Prior Report Recap

In Sophic Capital’s Solar Projects Are Shining Due to Strong Economics report, we provided an overview on:

- Invesco Solar ETF [NYSEARCA:TAN] has outperformed the NASDAQ 100 year-to-date;

- Solar photovoltaics (“PV”) would likely be the most dominant renewable energy source through 2024, and;

- Solar economics are driving solar PV adoption in America, despite an unfriendly US federal administration,

Sophic Capital client UGE International (“UGE” or the “Company”) [TSXV:UGE; OTC:UGEIF] develops and operates community solar projects in the U.S. The solar industry has seen utilities and private equity purchase projects, not only in the United States but across the world. This report highlights some of these transactions to help investors benchmark what UGE’s 65 megawatts (“MW”) of committed solar projects could be worth to third-parties, as a proxy for the Company’s current backlog value.

The Market for Purchasing Solar Projects is Hot

The past 12 months have seen increased acquisitions of solar PV projects. Some of the reasons for this include:

- Projects offer long-term recurring revenue streams, often from utilities and corporate off-takers, which present an attractive option in a low interest rate financial environment;

- Environmental, social, and governance (“ESG”) focus for investors, funds, pensions, and family offices;

- Attractive recurring revenue streams that can also scale with inflation;

- Government and utility incentives that continue after project completion.

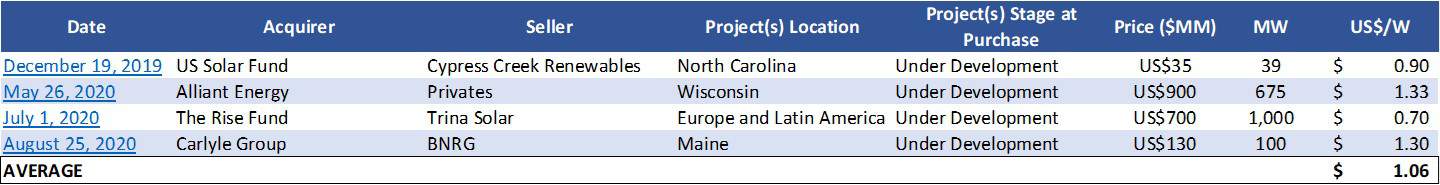

Exhibit 1 shows a list of development-stage solar projects that were sold over the past 12 months and the multiples acquirers paid. As per Exhibit 1, valuations for projects under development tend to lie in the US$0.70-1.33/W range. The BNRG project transaction in Maine at US$1.30/W is of particular relevance to UGE given the transaction’s recency and location in Maine (which is a key growth region for UGE). Based on discussions with industry participants, in some cases, we believe buyers would incur costs in the range of an additional US$1.00/W in order to bring these projects to operational status. In this scenario, the effective transaction value could easily approach US$2.50/W for an operational project.

Exhibit 1: Solar Projects Under Development Have Been Traded for US$0.70-1.33/W

Source: Sophic Capital

UGE’s Secret Sauce – Developing, Building, and Owning Community Solar Projects In Emerging Jurisdictions

Developing, building, owning and operating community solar projects is one aspect that makes UGE unique in this industry. Some investors we speak with believe (as Sophic initially did) that developing commercial solar is about knocking on doors and getting building owners to buy solar systems to generate electricity. In reality, our industry contacts suggest that this approach has low success rates. The reasons for this include:

- The vast majority of building owners are not the tenants, meaning they lack an economic incentive to install a system for the building’s self-consumption;

- The vast majority of building tenants are not the building owners, so they have no authority or long-term incentive to authorize a project;

- Landlords don’t necessarily want to navigate the complexities of permitting, interconnection, and incentives necessary to own, operate, and maintain solar projects.

What many building owners do understand is leasing their properties. And leasing their rooftops for community solar as a new passive revenue stream becomes even more compelling during the COVID-19 pandemic lockdowns and their aftermath. UGE understands this and the resistance landlords have towards developing their own solar projects. Thus, UGE provides an end-to-end platform and controls the development, building, ownership, and operations of rooftop solar projects. This creates a win/win situation for UGE and building owners – UGE gets recurring revenue from selling solar energy from its projects, and landlords get recurring revenue from leasing their rooftops to UGE.

What this effectively leads to, once UGE has established a relationship and track record with landlords who typically own multiple properties, is sales synergies and a competitive moat. For those landlords that own multiple properties, this becomes land-and-expand potential for UGE, shortening the sales, development, and installation cycles across subsequent properties in the landlord’s portfolio.

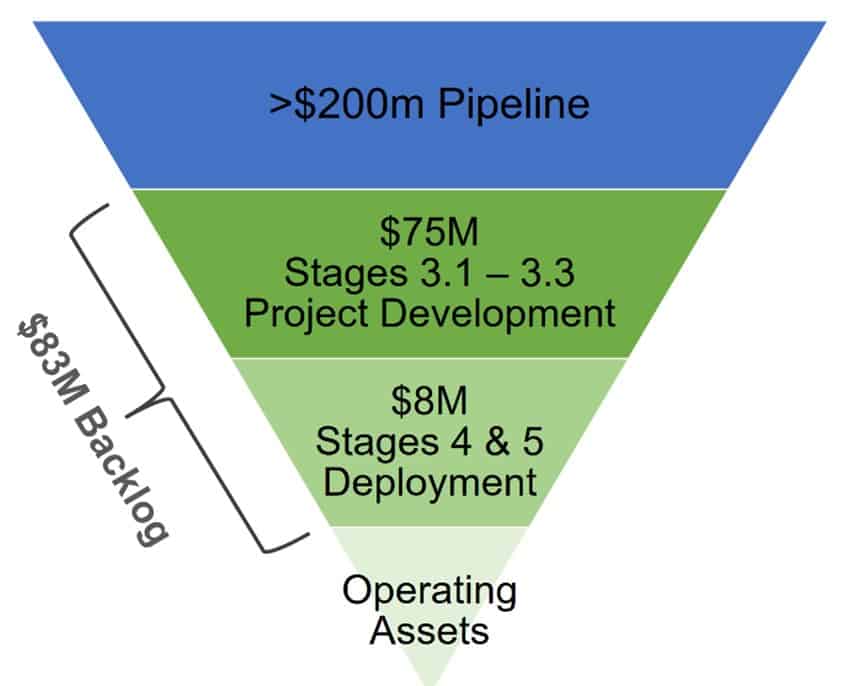

UGE’s Backlog is Actually Project Net Present Value

Figure 1 shows UGE’s US$83 million of backlog as of June 30, 2020 quarter-end. In addition, Figure 1 does not include US$21.5 million of new community solar projects in Maine announced post UGE’s second quarter end. UGE provided a third-quarter update, stating that backlog as of September 30, 2020 exceeded US$100 million. We believe that this equates to about 65MW of solar PV generation capacity for projects in UGE’s backlog. We’d be remiss to not point out that the Company originally aimed for its backlog to reach the US$100 million level by the end of 2020, which implies the Company attained this milestone a few months ahead of schedule.

Investors should understand that UGE’s “backlog” actually represents the net present value (“NPV”) of discounted revenues across the Company’s portfolio of projects. We have previously pointed this out and highlighted that typically, backlog refers to expected future revenue streams (the total value of contracts which get converted into revenue over the course of the contract). However, UGE’s backlog refers to the unlevered (excluding debt) NPV of committed projects, less value already realized. Without getting too deep into a corporate finance discussion, this refers to the present value of all of UGE’s projects, ignoring the debt required to finance the projects today, or what a buyer with the means to finance construction of backlog projects would be willing to pay for it. From a revenue perspective, UGE anticipates that all these projects will commence energy generation within two years, which will lead to upfront and recurring revenues flowing through the company’s income statement. Additionally, we point out that from a financial reporting point of view, UGE’s backlog is not reflected in the company’s reported financial results.

Figure 1 : UGE International’s Project Development Funnel (June 30, 2020)

The Value of UGE’s Pipeline Relative To Recent Project Transactions

Let’s put the pieces together on what UGE’s pipeline of solar PV projects could be worth. Exhibit 1 illustrated the multiples that project purchasers are paying for projects under development (i.e. pre-construction). These multiples vary, depending upon geography and the number of projects in the deal. However, the most relevant data point in Exhibit 1, pertains to a transaction in Maine (a key market for UGE) in August 2020, at a value of about US$1.30/W.

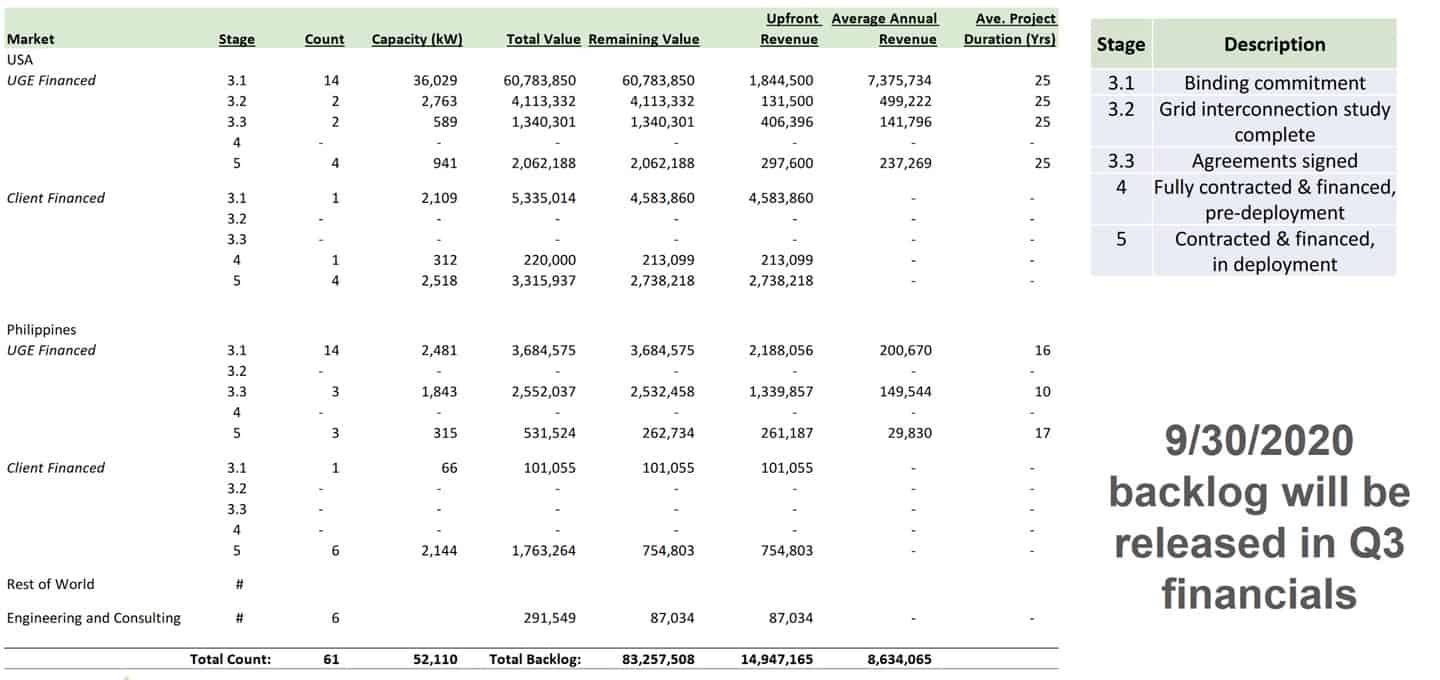

Exhibit 2 shows details of UGE’s backlog as of June 30, 2020. Not included in Exhibit 2 are any projects secured since June 30, including US$21.5 million of community solar projects in Maine announced September 16, 2020, which puts the backlog value at around US$104 million and 65 MW of capacity.

Exhibit 2: UGE Solar Project Stages of Completion

Source: Company Investor Presentation

The market’s implied valuation for UGE’s projects, suggests a favourable risk/reward for UGE investors based upon Exhibit 1 and Exhibit 2. We highlight some simple facts pertaining to this comparison below:

TSXV:UGE share price (November 6, 2020) C$1.32

UGE shares issued and outstanding 26.3 million

UGE market cap (November 6, 2020) C$34.7 million

UGE net debt (August 25, 2020) C$1.6 million

UGE enterprise value (November 6, 2020) C$36.3 million

Project backlog capacity 65MW

USD/CAD 1.31

Market valuation per MW of UGE project backlog capacity: About US$0.43/W.

Putting UGE’s Market Implied Backlog Capacity Into Context

We note UGE’s market implied market valuation is US$0.43/W versus the recent transaction in Maine valued close to US$1.30/W. Based on discussions with industry participants, in some cases, we believe buyers may have to incur costs of approximately US$1.00/W in order to bring these projects to operational status. In this scenario, the effective transaction value could easily approach US$2.50/W, once built. As an additional data-point, UGE’s US$104 million backlog currently implies a seemingly conservative value of about $1.60/W. Further, this does not factor in additional sales growth.

A Few More Reasons to Invest in UGE International

If investors believe that solar PV energy generation will continue to grow in the United States, (a reasonable thesis given the growth in the sector despite a less than friendly U.S. administration), we consider Sophic Capital client UGE International [TSXV:UGE; OTC:UGEIF] an inexpensive way to gain a foothold in this industry. The Company has over US$100 million of project backlog (which is actually NPV), and all the projects should commence operations within two years, resulting in the backlog flowing through the Company’s financial statements, making the value easier for investors to recognize. We note the backlog is, currently, not reflected in the Company’s reported financial results.

Another reason for investors to consider small cap stock UGE is the Company’s tight share structure. Issued and outstanding shares stand at 26.3 million Fully diluted, the share count would increase to 29.3 million. Tight share structures like UGE has steadfastly maintained provides a lot of torque to earnings and cash-per share which typically translates into rapid share price acceleration. Scarcity of shares, amplifies share price reaction to companies executing on strong business models.

Finally, one of the key things that Sophic Capital looks for in issuers is high insider ownership. This means that insider (management, board of director and significant shareholders) interests are aligned with common shareholder interests. As such, we find that very often management teams with high insider ownership are hesitant to undertake financing actions, which place new shareholder interests ahead of existing shareholders (themselves) or any other corporate actions, which are detrimental to shareholder interest. UGE insiders own over 51% of the Company’s shares, making the Company (in our opinion) attractive for longer-term investors.

Disclosures

UGE International has contracted Sophic Capital for capital markets advisory and investor relations services.

Disclaimer

The information and recommendations made available through our emails, newsletters, website and press releases (collectively referred to as the “Material”) by Sophic Capital Inc. (“Sophic” or “Company”) is for informational purposes only and shall not be used or construed as an offer to sell or be used as a solicitation of an offer to buy any services or securities. In accessing or consuming the Materials, you hereby acknowledge that any reliance upon any Materials shall be at your sole risk. In particular, none of the information provided in our monthly newsletter and emails or any other Material should be viewed as an invite, and/or induce or encourage any person to make any kind of investment decision. The recommendations and information provided in our Material are not tailored to the needs of particular persons and may not be appropriate for you depending on your financial position or investment goals or needs. You should apply your own judgment in making any use of the information provided in the Company’s Material, especially as the basis for any investment decisions. Securities or other investments referred to in the Materials may not be suitable for you and you should not make any kind of investment decision in relation to them without first obtaining independent investment advice from a qualified and registered investment advisor. You further agree that neither Sophic, its, directors, officers, shareholders, employees, affiliates consultants, and/or clients will be liable for any losses or liabilities that may be occasioned as a result of the information provided in any of the Material. By accessing Sophic’s website and signing up to receive the Company’s monthly newsletter or any other Material, you accept and agree to be bound by and comply with the terms and conditions set out herein. If you do not accept and agree to the terms, you should not use the Company’s website or accept the terms and conditions associated to the newsletter signup. Sophic is not registered as an adviser or dealer under the securities legislation of any jurisdiction of Canada or elsewhere and provides Material on behalf of its clients pursuant to an exemption from the registration requirements that is available in respect of generic advice. In no event will Sophic be responsible or liable to you or any other party for any damages of any kind arising out of or relating to the use of, misuse of and/or inability to use the Company’s website or Material. The information is directed only at persons resident in Canada. The Company’s Material or the information provided in the Material shall not in any form constitute as an offer or solicitation to anyone in the United States of America or any jurisdiction where such offer or solicitation is not authorized or to any person to whom it is unlawful to make such a solicitation. If you choose to access Sophic’s website and/or have signed up to receive the Company’s monthly newsletter or any other Material, you acknowledge that the information in the Material is intended for use by persons resident in Canada only. Sophic is not an investment advisor nor does it maintain any registrations as such, and Material provided by Sophic shall not be used to make investment decisions. Information provided in the Company’s Material is often opinionated and should be considered for information purposes only. No stock exchange or securities regulatory authority anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. Sophic and/or its principals and employees may have positions in the stocks mentioned in the Company’s Material and may trade in the stocks mentioned in the Material. Do not consider buying or selling any stock without conducting your own due diligence and/or without obtaining independent investment advice from a qualified and registered investment advisor. The Company has not independently verified any of the data from third party sources referred to in the Material, including information provided by Sophic clients that are the subject of the report, or ascertained the underlying assumptions relied upon by such sources. The Company does not assume any responsibility for the accuracy or completeness of this information or for any failure by any such other persons to disclose events which may have occurred or may affect the significance or accuracy of any such information. The Material may contain forward looking information. Forward-looking statements are frequently, but not always, identified by words such as “expects,” “anticipates,” “believes,” “intends,” “estimates,” “potential,” “possible,” “projects,” “plans,” and similar expressions, or statements that events, conditions or results “will,” “may,” “could,” or “should” occur or be achieved or their negatives or other comparable words and include, without limitation, statements regarding, projected revenue, income or earnings or other results of operations, strategy, plans, objectives, goals and targets, plans to increase market share or with respect to anticipated performance compared to competitors, product development and adoption by potential customers. These statements relate to future events and future performance. Forward-looking statements are based on opinions and assumptions as of the date made, and are subject to a variety of risks and other factors that could cause actual events/results to differ materially from these forward looking statements. There can be no assurance that such expectations will prove to be correct; these statements are no guarantee of future performance and involve known and unknown risks, uncertainties and other factors. Sophic provides no assurance as to future results, performance, or achievements and no representations are made that actual results achieved will be as indicated in the forward looking information. Nothing herein can be assumed or predicted, and you are strongly encouraged to learn more and seek independent advice before relying on any information presented.