Island off the West coast of Mexico 4,000 km to Kiribati area, has the highest density of deposits in water that ranges from 4,400 to 6,500 meters. This zone lies in international waters and falls under the jurisdiction of the U.N.’s International Seabed Agency (ISA). ISA data suggests that there are 5,400 million tonnes of mineral deposits in the area with an average density of 5.98 kg/m2, and 3,200 million tonnes with an average density of 8.14 kg/m2. A 6.0 kg/m2 density is considered the minimum for profitable operations.

Surveying the Sea Floor

UUVs are used to map the sea floor. The first operational mission of an AUV was hydrographic mapping conducted in BC using an International Submarine Engineering Ltd (Private) vehicle in 1985. Since then, hydrographic agencies have used them for cartography. Oil and gas companies conduct extensive sea floor surveys of pipelines, drilling sites and satellite fields. Telecom companies also contract seabed surveys to determine where to lay cables. Power companies conduct seabed surveys to locate wind platform sites and to survey the cable route. Navies conduct seabed surveys to assess the potential for mine laying and to assess the possibility for clandestine activities. Beyond pipeline and cable surveying, AUVs and Towed Systems also map harbours and sea lanes, monitor dredging, and gather data to assay everything from high value seabed mineral to sand and gravel deposits.

Oil and Gas

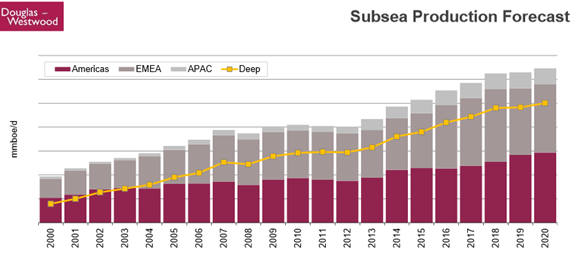

A key part of the industry’s growth is deep water oil and gas exploration, due to the depletion of shallow water reserves. The Douglas-Westwood subsea production forecast in Exhibit 1 illustrates that deep water subsea production will continue growing through 2020. AUVs have achieved good success in deep water, commercial operations in the Gulf of Mexico, off West Africa, the North Sea,[xxii] the East coast of South America, the South-East Asian Peninsula, and Western Australia. We believe the oil and gas industry will use AUVs to explore Arctic deep waters, which are some of the most hostile marine environments on the planet. Canadian-built AUVs have already conducted five successful under-ice deployments in the Canadian Arctic with missions of up to 1,000 km, and to depths of 3,600 meters.

ROVs are often used for pipeline inspection, oil exploration, offshore construction and repair, and harbour and seabed mapping. AUVs are predominantly used for exploration, mapping, and photographing seabeds. With increasing energy demand, we believe that UUV adoption will increase in the oil and gas industry, although capital expenditures will remain constrained until industry adapts its operations so that companies are profitable in a lower-priced oil market.

Even after wells are drilled, oil and gas companies need to inspect and maintain pipes and cables, tasks well suited to AUVs. And in some cases, oil and gas companies must provide evidence that their underwater activities have not disrupted marine life, especially creatures that live on the seabed like coral.

Exhibit 1: Subsea Production Forecast

Source: Oceanography International

Search and Recovery Missions

AUVs have been deployed on two search and recovery missions. The first mission involved the search for Air France 447 which departed from Rio de Janeiro and crashed into the Atlantic Ocean on June 1, 2009. Two search attempts were undertaken: first with ships and submarines soon after the crash, and then a second search in 2011 that used Hydroid REMUS 6000 AUV. The REMUS succeeded in locating the aircraft wreckage.

Search efforts continue for Malaysian Airlines flight 370, which disappeared March 8, 2014. To assist the search, the U.S. Navy used an AUV built by Bluefin Robotics (private) and operated by Phoenix International Holdings (private) over the course of several weeks. And although the AUV didn’t locate the wreckage, it demonstrated the versatility of the technology. The AUV undertook 25 missions in 21 days, operated for a total of 370 hours, covered 250 square miles, and dove to depths of 5,000 meters.[xxiii] What this demonstrates is that newer AUVs can cover wide seabed areas at a higher resolution over shorter periods of time compared to conventional sonar systems. A second search conducted by Fugro (AMS:FUR) is ongoing. Fugro is using a slower deep tow system, likely because (according to our sources) no 6,000 meter AUV is available for the duration of the survey.

Naval Mine Detection

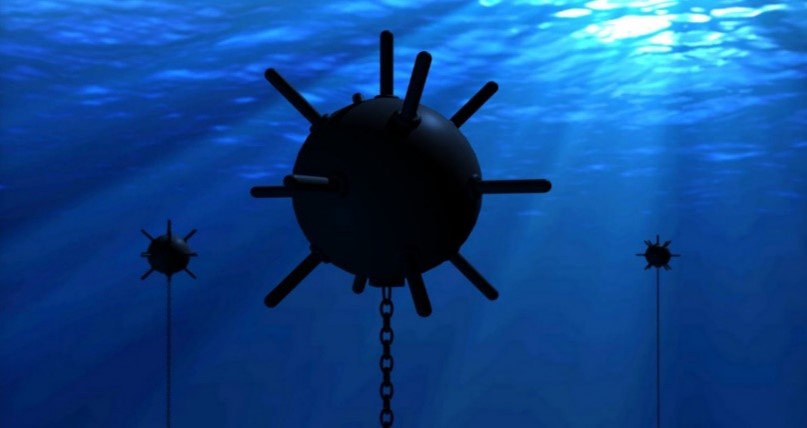

During the Korean War, over three thousand naval mines deployed over a few weeks prevented a 250-ship United Nations amphibious assault on Wonsan.[xxvi] This caused Rear Admiral Allen E. Smith to lament, “We have lost control of the seas to a nation without a navy, using pre–World War I weapons, laid by vessels that were utilized at the time of the birth of Christ.” [xxvii] Such is the effectiveness that naval mines have at deterring navies from advancing.

Over 400,000 naval mines are in the hands of U.S. competitors and enemies.[xxviii] Many of them are legacy mines, left over from prior wars. And similar to landmines, naval mines stay active for years after a conflict has ended. This poses danger to commercial and military vessels. Over 90% of the world’s goods are transported by sea.[xxix] Mines that block access to harbours can damage economies.

Source: Warfare Sims

A simple mine can cost as little as a few thousand dollars to manufacture. This makes them attractive to hostile groups and nations since the return on investment is high if the mine can sink a ship, especially a $13 billion aircraft carrier.

Compounding this unsavory situation are drifting mines and unexploded ordinance (UXO) mines whose mooring cables rust out drift ashore. These are threats to beachgoers. And both lakes and the ocean littoral have been used as weapons test ranges as well as for dumping. The bottom of Lac St. Pierre in Quebec is believed to hold over 10,000 “dormant or latent” UXOs which have proven challenging to locate and dispose of.

Whether naval mines are war leftovers or a hostile group’s cheap bomb, neutralizing them is difficult, dangerous, and expensive. Over 500 ships were lost due to mine clearing efforts following World War II. [xxx] And removing a single mine can cost ten to 200 times more than its manufacturing and deployment costs.[xxxi] Clearing a naval minefield can take up to 200 times longer than the time required to plant the mines. [xxxii]

Offshore Wind Farms

The installation and maintenance of offshore wind farms extend beyond location mapping. Underwater cabling systems are required to deliver offshore power to the mainland. Even after cables are laid, there are risks that they could entangle fishing nets causing boats to sink. Thus it is imperative that wind farm operators undertake routine inspections to ensure that cables are seated properly. One proposed project is the European Supergrid (Exhibit 2), a pan-European transmission network connecting renewable energy sources. This network could need thousands of kilometers of undersea cables, and some of these submarine cables could stretch as far as 500 kilometers.[xxxiii]

Exhibit 2: Conception of the proposed European Supergrid

Source: Friends of the Supergrid

Laying a submarine cable involves several steps, many of which an UUV could handle. These steps include: the selection of a provisional route, a survey of the route, cable burial locations (if applicable), and post-cable installation inspection. However, these would all be preceded by a desktop study to determine the best route for the cable.

Telecom Companies

Ninety-nine percent[xxxiv] of all global communications occurs via marine cabling (Exhibit 3). The first transatlantic cable was laid in 1854, connecting Newfoundland to Ireland. Since then, underwater cables have proliferated due to better performance than satellite communications.

Telecoms typically contract cable laying to third parties. Cable laying starts with a desktop study to determine the best route for the cable. Following this, the shallow continental shelf areas (0 to 200 meters) and areas with rugged terrain (usually the mid-ocean ridges) are surveyed, either with a ship or an AUV and a ship. Then comes the cable lay. In shallow or topographically challenging areas, a ship with an ROV follows the cable layer to observe the cable’s touch-down, ensures the cable is not strung between two promontories, and monitors the cable burial. Periodically, companies are required to resurvey these areas.

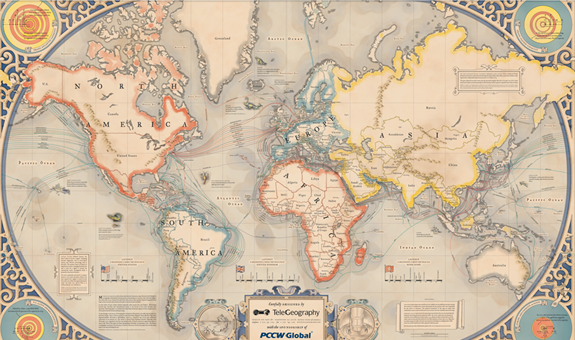

Exhibit 3: 2015 Undersea Telecommunications Cabling Map

Source: TeleGeography

Treasure Hunting

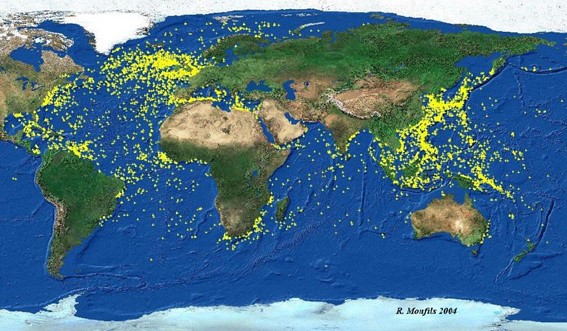

The United Nations estimates[xxxv] that over 3 million wrecks are sitting at the bottom of the ocean (Exhibit 4 shows the locations of World War II shipwrecks). Wrecks have always attracted treasure hunters, and recent discoveries have proven lucrative (in June 2015, treasure hunters found $1 million of gold artifacts dated from 1715 in 15 feet of water off the coast of Florida.[xxxvi]) But there are potential larger prizes in the sea; rumours abound that a torpedoed British World War II freighter 50 miles off the coast of Cape Cod, Massachusetts contains $3 billion of platinum ingots.[xxxvii] As incredible as this seems, this freighter is not by any means the biggest prize at the bottom of the sea.

Source: Supercompressor

Exhibit 4: World War II Shipwrecks across the World

Source: Amazing Maps

Many in the salvaging community are attracted to remote sensing applications embedded in UUVs to increase the probability of locating shipwrecks. Before the technology evolved, searches were random and often relied upon luck to locate and map wrecks. Now, sensing technology facilitates broader coverage of the sea. More important, it allows for accurate positioning so that salvagers can easily find a shipwreck again.

The Franklin Expedition search was an example of a UUV locating a shipwreck. In 1845, Sir John Franklin set sail from England in search of a Northwest Passage in Canada’s arctic. Franklin’s ships became icebound and the entire crew was lost. In September 2014, Parks Canada discovered one of Franklin’s ships, the HMS Erebus, using Synthetic Aperture sonar (SAS) technology developed by Kraken Sonar (TSXV:PNG), a company which we detail more extensively later in this report.

As attractive as treasure hunting is, we don’t foresee this becoming a large market for UUVs. There are three reasons for this. First, there is a threat of piracy. Once the treasure is brought to the surface, it must be transported to port, and then transported by land to a secure site. This opens the possibility to robbery. Second, countries and agencies that own the shipwrecks may not have the funds to recover the treasure. Thus, the treasure may remain sunk for decades. Third, once treasure is found, it is placed in escrow until all the countries and agencies have their chance to claim ownership in the courts. These can take decades to resolve and leave the treasure seekers with a pittance. Combined, these factors make it unlikely that treasure hunting will expand beyond the realm of well-funded companies. This means that not many UUVs will be required for treasure hunting.

The Technology to See Underwater

3D Geospatial Mapping Tools

Nearly all of the industries using UUVs that we detailed need to survey and manage their field assets across large geographies. 3D geospatial software allows the surveying of assets in combination with GPS (global positioning system) data to create three-dimensional maps.

Evolving from technology in the 1960s, CARIS (private) is a leading 3D geospatial mapping provider. CARIS (Computer Aided Resource Information System) has numerous vertical markets that include: military agencies, survey contractors, ports and harbours, municipalities, land administrators, and academia in more than 85 countries.

Geospatial Corporation (OTCMKTS:GSPH) creates 3D maps and models of shallow water, in-shore pipelines at depths of up to 55 meters. The Company manages infrastructure data on GeoUnderground, its Cloud-Based GIS Portal designed around the Google Maps API.

Conventional Sonar

Sonar is used to find and identify objects in water. There are two types of SONAR: active and passive. Active sonar transmits a sound wave, called a “ping”, and measures the time it takes for the ping to reflect back. The distance to an underwater object or seabed can then be extracted from the time it takes the ping reflection to return to the sensor. Passive SONAR, on the other hand, does not transmit pings; these systems listen to sounds occurring in the sea, such as those from sea animals and ships.

Active sonar was first used during World War I to detect German submarines. Then, in the 1920s, the U.S. Coast Guard used sonar to map deep water locations. And in World War II, sonar was again deployed for military applications. The 1960s introduced computers to sonar systems, allowing for data plotting. It wasn’t until the 1970s when the military declassified SONAR, allowing commercial exploitation of the technology.

Multibeam SONAR

Multi-beam sonar is a variant of regular SONAR. These systems use numerous transducers (a device that converts sound or pressure into electrical signals) that are pointed at different angles. This allows the system to cover a larger underwater volume than a single transducer SONAR. The data collected from multi-beam sonar are often used to create 3D models and fly-by videos of the area mapped.

Source: Wessex Archaeology

Side Scan SONAR

Side scan sonar (SSS) detects objects on the seafloor. SSS transmits sound whose energy is dispersed like a fan. The ping sweeps the depths to the towed vehicle’s port and starboard, and analyzes the signal that bounces off the seafloor and the surrounding objects. The sound’s energy is shaped like a fan and sweeps the volume along the length of the underwater vehicle. Most SSS systems do not provide depth information, although interferometric (or bathymetry) sidescans are becoming increasingly popular. Sidescan sonar is sometimes referred to as “real aperture sonar as the aperture (or size of the acoustic array) and is limited by the physical size of the acoustic transducer.

Synthetic Aperture Sonar

Side scan sonar (SSS) detects objects on the seafloor. SSS transmits sound whose energy is dispersed like a fan. The ping sweeps the depths to the towed vehicle’s port and starboard, and analyzes the signal that bounces off the seafloor and the surrounding objects. The sound’s energy is shaped like a fan and sweeps the volume along the length of the underwater vehicle. Most SSS systems do not provide depth information, although interferometric (or bathymetry) sidescans are becoming increasingly popular. Sidescan sonar is sometimes referred to as “real aperture sonar as the aperture (or size of the acoustic array) and is limited by the physical size of the acoustic transducer.

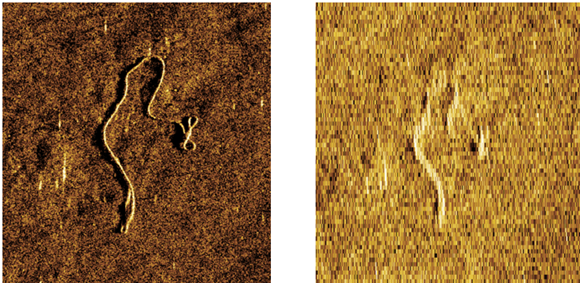

Exhibit 5: SAS (left) Comparison to SSS (right) – the image is a rope on the seabed

Source: Kraken Sonar Systems

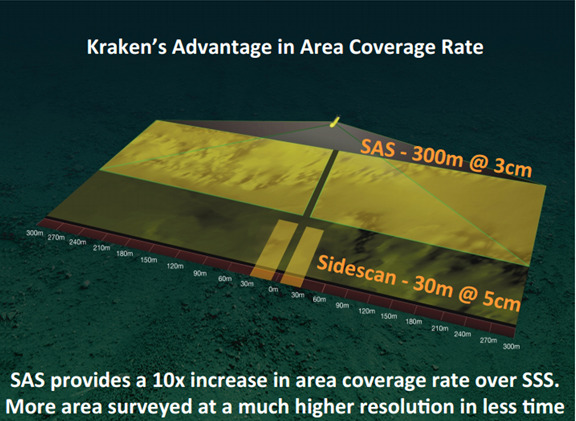

Exhibit 6: SAS Provides Greater Swath over Legacy Sidescan Sonar Systems

Source: Kraken Sonar Systems

Interferometric Synthetic Aperture Sonar

Interferometric Synthetic Aperture sonar (INSAS) systems can obtain image and bathymetric resolution of a few centimeters, even in very deep water and at long ranges. INSAS uses signal processing techniques to compare multiple observations of the same seafloor area to calculate its depth. Exhibit 6 demonstrates the advantages that SAS systems offer over traditional side scan technology. The coverage rate increases tenfold, and because of this, the time to map an area decreases which also decreases the costs to charter a ship (on average, some ships can cost $75,000 to $100,000 per day to rent).

So how can You Make Money as Drones Drive into the Sea?

Kraken Sonar Systems – A Good “Sense” of the Sea

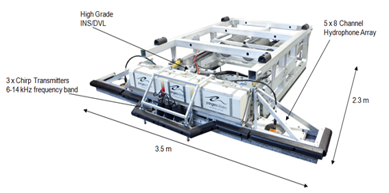

Kraken Sonar Systems (TSXV:PNG), a Sophic Capital client, is a marine technology company engaged in the design, development and marketing of advanced sonar and acoustic velocity sensors for UUVs used in military and commercial applications. The Company is recognized as a leader in SAS, a disruptive military technology now available for commercial applications. The Company is also moving from components to full systems like the recent announcement of their own towed vehicle called the KATFISH.

AquaPix® is Kraken’s 3D bathymetric sensor. AquaPix® can provide detailed images with a resolution better than 3cm out to a range of 300 meters from each side of an underwater vehicle. The sensors can be integrated into AUVs, ROVs, and towed bodies. Kraken recently won a contract for AquaPix® from ECA Robotics of France. The US$325,000 contract will see AquaPix® integrated into ECA’s newest A18D AUVs.

In 2013, a Cooperative Research and Development Agreement with the U.S. Navy’s Naval Undersea Warfare Center was successful. The tests involved 26 AUV missions where Kraken’s AquaPix® generated high resolution imagery to ranges as distant as 200 meters from the sensor.

Source: Naval Undersea Warfare Center AUV with Kraken’s AquaPix®

On August 4, 2015, Tritech International, a Moog (NYSE:MOG.A) company, signed a multi-year agreement to sell Kraken’s CVL. Under the agreement, Tritech will manufacture, sell, and support Kraken’s AquaTrak™ CVL across its extensive international network, with the first AquaTrak™ shipments expected in Q4/2015.

On July 21, 2015, Kraken announced plans to develop KATFISH, a proprietary towed vehicle. The KATFISH is the evolution of the Company’s sensors to systems strategy, based on Kraken’s Miniature Interferometric Synthetic Aperture Sonar technology and real-time SAS processing algorithms. KATFISH uses an actively controlled, smart towed vehicle as a platform for real-time ultra-high resolution seabed mapping system and comes with a winch and handling subsystems for easy launch, tow, recovery, and stowage. Kraken has scheduled KATFISH’s commercial availability for Q1 2016 with a price expected in the range of US$1.5 million. We view the Company’s strategy to develop a complete turn-key system as a key growth driver.

Kraken stands apart from all of its competitors by the simple fact that it is not a defense/aerospace company. Unencumbered by a bureaucracy, it is able to recognize potential, move smartly to capitalize on the opportunity, and develop products which are disruptive from both the perspective of cost and performance.

Tritech International – Piecing UUVs Together

Tritech International Limited, a Moog Inc. company, is a high-technology business that provides imaging and ancillary equipment for use in underwater applications. The Company offers an extensive family of imaging sonar, surveying sensors, video cameras, and control units – essentially everything the defense, energy, engineering, survey, and UUV markets require to design and manufacture UUVs.

Tritech is an industry leader in the provision of sensors and tools for the ROV and AUV markets. The Company earned this reputation over 21 years of delivering expertise through key industry-standard products such as the Super SeaKing mechanically scanning sonar (renowned for obstacle avoidance) and the Gemini 720i sonar for real-time multibeam imaging. Tritech has sales and customer support locations in Scotland, U.K. and Texas. Tritech also has a support office in Brazil. The Company’s design and production locations are in Cumbria, England and Edinburgh, Scotland. Tritech has further global representation through a broad agent network.

In August, 2012, Moog Inc. announced that it had acquired Tritech International Limited. The purchase price was approximately £21 million in cash. At the time, Tritech had trailing 12-month revenues of $19 million pegging its valuation at 1.1 times trailing 12-month revenues.

Kongsberg Gruppen ASA – Operating under Extreme Conditions

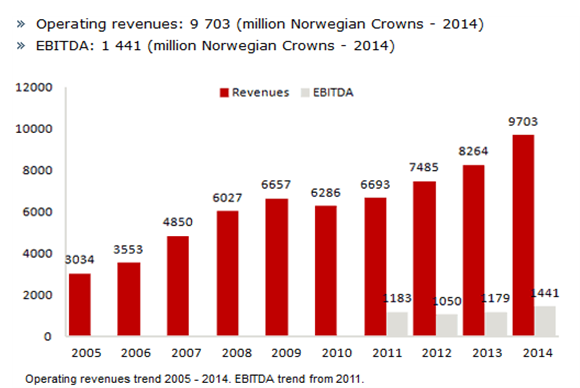

Kongsberg Gruppen ASA (OTCMKTS:NSKFF) supplies technological solutions that improve the reliability, safety and efficiency of complex operations under extreme conditions. The Oslo-based company has a division called Kongsberg Maritime that provides maritime solutions including: dynamic positioning and navigation, marine automation, safety management, cargo handling, subsea survey and construction, maritime simulation and training, and satellite positioning. The Company’s main markets are countries with large offshore, shipyard and energy exploration and production industries. Kongsberg Maritime provides sophisticated underwater and positioning technology and systems for survey vessel operation for the exploration vertical. For field development, the Division supports construction and offshore vessels with solutions for operation and specialist applications. In the production field, Kongsberg Maritime’s hardware and software solutions enhance output and minimize downtime. For maritime transport and offshore vessels, the Division provides a broad ecosystem of solutions that cover navigation, automation, training and safety. Exhibit 7 illustrates the Company’s financial success since 2005.

On December 12, 2007, Kongsberg Gruppen announced an agreement to purchase the assets and business of Hydroid LLC for approximately $80 million.[xxxix] Hydroid, a leading military and commercial AUV manufacturer based in Pocasset, Massachusetts, commercialized AUV technology developed by the Woods Hole Oceanographic Institution, the largest, independent, oceanographic research institution in the United States. At the time of acquisition, Hydroid’s 2007 forward sales estimate was pegged at $20 million, valuing the company at 4 times forward revenue.

Exhibit 7: Kongsberg Gruppen ASA’s Annual Revenues and EBITDA

Source: Kongsberg Gruppen

Teledyne Technologies – Growth by Acquisition

Teledyne Technologies (NYSE:TDY) provides technologies for multiple, industrial growth markets. The Company offers monitoring and control instrumentation for marine and environmental applications, harsh environment interconnects, electronic test and measurement equipment, and digital imaging sensors and cameras. Teledyne Marine, the Company’s marine division, has made several recent acquisitions. On February 2, 2015, Teledyne Marine acquired Bowtech Products, which makes harsh underwater vision systems. On November 2014, the Division completed its purchase of Bolt Technology, a leading supplier of marine seismic energy sources and replacement parts for offshore energy exploration, for $171 million.[xl] The Division also purchased The Oceanscience Group, a designer and manufacturer of marine sensor platforms and unmanned surface vehicles. Back in July 2014, Teledyne Marine also invested in Ocean Aero, a company designing an unmanned surface vehicle that will have the ability to descend.

On August 29, 2005, Teledyne acquired RD Instruments for approximate $37 million.[xli] RD Instruments, based in San Diego, California, manufactures acoustic Doppler instruments and had 2004 sales of $29 million, pegging the acquisition at 1.3 times trailing revenue.

Ultra Electronics Holdings – Combatting Enemy Mines

Ultra Electronics Holdings (LON:ULE) manages a portfolio of solutions and products across the defense and aerospace, security and cyber, transport, and energy markets. The Company has a Maritime Battlespace division that includes an Unmanned Naval Systems subdivision, which offers surface and subsurface equipment and sensor arrays for anti-submarine and mine countermeasure applications. Ultra Electronics Holdings has an extensive list of military customers including the Royal Navy (Ultra was prime contractor for a Royal Navy mine disposal system) and the U.S. Navy (Ultra provided specialist mine countermeasure UUV sonar).

Source: Ultra Electronics Holdings

Raytheon – Dipping into the UUV Market

Raytheon (NYSE:RTN) has a wide-range of undersea warfare solutions that help U.S. and allied naval fleets to detect, deter, and defend against a wide range of threats. The Company’s solutions are deployed in submarine combat systems and mine countermeasures. One such solution involves sonar that a helicopter can dip into the sea from a tether; another is mine hunting sonar for deep sea and littoral waters.

Thales Group – Mining their Own Business

Thales Group (EPA:HO) offers acoustic and communication systems and subsystems for anti-submarine warfare and anti-mine warfare. The Company’s solutions and services are suitable not only for UUVs but also submarines, surface ships, helicopters, and maritime patrol aircraft. In terms of UUV products, Thales Group provides a family of USVs and AUVs for military operations. Thales Group is particularly strong in mine hunting sonar with over 300 systems delivered across the globe, including contracts with France, the U.K., The Netherlands, Belgium, Malaysia, and India

EdgeTech – Cutting Edge Imaging

EdgeTech (private) is a leading manufacturer of underwater technology solutions that traces its history back to 1965 as a division of EG&G Marine Instruments (acquired by URS Corporation). The Company is known for its side scan sonars, sub-bottom profilers, bathymetry systems, AUV and ROV-based sonar systems, combined and customized solutions.

Sonardyne – A Sense of What’s in the Sea

Formed in 1971, Sonardyne International (private) aspires to improve the safety and efficiency of underwater navigation for divers through innovation in acoustic signal processing, hardware design, and custom engineering. Sonardyne also offers sonar imaging solutions that can detect underwater intruders. Search and classify AUVs benefit from the Company’s low power, high resolution side scan sonar. Sonardyne has also developed a leak detection sonar which can monitor more than one billion cubic feet for hydrocarbon leaks around subsea oil and gas assets – all from a single sensor location.

General Dynamics

General Dynamics (NYSE:GD) received an award from the U.S. Navy’s Naval Sea Systems Command to develop a mine detection system. While building the surface ship, General Dynamics subcontracted the AUV system development to Bluefin (Private), a Boston Mass. AUV manufacturer.

PanGeo Subsea – Mitigating Underwater Risks

PanGeo Subsea (private) specializes in high-resolution, 3D acoustic imaging solutions to mitigate risk in offshore installations. The Company accomplishes this by imaging and identifying seabed geohazards and providing detailed soil stratigraphy. PanGeo was formed in 2006 between Pan Maritime Energy Services Inc. and Guigné International Ltd, with venture capital investment by Energy Ventures AS. In July 2009, PanGeo Subsea welcomed Lime Rock Partners and CTTV Investments LLC, Chevron’s venture capital arm, as investors. PanGeo Subsea’s Sub-Bottom Imager provides full 3D images of sub-seabed up to 6 meter depths and 5 to 8 meter swathes. The technology can spot both man-made and natural non-metallic targets and identify the accurate depth of live cables – the only technology that can currently do this.

Lockheed Martin – Land, Air, and Water

Lockheed Martin (NYSE:LMT) has over five decades of experience designing unmanned systems. The Company’s solutions span the seas to the stratosphere. The K-MAX unmanned cargo helicopter saw duty in Afghanistan keeping military operating bases supplied thereby reducing the number of truck conveys and troops on the roads. K-MAX has also seen civilian duty, helping firefighters by hauling water to douse fires. Lockheed Martin’s Indago provides farmers with crop data, and the Desert Hawk III helps soldiers determine what’s over the next hill. The land-based Squad Mission Support System vehicle lessens the loads soldiers have to carry. And the Remote Mine hunting System keeps sailors and ships out of harms ways. Lockheed Martin also supplies oil and gas customers with the Marlin, an underwater surveying and inspection vehicle. This is not a pure-play way to invest in the drone market, but we believe land and air drones will become a larger percentage of the business.

UUV Consumers aren’t Left Behind

Although this report focused on the military and industrial UUV markets, we found two companies that cater to consumers. Fathom Drone (private) is conducting a kickstarter campaign to produce the world’s first jet-propelled, underwater drone, the Fathom. Users control the Fathom via a smartphone or smart device with live video streaming to the screen. The UUV will cost around $500 and will likely be attractive for fishing, underwater exploration, anchor detangling, and body recovery (okay, the last one isn’t really consumer-friendly, but it’s listing on the Company’s Twitter feed).

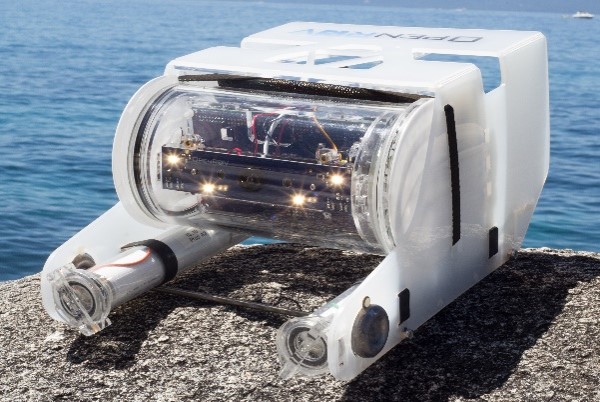

Source: Fathom Drone

OpenROV (private) is also targeting consumer underwater drone enthusiasts. The Company has a tethered robot that can dive to depths up to 100 meters and feed HD video and audio to a laptop. The OpenROV v2.8 kit costs $899 – users must assemble the drone – and the software, hardware, and electronics are open source, allowing users to improve the robot and share best practices. Battery life is up to 3 hours, giving the underwater do-it-yourself community plenty of time to explore underwater worlds at an affordable price.

Source: OpenRV

Deep Trekker (private) is on a mission to give anyone on Earth an opportunity to explore the depths of our vast oceans, seas, lakes, or rivers with a mini ROV. The Company is committed to providing a new breed of submersibles, based upon providing the most portable, affordable, and easy-to-use subsea observation tools in the world. Deep Trekker’s DTG2 and DTX2 ROVs are small yet robust and have been adopted around the world for underwater observation. The HD cameras rotate 270°, allowing for inspectino below, above, behind, or in front of the ROV as it maneuvers through its dive. The handheld controller is based on a gaming pad, to greatly reduce the learning curve.

Source: Trekker DTX2

Conclusion – Underwater is the next Big Market for Drones

Although we have traversed the seas for centuries, we know little of what lurks beneath the water’s surface. The military has aggressively adopted underwater drones, and it appears as though the industrial and consumer sectors are on the cusp of embracing the technology. We recommend that investors considering investing in this emerging tech space examine the public UUV companies that we have profiled. Many are large conglomerates (Raytheon, General Dynamics, Moog) which we believe won’t afford significant upside should the UUV market ramp as we expect. We suggest that investors look at Kraken Sonar, a Sophic Capital client, and Kongsberg Gruppen since these are publicly listed maritime companies.

Acronyms Used in this Report

AUSVI Association for Unmanned Vehicle Systems International

AUV autonomous underwater vehicle

CVL correlation velocity log

DVL Doppler velocity log

GPS global positioning system

INSAS interferometric synthetic aperture SONAR

ISA International Seabed Agency

LiB lithium-ion battery

NOAA National Oceanic and Atmospheric Administration

ROV remotely operated underwater vehicle

SAS synthetic aperture sonar

SSS side scan SONAR

SONAR SOund NAvigation and Ranging

UAV unmanned aerial vehicle

USV unmanned surface vehicle

UUV unmanned underwater vehicle

Glossary

bathymetry Measuring the depth and floor of water bodies.

hydrography The science of measuring and charting seabed depth.

interferometry Any of several optical, acoustic, or radio-frequency instruments that use interference phenomena between a reference wave and an experimental wave or between two parts of an experimental wave to determine wavelengths and wave velocities, measure very small distances and thicknesses, and calculate indices of refraction.

stratigraphy The order and relative position of strata and their relationship to the geological time scale.

References

[i] Teal Group Predicts Worldwide UAV Market Will Total $91 Billion in Its 2014 UAV Market Profile and Forecast, Teal Group Corporation, July 14, 2015

[ii] How much water is there on, in, and above the Earth?, U.S. Geological Survey, 1984

[iii] Ibid

[iv] How much of the ocean have we explored?, National Oceanic and Atmospheric Administration, June 24, 2014, pg. 30

[v] Unmanned Underwater Vehicles Market worth $4.84 Billion by 2019, MarketsandMarkets, March 2014

[vi] Ibid

[vii] Ibid

[viii] World Subsea Vessel Operations Market Forecast 2015-2019, Douglas-Westwood

[ix] Global AUV Fleet to increase 42% by 2018, Douglas-Westwood

[x] Cornelius Drebbel (1572 – 1633), BBC, 2015

[xi] Angela D’Amico and Richard Pittenger, A Brief History of Active Sonar, Aquatic Mammals, 2009

[xii] Murray Dormer, AUVs – Global Market Prospects, Douglas-Westwood, March 13, 2014, pg. 18

[xiii] Ibid.

[xiv] Clay Dillow, The Drone Revolution Hits the High Seas, Fortune, April 17, 2015

[xv] Megan Eckstein, Navy to Invest Up to $1.43 Billion to Support Unmanned Mine Countermeasures Vehicles, USNI News, July 22, 2015

[xvi] Remote Environmental Monitoring Unit System (REMUS), Naval Drones, 205

[xvii] Blue Growth opportunities for marine and maritime sustainable growth, COM(2012) 494 final, pg. 10, European Commission, September 13, 2012

[xviii] Terry Macalister, David Cameron says seabed mining could be worth £40bn to Britain, The Guardian, March 14, 2013

[xix] Matt Burgess, Deep sea mining: AUV to help unlock hidden resources, Factor, January 13, 2015

[xx] Steve Scott (Emeritus), University of Toronto, 2014

[xxi] David Shukman, Deep sea mining licences issued, BBC News, July 23, 2014

[xxii] Marine industries global market analysis, Dougless-Westwood, March 2005, pg. 79

[xxiii] Yasmin Tadjdeh, As Technology Matures, New Roles Emerge for Underwater Drones, National DEFENSE, September 2014

[xxiv] Edith M. Lederer, Second flight recorder recovered from wreckage, Associated Press, July 11, 1985

[xxv] Geoffrey Ho, Nada J. Pavlovi, Robert Arrabito, Rifaat Abdalla, Human Factors Issues When Operating Unmanned Underwater Vehicles, Defence R&D Canada, March 2011, page 25

[xxvi] Scott C. Truver, Taking Mines Seriously, Naval War College Review, Spring 2012, Vol. 65, No. 2, pg. 30

[xxvii] Scott C. Truver, Taking Mines Seriously, Naval War College Review, Spring 2012, Vol. 65, No. 2, pg. 31

[xxviii] Sydney J. Freedberg Jr., Sowing The Sea With Fire: The Threat Of Sea Mines, Breaking Defense, March 30, 2015

[xxix] Natasha Geiling, How the Shipping Industry is the Secret Force Driving the World Economy, Smithsonian, October 15, 2013

[xxx] Ryan Faith, The US Navy May Battle Deadly Naval Mines With Quadcopter Drones, Vice News, September 26, 2014

[xxxi] Ibid

[xxxii] Ibid

[xxxiii] Brieuc Hamon, Survey of Offshore Wind Farm Project in EU and Their Connecting Grid Systems, Global Energy Network Institute, July 2012, pg. 17

[xxxix] Secrets of Submarine Cables – Transmitting 99 percent of all international data!, NEC

[xxxv] Wrecks, United Nations Educational, Scientific and Cultural Organization, 2015

[xxxvi] Kaylee Heck, 300 Years After Shipwreck, Treasure Hunters Find $1M in Gold, ABCNews, July 28, 2015

[xxxvii]Alan Farnham, $3B Sunken Treasure? Questions Over Whether Hunt For WWII Bullion Is Fishy or Legit, ABCNews, April 16, 2014

[xxxviii] US Court Rules in Favor of Colombia in Holy Grail of Shipwrecks Case, Fox News Latino, October 25, 2011

[xxxix] KONGSBERG acquires Hydroid LLC, Kongsberg Gruppen ASA, December 12, 2007

[xl] Teledyne Completes Acquisition of Bolt Technology Corporation, Teledyne Technologies, November 18, 2014

[xli] Teledyne Acquires RD Instruments, Inc., Teledyne Technologies, August 29, 2005

Disclaimers

The particulars contained herein were obtained from sources that we believe to be reliable, but are not guaranteed by us and may be incomplete or inaccurate. The opinions expressed are based upon our analysis and interpretation of these particulars and are not to be construed as a solicitation of offer to buy or sell the securities mentioned herein. Sophic Capital Inc. (“Sophic Capital”) may act as financial advisor, for certain of the companies mentioned herein, and may receive remuneration for its services. Sophic Capital and/or its principals, officers, directors, representatives, and associates may have a position in the securities mentioned herein and may make purchases and/or sales of these securities from time to time in the open market or otherwise.