Introduction

Sophic Capital client Body and Mind (BAMM) [CSE:BAMM, OTC:BMMJ] entered Nevada (its first state) when it won a license to cultivate and produce cannabis in 2015. Since arriving, the Company’s cannabis strains have won several awards in the state, including the 2019 Las Vegas Weekly Bud Bracket, Las Vegas Hempfest Cup 2016, High Times Top Ten, the NorCal Secret Cup and the Emerald Cup. BAMM’s first-mover advantage and well-regarded products have helped the Company to establish a significant brand presence in Nevada, with products being sold in most dispensaries across the state.

Current Status of Cannabis in Nevada

The Battle Born State is the 33rd most populous in the United States with over 3.1 million people. Despite almost 2/3 of the population residing in what we lovingly refer to as Sin City (aka Las Vegas), Nevada was not, as some would expect, the first state to turn full recreational on cannabis. That honor was bestowed upon Washington and Colorado, which went full recreational in 2012. Although Nevada legalized medicinal cannabis in 2000, it didn’t go fully legal until 2017 through a ballot initiative.

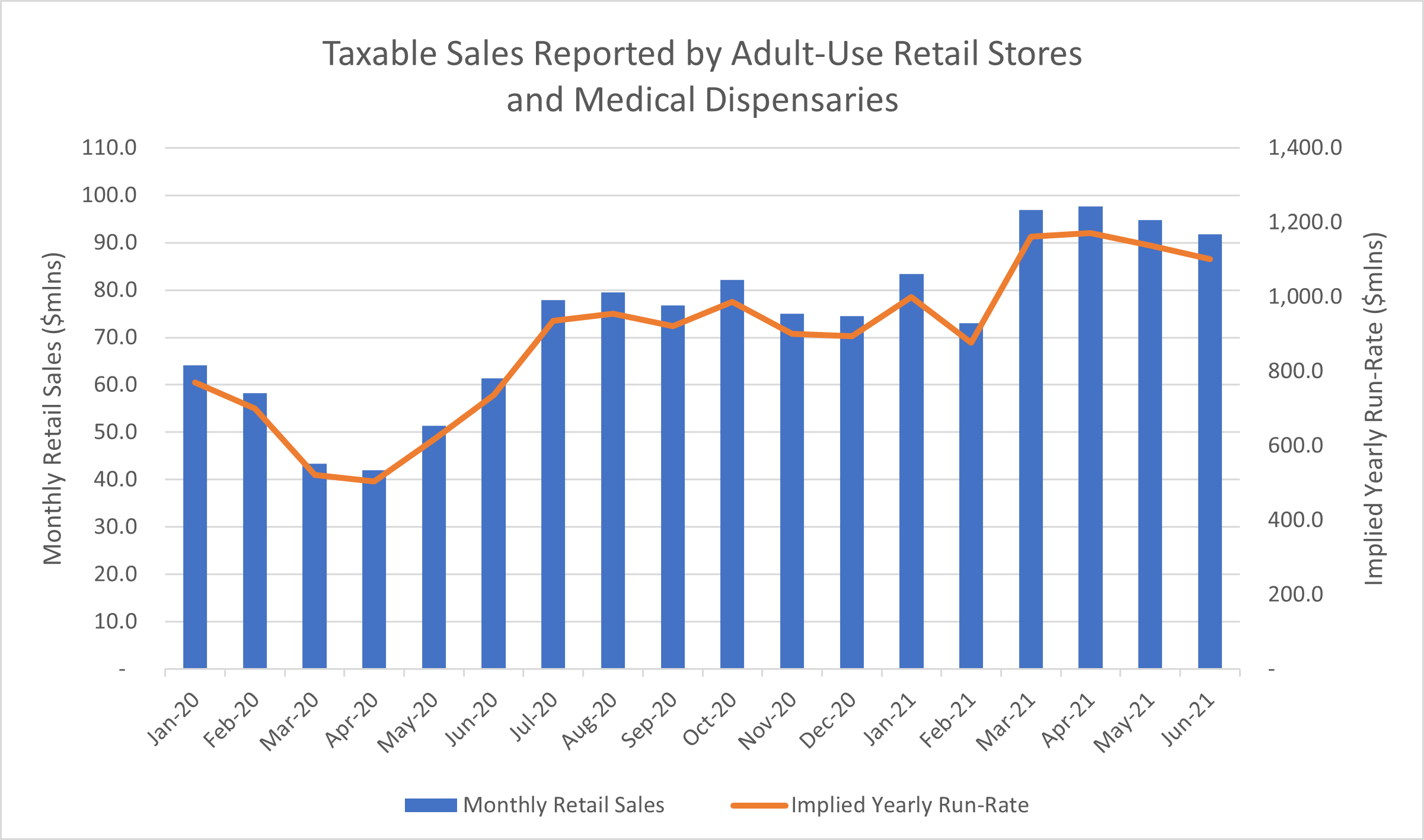

The Nevada retail cannabis market continues to see strong growth, with sales on pace to reach over US$900M by the end of 2021. This is despite a global pandemic which halved the 40+ million annual tourists to Las Vegas. Tourism has bounced back strongly throughout 2020 and into 2021, as pandemic restrictions have eased, and this has led to a renewal in cannabis sales across the state. What’s more, there is some belief that the pandemic might have kick-started a new wave of daily cannabis consumers, as consumption increased substantially during the pandemic. This could bode well for the cannabis tourism industry as well. Beyond gambling, hockey and pool parties, cannabis has weaved itself into the very fabric of the Las Vegas tourism industry, with signage seen all across the strip and new tour companies popping up daily.

Nevada should continue to show strength through 2021 with industry projections suggesting this could just be the beginning of a multi-year growth cycle. According to the 2020 Marijuana Economic & Fiscal Benefits Analysis report issued by the Nevada Dispensary Association (NDA), the Nevada cannabis industry was previously expected to see retail sales grow by an 8.5% CAGR to US$956 million in sales by 2024. However, with 2020 and 2021 sales coming in well ahead of expectations, this projection will likely move meaningfully higher. This would help drive per capita sales to by far the highest levels amongst adult recreational states (over $300 per capita). This is likely due to the very important Las Vegas tourism industry, which plays an important role providing additional brand exposure for BAMM that can be leveraged into tourists’ home states where BAMM currently (and potentially could in the future) operate. It’s a powerful brand awareness tool that is often underappreciated.

State of Nevada, Department of Taxation

Banking restrictions similar in Nevada as every other state. Access to capital, along with simple day-to-day operational aspects like payment processing and depository institutions remains limited. Cannabis is largely a cash business in Nevada and across the U.S. However, as we have referred to in past reports, this appears set to change in the coming months through the introduction of the SAFE banking act, which was just recently added to the Defense Bill. Passing of the bill would be a net positive with regards to the day-to-day operational costs of doing business in the state and have an even greater impact on the industries overall cost of capital.

A Tight Market for a Budding Industry

Cannabis licenses in Nevada are scarce, with only 84 retail licenses currently in use across the state, 39 of which are within the Las Vegas County lines. While BAMM does not currently have any retail licenses, it does maintain a strong presence at retail. The Company aspires to be vertically integrated in all of the states where it operates, and should a new wave of retail license applications become available, BAMM could leverage its operating and regulatory expertise accumulated in other states to try and win a dispensary location. M&A could also play a role; however, because of the current highly limited license environment pricing remains rather elevated

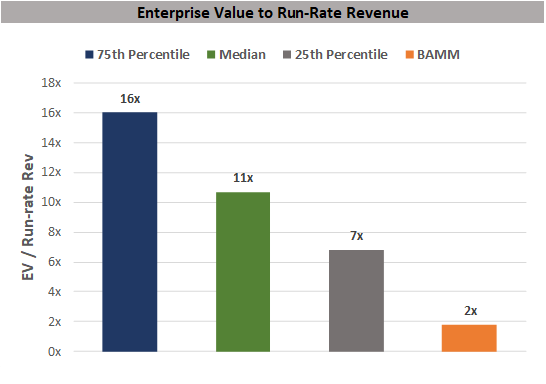

Valuation Research Corporation, Company Reports

Newly introduced cannabis lounges could pave the way for more growth. These lounges give consumers more places to consume cannabis instead of solely at private residences. With the introduction of casual consumption locations and the support of knowledgeable staff, a new group of consumers could be introduced to the market in the coming years. The current proposed regulations stipulate that the products can only be sold in single-use quantities or ready-to-consume packages and must be consumed inside the lounge, as public consumption is still illegal. Current expectations are that the lounges could become operational as early as the first half of 2022.

BAMM Operations in Nevada

BAMM has a strong track record and well recognized brand within Nevada. With 6+ years of experience in the Nevada market, BAMM has established its brand with cannabis consumers and proven itself to be a savvy operator capable of making the necessary adjustments when the need arises. The progression of the business is a testament to this fact – the Company started with a very small footprint of roughly 18,000 sq. ft. but leveraged its excess real estate to expand capacity over time. This reflects strong foresight by management, as the location was picked because of its ability to grow. With over 18,000 sq. ft. for cultivation and 8,000 sq. ft. for production today, BAMM will surely look to expand further as the market grows and conditions allow.

Strong margins throughout the supply chain give BAMM ample space for growth. With Nevada heavily constrained on the supply side (even BAMM recently announced they expanded their cultivation operations by 20% to keep up with demand) pricing for cannabis has been increasing as demand rushes back post-covid. With license supply continuing to be tight and expansion being conservative the profitability expansion may persist in the future.

BAMM is driving community involvement in Nevada as well. BAMM is involved in many initiatives in the area such as bringing the Her Highness brand into Nevada through a production partnership, which is working with the Last Prison Project to help women with reintegration into society post-prison. Along with the social outreach, BAMM also does regular pop-up events at various dispensaries throughout Nevada to help showcase its wonderful products hands-on. With these initiatives, the Company is increasing awareness around cannabis consumption. This is helping to attract potential customers to their brand in specific, and increasing their standing in the community.

What’s Next for BAMM in Nevada?

Twenty additional licenses will be up for grabs with the new cannabis lounge initiative. Nevada continues to show restraint in offering retail licenses with the 20 new locations specifically earmarked for independent consumption lounges. This could provide BAMM with an opportunity to enter the retail market or at the very least expand potential distribution points for one of Nevada’s strongest cannabis brands. Of the 20 new licenses becoming available, 10 have been designated for social equity applicants, which rely on larger corporate operations like BAMM to supply their product.

With its experience acquiring licenses in other states and extensive experience in Nevada, BAMM should be in a strong position to get involved in the next round of license issuance should it choose to. Coupled with its grass-roots approach to community engagement, this could provide ample opportunity for BAMM to continue to flex their cannabis expertise in the Battle Bong Born state.

Looking for More Info About BAMM?

For more info about Sophic Capital client Body and Mind Inc. [CSE:BAMM, OTC:BMMJ], please refer to our prior Company reports: