Investment Research for Your Business

“Thought leadership should be an entry point to a relationship. Thought leadership should intrigue, challenge, and inspire even people already familiar with a company. It should help start a relationship where none exists, and it should enhance existing relationships.” -Daniel Rasmus

Sophic Capital: Latest Research

Cybeats Eating the SBOM Market, One Byte at a Time

Cybeats Demonstrates Strong Customer Traction and Expanding Pipeline Report #2 Recap In Sophic Capital’s The Invisible Grid report, we introduced Sophic Capital client Cybeats Technologies Corp. [CSE:CYBT, OTCQB:CYBCF], a global leader in software supply chain...

The Invisible Grid: Cybeats Secures the Software Supply Chain for Critical Infrastructure

Report #1 Recap In Sophic Capital’s SBOMs Away!, we discussed security and privacy issues related to software development and shared recent significant cybersecurity events that exploited software vulnerabilities. Sophic Capital also introduced the growing global...

SBOMs Away!

Why Software Supply Chain Security Has Become a Top Priority Problem Modern software constantly changes as new features are added, bugs are fixed, and vulnerabilities are patched. Most people don’t realize that modern software isn’t built from scratch—it’s assembled...

Sophic Capital: Latest Research

Sophic Capital: Past Research

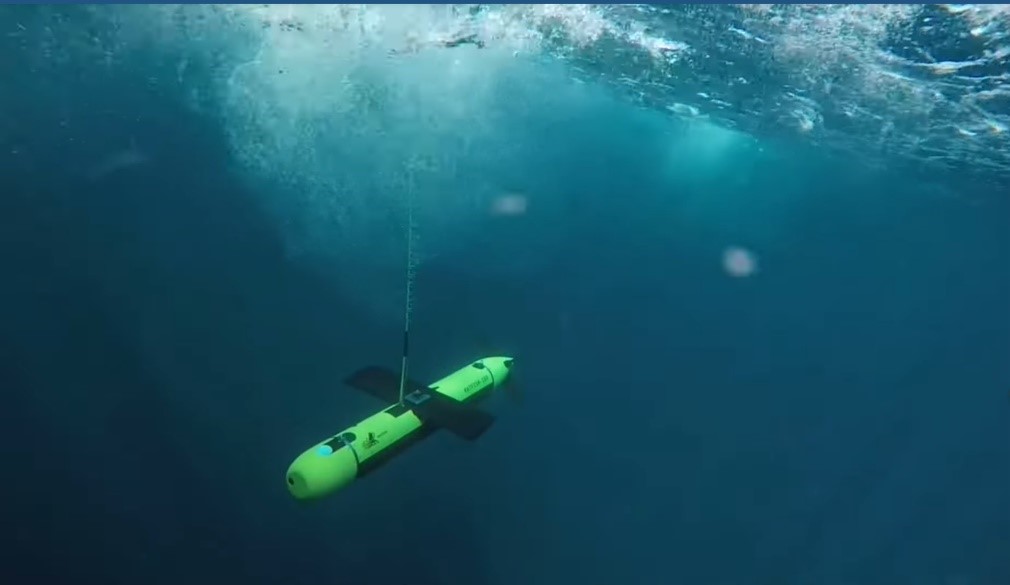

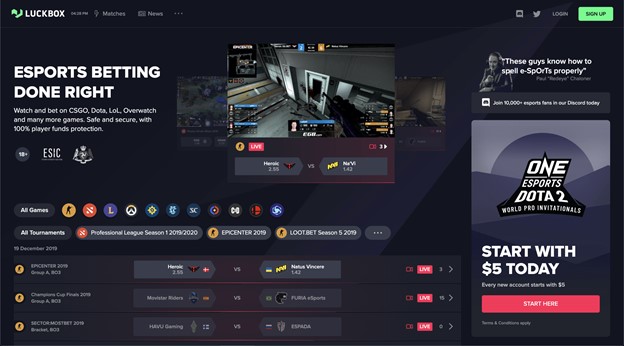

The U.S. Senate passed the Inflation Reduction Act of 2022, a bill that provides $369 billion of support to address climate change and energy security. Learn how the solar industry and UGE International can benefit. In the U.S., 80% of households and 90% of businesses can’t install solar systems. Community solar allows individuals and businesses to unlock power bill savings without having to install their own solar systems. UGE International is one of the few public companies for investors to participate in the U.S. community solar industry. Many defense departments have recently announced budget increases on the back of the Ukraine war. Even before these announcements, many nations were updating their naval capabilities. Following two NATO Navy deals won in 2020 and tests with the U.S. Navy, Kraken Robotics has established itself as underwater robotics leader. Swarmio Media is targeting the largest and youngest gaming markets where the greatest demand for its latency-reduction technology and gamer platform exists. Where these markets are may surprise you, but management has extensive relationships with telecom operators there. Gaming/Online communication, SaaS, and telco services companies are trading at less than half their 52-week highs. Now is the time to visit Swarmio Media. Sophic Capital client Swarmio Media [TSXV:SWRM] offers telecom operators a patented edge/cloud solution that helps them to attract, keep, and monetize the next generations of potential long-term subscribers through gaming. The 2019 global gaming market was worth about US$192 billion and could grow to almost US$400 billion by 2026. Gen-Z, the world’s largest demographic, prefers gaming to any other form of entertainment. Although telcos are absent from gaming, edge gaming presents opportunities to attract new Gen-Z subscribers and provide new revenue streams from existing customers. Only 1 company can bridge these stakeholders. Industry valuations of solar projects under development suggest that UGE International’s current 83.7MW project backlog is undervalued. UGE’s goal of 120MW of project backlog by the end of 2021 makes the Company’s current undervaluation even more compelling. Applying peer transactions to UGE’s 357MW (net of backlog) pipeline potentially puts the stock in future multi-bagger territory. Since his days at gaming company Electronic Arts (NASDAQ:EA), Thomas Rosander has thought about the massive opportunity from combining the large, growing esports audience with betting. Now, as Real Luck Group’s new CEO, he has the opportunity and the tools to execute upon his vision, implementing a proven strategy he used at prior companies to grow players and revenues via a nuanced and data-driven marketing approach.

Clearing the Way for Largest Climate Package in U.S. History

Solar is Hot – Community Solar is Hotter

Launch the Seabots

Swarmio Has Over 1 Billion Gamers in Its Sights

Swarmio Media – Helping Telcos Break Into the Game

Getting into the Game

UGE Backlog Continues to be Undervalued

Luckbox (TSXV:LUCK) – Meet the New CEO (Part 2)

Luckbox (TSXV:LUCK) – Meet the New CEO