AnalytixInsight

ALY:TSXV; ATIXF:OTC

Capital Structure

Company News

Industry News

Industry News

Sophic Insights

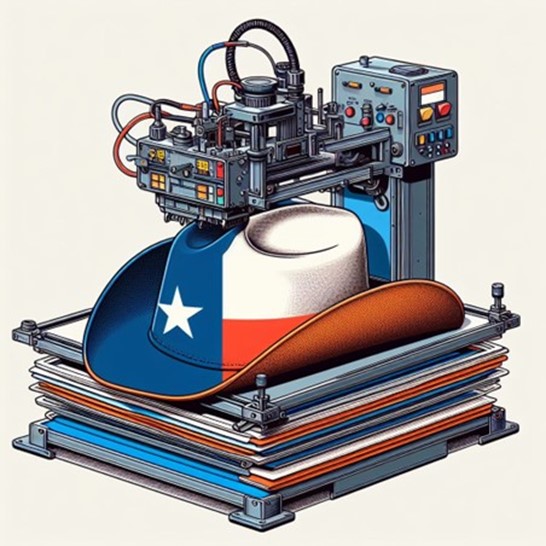

Endeavor Unleashed

Uniform, Promotional Product Mastery Uniforms unify. They connect people and build pride to an entity, whether that’s a government department, a school, or a corporation. At the same time, while uniting people to a common entity, they can also differentiate...

February 25, 2024: Dow And S&P At Record Highs, NASDAQ Closing In

Last week, Dow Jones rose 1.3%, S&P 500 gained 1.7%, as both indices reached new all-time highs. Nasdaq composite was up gained 1.4%, as it hit a fresh two-year high. The market value of Nvidia briefly touched US$2 trillion on Friday, two days after the chipmaker posted significant growth in its quarterly revenue. At the same time, Nvidia chips have become far easier to access than they were last year, and ChatGPT has seen declining web traffic in five of the past eight months and is currently down 11% from its May 2023 peak. Jeff Bezos, Nvidia, Microsoft and OpenAI are throwing serious cash at a human-like robot startup, Figure AI in US$675 million financing. Astera Labs, a startup that’s slated to be one of the first beneficiaries of the generative AI boom, filed documents to go public. Reddit filed to list its IPO on NYSE under the ticker RDDT. Nigeria, Africa’s most populous country, blocked access to crypto trading platforms including Binance. Electric vehicles seem to be encountering demand headwinds, according to recent data from Ford, Mercedes-Benz and the Chinese market. In Canada, Sophic Client OneSoft reported preliminary 2023 results, and provided guidance for 2024. 2023 revenue increased 51% y/y to $10.4 million, in line with previous guidance. OneSoft issued 2024 guidance for revenue of $15 million to $16 million, Adjusted EBITDA between $1.6 million to $1.9 million, and forecasted cash at the end of 2024 of between $4.7 to $5.0 million. The Company was also recognized as a top performer by the TSX Venture Exchange in the Technology sector. Sophic Client Legend Power Systems reported Q1 F2024 financial results. “While deals have taken longer to close than initially thought, we continue to advance all deals that have previously been communicated and have not lost a single opportunity,” said Randy Buchamer, Legend Power Systems CEO.

February 18, 2024: First Down Week In Six Weeks. All Eyes On Nvidia Next Week.

Last week, markets held up reasonably well despite hot inflation reports. Dow Jones was down 0.1%, S&P 500 lost 0.4% and Nasdaq fell 1.3%. As indices remain near highs, Nvidia’s earnings report Wednesday will be crucial. The Company surpassed Amazon in market capitalization on Tuesday. OpenAI completed a deal that values the company at US$80 billion or more, nearly tripling its valuation in less than 10 months. SoftBank founder Masayoshi Son is seeking as much as US$100 billion to bankroll a chip venture to compete with Nvidia and supply semiconductors essential for AI. Nvidia also blogged about a new AI model, Sora, that produces original video based on text descriptions of what people want to see. Google on Thursday announced an upgraded version of its flagship conversational artificial intelligence, Gemini. Apple plans to release an AI-powered coding assistant this year. Walmart is in talks to buy TV maker Vizio. Uber unveiled a US$7 billion stock buyback plan. In Canada, as Sophic Client Kraken Robotics’ stock is at fresh 52 week highs, the company provided positive updates for 2023 and a strong 2024 outlook. Kraken’s sales funnel pipeline at the end of December 2023 was over $900 million, and the company expects 2024 revenue between $90 to $100 million and Adj EBITDA in the $18 to $24 million range. Another Canadian small cap company is getting taken out, as Think Research entered into a definitive agreement to be acquired by Beedie Capital, for a 100% premium to the closing price of the Common Shares on February 15, 2024 and a 75% premium to the 30-day volume-weighted average trading price of the Common Shares. Shopify’s warned operating expenses would grow in Q1, sending its stock down more than 7% in trading Tuesday morning.

Illuminating Sustainable Cash Flow

Note: Exhibit 1 originally published February 13, 2024 incorrectly identified the $0.22 "EPC Margin" as a "developer fee". We apologize for the incorrect identification. In Sophic Capital’s Sunny Side Up report, we looked at how Sophic Capital client UGE (the...