Investment Research for Your Business

“Thought leadership should be an entry point to a relationship. Thought leadership should intrigue, challenge, and inspire even people already familiar with a company. It should help start a relationship where none exists, and it should enhance existing relationships.” -Daniel Rasmus

Sophic Capital: Latest Research

Cybeats Eating the SBOM Market, One Byte at a Time

Cybeats Demonstrates Strong Customer Traction and Expanding Pipeline Report #2 Recap In Sophic Capital’s The Invisible Grid report, we introduced Sophic Capital client Cybeats Technologies Corp. [CSE:CYBT, OTCQB:CYBCF], a global leader in software supply chain...

The Invisible Grid: Cybeats Secures the Software Supply Chain for Critical Infrastructure

Report #1 Recap In Sophic Capital’s SBOMs Away!, we discussed security and privacy issues related to software development and shared recent significant cybersecurity events that exploited software vulnerabilities. Sophic Capital also introduced the growing global...

SBOMs Away!

Why Software Supply Chain Security Has Become a Top Priority Problem Modern software constantly changes as new features are added, bugs are fixed, and vulnerabilities are patched. Most people don’t realize that modern software isn’t built from scratch—it’s assembled...

Sophic Capital: Latest Research

Sophic Capital: Past Research

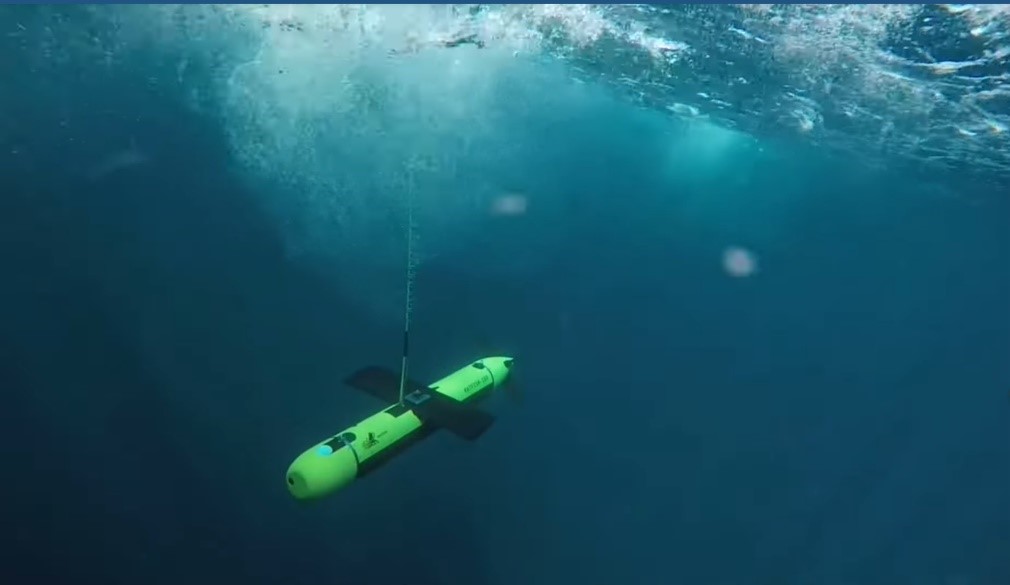

The Wave May Be Just Getting Started Surging Stock Still Looks Undervalued Even though the stock of Sophic Capital client Kraken Robotics (PNG:TSXV, KRKNF:OTCQB) has surged over 150% in the past six months, it still appears undervalued when compared to its peers. Kraken Robotics has been winning large defence contracts with several NATO Navies, including the Danish and Polish Navies. The Company has also done business with the U.S. Navy, Government of Canada, and several global defense contractors. Many defense departments have recently announced budget increases on the back of the Ukraine war. Even before these announcements, many nations were updating their naval capabilities. Following two NATO Navy deals won in 2020 and tests with the U.S. Navy, Kraken Robotics has established itself as underwater robotics leader. We understand that investors flee stocks when systematic risk prevails, and the current market meltdown has spared few microcap stocks. Kraken Robotics (TSXV:PNG, OTC: KRKNF), a Sophic Capital client, was no exception. Kraken Robotics’ stock is up more than 40% and has set a new 52-week high since Ocean Infinity, a Kraken customer, announced its plan to take an almost 10% stake in Kraken. In the days following the press release, Kraken’s stock has consistently closed above the $0.20/share investment price with comparatively heavy volume.

Rising to the Surface with Kraken Robotics

Smooth Sailing for Kraken Robotics

Deep Dive on Underwater Drone Manufacturers

Bottoms Up for Navies

Russia and China Droning for Sea Dominance

Unmanned Underwater Vehicles – The Most Challenging Technologies to Develop

Launch the Seabots

PNG: A Kraken Good Investment!

PNG: Kraken Investors Establish New Floor Price For Stock