AnalytixInsight

ALY:TSXV; ATIXF:OTC

Capital Structure

Company News

Industry News

Industry News

Sophic Insights

August 31, 2025: Ok Week, Weak Friday

Last week , Dow Jones fell 0.2%, S&P 500 lost 0.1%, and Nasdaq composite was down 0.2%. Markets were strong through Friday, which was a weak day for the AI trade, likely on reports that Alibaba is developing its own AI chip. Stocks had previously largely shrugged off Nvidia earnings. Nvidia’s Q2 revenue surged 56% y/y to US$46.7B, with hyperscalers driving demand, and the U.S. is seeking a 15% cut of China sales. Alibaba cloud revenue jumped 26% on AI demand, e-commerce grew 10%. Snowflake beat estimates with 32% growth and raised FY guidance as AI adoption lifts workloads. CrowdStrike beat earnings but swung to a US$77.7M loss; shares fell 6.7%. ByteDance is planning a US$330B employee buyback. Klarna is once again looking at a US IPO, at a US$13–14B valuation. Vast Data, a data storage startup backed by Nvidia, is reportedly preparing a U.S. IPO. Microsoft will unveil in-house AI models to lessen reliance on OpenAI. SpaceX aced its 10th Starship test flight. U.S. shoppers ordering smaller goods from abroad were met with waves of cancellation notices ahead of a key trade rule change ordered by the U.S. administration. In Canada news pertaining to Sophic Capital clients, Ionik delivered record Q2 revenue of US$53.5M (+20% y/y, +28% q/q) and Adjusted EBITDA of US$9.3M (+58% y/y). Gross margin expanded to 40% as acquisitions Nimble5 and Rise4 fueled growth. Free cash flow rose to US$7.3M. Boardwalktech Q1-FY26 revenue declined 28% y/y to US$0.9M amid previously announced customer non-renewals. Adjusted EBITDA loss narrowed to US$(0.6)M, while monthly burn improved to US$75K. The firm raised CAD$0.3M in a July financing and expects additional savings of ~US$0.7–0.8M over the next year. Plurilock released the latest Code and Country podcast with CrowdStrike’s co-founder. VitalHub closes a $75M Bought Deal financing, with a full Over-Allotment.

August 24, 2025: Record Highs For Dow And S&P500

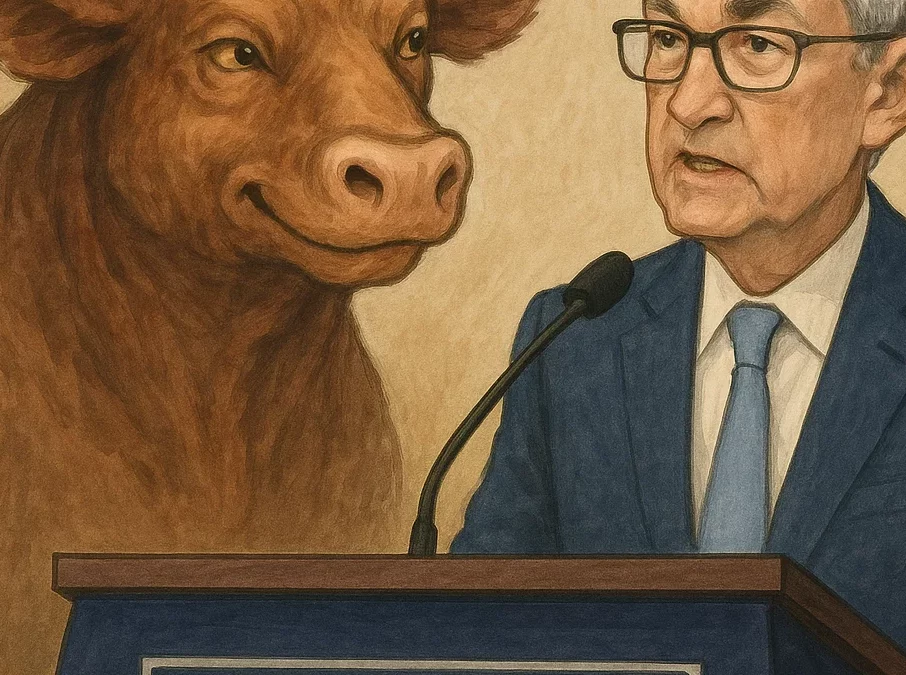

Last week, Dow Jones rose 1.5%, S&P 500 gained 0.3%, both hit record highs Friday after a “dovish” speech by Powell. Nasdaq composite was down 0.6% of the week, as investors look to Nvidia earnings next week following some recent mixed data-points on the AI trade. First-day IPO pops are running hot (median ~36%), reigniting IPO underpricing debates. Netskope’s IPO filing highlighted ongoing expected cyber demand into the fall window. Anthropic is reportedly targeting up to a US$10B raise at a ~US$170B valuation. Databricks is raising at a US$100B+; Canva’s secondary priced at ~US$42B. OpenAI logged its first US$1B revenue month, and reiterated compute constraints and hyperscale capex needs. Google expanded its TeraWulf backstop and warrants. The U.S. moved to take a 10% non-voting stake in Intel via CHIPS funds. Thoma Bravo is in talks to take Dayforce private. Palantir’s multi-session drawdown gave shorts rare relief as valuation debates intensified. Google/Kairos inked a TVA-linked advanced-nuclear PPA (target 2030). Apple is weighing Gemini to power a revamped Siri. Google unveiled Pixel 10 with “Magic Cue”. ESPN launched its full-fat streaming app. Robinhood and CME/FanDuel pushed further into event-driven prediction markets. In Canada, Sophic Client Kraken Robotics posted Q2 revenue of +16% y/y to $26.4M; GM expanded to 56% even as adj. EBITDA margin dipped to 18% on higher opex. Cash rose to $32.9M, and a post-quarter $115M bought deal strengthened the balance sheet. Management reiterated 2025 guidance (rev $120–135M; adj. EBITDA $26–34M). Legend Power reported softer Q3 rev ($0.39M) and a larger loss amid deal timing. Management cited one of the strongest backlogs and late-stage opportunities into year-end. Plurilock Q2 revenue grew to $16.4M with improved adj. EBITDA y/y. Management’s outlook highlighted higher-margin Critical Services, NATO/public-sector expansion. Separately, Plurilock agreed to sell CloudCodes assets for ~$1.78M. Renoworks launched LeadPOD + AI Design Assistant to convert homeowner engagement into measurable pipeline.

August 17, 2025: Markets Expecting September Rate Cut?

Last week, Dow Jones rose 1.7%, S&P 500 gained 0.9%, and Nasdaq composite was up 0.8%. Latest macro data could suggest investors are expecting September rate cuts, as there appears to be rotation amongst stocks underneath rising indices. Crypto IPO Bullish soared 84% in its US$1.1 billion IPO debut, valuing the Thiel-backed firm at US$10 billion. Gemini filed for an IPO despite widening losses. StubHub revived its long-delayed IPO for September. SoftBank’s PayPay confidentially filed for a U.S. listing at a potential US$10 billion+ valuation. Perplexity continued its fundraising streak, seeking a US$20 billion valuation after quadrupling ARR to US$150 million. Reports also surfaced of Perplexity making bold acquisition offers, including US$34.5 billion for Google’s Chrome. Meanwhile, OpenAI employees are plotting a US$6 billion secondary share sale at a US$500 billion valuation, even as CEO Sam Altman acknowledged AI is in a bubble. CoreWeave tripled revenue to US$1.2 billion but faces scrutiny over cash burn and an IPO lockup expiry. Nvidia and AMD struck a deal to give the U.S. 15% of their China sales, while Intel explored a potential government-backed rescue stake. Circle reported 53% revenue growth, unveiled a new blockchain, and faced post-earnings share pressure. Apple plans a 2027 robot device with Siri at its core, while OpenAI is backing Merge Labs, a Neuralink competitor. Space broadband player AST SpaceMobile surged after announcing fully funded satellite deployment. In Canada, Cohere raised US$500 million at a US$6.8 billion valuation. Kitchener-based BinSentry secured a US$68.8 million Series C to expand its precision ag-tech platform into Brazil. Sophic Client, Intermap posted Q2 revenue of US$3.0 million, reaffirming its US$30–35 million 2025 guidance and highlighting Indonesia and U.S. DOD contract momentum alongside commercial AI-driven insurance adoption.

August 10, 2025: Markets Rebound After Scare

Markets rebounded last week, Dow Jones rose 1.3%, S&P 500 gained 2.4%, Nasdaq was up 3.9%. Markets saw a mix of earnings beats, strategic financings, and notable M&A across tech, crypto, and AI this week. OpenAI is planning a US$500 billion secondary share sale after hitting US$12 billion annualized revenue. Palantir reported 48% revenue growth, and raised guidance. Carro, Bullish, and Figure Technology are advancing U.S. IPO plans. Apple pledged an additional US$100 billion to U.S. manufacturing to avoid tariffs, leading to one its largest weekly gains. TSMC and Korean chipmakers secured tariff exemptions. Tesla granted Elon Musk a US$23.7 billion stock award. Amazon and Meta projected lower U.S. tax bills under new legislation. ChatGPT reached 700 million weekly active users, and ChatGPT 5 has begun rolling out to mixed reviews. Uber repored Waymo robotaxis outperformed 99% of human drivers by trip volume. The FAA proposed rules to ease drone delivery operations. The U.S. Navy is soliciting designs for ultra-large AUVs, while space policy shifted with an accelerated NASA plan for a lunar nuclear reactor. In Canada, Sophic clients, Cybeats Technologies closed a $3.24 million LIFE offering, Kraken Robotics filed a 25-month base shelf prospectus to preserve financing flexibility, and Renoworks Software posted Q2 revenue up 18% YoY, with recurring revenue up 29% and improved working capital. Shopify stock gained 19% on 31% revenue growth and no tariff impact, unveiling new AI-powered merchant tools. Mogo sold nearly half of its WonderFi stake for $13.8 million ahead of the Robinhood acquisition, using proceeds to expand its Bitcoin holdings under a $50 million board-approved allocation strategy. Ripple acquired Toronto stablecoin payments platform Rail for $275 million, while U.S. telehealth firm Doximity bought Montréal’s Pathway Medical for $87 million. Blue J secured a $167.4 million Series D to scale its AI-powered tax research platform, and TeamLinkt raised $8.3 million Series A for sports administration software.