Yuck!

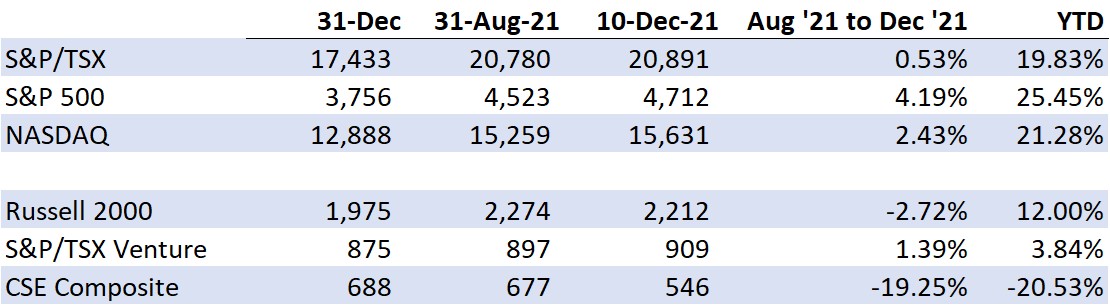

The last few months have brought significant uncertainty to public markets. Talk of rapid inflation and acceleration of FED tapering has become overshadowed by a new strain of the relentless COVID virus: however, despite all this uncertainty the broader markets continue to perform quite well.

The S&P/TSX is now +20% on the year (Exhibit 1) and +0.5% since the end of August. While in the U.S., the S&P 500 is +25% and +4%, respectively. Strong index returns appear to be largely concentrated in a few bellwether stocks. For example, while most investors acknowledge that tech stocks have performed nearly as well — Nasdaq is up ~22% YTD as of December 9. Excluding Apple, Microsoft, Alphabet, Tesla and Nvidia (top 5 return contributors), the Nasdaq is up only ~6% during the same period, according to widely followed investor Gavin Baker.

In this context, despite a continued melt-up for mid-cap and large cap U.S. listed stocks (especially the winners – more on that in a bit), small-cap stocks have not performed as well. The Russell 2000 in the U.S. is up only 12% on the year and down -2.7% since the end of August, but the U.S. still far outpaced Canada when it came to the performance of small and micro-cap stocks, as the TSX Venture composite is now only +4% on the year, while the CSE composite is down -21%. Yup that is not a typo!

Exhibit 1: Year-to-Date indices returns show Canadian microcaps haven’t fared well

Source: Sophic Capital

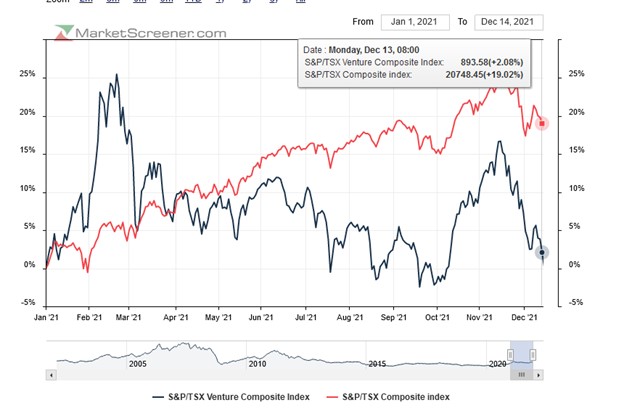

The drastic run-up in share prices in December 2020 and into January of 2021 likely didn’t help; but with many of these individual companies showing significant growth and/or business progress throughout the year, small-cap and micro-cap stocks are clearly being harshly hit. Supply and demand of new issuers in the space has likely played a factor. As of the end of November 2021, 133 new issuers listed on the TSX Venture were up a staggering 142% from the 55 new issuers listed on the TSX venture during the same time frame last year. However, the bigger impact to the destruction of small- and micro-cap stock prices in the last few months appears to be tax-loss selling.

Tax-loss selling is an annual event where market participants sell stocks at a loss to reduce capital gains earned from other investments. Although there is no official start date, tax loss selling generally starts in the late Fall. The final official day for tax-loss selling is December 29, but typically the activity slows considerably in the week before Christmas.

Exhibit 2: TSX Venture Index Lags the TSX Big Board in 2021

Source: MarketScreener.com

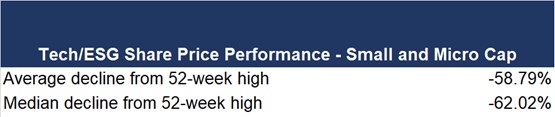

As a firm, Sophic Capital works with several tech- and ESG-focused companies. We did some work to better understand the share-price dynamics of the broader small-cap and micro-cap stocks in these sectors. As of November 30, the median stock in this group was trading at only ~38% of its 52-week highs. Not down 38% – DOWN 62%! Put another way, half of the stocks in the tech- and ESG-focused sectors with a market cap lower than C$100 million had declined 62% from their 52-week highs (Exhibit 3). That’s quite a drop, in a momentum-focused market.

Exhibit 3: Sub-C$100 million market cap Canadian tech and ESG stocks have had a horrible 2021 so far

Source: Sophic Capital

hese declines have been indicative of the share price dynamics that occurred throughout the year. For example, our sub-C$100 million market cap group’s median share price performance has consistently slipped every quarter in 2021. As of Q1, this group was trading at 60% of the 52-week high; as of Q2, at ~50%; as of Q3 at ~40%; and ~35% as of November 30. So, if it feels like 2021 has been a tough year for small caps – it was!

So how did this carnage occur? Woe and behold the glory days of Q1, when stocks ran hard, hitting all-time highs as many retail investors bought on the way up. And then the bloom came off the micro-cap rose, and a lot of these same investors were left holding shares at much higher prices (we include ourselves in this group for some of our holdings but can’t bring ourselves to talk about them yet).

As we moved through the summer and into the fall, small- and micro-cap selling pressure led to more selling pressure. In the context of a basket of investments of large caps with huge gains, it makes sense these investors and portfolio managers would take large tax losses this year to offset big gains in large-caps to reduce their taxes and re-set for 2022. Unfortunately this selling is a bit of a spiral, hence the continued tax loss selling we’ve seen over the past few weeks.

With Tax-loss Selling, Come Opportunities

As devastating as tax loss selling can be for some market participants, others should view the obliteration of small- and micro-cap stocks as an opportunity. The smart money is going to start looking for potential buying opportunities in the tax-loss names. Our client list is no different, with many off more than 50% from their yearly high (Exhibit 4).

The key characteristics we look for when looking for a strong tax loss idea are:

- A Strong business, good management team and all the things we normally look for in making an investment into a quality business.

- A significant equity offering in 2021, which hopefully included institutional investors, at a much higher price than where we are today.

- No fundamental change in the business, but the stock continues to fall and has been accelerating to the downside in the last month or so on volume.

- A strong balance sheet, so if we enter 2022 with a weaker market the company has the capital to execute and is not needing additional cash for at least 6 to 12 months.

Exhibit 4: Tax loss selling has also hit Sophic Capital clients and pulled others down

Source: Sophic Capital

A Good Year for the Group Fundamentally

Despite the significant sell-off that has occurred in recent months, our clients and many other issuers have never been stronger. As a group they are well-capitalized, driving significant growth/improvements in their businesses and see a multitude of opportunities for continued expansion in the coming months and years. Below, we walk through a brief update on the major accomplishments for 2021, where they are trading today on a revenue multiple basis versus the same time one year ago and what is in store for the coming year.

“The stock is not the company. And the company is not the stock, And so, as I watched Amazon stock fall from $113 to $6, I was also watching all of our internal business metrics — number of customers, profit per unit….every single thing about the business was getting better. And so, while the stock price was going the wrong way, the company was going the right way.”

-Jeff Bezos, former CEO Amazon-

We Think it Makes Sense To Start Deploying Capital

While impossible to time exactly when tax-loss selling will end for any given stock, with only two weeks left in the year we think now is the right time to start legging into micro-cap and small-cap stocks that have strong fundamentals, strong balance sheets and can execute through tougher markets if they do continue. Beyond our client list, which we continue to maintain strong positions in, we are also looking at a few other small-cap and micro-cap stocks that have seen their share price dislocate from their fundamental performance.

As growth investors, we remain focused on companies that can grow their businesses at rates in excess of their costs of capital. Typically, we are aiming for 20%+ top-line growth, but in small and micro-cap stocks this can often be more than 100%. Beyond our clients, there are several companies we have been watching the last 12 months that have continued to execute on their growth plans, and despite this, their shares have gotten hit and their valuations (on a revenue multiple basis) have compressed. From a fundamental perspective we like these names because of the long-term growth outlook, strong management teams and the fact we are now buying better businesses at lower multiples.

See the full list of tax loss ideas, which includes some of our clients as well as other names that could be impacted from tax loss.

UGE International (TSXV:UGE, OTC:UGEIF)

Current Share Price C$1.63 (down 49.7% from 52-week high)

UGE International is a developer/builder/financer/owner/operator of a portfolio of U.S. community solar projects. Energy off-take customers include Bloomberg and T-Mobile. Community solar is the fastest growing solar segment, and UGE’s pipeline includes almost 800MW of projects.

Reasons to Invest

- UGE backlog growth from 17MW on January 1, 2020 to 145MW on November 22, 2021

- U.S. Department of Energy wants to see community solar grow 8x through 2025

- Capital-light, end-to-end business model

- Long-term recurring revenues, usually at least 25 years

- Insiders own 43% of shares

Tax-loss Checklist

- Completed a brokered equity raise at $2.60 with institutions, which closed on 10/02/21

- Business has continued to grow as evidenced by increasing backlog and pipeline

- Balance sheet good, but management has mentioned they are working on large debt to fund project growth in early 2022

Valuation

- Industry transactions for solar projects under development valued at an average US$0.93/watt

- Market currently values UGE’s 145MW backlog at US$0.27/watt

- Each MW generated could generate US$150,000 to US$180,000 of annual EBITDA

- 4 analysts – consensus $3.63 1-year price target

Stock Chart

UGE International (RED), TSX-Venture (BLACK)

Source: MarketScreener.com

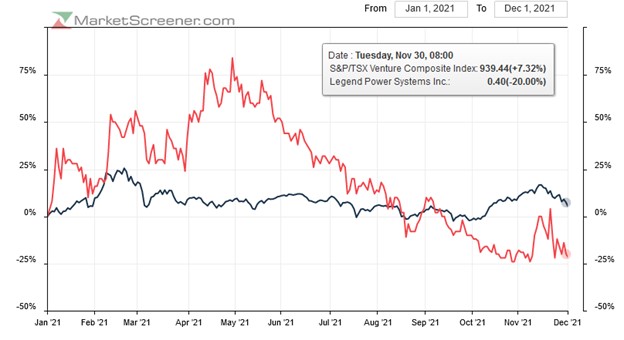

Legend Power Systems (TSXV:LPS, OTC:LPSIF)

Current Share Price C$0.375 (down 60.9% from 52-week high)

Legend Power Systems assesses and rectifies power quality issues commercial properties experience from utility grids. With over $10 million of working capital, improved supply chain, and the first units of its next generation offering shipped, Legend Power is perfectly situated to address a problem that costs commercial real estate about $80 billion annually.

Reasons to Invest

- Over 300 installations, including with IKEA Canada, Oxford, and Morguard

- No direct competitors

- Reseller channel established with leading, U.S. energy service companies

- Decarbonization and electrification will compound power issues Legend Power remedies

- Solid balance sheet (June 30) with $10.4 million of cash and no debt

Tax-loss Checklist

- Completed a brokered equity raise for $10.3 million at $0.75 with institutions, which closed on 15/06/21

- Recent corporate update highlighted significant growth opportunities with major ESCOs and multi-billion market opportunity

- Strong balance sheet also highlighted in recent corporate update with working capital of $10 million

Valuation

- $37.2 million enterprise value, $2.5 million of revenue through first 9 months of F2021

Stock Chart

Legend Power Systems (RED), TSX-Venture (BLACK)

Source: MarketScreener.com

Reklaim (TSXV:MYID, OTC:MYIDF)

Current Share Price C$0.30 (down 71.0% from 52-week high)

Offering compliant consumer data to brands, platforms and data companies, Reklaim allows consumers to sign up and view for the first time their online data profile that companies have been using for years with the consumers knowledge. Consumers can opt-in (or not) to sell their data. Customers include BP, Microsoft and HP.

Reasons to Invest

- 320 million profiles under management of which 120 million have been ‘Reklaimed’ by users

- US$245 billion ($400 billion globally) data industry

- Data Industry undergoing a destructive shift, driven by big technology reducing access to core data that industry has a dependency on and government actions to protect consumer data privacy

- Integrated with 15 of the top platforms that facilitate the purchase and distribution of data

- Long-term recurring contracts that are growing in value and number

Tax-loss Checklist

- Completed a non-brokered equity raise at $0.65, which closed on 25/02/21

- Business has continued to grow significantly both year-over-year and quarter-over-quarter and entering the seasonally strongest quarter in Q4

- Last reported cash at the end of Q3 was $2,031,753

Valuation

- Market capitalization of $22 million and looking to disrupt a multi-billion market

- The Company has begun to post revenue from the sale of its data with YTD revenue in Q3/F21 being $558,342, up from $34,973 a year ago

Stock Chart

Reklaim (RED), TSX-Venture (BLACK)

Source: MarketScreener.com

HIRE Technologies (TSX:HIRE, OTC:HIRRF)

Current Share Price C$0.22 (down 75.6% from 52-week high)

HIRE Technologies focused on modernizing and digitizing human resources solutions. The Company is consolidating the industry, successfully acquiring strong brands for 4x to 6x EBITDA that have opportunities for optimization and cross-selling.

Reasons to Invest

- Significant upside via continued organic growth, synergies and accretive strategic acquisitions

- Massively fragmented, growing $500+ billion market ripe for consolidation

- No dominant competitor

- Resilient recurring revenue streams and robust growth since inception

- HIRE recently closed the second tranche of its non-brokered private placement for a total of $4.8 million in oversubscribed financing on September 30

- HIRE reported strong Q3/21 results with 35% y/y organic growth across all business units (Revenue $7.7 million, ~44% gross margin and ~$300,000 adjusted EBITDA), ending the quarter with $2.4 million of cash

- Only Canadian public consolidator in the HR industry for staffing, HR consulting and SaaS solutions

Tax-loss Checklist

- Completed a non-brokered equity raise of $4.8 million at $0.30, which closed on September, 30, 2021

- Business has continued to grow with record revenue in Q3, positive Adj EBITDA and 35% organic growth.

- Strong balance sheet with last reported cash at the end of Q3 of $2.4 million

Valuation

- Trading at around 0.7x 2022 revenue, a slight premium to traditional staffing firms at 0.6x and discount to tech-enabled staffing companies at 4.3x.

- Analyst price target is $0.55

Stock Chart

HIRE Technologies (RED), TSX-Venture (BLACK)

Source: MarketScreener.com

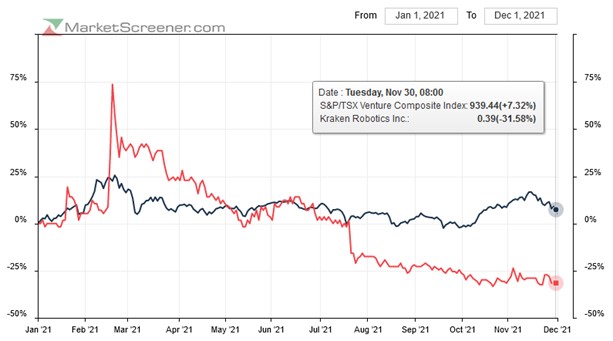

Kraken Robotics (TSXV:PNG, OTC:KRKNF)

Current Share Price C$0.35 (down 69.8% from 52-week high)

Kraken Robotics is a marine technology company engaged in the design, development, and marketing of advanced sonar and laser sensors and systems and subsea power solutions for Unmanned Underwater Vehicles for military and commercial applications. Customers include the U.S. Navy, Danish Navy, Polish Navy, Husky, and Ocean Infinity. Kraken’s recent acquisition of PanGeo broadens the Company’s commercial market opportunity with offshore renewables focus and provides a platform to significantly grow recurring revenue.

Reasons to Invest

- 2020 revenue of $12 million. On November 29, Kraken reiterated 2021 guidance of $28 million to $30 million – $10.6 million reports through first 9 months of 2021, setting Kraken up for a big fourth quarter

- Solid balance sheet – $8 million of working capital as of September 30. Subsequent to quarter end, awarded contracts worth $7.1 million

- Management and insiders own 18% of shares. Strategic investor/customer Ocean Infinity owns 11%

- Maritime robotics is a $10 billion market by 2025

- Over $250 million contract pursuits for hardware only – excludes recurring revenue opportunities

Tax-loss Checklist

- Completed a $10 million brokered equity raise at $0.50 with institutions, which closed on 26/07/21

- Strong balance sheet with significant deliveries anticipated in Q4 to hit guidance, which should result in significant cash increase to end the year

Valuation

- ~$68.2 million enterprise value on $28 million to $30 million 2021 revenue guidance and $3 million to $4 million EBITDA guidance and management expects continued growth in 2022

Stock Chart

Kraken Robotics (RED), TSX-Venture (BLACK)

Source: MarketScreener.com

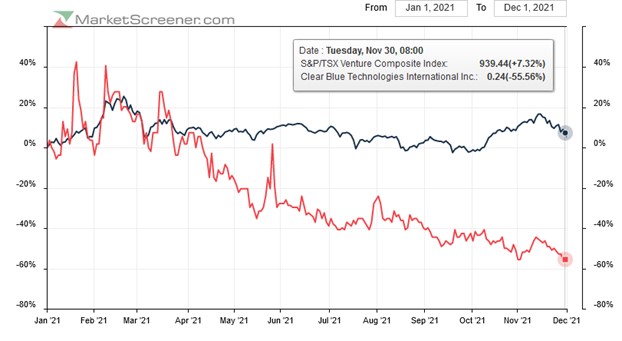

Clear Blue Technologies (TSXV:CBLU, OTC:CBUTF, FRA:0YA)

Current Share Price C$0.23 (down 71.3% from 52-week high)

Clear Blue Technologies delivers clean, managed, “wireless power” to meet the global need for reliable, low-cost, off-grid power for lighting, telecom, security, Internet of Things devices, and other critical systems. Clear Blue has an extensive list of global brand customers that includes Orange, Facebook, and Telefonica.

Reasons to Invest

- Market leader for wireless power for smart-city streets, telecom cell phone towers & satellite Wi-Fi

- Energy-as-a-Service drives strong high-margin recurring revenue business

- Off-grid solar lighting US$1.6 billion in 2020 growing to US$4.9 billion by 2027

- Telcos power system upgrades US$4.4 billion in 2020 growing to US$5.3 billion by 2026

Tax-loss Checklist

- Pro forma unaudited cash as at November 15, 2021 of $2.8 million — due to the closing of recent convertible debt financings, exceeding management goals

- Q3 Trailing Twelve Months (TTM) revenue was a record $9 million, up 130% year-over-year. Gross profit was $2 million, a 163% increase year-over-year

- Early Q1 2022 large order could be twice Q3 bookings of $2.9 million

- Forward Twelve Month (FTM) revenue for the period Q4 2021 to Q3 2022 is expected to be $9 million

- Clear Blue could be Adjusted EBITDA break-even at an annual revenue in the $15 to $20 million range at a 30-35% Gross Margin range

Valuation

- $24 million enterprise value, with Forward Twelve Month revenue expectations of $9 million, not including potential for significant large orders, which when realized could propel the Clear Blue to EBITDA break even

Stock Chart

Clear Blue Technologies (RED), TSX-Venture (BLACK)

Source: MarketScreener.com

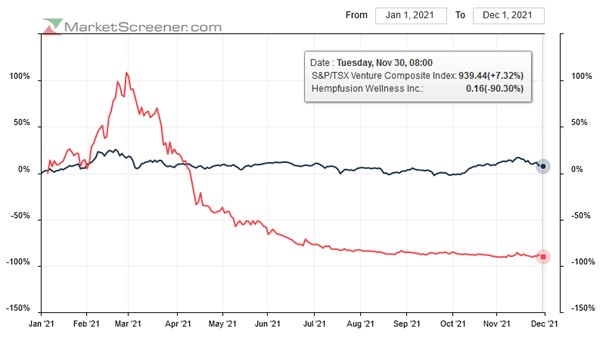

HempFusion Wellness (TSX CBD.U, OTC:CBDHF)

Current Share Price C$0.15 (down 95.8% from 52-week high)

HempFusion is a health and wellness business with leading brands in the CBD, probiotics and OTC pain categories. The company is one of the select few in the CBD industry that is fully prepared to meet or exceed expected FDA guidance. Available from over 18,000 US retail locations across 50 states, the company has a growing distribution footprint.

Reasons to Invest

- Undervalued probiotics brand that is currently the fastest growing in the U.S.

- Acquired #1 selling topical CBD brand in the U.S., Sagely naturals, and producer of the #1 selling topical product in the Ontario Cannabis Store, Apothecanna to bolster product portfolio

- Retail distribution footprint of over 18,000 locations and counting

- Industry leader in regulatory compliance

- Revenue guidance for 2022 of $20 to $25 million represents growth of 50% to 100%

Tax-loss Checklist

- Completed a private placement at $0.25 for total proceeds of $2.9 million in September 2021

- Distribution footprint growth has accelerated as business has gained traction and acquisition synergies have begun to take hold

- Strong top-line growth, coupled with improving cost structure should lead to meaningful improvements in profitability throughout 2022

- Regulatory change could be significant potential catalyst that would increase revenues by 3x to 5x their current 2022 guidance

- Strong balance sheet, with several brands that on their own could be worth the entire market cap of the business

Valuation

- Currently trading at roughly 1x the mid-point of 2022 revenue, which is at a 1x to 3x discount to the group average

- If there is a regulatory change before 2023, the company could quickly become EBITDA and FCF positive and the current valuation would represent a low single-digit EBITDA multiple

Stock Chart

Real Luck Group (TSXV:LUCK, OTC:LUKEF)

Current Share Price C$0.22 (down 87.8% from 52-week high)

Real Luck Group (“Luckbox”) is a pure-play esports betting company that offers legal, real-money betting, live streams, and statistics on 14 esports on desktop and mobile devices. Luckbox has a B2C platform, and by leveraging shared technology, data, and resources Luckbox can offer an extensive range of betting options for esports tournaments.

Reasons to Invest

- Award-winning, proprietary platform in a growing $18 billion market

- Targeting Gen-Z bettors, a generation that prefers esports to traditional sports and can be customers for decades to come

- Experienced team with combined decades of igaming experience and esports knowledge

- Live in over 80 countries due to strong Isle of Man gaming license

- Strong balance sheet with $15.8 million of cash, no debt and runway to execute

- After a six month plus heads down platform rebuild, Luckbox is expected to launch its online casino in December 2021, which will be followed by player marketing to drive organic growth in 2022

Tax-loss Checklist

- Completed a brokered equity raise at $1.20 with institutions, which closed on March 9, 2021

- Management has guided to have online casino launched by year end, along with a platform relaunch, enabling the company to commence organic player marketing to drive revenue growth

- Very strong balance sheet with $15.8 million in cash, and no debt as of the last reported quarter (Q3 2021) and a guided burn rate of ~$2 million a quarter, giving management over a year and a half to execute

Valuation

- Currently trading near cash of ~$0.23/share, the stock could benefit as investors gain comfort that the Company’s platform rebuild could begin to drive 2022 revenue.

Stock Chart

Real Luck Group (RED), TSX-Venture (BLACK)

Source: MarketScreener.com

GameSquare Esports (CSE:GSQ)

Current Share Price C$0.23 (down 64.6% from 52-week high)

As big as it already is, the potential growth for esports has not yet even begun to be realized. New game titles, new competitions, new dedicated esports facilities, new technologies, and new partnerships with established sports organizations are continuing to multiply opportunities. As GameSquare continues to identify, acquire, and develop viable entities in both competitive esports and non-competitive gaming, its partners will continue to benefit.

Reasons to Invest

- GameSquare has 2 agency businesses targeting the US$1.8 billion esports industry

- Recently acquired Complexity Gaming , a tier-one esports organization with strong ties to the Dallas Cowboys

- Esports influencer TimTheTatman (4 million YouTube fans) joined GameSquare’s Complexity Gaming

- Strategic investments by the Jones (Dallas Cowboys) and Goff families

- Esports could have a 24% CAGR, growing to a US$6.8 billion market by 2027

Tax-loss Checklist

- Completed a $17 million brokered and non-brokered equity raise at $0.40 with institutions, which closed on July 22, 20211

- Business has continued to grow as evidenced by recent management commentary suggesting GameSquare will generate $28 million of revenue in 2022 versus over $3.5 million in the two months ended October 28, 2021 and ~$2.5 million in the three months ended August 31

- $13.1 million of cash on at the end of Q3 (August 31), analysts expect that it has $12 million cash currently

- Recent insider buying in the $0.27 to $0.39 range.

- Analyst price target is $0.60

Valuation

- Trading at ~2.4x analysts’ projected 2022 sales versus FaZe Clan’s expected go public valuation of ~8x projected 2022 sales

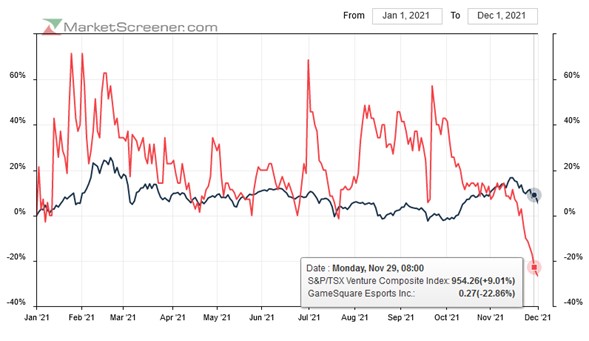

Stock Chart

GameSquare Esports (RED), TSX-Venture (BLACK)

Source: MarketScreener.com

OTHER ISSUERS TO CONSIDER

General Assembly Holdings (TSXV:GA, OTC:GASMF)

Current Share Price C$0.60 (down 55.6% from 52-week high)

General Assembly Pizza delivers premium pizza experiences across multiple distribution and retail channels. The Company is anchored by a flagship fast casual restaurant with dine-in and off-premises operations, and a consumer-packaged goods line of naturally leavened frozen pizzas, available at specialty grocery stores and through a direct-to-consumer eCommerce platform.

Reasons to Invest

- World’s first pizza subscription service

- Poised to scale nationally with the development of a master production facility

- Fast growing wholesale business, with significant early retail wins and the potential to become the premium frozen pizza player at grocery

- Massive market – global frozen pizza could be worth US$25.2 billion by 2025

- Insiders own 49% of shares

Tax-loss Checklist

- Completed a private loan arrangement for $2 million to be used to fund working capital, general corporate purposes, and the purchase of capital equipment on November 5, 2021

- Significant year-to-date growth, despite the restaurant being closed for almost half the year

- Balance sheet is solid, and the new facility is fully built and ready to start generating incremental revenue

Valuation

- $13.2 million enterprise value, $3.6 million of revenue through the first 9 months of 2021

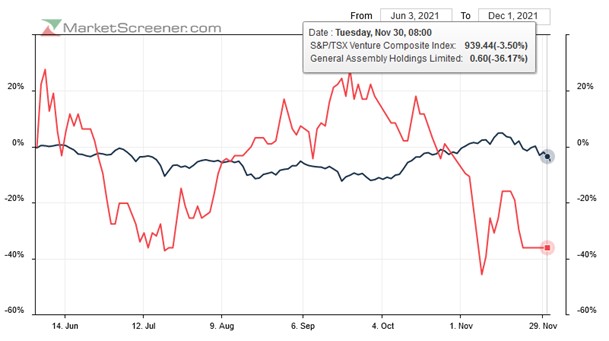

Stock Chart

General Assembly Holdings (RED), TSX-Venture (BLACK)

Source: MarketScreener.com

EMERGE Commerce (TSXV:ECOM, OTC:EMCMF)

Current Share Price C$0.62 (down 63.9% from 52-week high)

EMERGE is a disciplined, diversified acquirer and operator of category-leading niche e-commerce brands across North America. EMERGE is led by e-commerce veteran Ghassan Halazon who has over 12 years acquiring and operating some of Canada’s most coveted brands. Mr. Halazon has built up an impressive management team, which has proven that they can acquire, integrate and accelerate the growth of niche brands at a lower cost of acquisition and with better long-term economics, than building businesses from the ground-up.

Reasons to Invest

- EMERGE recently eclipsed $120 million in pro forma GMS along with $7 million Adj. EBITDA

- Had its first $10 million GMS month in November exceeding its entire GMS in Q3 2021

- 2022 is expected to be their first operating cash flow positive year

Tax-loss Checklist

- Completed RTO on December 14, 2020 at $0.75 cents. Emerge raised additional capital in February 2021 at $1.40 to fund M&A pipeline

- On November 29th 2021, EMERGE reported Q3 results EMERGE ended Q3 with $16.8 million in cash prior to the acquisitions in Q4. Post-acquisitions, EMERGE had approximately $6 million in cash

- EMERGE has a $25 million debt facility and they have proven they can scale up the debt cost-effectively to acquire additional companies, while minimizing dilution

Valuation

- Trading at ~1x Pro Forma 2022 revenue and 10x Pro Forma 2022 Adjusted EBITDA versus Canadian consolidators at 5x and 17x respectively. D2C and Ecommerce valuation multiples are significantly higher

- Recent insider buying in the $0.67-$0.72 range

- Analyst price target consensus is $1.72

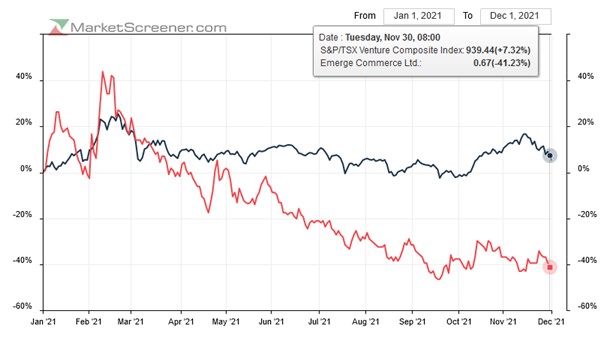

Stock Chart

EMERGE Commerce (RED), TSX-Venture (BLACK)

Source: MarketScreener.com

Freshlocal Solutions Inc. (TSXV:LOCL, OTC:FLOCF)

Current Share Price C$0.79 (down 89.5% from 52-week high)

Freshlocal Solutions Inc. has evolved from a local and organic online grocery company into an award-winning complete eGrocery management solution with over 20 years of experience. The company has been there since the beginning of eGrocery and is now building a leadership position in this high-value global market.

Reasons to Invest

- 25% of grocery is going online (from HSD to MDD) and FoodX helps grocers go online profitably. Grocery is a massive industry, so TAM huge

- Food waste is a massive problem. We help grocers significantly reduce food waste, saves big $$ and enhances sustainability aspect of business

- Marquee customer (Carrefour) that will open us up to other large customers around the world

- SAAS part of the business will ramp significantly in ‘22 as we launched our first facility with Carrefour in 2021. Much higher margin business

- New management team and board will focus on cash flow generation and business optimization

Tax-loss Checklist

- Raised $40 million an average price of just over $7/share, and it was predominantly institutional last fall 2020

- Covenant breach with SVB spooked the market and accelerated the sell off. It also led to the requirement to do the convert financing

Valuation

- The worst online grocery/meal delivery biz trades at 1x revenues. Freshlocal’s online grocery revenue exceeds $100 million yet the market cap is $35 million. Almost as though no value is given to FoodX, which will be a pure play high-margin, recurring revenue SAAS business

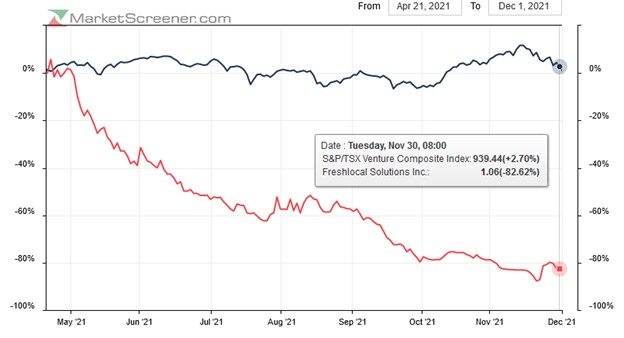

Stock Chart

Freshlocal Solutions (RED), TSX-Venture (BLACK)

Source: MarketScreener.com

Greenlane Renewables (TSXV:GRN, OTC:GRNWF)

Current Share Price C$1.13 (down 61.2% from 52-week high)

Greenlane Renewables is a leading global provider of biogas upgrading systems that are helping decarbonize natural gas. Our systems produce clean, low-carbon and carbon-negative renewable natural gas from organic waste sources including landfills, wastewater treatment plants, dairy farms, and food waste, suitable for either injection into the natural gas grid or for direct use as vehicle fuel. Greenlane is the only biogas upgrading company offering the three main technologies: waterwash, pressure swing adsorption, and membrane separation.

Reasons to Invest

- Recent quarter (Q3) was record revenue of $13.4 million, an increase of 107% over the $6.5 million reported in the third quarter of 2020

- Reported Net Income of $100,000

- Just announced a definitive agreement to acquire Airdep SRL, a provider of biogas desulfurization and air deodorization products based in Vicenza, Italy. Airdep had reported revenues of approximately $5 million for the last twelve months

- Cash and cash equivalents of $35.6million and no debt, other than payables and bonding resulting from normal course operations, as at Sept. 30, 2021

Tax-loss Checklist

- Completed a $26.5 million brokered equity raise at $2.17 with institutions, which closed on 01/27/21

- Business has continued to grow as evidenced by increasing backlog and pipeline

- Balance sheet good, plus management offering guidance on good revenue growth for this year

Valuation

- Recent analyst valuations have shown positive reactions in addition to some targets increasing such as TD which increased its target from $2.50 to $2.75

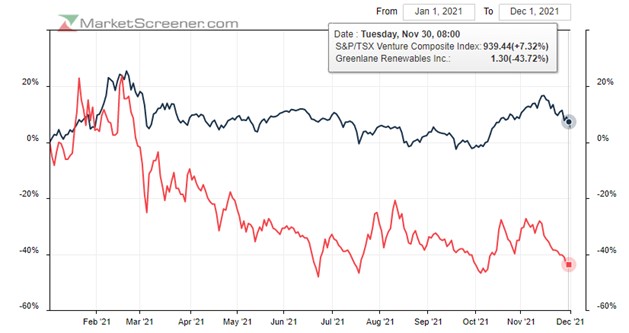

Stock Chart

Greenlane Renewables (RED), TSX-Venture (BLACK)

Source: MarketScreener.com

Martello Technologies (TSXV:MTLO, OTC:DRKOF)

Current Share Price C$0.075 (down 70.6% from 52-week high)

Martello’s digital experience monitoring (DEM) solutions monitor and analyze performance and user experience of critical cloud business applications. The Martello platform enables Information Technology (IT) teams and service providers to better control their IT infrastructure. Products provided include Microsoft 365 end user experience monitoring, unified communications performance analytics, and IT service analytics.

Reasons to Invest

- Recent launch of Microsoft Teams and Microsoft 365 Digital Experience Monitoring platform, Vantage DX, came as Microsoft Teams reached 200 million monthly active users (up from 75 million daily active users in April 2020) – continued growth in Microsoft Teams users and hybrid work models are driving demand for Martello’s solutions

- Consistently high-quality revenue: 98% recurring with gross margins of 92% (Q2 FY22)

- CAGR 50% (FY17 through FY21) and two consecutive quarters of Microsoft DEM revenue growth in FY22

- Expanding Microsoft relationship – part of Microsoft Global Solutions Alliance Partner Program, which offers enhanced access to marketing and sales channels

- Co-Chairmen are, tech titan, Sir Terry Matthews and Bruce Linton, founder of Canopy Growth

Tax-loss Checklist

- As of September 30, 2021 Martello had $4.8 million in cash and $2.7 million in working capital

- $5.76 million raised in a bought deal offering in March 2021 including institutional investors, at $0.19/unit. A concurrent non-brokered private placement raised an additional $439 thousand

- In November 2021 announced a $2 million private placement by insiders at $0.12 suggests high insider confidence in the business’ prospects. Second tranche of a minimum of $1 million expected to close by January 31, 2022

Valuation

- Trading at 2x Sales versus Software-as-a-Service stocks at 7x to 15x

- Consensus analyst price target of three equity analysts is $0.17

Stock Chart

Martello Technologies (RED), TSX-Venture (BLACK)

Source: MarketScreener.com

Nabati Foods Global (CSE:MEAL, OTC:MEALF)

Current Share Price C$0.48 (down 65.0% from 52-week high)

Nabati Foods is a family-founded food technology company offering whole, natural, plant-based, gluten and soy-free foods for health conscious consumers. The company sells a line of plant-based, non-dairy cheesecakes, cheese alternatives, plant-based meats, and a plant-based liquid egg alternative. The company’s products are distributed throughout Canada, the U.S. and internationally.

Reasons to Invest

- Fast growing plant-based, non-dairy cheese business, with significant distribution wins in 2021 and newly minted US distribution agreement with KeHE for cheesecakes, cheese, and meat

- Strong demand for product portfolio in the food service industry, with early wins at COBS Bread

- Newly launched plant-based eggs product seeing strong initial demand with the potential for rapid growth in 2022

- Eat Just IPO in early 2022 could be significant valuation catalyst, as the number one player in plant-based eggs is expected to be valued at $3 billion

- Strong management team, with significant insider ownership of over 50%

- Launched plant based eggs in Q4 2021 and secured shelf space with numerous national retailers

Tax-loss Checklist

- Raised over $7 million as part of RTO transaction in 2021

- New facility is fully built out, removing the supply constraint that had limited its ability to meet demand

- Exiting the year with significant momentum, with new distribution wins paving the way for accelerated revenue growth in 2022 and beyond

Valuation

- Current market capitalization of $22 million after recently going public and expecting significant growth from its plant-based products

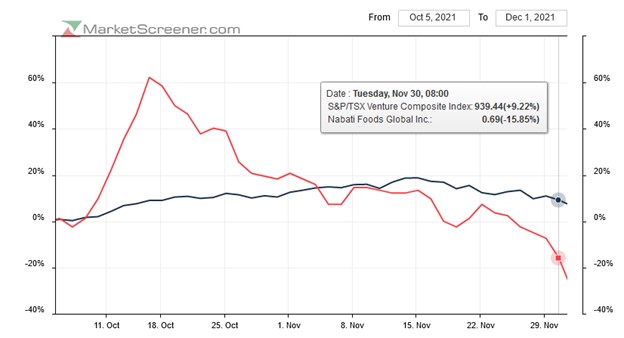

Stock Chart

Nabati Foods Global (RED), TSX-Venture (BLACK)

Source: MarketScreener.com

Skylight Health Group (NASDAQ:SLHGP, TSXV:SLHG)

Current Share Price US$1.48 (down 80.4% from 52-week high)

Skylight Health Group is a healthcare services and technology company, working to positively impact patient health outcomes. The Company operates a U.S. multi-state primary care health network of clinics providing a range of services from primary care, sub-specialty, allied health, and laboratory/diagnostic testing. The Company is focused on helping small and independent practices shift from a traditional fee-for-service model to value-based care through our proprietary technology, unique data analytics and our robust operations infrastructure.

Reasons to Invest

- $3 trillion dollar U.S. healthcare industry opportunity ripe for disruption

- Strong growth both organically and through acquisition in the United States

- 8 acquisitions successfully completed in the last 12 months contributing more than $35 million in annualized revenue growth

- Strong history of accretive acquisitions in a fragmented marketplace with attractive multiples of 3x to 7x EBITDA

- Experienced leadership and executive team in primary and value-based care

Tax-loss Checklist

- Company has approximately C$12 million of cash on the balance sheet, with no traditional debt (only Perpetual Preferred Stock)

- Approximate burn is less than C$2 million per quarter

- On December 7, 2021, Skylight closed a Series A Cumulative Redeemable Perpetual Preferred Stock offering, raising US$5.8 million at a price of US$21/share

- On May 26, 2021, Skylight closed a C$13.8 million equity financing at C$1.40/share (before a 5:1 share consolidation)

Valuation

- Trading at 3x 2021E EV/Revenue with average peers at 10x 2021E EV/Revenue

- 2021 guidance of $41 million, which represents total revenue growth of ~215% over 2020, with a robust pipeline of acquisition targets under review

- Analyst consensus price target of C$5.60, based on six equity analysts who follow the stock

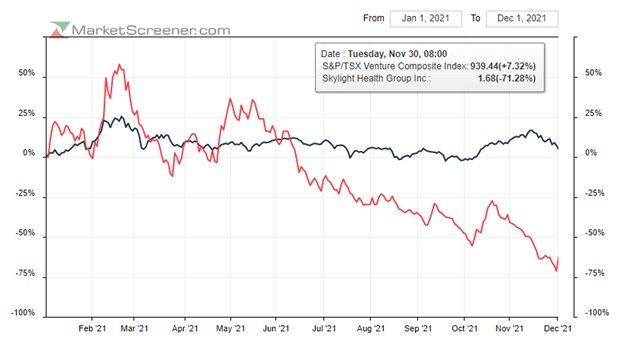

Stock Chart

Skylight Health Group (RED), TSX-Venture (BLACK)

Source: MarketScreener.com