In Part 1 of this series, we highlighted that many people didn’t know that their personal digital data was being accumulated and sold. We also detailed how consumer data privacy legislation is going to rattle companies that mine and broker your personal data. In Part 2, we discussed how your personal data is mined and sold, what it could be worth, and how even the largest brands are not compliant with current and pending data privacy legislation. Welcome to Part 3 of Give it Away – The Million You Never Made, where we’ll show how Freckle (FRKL-TSXV), a Sophic Capital client, has a data privacy-compliant application that will fill the void left by traditional data brokers that cannot meet regulatory requirements around the collection and monetization of YOUR personal data.

A Speckle of Personal Data Compliance

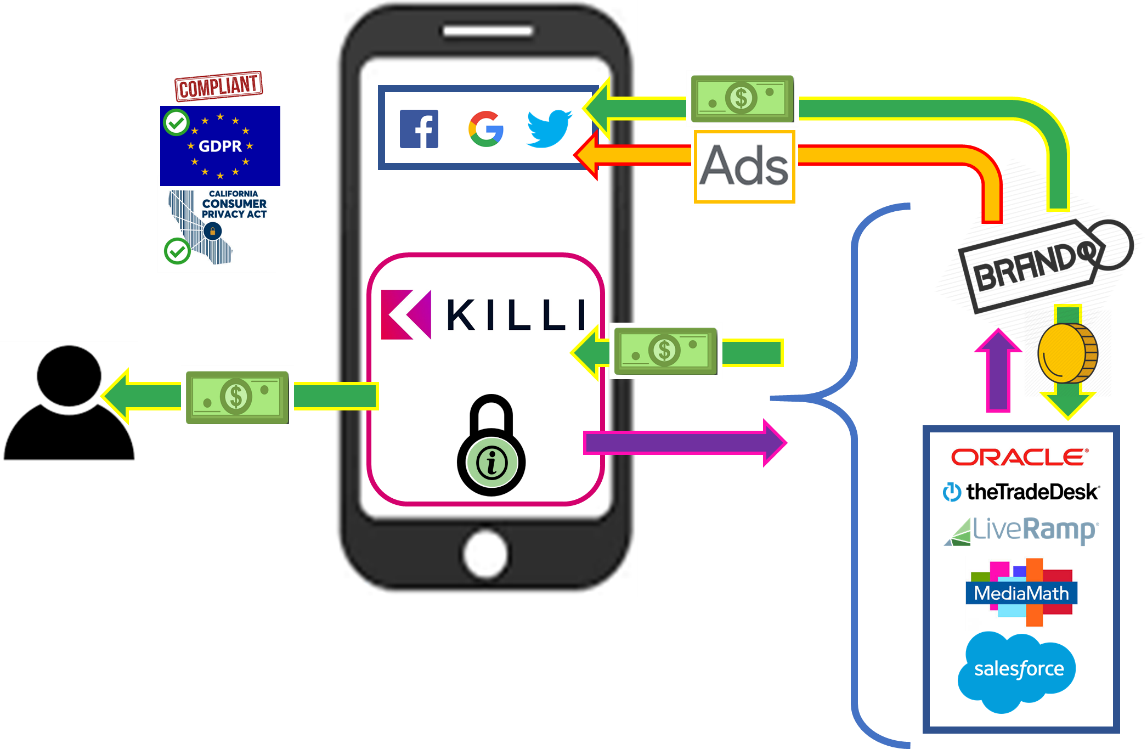

Freckle is the only personal data company that adheres to consumer compliance regulations like the California Consumer Privacy Act (CCPA) and Europe’s General Data Protection Regulation (GDPR). Freckle accomplishes this through its Killi application, where users select what personal information they choose to add and then monetize. Brands, platforms and companies pay Killi users to complete consumer surveys that add additional layers of behavioural data to their persona. The more personal information Killi users share, the more money they can earn. Killi users can change their privacy preferences, supplying as much or as little personal info they choose at any time. Should the Killi user choose to forego future monetization of their data and delete the application, all personal data used by Killi is also deleted.

Killi does not prevent data brokers from collecting user data; there are thousands of companies amalgamating data unbeknownst to the consumer. However, data sources used by data brokers will be responsible for managing the opt-in and opt-out rights for consumer data collection and monetization. Since there is no U.S. national standard concerning data privacy and several U.S. states are drafting their own legislation, many data sources are likely to generate less revenues going forward rather than deal with the unique data privacy requirements of potentially 50 states. But legislated consumer opt-out rights are not the only negative catalyst that the data sources and data brokers will likely endure as consumer data privacy legislation goes live.

Just like Uber enables consumers to monetize their vehicles and Airbnb allows consumers to monetize their homes, Killi enables consumers to monetize their personal data; the data that publishers, platforms, and data brokers have long exploited for profit without paying you. We previously stated that most consumers have not cared about their personal data, but as they become aware of the value of their personal data and Killi’s ability to monetize it, we believe more consumers will opt-out of the collection and monetization of their personal data through data sources and data brokers. Killi allows consumers to control what data they choose to share. Because Killi users choose what personal data to share and monetize, they effectively opt-in and can opt-out at any time. This means that Killi is GDPR and CCPA compliant. Brands love privacy compliant, high-fidelity, consumer data and will pay Killi users for it. Killi and the consumers split revenues 50/50.

Another Piece Making Killi More Valuable

Offline attribution allows brands to accurately quantify how effective their advertising campaigns have been in driving targeted customers into desired locations. Freckle does this, sourcing location data from 190 million mobile devices generating 100 billion consumer location events each month. Combining location data with the data underpinning advertising, Freckle’s analytics can determine what advertisement, what advertising medium and what vendor drove a consumer to a location. While there are others that also provide this service, they all have their own algorithms. However, by Freckle adding Killi’s high-fidelity, consumer data, they are able to add an identity layer that is compliant with current and proposed privacy regulations that adds more insight than other companies in the space. This is a major competitive advantage that Freckle has not seen elsewhere.

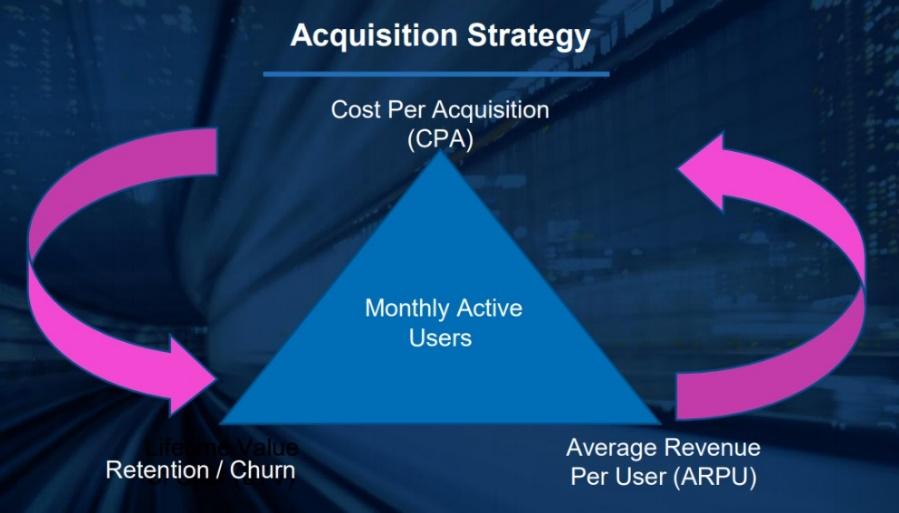

To scale Killi, Freckle plans to acquire more users. Currently the Company is focused on driving higher average revenue per user (ARPU), reducing churn, improving retention/lifetime value and lowering the cost per acquisition (CPA) of a new user. At a certain point there is an “ah-ha” moment when CPA falls below ARPU and retention increases, making every dollar spent on CPA accretive to the bottom line. These metrics are improving, and the Company is getting ready to expand Killi rapidly in both North America and internationally.

To retain users, Freckle will incorporate international partners to increase the number of survey opportunities for consumers. The bi-product of more surveys is that consumers receive more money, closing the gap between CPA and ARPU. All downstream metrics for a KIlli user improves in direct correlation to an increase in money to consumers, meaning for each new penny acquired by a user there is a corresponding reduction in churn, a corresponding increase in retention, as well as a corresponding improvement in lifetime value and virality. The Company, currently operating Killi in USA and Canada will also look to expand internationally to add additional markets to this matrix thereby creating additional options for lower CPA – bringing CPA and ARPU closer and closer together. The Company may also ask users for richer data like a driver’s license, credit card information, and other personal data that can easily be uploaded to the application, which can increase ARPU for the consumer. All personal data that is currently collected and sold can all come under the control of the consumer for them to monetize. People like getting paid, and offering more money is an incentive to keep them using Killi. The longer a Killi user monetizes their data, the more revenue generated (i.e. total lifetime value).

Competitive Landscape is Shrinking

Freckle has three main competitors. Foursquare acquired Placed from SNAP for an undisclosed sum (Bloomberg reported that SNAP paid $125 million for Placed). Placed determines the efficacy of certain ad campaigns by tracking users’ real-time movements, paying users or offer other types of rewards. Factual is an offline attribution competitor as is Cuebiq.

Viewability measurement companies have all been acquired, creating a direct parallel to what we believe will happen to those operating in the offline measurement space.

Viewability Measurement Companies:

- Oracle acquired Moat, a provider of measurement, analytics, and intelligence, for an estimated $850 million;

- Vista Equity Partners acquired a majority stake in Integral Ad Science, technology that maximizes the ability of every brand impression to capture consumers’ attention. The investment size was not disclosed but speculated to be $850 million;

- Providence Equity Partners acquired a majority stake in DoubleVerify, a provider of marketing measurement software, data and analytics that authenticates the quality and effectiveness of digital media. The deal size was estimated at $200 million.

Offline Attribution Companies:

- Nielsen bought Visual IQ, a provider of multi-touch attribution insights, for an undisclosed amount but could have been worth as much as $200 million;

- Foursquare acquired Placed from SNAP for an undisclosed sum (Bloomberg reported that SNAP paid $125 million for Placed).

High Insider Ownership

One of Sophic Capital’s key investment tenets is high insider ownership. We like businesses where management has invested a significant amount of capital alongside shareholders. Freckle checks this box nicely. CEO Neil Sweeney, who ran 3 prior start-ups including JUICE Mobile, which was sold to Yellow Pages for $35 million, invested approximately $7 million of his own capital into Freckle. Management and insiders own about 76% of the Company, meaning they are motivated to make the business succeed and make the best financing decisions alongside investors.

THE Reason to Invest

We know of no other way to invest in the growing consumer data privacy regulatory space. Many companies are exploiting consumer data without permission and without compensating consumers. Privacy regulations like GDPR and CCPA are causing third-party data sources, data brokers, and brands to re-evaluate their operations to become compliant. Freckle’s Killi app is the only GDPR-, CCPA-compliant identity tool that we’re aware of that allows consumers to monetize their data.