AnalytixInsight

ALY:TSXV; ATIXF:OTC

Capital Structure

Company News

Industry News

Industry News

Sophic Insights

April 03, 2022; Another Week, A New Canadian Tech Unicorn

Vancouver blockchain tech startup, LayerZero Labs is the latest Canadian company to join the country’s growing group of unicorns, as it raised $135 million that values LayerZero at $1 billion. LayerZero’s financing was tri-led by notable venture capital firms Sequoia Capital, Andreessen Horowitz, and FTX Ventures, which is the fund launched by crypto exchange FTX. As Canadian VC seems more active in tumultuous public markets, Mogo (MOGO-TSX, MOGO-NASDAQ) announced the formation of Mogo Ventures to manage its $124 million investment portfolio. SoftBank founder Masayoshi Son has told the company’s top executives to slow down investments, as the Japanese investment giant tries to raise cash amid a global stock market turmoil, the Financial Times reported. OnlyFans, the subscription-based social platform, has spoken with several blank check companies known as SPACs about a merger to take it public, Axios reported. The SEC is taking aim at SPACs with proposed rules to make disclosures more like those in a traditional IPO. Apple is planning to cut production of some of its most popular products due to macroeconomic factors such as the war in Ukraine and rising inflation, which are impacting demand, Nikkei Asia reported. Huawei’s 2021 revenue was down 29% as U.S. sanctions hurt smartphone sales. A bug that exposed Facebook users to a swell of posts containing misinformation persisted for six months on the platform before it was fixed, The Verge reports. The DOJ backs a bill targeting business practices of Amazon, Apple and Google. The Justice Department threw its support behind bipartisan legislation forbidding large internet companies from favoring their own products and services over those from competitors, according to the Wall Street Journal. Singapore’s giant Sea said on Monday it is shutting down its e-commerce business, Shopee, in India, months after the firm began recruiting sellers in the country.

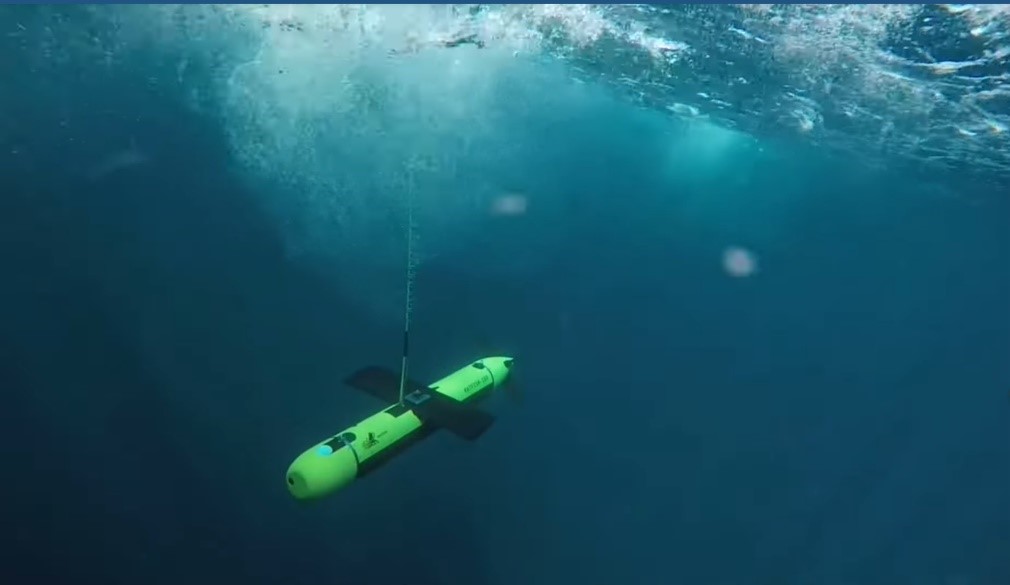

Launch the Seabots

Many defense departments have recently announced budget increases on the back of the Ukraine war. Even before these announcements, many nations were updating their naval capabilities. Following two NATO Navy deals won in 2020 and tests with the U.S. Navy, Kraken Robotics has established itself as underwater robotics leader.

Diving into the Data

Enterprises are drowning in data. Extracting accurate, decision-ready data isn’t easy because business leaders don’t know how to navigate vast datasets siloed throughout the enterprise. What they need are solutions that unify enterprise systems, simplifying data analysis to make better data-driven decisions. Enterprise data management is a huge market – over US$72 billion in 2020 – and it could triple by 2028.

March 27, 2022: Toronto – Now North America’s Third Largest Tech Hub

The New York Times published an interesting piece about Toronto’s booming tech sector last week. Toronto is now the third-largest tech hub in North America. It is home to more tech workers than Chicago, Los Angeles, Seattle and Washington, D.C., trailing only New York and Silicon Valley, according to CBRE, a real estate company that tracks tech hiring. Interestingly, last week, we counted ~$150 million of activity in the Canadian VC ecosystem, against a backdrop of high public market volatility. SoftBank seeking US$60 billion valuation for Arm, which would imply a far higher multiple of Arm’s revenue and profits than is common in the chip sector. GoTo Group, an Indonesian startup giant, raised about US$1.1 billion in one of the world’s largest initial public offerings announced since the Russian invasion of Ukraine. Private-equity firm Thoma Bravo LP has struck a deal to buy Anaplan Inc. for $10.7 billion, the latest in a recent string of big leveraged buyouts. Instacart Inc., a pandemic darling that’s now facing decelerating growth, is slashing its valuation by almost 40% to about US$24 billion, a move it says will help the company attract talent and adapt to market conditions. Uber stock gains after company strikes partnership with NYC taxis. Nikola stock price soars after it begins production on electric truck. Adobe slumps 11% as the software maker says halting sales in Russia will reduce yearly revenue. Shares of Okta dropped more than 7% Tuesday following reports of a data breach. Famed short-seller Jim Chanos revealed he’s betting against crypto exchange Coinbase. “Coinbase is what we would call a bubble stock,” he told CNBC’s Scott Waper on Friday. Late Thursday night in Brussels European lawmakers reached a tentative agreement after nearly two years of negotiations on rules restricting certain business practices of Google, Apple, Meta Platforms, Amazon, Microsoft and other tech companies. Nvidia is exploring using Intel’s manufacturing services.