AnalytixInsight

ALY:TSXV; ATIXF:OTC

Capital Structure

Company News

Industry News

Industry News

Sophic Insights

Vital Signs: Taking the Pulse of Critical Services

Plurilock’s strategic shift towards integrating its services, enhancing its advisory council, and optimizing its resource allocation to meet the escalating demand for comprehensive cybersecurity amidst a fragmented market is fortifying the Company’s position. It stands poised to address critical challenges like business continuity, geopolitical threats, and regulatory compliance, solidifying its reputation in the evolving landscape of cybersecurity.

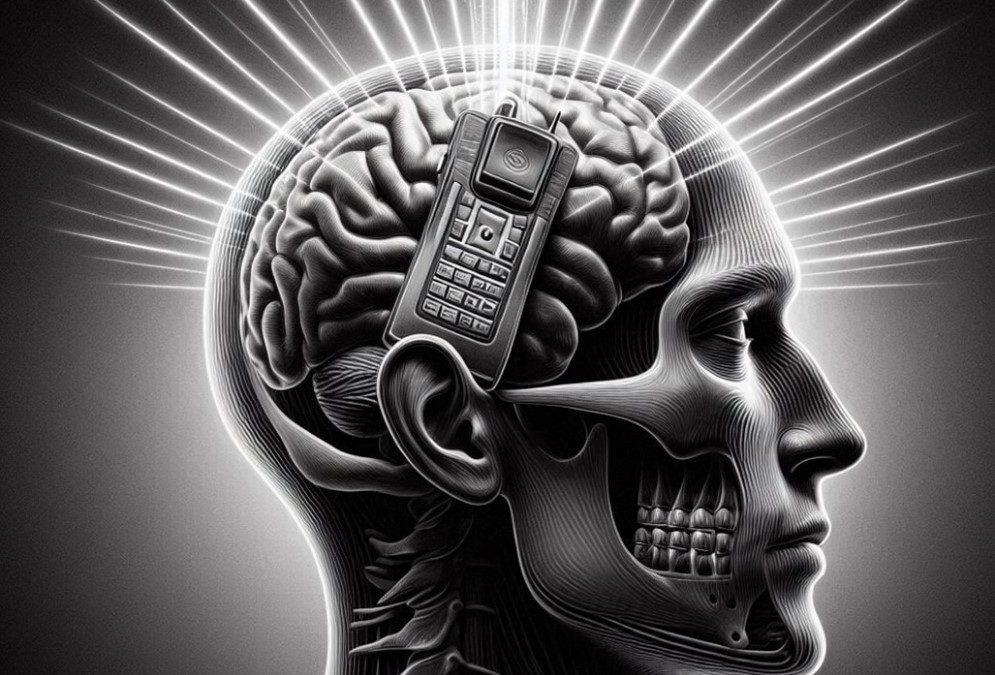

Dialing Up Danger?

The potential of harmful effects from Electromagnetic Field (EMF) radiation is a polarizing topic. It’s fair to say that scientific research is currently indeterminate. Many people wonder if having a smart phone beside their head or in front of their face for hours every day may harm their health, while others are adamant that there are no ill effects. Although the human body can cope with many natural sources of radiation (like the sun), could prolonged EMF radiation from consumer devices such as mobile phones, WiFi routers, and baby monitors harm us? Exceeding EMF radiation guidelines for mobile phones, electric vehicles, microwave ovens and other electrical devices suggest that these devices can harm us.

October 13, 2024: Five Up Weeks For Major Indices

Last week, Nasdaq and S&P 500 both gained 1.1%, while Dow Jones gained 1.2% – the fifth straight weekly rise for all major indices. Cerebras Systems is likely to postpone its IPO. CoreWeave, an Nvidia-backed AI startup that rents out chips to other companies, announced that it has a new US$650 million credit line to expand its business and data center portfolio. Shortseller Hindenburg accused Roblox of inflated metrics. Tesla CEO Elon Musk unveiled autonomous Robotaxis he says will be available in 2026. Google’s grip on search appears to be slipping as TikTok and AI startups mount challenges. The Justice Department said Tuesday that it may ask a federal judge to force Google to divest Chrome, Google Play and Android, in order to fix Google’s illegal monopoly in general search engines and search text advertising. More than a dozen US states sued TikTok over allegedly harming kids, and the company has reportedly earmarked US$1 billion for future EU privacy fines. Delta Air Lines spent US$170 million on customer and crew-related costs in the wake of the CrowdStrike outage in the summer. Apple will sell its TV+ service on Amazon Prime video. In Canada, Sophic Client Plurilock and CrowdStrike partnered to secure critical infrastructure and organizations. Plurilock also announced a new US$1.7 million sale with an existing client, a major semiconductor manufacturer. Sophic Client, Kraken Robotics was featured in Motley Fool as a no-brainer tech stock to buy right now for less than $200. Sophic Client American Aires announced a partnership with dynamic UFC Lightweight title contender Michael Chandler. Sophic Client NowVertical highlighted a solution that provides simplified data management and provides greater transparency into partner marketing activities. Sophic Client Xcyte Digital, unveiled advanced AI capabilities.

(Pluri)Lock-ing Your Data

Cybersecurity encompasses the strategies and tools used to safeguard internet-connected devices, networks, and data against unauthorized access and illicit use. Pure-play cybersecurity Company [TSXV:PLUR, OTC:PLCKF] is a leader in the fight against cyber threats. Plurilock stands out as a prominent North American cybersecurity Company in the microcap space. Plurilock is a trusted provider of IT and cybersecurity solutions for governments and commercial clients across North America and NATO countries.