Investment Research for Your Business

“Thought leadership should be an entry point to a relationship. Thought leadership should intrigue, challenge, and inspire even people already familiar with a company. It should help start a relationship where none exists, and it should enhance existing relationships.” -Daniel Rasmus

Sophic Capital: Latest Research

Cybeats Eating the SBOM Market, One Byte at a Time

Cybeats Demonstrates Strong Customer Traction and Expanding Pipeline Report #2 Recap In Sophic Capital’s The Invisible Grid report, we introduced Sophic Capital client Cybeats Technologies Corp. [CSE:CYBT, OTCQB:CYBCF], a global leader in software supply chain...

The Invisible Grid: Cybeats Secures the Software Supply Chain for Critical Infrastructure

Report #1 Recap In Sophic Capital’s SBOMs Away!, we discussed security and privacy issues related to software development and shared recent significant cybersecurity events that exploited software vulnerabilities. Sophic Capital also introduced the growing global...

SBOMs Away!

Why Software Supply Chain Security Has Become a Top Priority Problem Modern software constantly changes as new features are added, bugs are fixed, and vulnerabilities are patched. Most people don’t realize that modern software isn’t built from scratch—it’s assembled...

Sophic Capital: Latest Research

Sophic Capital: Past Research

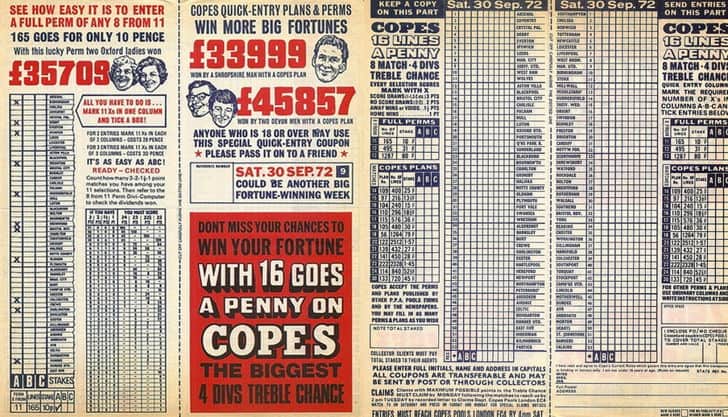

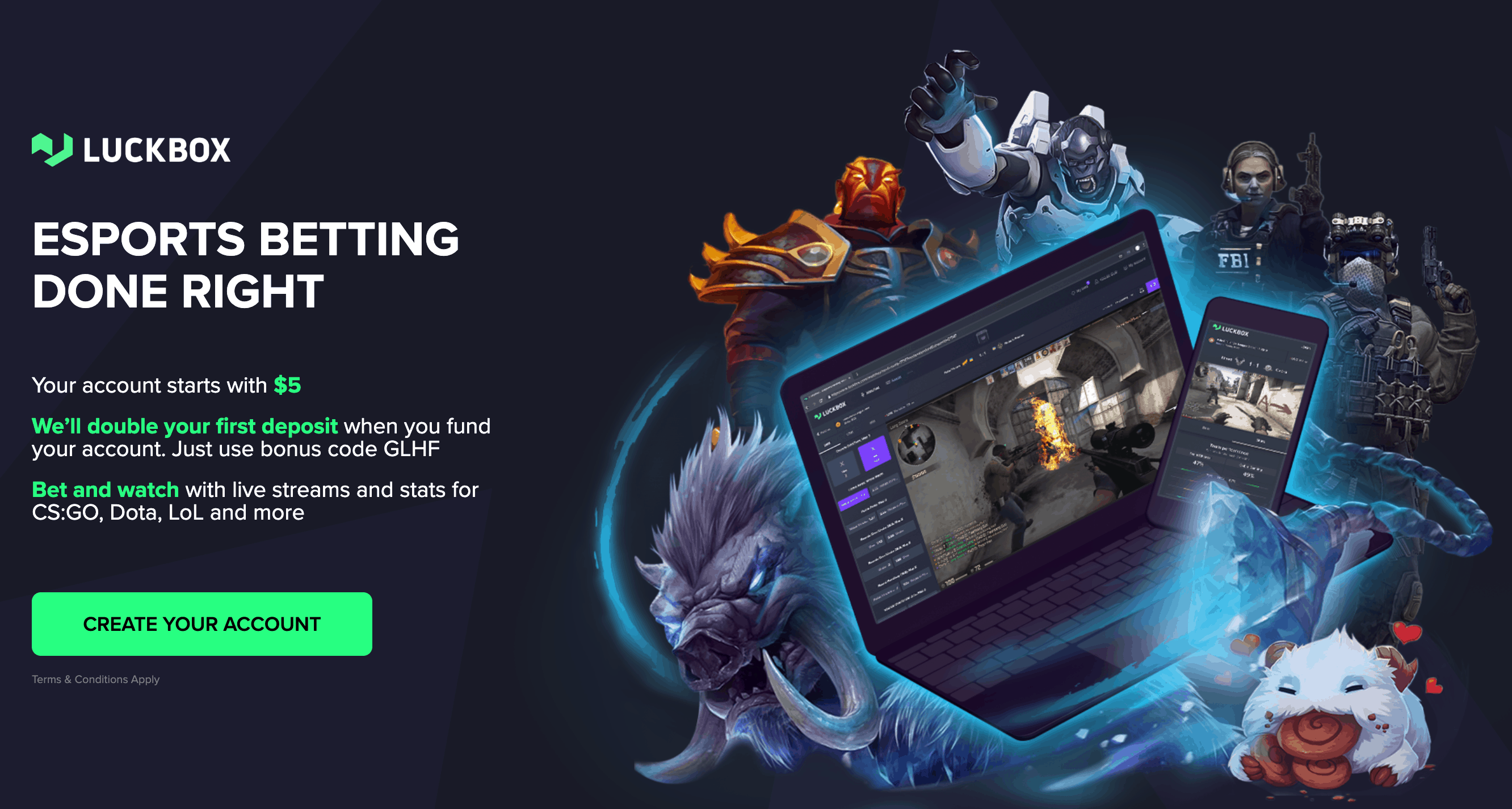

Commercial real estate owners have excessive operating costs and unplanned capital expenditures due to power grid instability. The combination of electrification and renewable energy are going to compound grid instability and increase these excessive costs. Plus governments have implemented carbon emission reduction targets that commercial property owners will have to abide by. Legend Power Systems has the solutions to quantify and reduce these excessive costs. After strong shareholder returns in 2020, 2021 could be another strong year for UGE International, a developer and operator of community solar projects (mostly in the U.S.). Why? Compared to solar project peer transactions, the market is undervaluing UGE shares. Plus, almost C$7 million was added to UGE’s balance sheet this week, in an oversubscribed offering. Esports offers an absurdly large number of betting opportunities.Esports bettors are a young and growing demographic – a generation that grew up with video games.Luckbox’s stock (TSXV:LUCK) is one of the few ways investors can invest in esports betting. esports betting accelerated in 2020 as traditional sports leagues suspended matches but esports leagues continued. This is not a short term blip. esports bettors are a young and growing demographic that has grown up with video games. Today’s fans will be tomorrow’s bettors where as traditional sports bettors are a shrinking market. esports bettors require community and trust. Luckbox management’s esports and betting backgrounds, building of community, as well as an Isle of Man license that is one of the strongest for consumer protection are some reasons why Luckbox can dominate esports betting.. esports audiences are surpassing those of traditional sports leagues, including NFL and MLB.esports betting could be a $12 to $15 billion business in 2020 and attracts a younger and growing demographic.Luckbox is a privately held esports betting firm.We spoke with Luckbox CEO Quentin Martin to learn about the opportunity. UGE International announced the sale of one of its completed solar projects (AND 3 new ones AND the completion of another). Last week, Sophic Capital wrote that solar projects under construction have sold for multiples much higher than what the market values UGE International. UGE’s project sale multiple shows that the market still undervalues the Company. Solar projects under construction sell for multiples much higher than what the markets value UGE International. In spite of the Blue-Wave that didn’t materialize in the 2020 U.S. election, solar stocks and the Invesco Solar ETF are hot. Why? Solar projects are hot due to government and utility incentives as well as an abundance of solar project financing. UGE International [TSXV:UGE; OTC:UGEIF], a community solar project developer and operator, is a way to invest in the growing solar energy theme.

Legend Power Systems Powers Ahead

Market Undervalues UGE Versus Peer Transactions

2020 Was A Banner Year for Video Gaming & Sports Betting

Luckbox (TSXV:LUCK) – Meet the Company

Luckbox (private) – Meet the Company

Luckbox (private) – Meet the CEO: Quentin Martin

UGE Sells Solar Facility Well Above Current Implied Valuation

Sizzling Solar Project Valuations Bode Well For UGE

UGE: Solar Projects Are Shining Due to Strong Economics