AnalytixInsight

ALY:TSXV; ATIXF:OTC

Capital Structure

Company News

Industry News

Industry News

Sophic Insights

Clearing the Aires

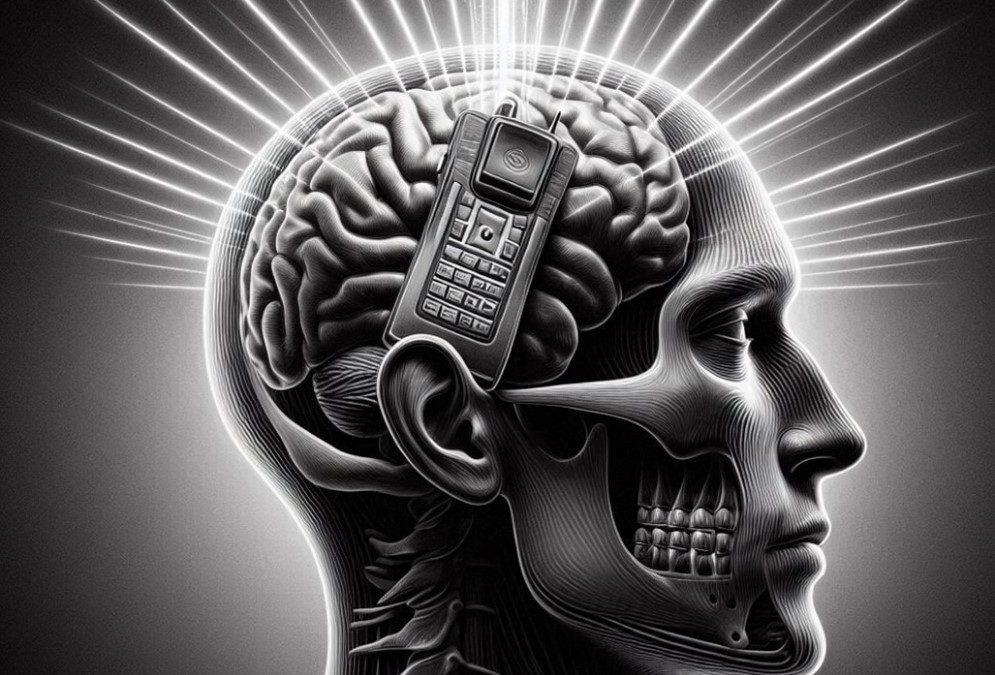

Discharging for a Healthier Life Report #1 Recap In Sophic Capital’s Dialing Up Danger? report, we detailed that the potential of harmful effects from Electromagnetic Field (EMF) radiation from consumer devices such as mobile phones, Wi-Fi routers, or baby monitors is...

October 20, 2024: Markets Keep Climbing Wall of Worry

Last week, major indexes rose for the sixth straight week. Dow Jones rose, ~1% and a hit a record high Friday, S&P 500 was up 0.85%, and hit a record close Friday, Nasdaq composite rose 0.8%. Chinese robotaxi firm, Pony AI filed for a US IPO. Zuora, which sells software for businesses to manage subscription billing, has agreed to be bought by private equity firm Silver Lake and Singaporean sovereign wealth fund GIC for US$1.7 billion. Uber reportedly explored a possible bid for Expedia in a ‘super app’ growth push. Stripe is in talks to acquire Bridge for US$1 billion, Stripe has made it clear that crypto is a huge priority for the company. Billionaire investor Stanley Druckenmiller said he regrets selling his entire Nvidia stake, and is looking to buy again. Shares in semiconductor equipment maker ASML fell 16% on Tuesday, after the Dutch company published financial results a day early, issuing disappointing sales forecasts. TSMC’s profit rose 54% on AI demand. Netflix stock hit an all time high in Q3 results. Amazon and Google are also investing in nuclear power and backing small nuclear reactors. iPhone reportedly had its best ever and nearly topped Samsung globally per research firm Canalys. In Canada, a Hong Kong billionaire increased their stake in Well Health Technologies with a $81-million private share purchase. Sophic Client, Kraken Robotics filed its final short form prospectus in connection with its bought deal public offering. The Company also received $13 million of subsea battery orders. Sophic Client, Intermap announced that Česká podnikatelská pojišťovna (ČPP), a subsidiary of the Vienna Insurance Group subscribed to Intermap’s innovative solution for determining the market price of real estate properties. Sophic Client, American Aires and MBM Motorsports partnered to protect NASCAR Cup team from in-race EMF radiation in an innovative sponsorship.

Vital Signs: Taking the Pulse of Critical Services

Plurilock’s strategic shift towards integrating its services, enhancing its advisory council, and optimizing its resource allocation to meet the escalating demand for comprehensive cybersecurity amidst a fragmented market is fortifying the Company’s position. It stands poised to address critical challenges like business continuity, geopolitical threats, and regulatory compliance, solidifying its reputation in the evolving landscape of cybersecurity.

Dialing Up Danger?

The potential of harmful effects from Electromagnetic Field (EMF) radiation is a polarizing topic. It’s fair to say that scientific research is currently indeterminate. Many people wonder if having a smart phone beside their head or in front of their face for hours every day may harm their health, while others are adamant that there are no ill effects. Although the human body can cope with many natural sources of radiation (like the sun), could prolonged EMF radiation from consumer devices such as mobile phones, WiFi routers, and baby monitors harm us? Exceeding EMF radiation guidelines for mobile phones, electric vehicles, microwave ovens and other electrical devices suggest that these devices can harm us.