Military Adoption of Unmanned Underwater Vehicles Accelerating

Recap

In Sophic Capital’s Russia and China Droning for Sea Dominance report, we discussed how Russia and China were bolstering their marine presence with unmanned underwater vehicles (UUVs). In this third of five reports, our focus shifts to how the rest of the world is enhancing their subsea national security, which will be followed by an update on how UUV companies have evolved over the last 7 years. We will then tie this all back Sophic Capital client Kraken Robotics [TSXV:PNG, OTCQB:KRKNF] and how these market forces are driving their growth.

United States

The U.S. Navy continues to drive unmanned vessel programs. As outlined in the March 2021, Department of the Navy Unmanned Campaign Framework, the U.S. Navy is working to incorporate unmanned vessels into its future fleet. The U.S. Navy wants to continue development, as evidenced by the FY 2022 Navy Ship building plan which allocates a potential US$1.7 billion towards unmanned vessels, $400 million for undersea, and $1.3 billion for surface vessels. The Chief of Naval Operations Navigation Plan 2022 suggests why U.S. Navy UUV interest is high, as it details a transition that will rebalance the fleet away from “exquisite, manpower-intensive platforms toward smaller, less-expensive, yet lethal ones.”

For its 2023 budget request, the U.S. Navy continues diversifying and expanding sea power strike capacity by continuing funding for offensively armed Uncrewed Surface Vessels (USV). The Snakehead Large-Displacement Unmanned Undersea Vehicle Program calls for a long endurance system to be launched from submarines and surface ships to conduct missions in deep and inaccessible waters. The Department of the Navy has also requested a $24.1 billion research and development budget that includes the development of large and extra-large UUVs in order to maintain technological superiority. Of this, the Navy has requested $549.3 million of funding for USVs and UUVs, with an additional $60.7 million of funding for core technologies needed by UUVs.

The U.S. Naval Undersea Warfare Center christened its Snakehead UUV on February 2, 2022. Snakehead will scout or monitor certain areas and perform other intelligence-gathering missions, leveraging its guidance and control capabilities, navigation, situational awareness, propulsion, maneuverability, and mission support sensors. The service completed long-distance tests in August 2022, representing a major milestone in the UUV’s capabilities and adding to its 155 in-water sorties and 78 hours of runtime.

In 2019, the U.S. Navy awarded Boeing a US$247.4 million contract to produce up to nine Orca Extra Large Unmanned Undersea Vehicles (XLUUVs). The Orca is an underwater drone the size of a subway car that can be used for anti-submarine warfare, anti-surface warfare, electronic warfare, strike missions, and mine countermeasures. The delivery of the Orcas has been continually delayed, but the first five operational drones could be ready as early as September 2023. A prototype was tested in April 2022 off the coast of California. Orca was the largest of several classes of unmanned vessels (both surface and undersea) being developed during the Trump administration, in an effort to boost the Navy’s total inventory to as many as 355 unmanned vessels by 2030.

Canada

Canada’s Budget 2022 provided an $8 billion increase in defence spending. The increase will see Canada’s defence budget grow from the $18.9 billion in 2016/2017, which was laid out in the Strong, Secure, Engaged: Canada’s Defence Policy of 2017, to $32.7 billion by 2026/2027. Defence priorities include: continental defence, commitment to allies and investments in equipment and technology to immediately increase the capabilities of the Canadian Armed Forces.

The Royal Canadian Navy (RCN) plans to purchase Remote Minehunting and Disposal Systems (RMDS). The acquisition process began in 2017, and bids were accepted in 2021. However, the purchase was delayed due to procurement priorities related to the Ukrainian war. The RMDS program is expected to be awarded before year end 2022 and aims to use Commercial off the Shelf unmanned systems and Autonomous Underwater Vehicles (AUV) technology. The funding ranges between $20 million to $49 million.

Furthermore, the RCN has a mandate to develop and maintain advanced sonar imaging and data storage capability for all three coasts (East: Atlantic, West: Pacific, North: Arctic). The RCN expects these capabilities to enhance national and international intelligence.

Australia

Australia’s defence spending has been largely attributed to naval vessels and the submarine sector. The Department of Defence government funding for 2022/2023 is AU$47 billion, which equates to 2.1% of GDP and 7.4% growth year-over-year. As an island nation, naval prowess is paramount to the country’s security. Australia’s defence strategy was developed to safeguard their border and offshore territories, as well as the surrounding regions, with emphasis on protecting trade routes.

Prime Minister Scott Morrison has allocated an additional AU$74.7 million in 2022/2023 for Operation RESOLUTE to protect Australia’s maritime interests through surveillance and response. Approximately 10% of the worlds total area will be monitored. The rapid technological advancements and military modernization of China, Russia, and North Korea are creating strategic challenges for Australia. As these countries expand their sphere of influence, other nations are prompted to respond.

The Royal Australian Navy is improving their Marine Mine Countermeasures (MCM) and military survey capabilities with the SEA 1905 MCM program. Various consortiums have submitted bids and expectation is award will be announced mid 2023 with first deliveries end of 2024.

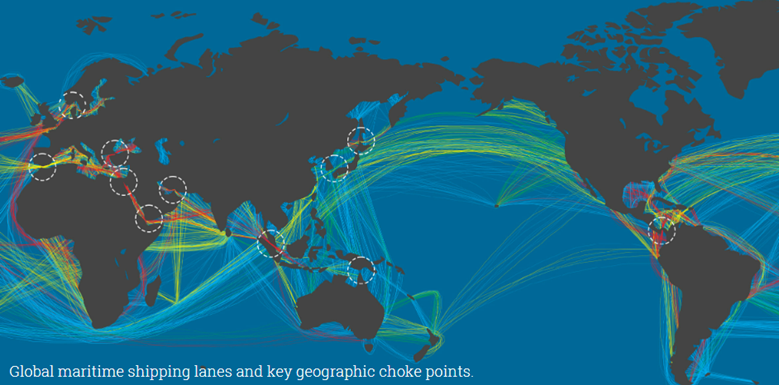

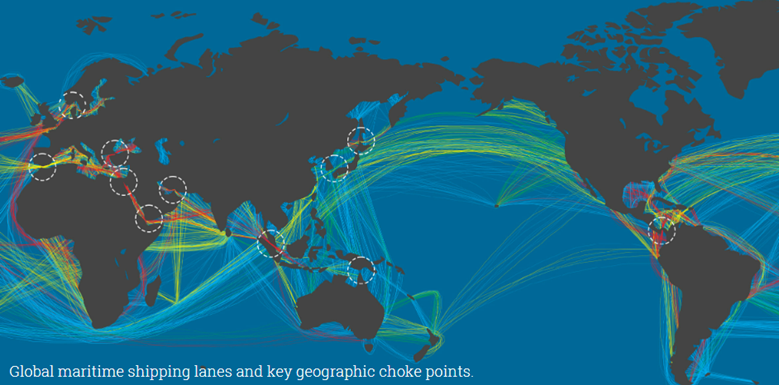

Exhibit 1: Global Maritime Shipping Lanes and Key Geographic Choke Points Leave Australia Vulnerable

Furthermore, a AU$10 billion, 20-year investment has been made to develop ship building infrastructure. The east coast will be home to a new submarine base and Australia’s first large-vessel dry berth precinct.

Australia also plans to replace its ageing naval fleet. It wants to procure nuclear powered submarines in collaboration with the U.S. and U.K. To replace ageing patrol boats, Australia is also procuring Hunter-class frigates and Arafura-class patrol vessels.

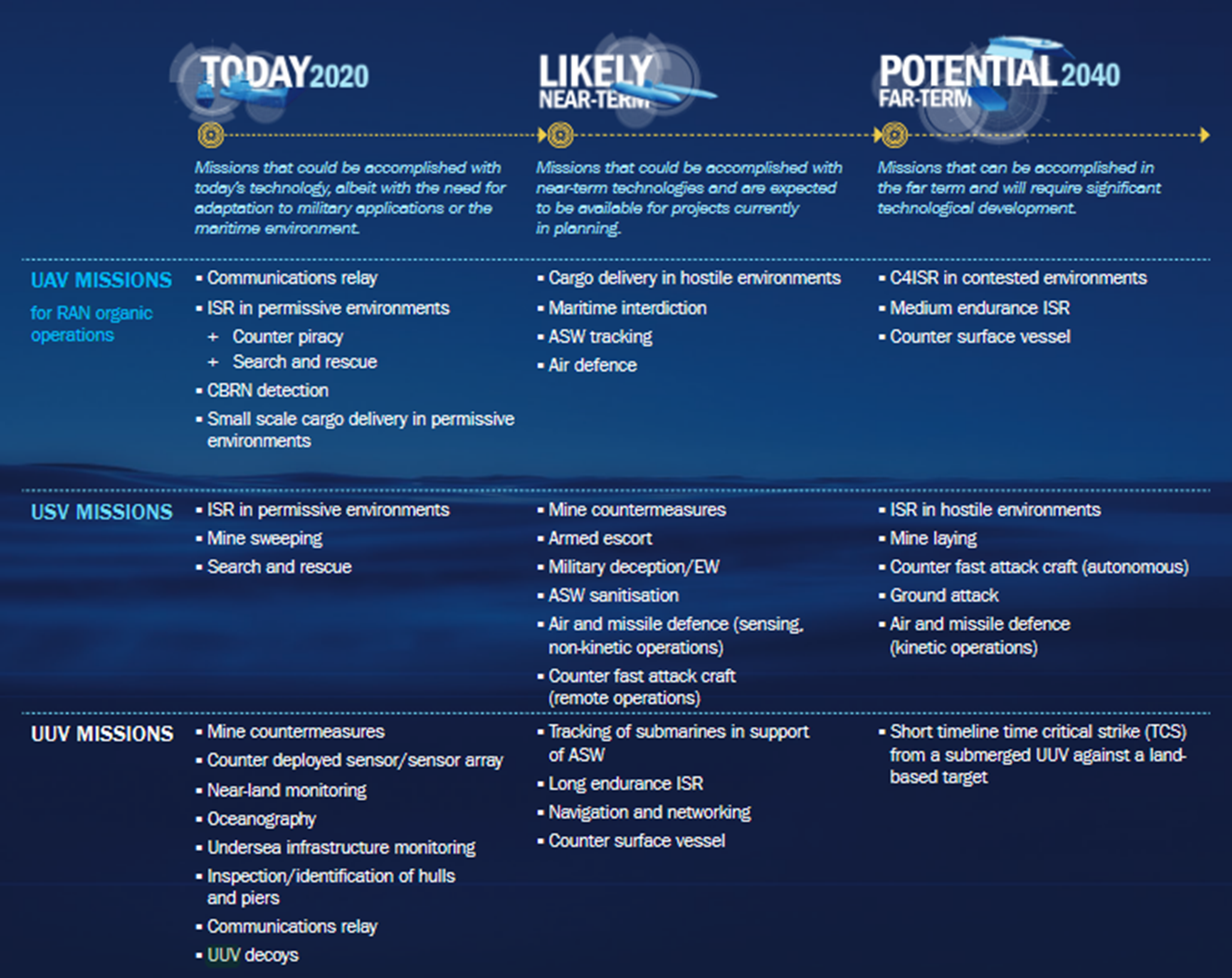

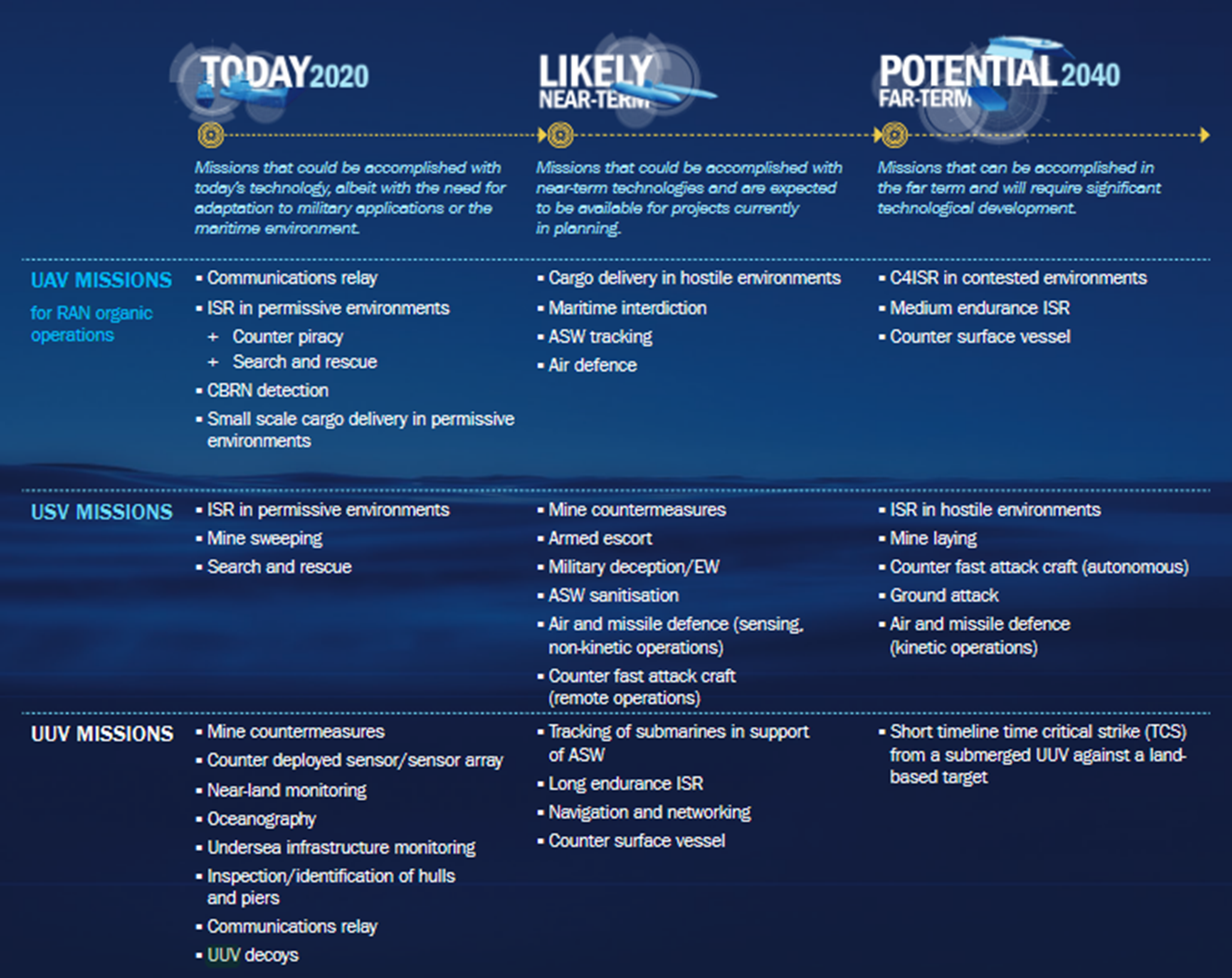

In 2021, the Royal Australian Navy (RAN) released its Robotics, Autonomous Systems, and Artificial Intelligence (RAS-AI) strategy. RAS-AI outlines the RAN mission potential through UUV/USV/AUV adoption today, near-term and by 2040. (Exhibit 2).

Exhibit 2: Royal Australian Navy Use Cases For Sea Drones

Source: Royal Australian Navy

The Navy used tethered UUVs over three decades for sea mine hunting. Project SEA 1905 will provide the next generation of mine-hunting systems.

United Kingdom

The Royal Navy received its first large, unmanned submarine in 2020 called MANTA. Phase 1 of MANTA tests established the vessel’s seaworthiness and ability to operate autonomously. Phase 2 involves 2 years of mission tests. Two key challenges were communicating with the vessel as well as mission length of its Lithium-ion batteries. There was also concern about the danger presented to a host ship should the Lithium-ion batteries catch fire, especially if stored within the ship’s hull.

The Royal Navy has also tendered an extra large AUV under Project CETUS. The £21.5 million Project CETUS program is for the design and construction of an AUV that can work alongside British attack submarines. Design work should finish in 2022 or 2023 with demonstrations in 2023 or 2024.

When it comes to commercial fishing, the United Kingdom launched a 5-year, maritime security strategy in August 2022. The plan calls for working with international partners to tackle organized crime, piracy, and security threats – generally, upholding the laws of the sea and protecting U.K. borders. The strategy also highlights the need to update laws to ensure the safe, secure, and environmentally sound operation of remotely operated and autonomous vehicles. As well, the U.K. government established the Centre for Seabed Mapping to enhance maritime trade and environmental protection through the use of seabed data.

Denmark

Denmark plans to invest 40 billion kroner (about US$5.5 billion) for new warships to strengthen its maritime security. Prior to the announcement, the Denmark’s Minister of Foreign Affairs accused a Russian warship of violating territorial waters.

The expansion of NATO to include Sweden and Finland could be an opportunity to create a new Nordic defense strategy. In the wake of attacks to the Nord Stream 1 and 2 pipelines, the vulnerability of undersea infrastructure has been exposed. Countries will need to accelerate the security of seabed pipeline and communications cables to safeguard their economies.

Japan

The Ministry of Defense in Tokyo has requested their largest defence budget ever for FY 2023. Amidst the increasing complexity of the security situation in the surrounding regions, Japan requested a 5.59 trillion-yen (US$40.4 billion) defence budget for 2023. One of the five fundamental defence capabilities that will be addressed in the next five years includes unmanned asset defense capabilities such as the use of drones.

In April 2022, Japan’s Ministry of Defence released its FY2022 budget. Included in the budget was ¥1.2 billion (US$8.3 million) for mine countermeasure USV development. Once the USVs detect mines, they will also be tasked with disposing of them. These development resources are part of a longer-term plan for Japan to have MCM USVs and UUVs.

Taiwan

Taiwan’s proposed defense budget for 2023 is Tw$415.1 billion (US$13.7 billion), 13% higher than 2022. This proposal comes as increased security risks loom from the threat of neighbouring China. To boost defence capabilities for the remainder of 2022, Taiwan parliament also provided an extra US$8.6 billion. This special budget will be used to boost the islands see and air capabilities.

Asymmetric warfare is the best chance for democratic Taiwan to defend themselves against authoritarian China. To close the gap in defence spending between the two countries, Taiwan is prioritizing investments into capabilities that could help prevent an amphibious landing of Chinese troops. As such, there has been a focal point on unmanned vehicles and small precision weapons systems.

Approximately half of the worlds global container fleet passed through The Taiwan Strait this year. This vital shipping lane is the primary route for westward bound ships hailing from China, Japan, South Korea and Taiwan. Any disturbance in this region could further disrupt key supply chains through the waterway.

Taiwan signed a US$555 million deal to buy 4 Sea Guardian Drones from the U.S. Although these are aerial drones, it signals Taiwan’s commitment to deter regional threats and strengthen their self-defence. It would not be surprising to see similar purchases of underwater drones soon.

Coming Up…

In our next UUV Update Report, we’ll learn how industry OEMs in the defence and commercial marine technology markets have evolved since first highlighting them in 2015.

Disclosures

Kraken Robotics [TSXV:PNG, OTC:KRKNF] has contracted Sophic Capital for capital markets advisory and investor relations services.

Recap

In Sophic Capital’s Russia and China Droning for Sea Dominance report, we discussed how Russia and China were bolstering their marine presence with unmanned underwater vehicles (UUVs). In this third of six reports, our focus shifts to how the rest of the world is enhancing their subsea national security, which will be followed by an update on how UUV companies have evolved over the last 7 years. We will then tie this all back Sophic Capital client Kraken Robotics [TSXV:PNG, OTCQB:KRKNF] and how these market forces are driving their growth.

United States

The U.S. Navy continues to drive unmanned vessel programs. As outlined in the March 2021, Department of the Navy Unmanned Campaign Framework, the U.S. Navy is working to incorporate unmanned vessels into its future fleet. The U.S. Navy wants to continue development, as evidenced by the FY 2022 Navy Ship building plan which allocates a potential US$1.7 billion towards unmanned vessels, $400 million for undersea, and $1.3 billion for surface vessels. The Chief of Naval Operations Navigation Plan 2022 suggests why U.S. Navy UUV interest is high, as it details a transition that will rebalance the fleet away from “exquisite, manpower-intensive platforms toward smaller, less-expensive, yet lethal ones.”

For its 2023 budget request, the U.S. Navy continues diversifying and expanding sea power strike capacity by continuing funding for offensively armed Uncrewed Surface Vessels (USV). The Snakehead Large-Displacement Unmanned Undersea Vehicle Program calls for a long endurance system to be launched from submarines and surface ships to conduct missions in deep and inaccessible waters. The Department of the Navy has also requested a $24.1 billion research and development budget that includes the development of large and extra-large UUVs in order to maintain technological superiority. Of this, the Navy has requested $549.3 million of funding for USVs and UUVs, with an additional $60.7 million of funding for core technologies needed by UUVs.

The U.S. Naval Undersea Warfare Center christened its Snakehead UUV on February 2, 2022. Snakehead will scout or monitor certain areas and perform other intelligence-gathering missions, leveraging its guidance and control capabilities, navigation, situational awareness, propulsion, maneuverability, and mission support sensors. The service completed long-distance tests in August 2022, representing a major milestone in the UUV’s capabilities and adding to its 155 in-water sorties and 78 hours of runtime.

In 2019, the U.S. Navy awarded Boeing a US$247.4 million contract to produce up to nine Orca Extra Large Unmanned Undersea Vehicles (XLUUVs). The Orca is an underwater drone the size of a subway car that can be used for anti-submarine warfare, anti-surface warfare, electronic warfare, strike missions, and mine countermeasures. The delivery of the Orcas has been continually delayed, but the first five operational drones could be ready as early as September 2023. A prototype was tested in April 2022 off the coast of California. Orca was the largest of several classes of unmanned vessels (both surface and undersea) being developed during the Trump administration, in an effort to boost the Navy’s total inventory to as many as 355 unmanned vessels by 2030.

Canada

Canada’s Budget 2022 provided an $8 billion increase in defence spending. The increase will see Canada’s defence budget grow from the $18.9 billion in 2016/2017, which was laid out in the Strong, Secure, Engaged: Canada’s Defence Policy of 2017, to $32.7 billion by 2026/2027. Defence priorities include: continental defence, commitment to allies and investments in equipment and technology to immediately increase the capabilities of the Canadian Armed Forces.

The Royal Canadian Navy (RCN) plans to purchase Remote Minehunting and Disposal Systems (RMDS). The acquisition process began in 2017, and bids were accepted in 2021. However, the purchase was delayed due to procurement priorities related to the Ukrainian war. The RMDS program is expected to be awarded before year end 2022 and aims to use Commercial off the Shelf unmanned systems and Autonomous Underwater Vehicles (AUV) technology. The funding ranges between $20 million to $49 million.

Furthermore, the RCN has a mandate to develop and maintain advanced sonar imaging and data storage capability for all three coasts (East: Atlantic, West: Pacific, North: Arctic). The RCN expects these capabilities to enhance national and international intelligence.

Australia

Australia’s defence spending has been largely attributed to naval vessels and the submarine sector. The Department of Defence government funding for 2022/2023 is AU$47 billion, which equates to 2.1% of GDP and 7.4% growth year-over-year. As an island nation, naval prowess is paramount to the country’s security. Australia’s defence strategy was developed to safeguard their border and offshore territories, as well as the surrounding regions, with emphasis on protecting trade routes.

Prime Minister Scott Morrison has allocated an additional AU$74.7 million in 2022/2023 for Operation RESOLUTE to protect Australia’s maritime interests through surveillance and response. Approximately 10% of the worlds total area will be monitored. The rapid technological advancements and military modernization of China, Russia, and North Korea are creating strategic challenges for Australia. As these countries expand their sphere of influence, other nations are prompted to respond.

The Royal Australian Navy is improving their Marine Mine Countermeasures (MCM) and military survey capabilities with the SEA 1905 MCM program. Various consortiums have submitted bids and expectation is award will be announced mid 2023 with first deliveries end of 2024.

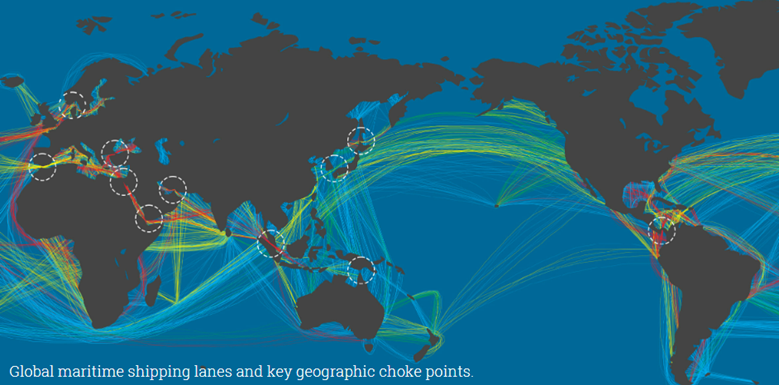

Exhibit 1: Global Maritime Shipping Lanes and Key Geographic Choke Points Leave Australia Vulnerable

Furthermore, a AU$10 billion, 20-year investment has been made to develop ship building infrastructure. The east coast will be home to a new submarine base and Australia’s first large-vessel dry berth precinct.

Australia also plans to replace its ageing naval fleet. It wants to procure nuclear powered submarines in collaboration with the U.S. and U.K. To replace ageing patrol boats, Australia is also procuring Hunter-class frigates and Arafura-class patrol vessels.

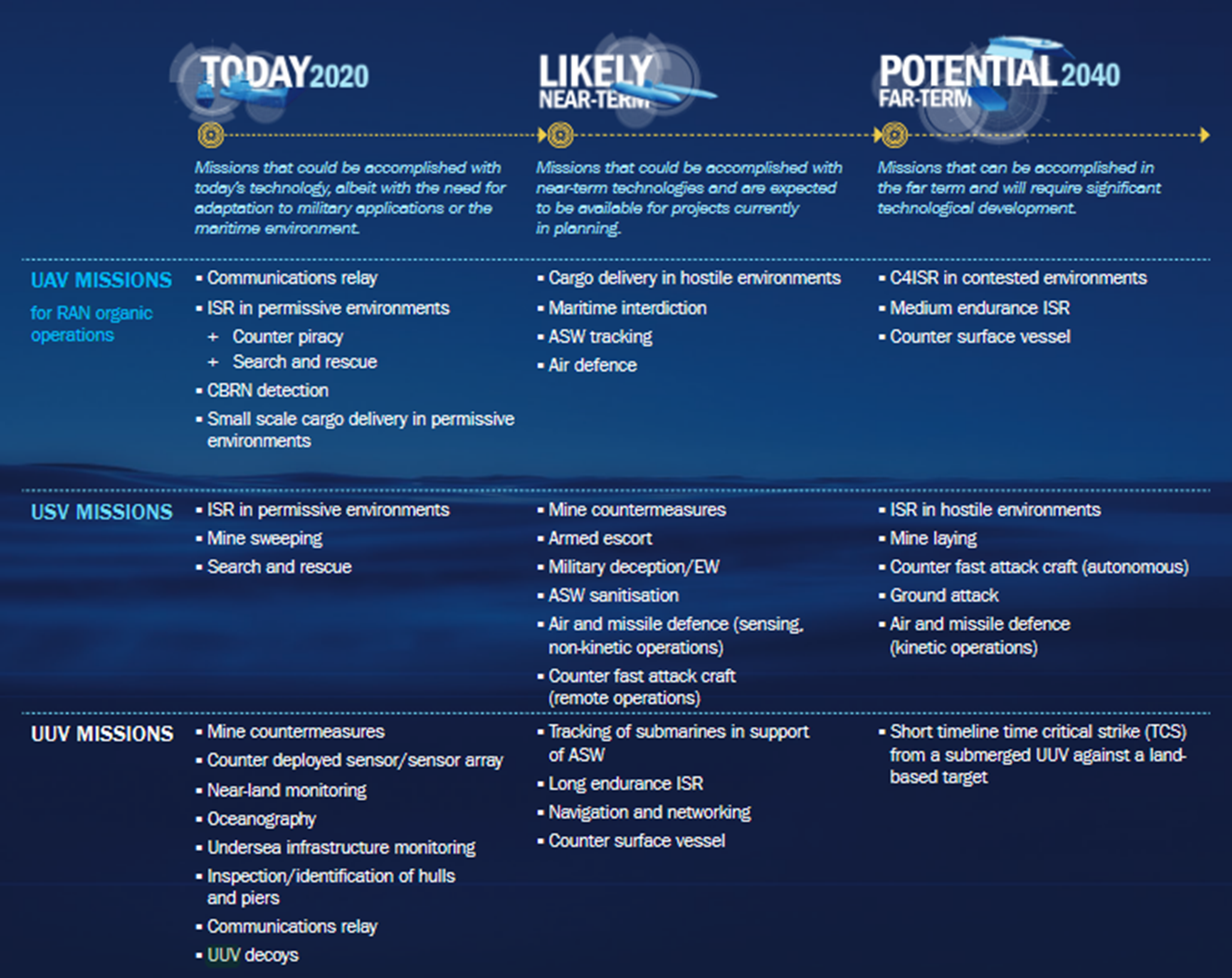

In 2021, the Royal Australian Navy (RAN) released its Robotics, Autonomous Systems, and Artificial Intelligence (RAS-AI) strategy. RAS-AI outlines the RAN mission potential through UUV/USV/AUV adoption today, near-term and by 2040. (Exhibit 2).

Exhibit 2: Royal Australian Navy Use Cases For Sea Drones

Source: Royal Australian Navy

The Navy used tethered UUVs over three decades for sea mine hunting. Project SEA 1905 will provide the next generation of mine-hunting systems.

United Kingdom

The Royal Navy received its first large, unmanned submarine in 2020 called MANTA. Phase 1 of MANTA tests established the vessel’s seaworthiness and ability to operate autonomously. Phase 2 involves 2 years of mission tests. Two key challenges were communicating with the vessel as well as mission length of its Lithium-ion batteries. There was also concern about the danger presented to a host ship should the Lithium-ion batteries catch fire, especially if stored within the ship’s hull.

The Royal Navy has also tendered an extra large AUV under Project CETUS. The £21.5 million Project CETUS program is for the design and construction of an AUV that can work alongside British attack submarines. Design work should finish in 2022 or 2023 with demonstrations in 2023 or 2024.

When it comes to commercial fishing, the United Kingdom launched a 5-year, maritime security strategy in August 2022. The plan calls for working with international partners to tackle organized crime, piracy, and security threats – generally, upholding the laws of the sea and protecting U.K. borders. The strategy also highlights the need to update laws to ensure the safe, secure, and environmentally sound operation of remotely operated and autonomous vehicles. As well, the U.K. government established the Centre for Seabed Mapping to enhance maritime trade and environmental protection through the use of seabed data.

Denmark

Denmark plans to invest 40 billion kroner (about US$5.5 billion) for new warships to strengthen its maritime security. Prior to the announcement, the Denmark’s Minister of Foreign Affairs accused a Russian warship of violating territorial waters.

The expansion of NATO to include Sweden and Finland could be an opportunity to create a new Nordic defense strategy. In the wake of attacks to the Nord Stream 1 and 2 pipelines, the vulnerability of undersea infrastructure has been exposed. Countries will need to accelerate the security of seabed pipeline and communications cables to safeguard their economies.

Japan

The Ministry of Defense in Tokyo has requested their largest defence budget ever for FY 2023. Amidst the increasing complexity of the security situation in the surrounding regions, Japan requested a 5.59 trillion-yen (US$40.4 billion) defence budget for 2023. One of the five fundamental defence capabilities that will be addressed in the next five years includes unmanned asset defense capabilities such as the use of drones.

In April 2022, Japan’s Ministry of Defence released its FY2022 budget. Included in the budget was ¥1.2 billion (US$8.3 million) for mine countermeasure USV development. Once the USVs detect mines, they will also be tasked with disposing of them. These development resources are part of a longer-term plan for Japan to have MCM USVs and UUVs.

Taiwan

Taiwan’s proposed defense budget for 2023 is Tw$415.1 billion (US$13.7 billion), 13% higher than 2022. This proposal comes as increased security risks loom from the threat of neighbouring China. To boost defence capabilities for the remainder of 2022, Taiwan parliament also provided an extra US$8.6 billion. This special budget will be used to boost the islands see and air capabilities.

Asymmetric warfare is the best chance for democratic Taiwan to defend themselves against authoritarian China. To close the gap in defence spending between the two countries, Taiwan is prioritizing investments into capabilities that could help prevent an amphibious landing of Chinese troops. As such, there has been a focal point on unmanned vehicles and small precision weapons systems.

Approximately half of the worlds global container fleet passed through The Taiwan Strait this year. This vital shipping lane is the primary route for westward bound ships hailing from China, Japan, South Korea and Taiwan. Any disturbance in this region could further disrupt key supply chains through the waterway.

Taiwan signed a US$555 million deal to buy 4 Sea Guardian Drones from the U.S. Although these are aerial drones, it signals Taiwan’s commitment to deter regional threats and strengthen their self-defence. It would not be surprising to see similar purchases of underwater drones soon.

Coming Up…

In our next UUV Update Report, we’ll learn how industry OEMs in the defence and commercial marine technology markets have evolved since first highlighting them in 2015.

Disclosures

Kraken Robotics [TSXV:PNG, OTC:KRKNF] has contracted Sophic Capital for capital markets advisory and investor relations services.

Recap

In Sophic Capital’s Russia and China Droning for Sea Dominance report, we discussed how Russia and China were bolstering their marine presence with unmanned underwater vehicles (UUVs). In this third of six reports, our focus shifts to how the rest of the world is enhancing their subsea national security, which will be followed by an update on how UUV companies have evolved over the last 7 years. We will then tie this all back Sophic Capital client Kraken Robotics [TSXV:PNG, OTCQB:KRKNF] and how these market forces are driving their growth.

United States

The U.S. Navy continues to drive unmanned vessel programs. As outlined in the March 2021, Department of the Navy Unmanned Campaign Framework, the U.S. Navy is working to incorporate unmanned vessels into its future fleet. The U.S. Navy wants to continue development, as evidenced by the FY 2022 Navy Ship building plan which allocates a potential US$1.7 billion towards unmanned vessels, $400 million for undersea, and $1.3 billion for surface vessels. The Chief of Naval Operations Navigation Plan 2022 suggests why U.S. Navy UUV interest is high, as it details a transition that will rebalance the fleet away from “exquisite, manpower-intensive platforms toward smaller, less-expensive, yet lethal ones.”

For its 2023 budget request, the U.S. Navy continues diversifying and expanding sea power strike capacity by continuing funding for offensively armed Uncrewed Surface Vessels (USV). The Snakehead Large-Displacement Unmanned Undersea Vehicle Program calls for a long endurance system to be launched from submarines and surface ships to conduct missions in deep and inaccessible waters. The Department of the Navy has also requested a $24.1 billion research and development budget that includes the development of large and extra-large UUVs in order to maintain technological superiority. Of this, the Navy has requested $549.3 million of funding for USVs and UUVs, with an additional $60.7 million of funding for core technologies needed by UUVs.

The U.S. Naval Undersea Warfare Center christened its Snakehead UUV on February 2, 2022. Snakehead will scout or monitor certain areas and perform other intelligence-gathering missions, leveraging its guidance and control capabilities, navigation, situational awareness, propulsion, maneuverability, and mission support sensors. The service completed long-distance tests in August 2022, representing a major milestone in the UUV’s capabilities and adding to its 155 in-water sorties and 78 hours of runtime.

In 2019, the U.S. Navy awarded Boeing a US$247.4 million contract to produce up to nine Orca Extra Large Unmanned Undersea Vehicles (XLUUVs). The Orca is an underwater drone the size of a subway car that can be used for anti-submarine warfare, anti-surface warfare, electronic warfare, strike missions, and mine countermeasures. The delivery of the Orcas has been continually delayed, but the first five operational drones could be ready as early as September 2023. A prototype was tested in April 2022 off the coast of California. Orca was the largest of several classes of unmanned vessels (both surface and undersea) being developed during the Trump administration, in an effort to boost the Navy’s total inventory to as many as 355 unmanned vessels by 2030.

Canada

Canada’s Budget 2022 provided an $8 billion increase in defence spending. The increase will see Canada’s defence budget grow from the $18.9 billion in 2016/2017, which was laid out in the Strong, Secure, Engaged: Canada’s Defence Policy of 2017, to $32.7 billion by 2026/2027. Defence priorities include: continental defence, commitment to allies and investments in equipment and technology to immediately increase the capabilities of the Canadian Armed Forces.

The Royal Canadian Navy (RCN) plans to purchase Remote Minehunting and Disposal Systems (RMDS). The acquisition process began in 2017, and bids were accepted in 2021. However, the purchase was delayed due to procurement priorities related to the Ukrainian war. The RMDS program is expected to be awarded before year end 2022 and aims to use Commercial off the Shelf unmanned systems and Autonomous Underwater Vehicles (AUV) technology. The funding ranges between $20 million to $49 million.

Furthermore, the RCN has a mandate to develop and maintain advanced sonar imaging and data storage capability for all three coasts (East: Atlantic, West: Pacific, North: Arctic). The RCN expects these capabilities to enhance national and international intelligence.

Australia

Australia’s defence spending has been largely attributed to naval vessels and the submarine sector. The Department of Defence government funding for 2022/2023 is AU$47 billion, which equates to 2.1% of GDP and 7.4% growth year-over-year. As an island nation, naval prowess is paramount to the country’s security. Australia’s defence strategy was developed to safeguard their border and offshore territories, as well as the surrounding regions, with emphasis on protecting trade routes.

Prime Minister Scott Morrison has allocated an additional AU$74.7 million in 2022/2023 for Operation RESOLUTE to protect Australia’s maritime interests through surveillance and response. Approximately 10% of the worlds total area will be monitored. The rapid technological advancements and military modernization of China, Russia, and North Korea are creating strategic challenges for Australia. As these countries expand their sphere of influence, other nations are prompted to respond.

The Royal Australian Navy is improving their Marine Mine Countermeasures (MCM) and military survey capabilities with the SEA 1905 MCM program. Various consortiums have submitted bids and expectation is award will be announced mid 2023 with first deliveries end of 2024.

Exhibit 1: Global Maritime Shipping Lanes and Key Geographic Choke Points Leave Australia Vulnerable

Furthermore, a AU$10 billion, 20-year investment has been made to develop ship building infrastructure. The east coast will be home to a new submarine base and Australia’s first large-vessel dry berth precinct.

Australia also plans to replace its ageing naval fleet. It wants to procure nuclear powered submarines in collaboration with the U.S. and U.K. To replace ageing patrol boats, Australia is also procuring Hunter-class frigates and Arafura-class patrol vessels.

In 2021, the Royal Australian Navy (RAN) released its Robotics, Autonomous Systems, and Artificial Intelligence (RAS-AI) strategy. RAS-AI outlines the RAN mission potential through UUV/USV/AUV adoption today, near-term and by 2040. (Exhibit 2).

Exhibit 2: Royal Australian Navy Use Cases For Sea Drones

Source: Royal Australian Navy

The Navy used tethered UUVs over three decades for sea mine hunting. Project SEA 1905 will provide the next generation of mine-hunting systems.

United Kingdom

The Royal Navy received its first large, unmanned submarine in 2020 called MANTA. Phase 1 of MANTA tests established the vessel’s seaworthiness and ability to operate autonomously. Phase 2 involves 2 years of mission tests. Two key challenges were communicating with the vessel as well as mission length of its Lithium-ion batteries. There was also concern about the danger presented to a host ship should the Lithium-ion batteries catch fire, especially if stored within the ship’s hull.

The Royal Navy has also tendered an extra large AUV under Project CETUS. The £21.5 million Project CETUS program is for the design and construction of an AUV that can work alongside British attack submarines. Design work should finish in 2022 or 2023 with demonstrations in 2023 or 2024.

When it comes to commercial fishing, the United Kingdom launched a 5-year, maritime security strategy in August 2022. The plan calls for working with international partners to tackle organized crime, piracy, and security threats – generally, upholding the laws of the sea and protecting U.K. borders. The strategy also highlights the need to update laws to ensure the safe, secure, and environmentally sound operation of remotely operated and autonomous vehicles. As well, the U.K. government established the Centre for Seabed Mapping to enhance maritime trade and environmental protection through the use of seabed data.

Denmark

Denmark plans to invest 40 billion kroner (about US$5.5 billion) for new warships to strengthen its maritime security. Prior to the announcement, the Denmark’s Minister of Foreign Affairs accused a Russian warship of violating territorial waters.

The expansion of NATO to include Sweden and Finland could be an opportunity to create a new Nordic defense strategy. In the wake of attacks to the Nord Stream 1 and 2 pipelines, the vulnerability of undersea infrastructure has been exposed. Countries will need to accelerate the security of seabed pipeline and communications cables to safeguard their economies.

Japan

The Ministry of Defense in Tokyo has requested their largest defence budget ever for FY 2023. Amidst the increasing complexity of the security situation in the surrounding regions, Japan requested a 5.59 trillion-yen (US$40.4 billion) defence budget for 2023. One of the five fundamental defence capabilities that will be addressed in the next five years includes unmanned asset defense capabilities such as the use of drones.

In April 2022, Japan’s Ministry of Defence released its FY2022 budget. Included in the budget was ¥1.2 billion (US$8.3 million) for mine countermeasure USV development. Once the USVs detect mines, they will also be tasked with disposing of them. These development resources are part of a longer-term plan for Japan to have MCM USVs and UUVs.

Taiwan

Taiwan’s proposed defense budget for 2023 is Tw$415.1 billion (US$13.7 billion), 13% higher than 2022. This proposal comes as increased security risks loom from the threat of neighbouring China. To boost defence capabilities for the remainder of 2022, Taiwan parliament also provided an extra US$8.6 billion. This special budget will be used to boost the islands see and air capabilities.

Asymmetric warfare is the best chance for democratic Taiwan to defend themselves against authoritarian China. To close the gap in defence spending between the two countries, Taiwan is prioritizing investments into capabilities that could help prevent an amphibious landing of Chinese troops. As such, there has been a focal point on unmanned vehicles and small precision weapons systems.

Approximately half of the worlds global container fleet passed through The Taiwan Strait this year. This vital shipping lane is the primary route for westward bound ships hailing from China, Japan, South Korea and Taiwan. Any disturbance in this region could further disrupt key supply chains through the waterway.

Taiwan signed a US$555 million deal to buy 4 Sea Guardian Drones from the U.S. Although these are aerial drones, it signals Taiwan’s commitment to deter regional threats and strengthen their self-defence. It would not be surprising to see similar purchases of underwater drones soon.

Coming Up…

In our next UUV Update Report, we’ll learn how industry OEMs in the defence and commercial marine technology markets have evolved since first highlighting them in 2015.

Disclosures

Kraken Robotics [TSXV:PNG, OTC:KRKNF] has contracted Sophic Capital for capital markets advisory and investor relations services.