The Next Killer App for Telcos

Gaming Market’s Energy Bar at Full Strength

The gaming market is huge! In 2019, it was an estimated US$192 billion market, forecasted to grow at an 11% CAGR to almost US$400 billion by 2026. Compare this to the music industry, which had US$20.2 billion of revenue in 2020 or the movie industry which had a $42.5 billion global box office in 2019. Gaming is starting to catch up to the global sports market, which is expected to grow from US$388 billion in 2020 about US$600 billion by 2025.

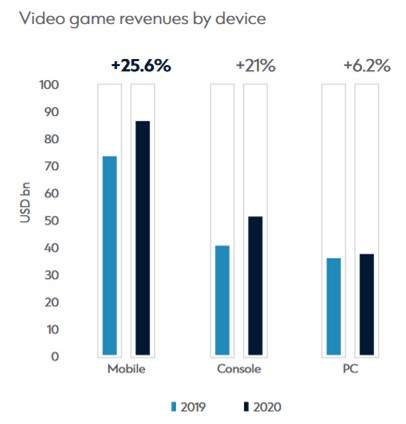

Sophic Capital has published research (Report 1, Report 2, other gaming industry research) about the gaming industry/market and catalysts accelerating growth. As we previously wrote, lockdowns during the COVID-19 pandemic accelerated gaming interest as many people looked for new forms of entertainment in the absence of sporting events, concerts, and cinema outings. Not only did the gaming industry benefit but so did the streaming of video games – Twitch, Facebook Gaming, and DLive all saw year-over-year growth of content watched in 2020. In fact, esports audiences could grow to 474 million viewers in 2021.

Source: NewZoo, Standard Chartered

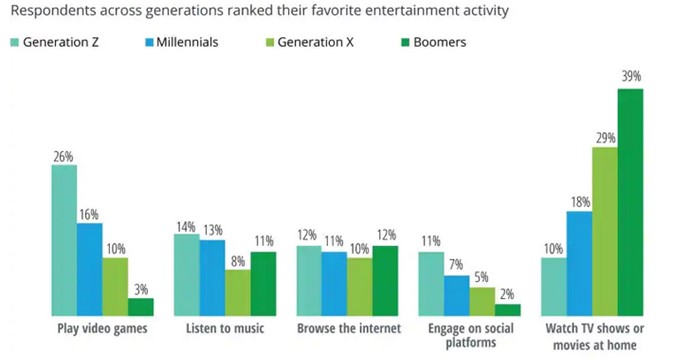

Mobile gaming is set to benefit from increased interest in gaming. In 2020, mobile gaming was a US$71.9 billion industry posed to grow to US$153.5 billion by 2027 (NewZoo and Standard Chartered estimated over US$80 billion). Prior to implementing restrictions on play time, China was set to account for US$48 billion of this 2027 market. Virtually all game sales for mobile gamers happens online, driven by Gen-Z (those born between 1996 and 2012) being both the world’s largest demographic and the demographic that spends the most time on their mobile phones. Gaming is Gen-Z’s favourite entertainment activity (Exhibit 1) – in fact, it is a lifestyle, a way to meet friends and socialize. And as telecommunications companies (telcos) across the world upgrade to 5G infrastructure, Gen-Z’s mobile gaming experiences are about to be enhanced as is Gen-Z’s ability to build communities with like-minded peers.

Exhibit 1: Playing Video Games is Gen-Z’s Favorite Activity

Telcos Need to Become Business Platform Service Providers

Before entertainment companies adopted OTT models, telcos were the dominant technology companies. Music offerings were never a telco strength, and Over-the-Top (OTT) music services (services that are streamed over the Internet, bypassing network operators and potentially competing against similar operator services) like Spotify, removed any potential for telcos to gain market share. Video packages (cable) continues to lose market share as people “cut the cable”. Telcos have even lost their dominant position in teleconferencing due to OTT video conferencing services like Facebook Messenger, WhatsApp, and Zoom. In effect, OTT services have relegated telcos to the suppliers of data pipes – in other words a utility – providing the data highways for OTT services to extract revenues from telco subscribers. Worse yet, when OTT services falter, subscribers don’t complain to Netflix or Amazon Video – they complain to telcos, and telcos are left to spend on opex and capex while OTTs pay nothing.

To counter the lost revenue opportunities, network operators attempted to bundle services (telco, broadband, SMS) to extract higher Average Revenue Per Customer (ARPU). ARPU did increase, but telcos are still the same, low-growth utilities. What telcos need to do is transform into business platform service providers.

Telcos Need to Target Gen-Z, the Largest Demographic

Here is a summary of the evolution of telco networks:

- First generation (1G) networks were analog-based and only offered voice communications;

- 2G transitioned to digital communications from analog, and SMS messaging introduced;

- 3G offered video and mobile data;

- 4G and 4G+ brought high-speed access and mobile internet;

- 5G downloading will be 10 times faster than 4G.

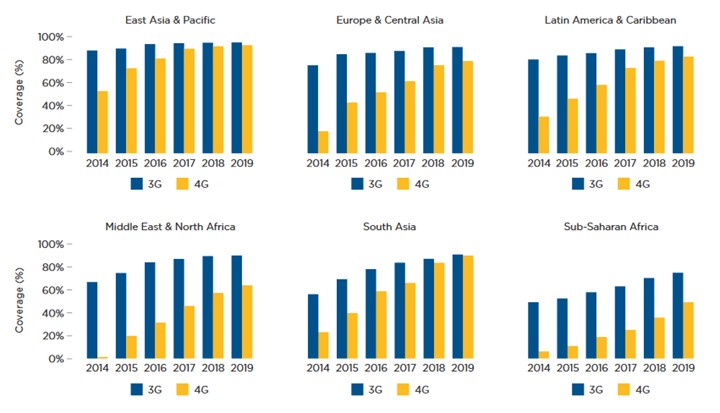

Gen-Z is the next generation for telcos to monetize. Most of Gen-Z’s first exposure to mobile communications has been via 4G networks. Even in emerging markets, 4G networks covered 46% of the population 2015 which grew to 82% by 2019 (Exhibit 2) and have driven much of Gen-Z’s mobile communications adoption. Beyond the cost of mobile data, Gen-Z doesn’t care who provides their mobile data – they only want reliable access to their favourite OTT services. Given this, it’s incumbent on telcos to not only give Gen-Z reliable access to keep them as subscribers but also add extra value to increase Gen-Z ARPU. Reliability will come from 5G networks; reliability will come from the “killer app” for 5G – gaming.

Exhibit 2: Growth of 3G and 4G Coverage

Telcos Absent from Gaming

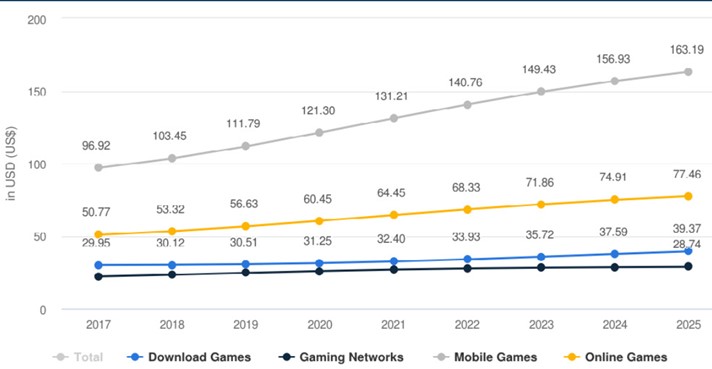

To meet growing demand for wireless bandwidth, telcos are upgrading their communications networks. Although 4G networks dominate global coverage, network operators are investing in 5G infrastructure. Customers will benefit from these upgrades; so will OTT service providers, and telcos do not want to repeat the missed opportunity of failing to investing in services subscribers demand (like music streaming in the past). Telcos are looking for new services that will generate new subscribers, reduce churn and extract more ARPU from existing customers, and (mobile) gaming is a growing opportunity (Exhibit 3).

Exhibit 3: Gaming ARPU by Channel

Source: DOCOMO Digital

Cloud and edge gaming could provide new revenue streams for telco operators. Gaming does exist over 4G networks, but 5G networks will provide faster download speeds and lower latencies (the time it takes data to travel across a network to its destination).

Cloud Gaming

Cloud gaming streams games from a server to the gaming device. It centralizes processing and pushes content to the gamer’s device, making the gaming experience largely dependent on the network coverage, capability, stability and distance from cloud server locations. There are no storage requirements for the phone and reduced processing requirements. Every player input from the gaming device is sent to the cloud engine, graphic changes computed and encoded as video, and then streamed back to the gaming device. Gamers can access cloud games whenever they have network coverage and do not have to download or install games. Although cloud gaming simplifies access and hardware requirements for games, game providers need to invest in data centers and manage processing to ensure gamers have seamless access and error-free experiences.

Cloud gaming provides the opportunity for telcos to host game processing. For example, rather than process and pull game data from a centralized Facebook data server that then has to connect the Internet to deliver the data to the end user, a telco could provide the service. The advantage of shifting the data processing to the telco is a reduced data path (from thousands of kilometers to tens or hundreds) thereby reducing latency. As well, the telco generates new revenue through this service.

Edge Gaming

Edge gaming pushes processing closer to the user’s device (the edge of the network) rather than to a centralized server. Processing at the edge removes the need to upload data to a server and then wait for the server to process the data and return video. The “edge” device can be a cell tower, a data center, or even the user’s phone. Pushing the processing to the edge minimizes the amount of data that needs to be processed at a centralized server, thus reducing network bandwidth requirements.

Telcos Could Game the Gaming Consoles

Cloud and edge gaming could disrupt traditional gaming business models. Major gaming publishers distribute their titles via consoles like PlayStation and XBOX. By partnering with telco operator and leveraging their networks, game publishers can remove their dependency upon consoles. This is no different from video publishers bypassing cable networks or cinema chains by offering an OTT service (Disney+, Amazon Prime, for example). Gaming OTT subscription models seem to be the next entertainment disruption, providing telcos opportunities to attract new subscribers, increase ARPU with existing customers, and build customer stickiness. It’s even possible that telcos themselves could start producing gaming content.

Telcos Need to Own the Edge

To attract new subscribers and in increase ARPU from existing customers, we’ve made the case that telcos need to:

- Evolve from being utilities to business platform service providers;

- Target Gen-Z, the largest demographic, and;

- Offer gaming services to attract and keep Gen-Z subscribers.

We’ve also established the case that EDGE gaming and 5G networks are the path to provide seamless gaming experiences. Thus, we conclude that telcos need to own the edge and offer edge computing. There are numerous edge computing use cases: for example, autonomous vehicles are edge devices that are suited to process data locally rather than by transferring data to a centralized server. Remote monitoring of assets such as off-grid power systems is another use case. Hospital monitoring of patients, where the hospital is the edge, not only reduces reliance on cloud processing but also reduce data privacy risks. But as it applies to attracting and maintaining Gen-Z subscribers, telcos need to offer edge computing gaming, especially on fast 5G networks. On top of this, they can add value-add gaming services that add value for Gen-Z. Sophic Capital will detail these gaming services in our next report.

Coming Up…

In our next report, we’ll introduce Sophic Capital client Swarmio Media [CSE:SWRM], a global gaming and esports technology and media company that provides a turnkey gaming platform and community for telcos to quickly launch and start leveraging their customer base today.