In our Luckbox (private) – Meet the Company report, Luckbox CEO Quentin Martin’s insights into esports and esports betting included:

- Metrics about how Luckbox benefitted from the transition from betting on traditional sports to esports;

- Luckbox’s average customer comes from a generation that grew up with video gaming that is younger than traditional sports bettors and is growing in numbers, and;

- Competitive profiles and why Luckbox’s Isle of Man gaming license is a clear differentiator amongst most esports betting platforms.

We had the opportunity to continue our discussion with Quentin, focusing on how Luckbox, which on December 16, 2020 went public on the TSX Venture exchange under the symbol LUCK, is positioned to capture a large share of the multi-billion dollar esports betting market and metrics and milestones investors should focus on.

Luckbox CEO Quentin Martin

Q: Quentin, first of all, congratulations on the recent listing on the TSX Venture exchange. Before we delve deeper into Luckbox, could you help investors new to the stock understand your rationale for listing in Canada?

A: Thank you. We’re pleased that we’ve finally become a public company. Why we listed in Canada is a good question, and one that we often get from American investors. We have an existing investor base in Canada who helped incubate our company and get us ready for our public market debut. We’re grateful for their support, which also makes Canada a natural first venue for us to list our stock. In addition, Canadian capital markets have a relatively robust ecosystem in the gaming and esports space. These are essential ingredients for us to develop our investor story from Canada. When we achieve larger scale, we would not rule out a listing on the NASDAQ perhaps, but we have to grow our business to a point where such a move benefits our shareholders. As an intermediate step, we expect to have an OTC listing in the USA to provide easier access to our American investors.

Q: In our last conversation, you told us about the transition to esports betting from sports betting during the COVID-19 pandemic, Luckbox’s target customer and their evolving demographic profile, the competitive landscape, and the licensing regime. Picking up on that conversation, can you help us understand Luckbox’s value chain and how the different pieces of the value stack interconnect with each other?

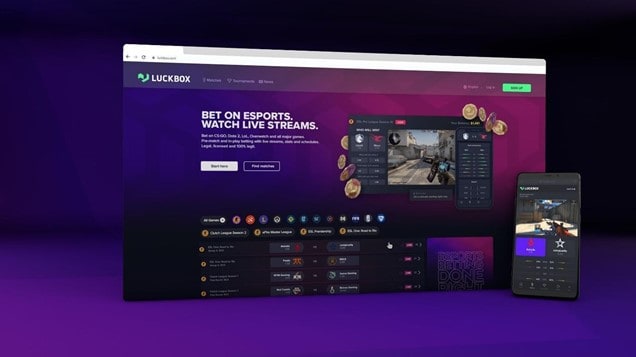

A: Sure. Esports’ value chain begins with player acquisition, usually via traditional digital marketing channels and some newer channels and mediums as well (such as content marketing, influencers, etc.) Player bonuses help support player deposits and also cost operators money. Third-party providers enable odds data, customer verification services (such as geolocation), and payment processing. Tying these pieces together through a compelling user experience and managing gaming risk – both of which we do in-house – is what sets apart successful providers in this space. An important part of the user experience is associated with the width of games bettors can bet on and the depth of different types of bets they are offered.

Q: Could you tell us what types of bets Luckbox offers that competitors do not?

A: Similar to traditional sports betting, esports have all of the commonly known markets, including outright winner, handicaps, and score differential. In addition to all of these standard markets, many competitive video games have distinct outcomes that lend beautifully to betting. For example, Dota 2 is an extremely popular multiplayer online battle game where the objective is to destroy a defending team’s base. Our clients can bet on things such as when a team kills its first 10 opponents or achieves other objectives. Each strategic objective has odds for our customers to bet upon, and we can implement an absurdly large number of strategic objectives for them to place wagers upon.

Q: Can you help us better understand the wider gaming coverage Luckbox offers as well as benefits from your Isle of Man gaming license?

A: Yes, absolutely. We spoke about our gaming license in our last interview, and to add to it, an Isle of Man license essentially allows us to work with more payment processors, which results in a better customer experience. Many large and existing gaming providers suffer from the Innovator’s Dilemma, and do not want to turn focus away from their existing and profitable business lines of casino games and sports betting. As a result, some providers have entered esports betting but only in a minimal fashion, which is very evident from the resulting tournament coverage and user experience. As a pure play esports betting provider, Luckbox is unencumbered by legacy considerations, which enables us to provide the best esports betting experience to our customers.

Q: Is this a reason why Luckbox recently won the 2020 EGR Operator Rising Star award?

A: Yes. For those who may not be familiar with the EGR awards, they are basically the “Oscars for the gambling industry”. Winning the Rising Star, one of their headline awards, was a great industry accomplishment and so were the reasons that EGR selected us.

Q: What were the reasons that EGR selected Luckbox for the Rising Star award?

A: The reasons were great testament to our team and the work that they’ve done. According to, EGR, “Luckbox was head and shoulders above everyone else”, and Luckbox was a “really interesting entrant to a growing/new market and may be the first to really nail this and compete with the larger books”, and that we are “really on top of the business”.

Q: How is Luckbox growing market share within your typical client demographic and beyond?

A: Luckbox has several tactics for growing our market penetration. Recently, we signed with Income Access, one of the largest gaming affiliate platforms, giving us access to 25,000 marketing partners. We also partner with esports teams, organizers, affiliates, and audiences to drive traffic to Luckbox.com. Luckbox is also cultivating communities on social media channels like Twitter and Facebook, creating and sharing our content through those platforms. Going forward, we’ll be cultivating more content to build our base. Finally, direct media is another channel we are targeting.

Q: What key metrics should investors monitor when following esports betting companies?

A: Investors should watch for growth in player numbers, that is how many customers are wagering. Player deposits, which convert into bets and revenue, is another important metric. Finally, revenue growth is the most important metric that eventually matters to investors, based upon our conversations with investors so far.

Q: Going forward, what do you think will become a bigger part of Luckbox’s business?

A: There are several things we can do. We could offer traditional sports betting or casino games. For now, we want to continue to grow our customer base, market share, and revenue.

Q: Over the next few years, what are some additional growth drivers or focus areas for the industry and Luckbox that investors should be cognizant of?

A: I believe we will see robust M&A in this space – we believe that most existing gaming companies will want to buy esports companies in 3 to 5 years. Esports, in this regard, are a good customer acquisition channel for established companies to gain younger bettors. This dynamic is already playing out to some extent with sports betting. For example, at established European sportsbooks around 30% of sports bettors are also casino players, according to industry sources. On top of this, compliance and regulatory costs are high, which is why M&A makes sense in this space. From our perspective, platform consolidation with regards to an odds platform, Artificial Intelligence to provide a better tailored user experience, casino games, and cultivating an esports community are value multipliers for Luckbox.

Q: What risks to your business and/or industry do you think the most about?

A: As always with the gambling industry, risk of how and when countries regulate or de-regulate can impact our business. We monitor these risks on an ongoing basis and will communicate any that threaten to become significant as soon as we can to the market, though we do not perceive any such significant threats at this time.

Q: Quentin, a key metric that investors always watch is insider share ownership. How much of the stock do insiders own?

A: Approximately 48% is owned by insiders – all of which is locked up from 15 to 36 months.

Q: Another question that always comes up with growing small cap companies is whether they plan to raise money in the near term. Please walk us through your thoughts on this.

A: We do not plan on raising additional capital in the immediate future, especially factoring in anticipated funds of about $4 million from warrants being exercised. Based on our cash burn and balance sheet, we believe we have sufficient runway to grow our business in the near term. However, we could opportunistically choose to pursue acquisitions, as all companies do, which could change the equation.

Q: How can investors get more info about Luckbox?

A: Investors can contact Sophic Capital, our investor relations firm, at All@SophicCapital.com. They can also subscribe to Luckbox’s email newsletter: https://upscri.be/l4q7zg.

Q: Quentin, we know you’ve been extremely busy these past few weeks. Thank you for making time to speak with us.

A: You’re welcome. I look forward to providing future updates.