AnalytixInsight

ALY:TSXV; ATIXF:OTC

Capital Structure

Company News

Industry News

Industry News

Sophic Insights

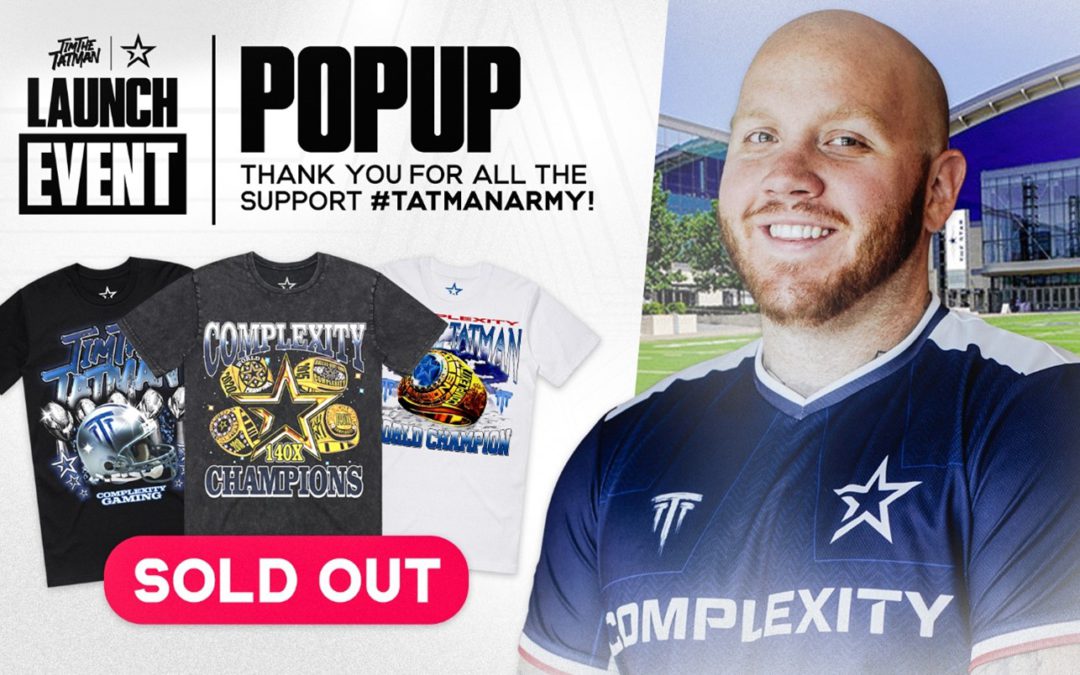

GameSquare Adds TimTheTatman to Increase Engagement and Drive New Revenue Streams

Esports influencer TimTheTatman recently announced that he would join Complexity Gaming [and GameSquare Esports.

TimTheTatman has built an audience of more than 4 million YouTube subscribers, 3.4 million Instagram followers, and 2.6 million Twitter followers.

Influencer advertising is growing as it gains acceptance with marketers – and TimTheTatman adds to GameSquare’ audience reach and engagement.

September 26, 2021: Quiet Week in Canadian Capital Markets, But Plenty of Industry Developments

This past week was relatively quiet in Canadian capital markets, in the face of global market volatility, however there were multiple developments in various innovation sectors globally. In Canada, Shopify (SHOP-TSX, SHOP-NYSE) reportedly surpassed Amazon in online traffic. Vancouver-based Dapper Labs raised US$250 million led by Coatue. These two developments, once again highlight how the tech ecosystem, and investing opportunities in Canada have expanded in recent times. CEO of Sophic Client Clear Blue Technologies (CBLU-TSXV, CBUTF-OTC, 0YA-FRA), Miriam Tuerk, showed how Clear Blue’s power innovation for MNOs in Africa unleashes The Green New Deal that pays for itself in an interesting industry discussion. In the USA, Toast and Freshworks had strong public market debuts, and WeWork set Oct. 21 as the date of its public listing. DraftKings stock dropped after a CNBC report of a US$20 billion cash-and-stock buyout bid for U.K.’s Entain. China said all crypto-related transactions are illegal, and the SEC’s Gary Gensler criticizes stablecoins amid call for tougher crypto regulation.

September 19, 2021: A few interesting US new listings, and a Canadian cleantech investment idea

Last week saw a complementary $600 million notes offering by (GIB.A-TSX, GIB-NYSE) following a US$1 billion notes offering the week before. Neo Financial is furthering its push to become a full-stack digital bank: the three-year-old startup closed a $64 million Series B round this summer led by Peter Thiel-backed Valar Ventures, which also led Neo’s Series A financing. We published a piece on Sophic client UGE (UGE-TSXV, UGEIF-OTC) highlighting that the company’s solar project backlog continues to be undervalued compared to mid scale project transactions. The stock is trading at an implied US$0.44/W, which represents about a 43% discount to the average US$0.77/W peer transactions, before accounting for any additional project wins. In the USA, Toast, GitLab, and Forge Global could be some interesting new listings to add to your screens. There was also a fair amount of news in the crypto space, with both bullish and bearish takeaways.

UGE Backlog Continues to be Undervalued

Industry valuations of solar projects under development suggest that UGE International’s current 83.7MW project backlog is undervalued.

UGE’s goal of 120MW of project backlog by the end of 2021 makes the Company’s current undervaluation even more compelling.

Applying peer transactions to UGE’s 357MW (net of backlog) pipeline potentially puts the stock in future multi-bagger territory.