Investment Research for Your Business

“Thought leadership should be an entry point to a relationship. Thought leadership should intrigue, challenge, and inspire even people already familiar with a company. It should help start a relationship where none exists, and it should enhance existing relationships.” -Daniel Rasmus

Sophic Capital: Latest Research

Cybeats Eating the SBOM Market, One Byte at a Time

Cybeats Demonstrates Strong Customer Traction and Expanding Pipeline Report #2 Recap In Sophic Capital’s The Invisible Grid report, we introduced Sophic Capital client Cybeats Technologies Corp. [CSE:CYBT, OTCQB:CYBCF], a global leader in software supply chain...

The Invisible Grid: Cybeats Secures the Software Supply Chain for Critical Infrastructure

Report #1 Recap In Sophic Capital’s SBOMs Away!, we discussed security and privacy issues related to software development and shared recent significant cybersecurity events that exploited software vulnerabilities. Sophic Capital also introduced the growing global...

SBOMs Away!

Why Software Supply Chain Security Has Become a Top Priority Problem Modern software constantly changes as new features are added, bugs are fixed, and vulnerabilities are patched. Most people don’t realize that modern software isn’t built from scratch—it’s assembled...

Sophic Capital: Latest Research

Sophic Capital: Past Research

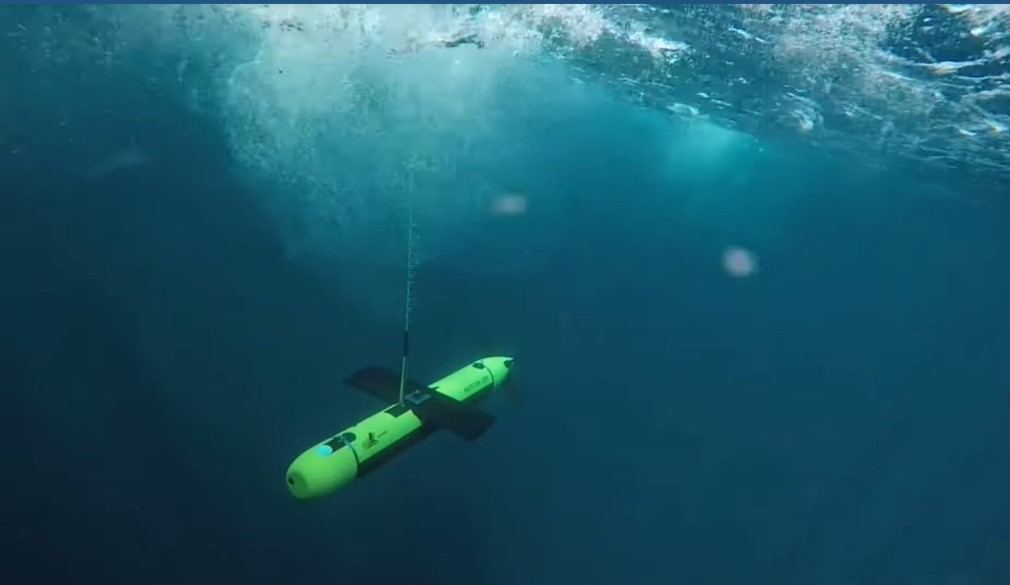

Welcome to Part 3 of Give it Away – The Million You Never Made, where we’ll show how Freckle (FRKL-TSXV), a Sophic Capital client, has a data privacy-compliant application that will fill the void left by traditional data brokers that cannot meet regulatory requirements around the collection and monetization of YOUR personal data. We’ve all seen online advertisements that match our interests. Many of us have pieced together that websites and apps collect our personal info, determine our interests, and somehow advertise to our interests whenever we’re online. What many people don’t know is that there are companies beyond Facebook and Google collecting our personal data and selling our digital profile to the highest bidders. You get paid nothing. Here is what happens when we use social media, applications and websites. In exchange for free access, we provide (often voluntarily) details about who we are, what we do, where we are, our interests, apps we use, Internet pages we visit, who are friends are… you get the point. Companies create a profile about you from your personal data, which is then packaged by companies like Oracle and sold to brands and data companies. Kraken Robotics’ stock is up more than 40% and has set a new 52-week high since Ocean Infinity, a Kraken customer, announced its plan to take an almost 10% stake in Kraken. In the days following the press release, Kraken’s stock has consistently closed above the $0.20/share investment price with comparatively heavy volume. On October 26, 2017, GE Venture company Avitas Systems partnered with Kraken Robotics to develop subsea inspection solutions for the oil and gas industry. This a milestone for Kraken Robotics because for the past two years management has been communicating a search/recovery/inspection, subscription model called Robotics-as-a-Service (RaaS) for sea drones.

Data Privacy – The Canary in the Coal Mine

Give it Away – The Million You Never Made (Part 3)

Give it Away – The Million You Never Made (Part 2)

Sophic Insights – Give it Away – The Million You Never Made (Part 1)

An Electrifying Idea

Sophic Insights – The Weather is Nice, Investors are on Holiday; Opportunity Knocks

PNG: Kraken Investors Establish New Floor Price For Stock

Thoughts from North America’s Largest Blockchain Expo

Kraken Robotics – Opportunities with GE and Beyond