AnalytixInsight

ALY:TSXV; ATIXF:OTC

Capital Structure

Company News

Industry News

Industry News

Sophic Insights

November 17, 2024: And It’s Gone, NASDAQ Below Post Election Gap Up

Last week, Dow Jones lost 1.2%, S&P 500 was down 2.1%, Nasdaq composite lost 3.15%, and fell below the lows of the post election gap up. The 10-year jumped 12 basis points to 4.43%. Fed chief Jerome Powell on Thursday signaled that the Fed is in “no hurry,”. CoreWeave closed a US$650 million secondary share sale at US$23 billion valuation, a 3x increase in valuation over the past year. Trump’s win has stoked defense tech bulls, despite talk of a bubble — at US$14 billion, investors have valued Anduril between 18 and 19x this year’s expected sales, traditional defense contractors, which are profitable but grow much more slowly, are valued at ~1-2x sales. Shares of electric vehicle companies including Tesla fell Thursday after a report that the incoming Trump administration hopes to end US$7,500 consumer tax credits on the purchase of EVs. Tesla shares fell almost 6% after the Reuters report. Amazon is developing smart glasses for delivery workers, Reuters reported Monday. Apple is developing surveillance camera amid smart home push. OpenAI discussed plans for an AI data center that could cost US$100 billion. OpenAI is preparing to launch a new AI agent that can use a computer to take actions on a person’s behalf, such as writing code or booking travel, according to two people familiar with the matter. In Canada, Shopify stock was up more than 20% on revenue, margin growth. Sophic Client Intermap announced Q3 revenue grew 241% year-over-year, the stock closed the week up nearly 20%. Sophic Client, NowVertical Group reported Q3 results, which put the company on a path to achieving annual EBITDA of US$10 million, by achieving annual revenue of US$50 million and a best-in-class 20% EBITDA margin, the stock closed the week up around 150%. Sophic Client, ADM Endeavors reported Q3 results, revenue grew 12% y/y, the company is pursuing new school uniform opportunities and has hidden asset value in its new facility. Sophic Client, Plurilock announced a $5.4 million order with a law enforcement agency, and provided a corporate update.

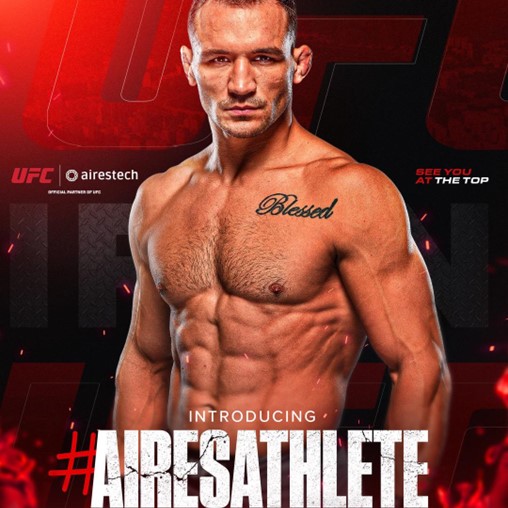

A Revenue Model that’s a Breath of Fresh Aires

In Sophic Capital’s Aires to Success report, we highlighted how the CEO of Sophic Capital client American Aires Inc. (CSE:WiFi, OTCQB:AAIRF) has developed, and is successfully executing against, a business model that leverages high-impact partnerships. In this report,...

November 10, 2024: Hold My Beer, Major Indices Hit Record Highs

Last week, Dow Jones rose 4.6%, S&P 500 gained 4.7%, and Nasdaq composite leaped 5.7% — all hitting record highs. Palantir climbed 13% on accelerating growth, and a higher revenue projection on Monday, as the company raised its full-year 2024 guidance for the third time this year. The retail favorite stock is now trading at ~35-40x sales. Palantir will also provide Anthropic’s Claude to the U.S. military. Amazon is discussing making another multi billion-dollar investment in Anthropic. VC’s are in talks about an investment in Perplexity, at a US$9 billion valuation, triple the valuation from a round earlier this year. Cryptocurrencies and related equities, Coinbase, Robinhood, and Microstrategy broadly rallied on Wednesday, after Donald Trump won the U.S. presidential election and Republicans took control of the Senate. Bitcoin hit an all time high, jumping more than 8% to US$75,450. Arm Holdings’ revenue growth slowed to just 5% in Q3, from 39% in Q2, the stock fell 4% in after-hours trading. SuperMicro showed disappointing earnings but “no evidence of fraud”, according to media reports. Airbnb’s growth slowed further in Q3, down eight points from Q1. Pinterest’s revenue growth slowed to 18% in Q3, the stock fell ~15% after the company projected even slower growth in Q4. Apple is reportedly exploring smart glasses in order to challenge Meta, and Snap. According to Mark Gurman from Bloomberg, Apple is ‘seriously considering’ developing a cheaper Apple Vision device that offloads all of the computing power to your iPhone, essentially developing a headset with primarily displays and a battery. Meta is opening a pop-up retail store for the Ray-Ban Meta glasses. Baidu will reportedly announce AI-powered smart glasses in China next week. Sophic Client, Kraken Robotics demonstrated a new KATFISH autonomous launch and recovery system to Navy customers. Sophic Client, Plurilock achieved CMMC Level 1 compliance for the United States Department of Defense.

Aires to Success

Airing Out Opportunities with the CEO Report #2 Recap In Sophic Capital’s Clearing the Aires report, we discussed how the technology of our client American Aires Inc. (CSE:WiFi, OTCQB:AAIRF), (“Aires” or the “Company”) protects against electromagnetic (EMF) radiation...